S&P 500, NAS 100 Experience Choppy Price Action as Treasuries Rise, More Earnings Ahead

SP 500 & NAS100 PRICE FORECAST: Choppy Price Action and Indecision Returns as US Earnings Continues. Geopolitical Uncertainties and Robust US Data Give Market Participants a Headache as Evidenced by Retail Trader Sentiment. Rangebound trade for both the SPX and the Nasdaq 100 Cannot be Ruled Out for the Rest of the Week. To Learn

SP 500 & NAS100 PRICE FORECAST:

- Choppy Price Action and Indecision Returns as US Earnings Continues.

- Geopolitical Uncertainties and Robust US Data Give Market Participants a Headache as Evidenced by Retail Trader Sentiment.

- Rangebound trade for both the SPX and the Nasdaq 100 Cannot be Ruled Out for the Rest of the Week.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: Japanese Yen Price Action Setups: USD/JPY, GBP/JPY Update

US Indices have been choppy today with the S&P trading down 0.36% at the time of writing having fluctuated between gains and losses for the majority of the day. A brief spike higher following the US open appears to have faded but a bullish continuation remains possible following upbeat earnings and positive retail sales data.

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

The SPX and NAS100 faced selling pressure earlier in the day as megacap stocks faced selling pressure as US treasury yields rose with the 2Y yield now above the 5.2% mark and trading at 2006 levels. The increase in US treasury yields are largely down to rising geopolitical risks, a looming supply glut and ongoing concern around the higher or longer narrative potentially tipping the global economy into a recession.

US 2Y and 10Y Yield Chart

Source: TradingView, Created by Zain Vawda

US Retail sales data came in hot today and well above expectations adding further uncertainty on the Fed decision ahead of the year end FOMC meetings. The November meeting seems set to be a continued pause from the Fed but as the data stays strong from the US the Fed meeting in December remains up in the air. We are seeing hawkish repricing following each high impact data release from the US of late, this is in stark contrast to comments from Federal Reserve policymaker Barkin who stated that he is seeing signs of cooling inflationary pressures. Barkin reiterated that data ahead of the December meeting will give the Fed more data and time to decide on its next interest rate move.

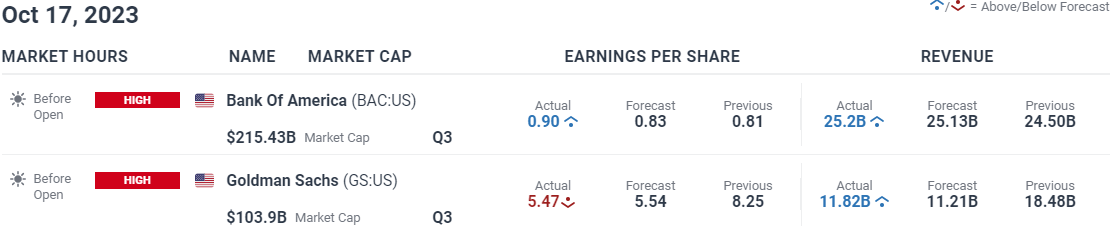

Earnings season is now in full flow with Bank of America after reporting higher earnings from interest payment by customers gaining 3.1%. Goldman Sachs meanwhile saw income from deal making drop but overall profit still came in better than expected.

In other news Nvidia dipped around 3.5% on news that the Biden administration plans to halt shipments of AI chips to China. More earnings are expected tomorrow with full data available on the DailyFX Earning Calendar.

For all market-moving earnings releases, see theDailyFX Earnings Calendar

Elevate your trading skills and gain a competitive edge. Get your hands on the US Equities Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Zain Vawda

Get Your Free Equities Forecast

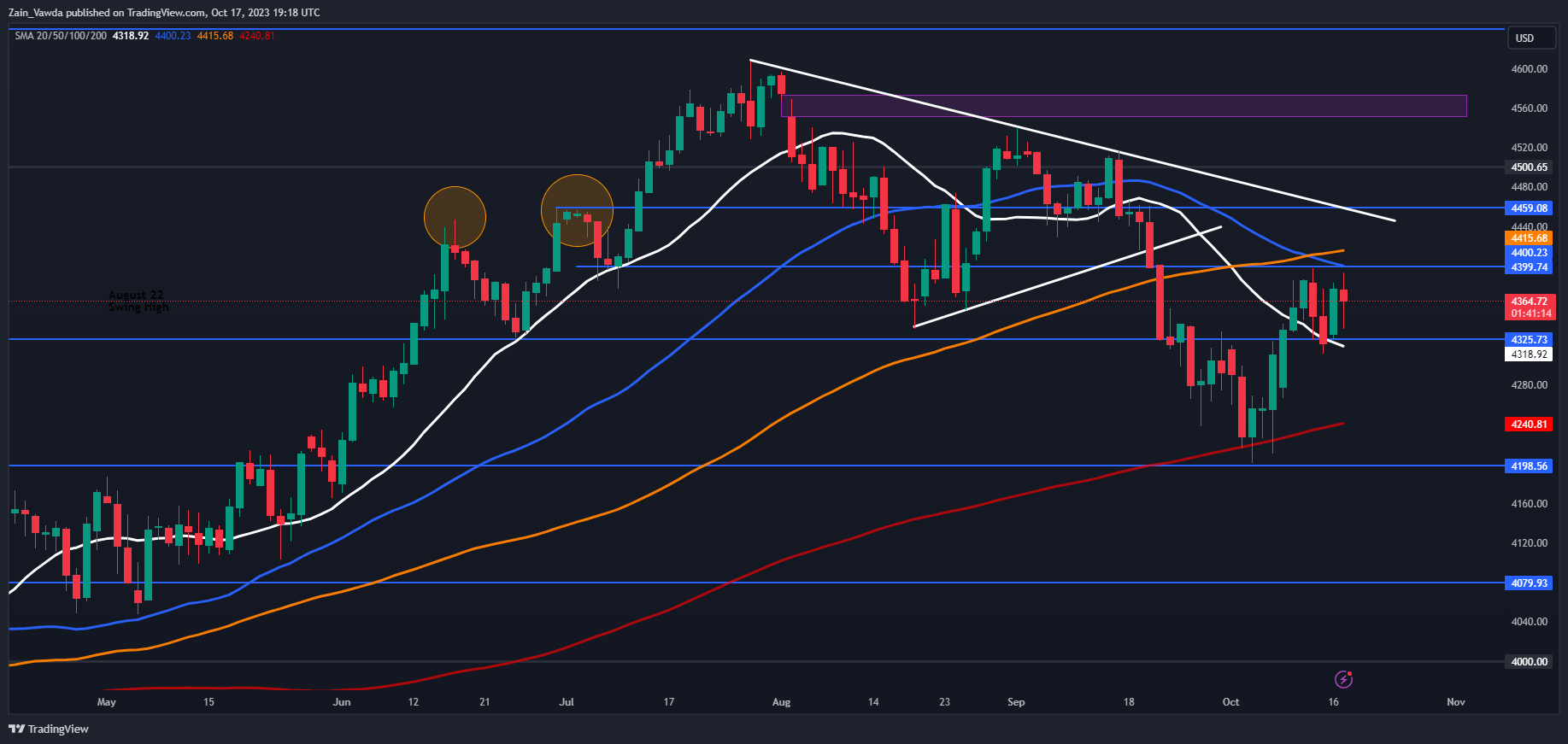

S&P 500 TECHNICAL OUTLOOK

Form a technical perspective, the S&P has bounced off a key area of support before rallying some 200 points toward the key resistance level resting at the 4400 mark. The chllenge now for the SPX is breaking above the key resistance level which is helped by the presence of both the 50 and 100-day MAs which also rest around the 4400 handle.

The daily candle close yesterday completed a morningstar candlestick pattern but so far failed in its attempts at a bullish continuation today. There is a chance that price could remain rangebound this week without any major changes on the geopolitical front and if Earnings dont throw up any surprises. For now, the range between 4400-4318 needs to be monitored with a break out in either direction a possibility at this stage.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

S&P 500 October 17, 2023

Source: TradingView, Chart Prepared by Zain Vawda

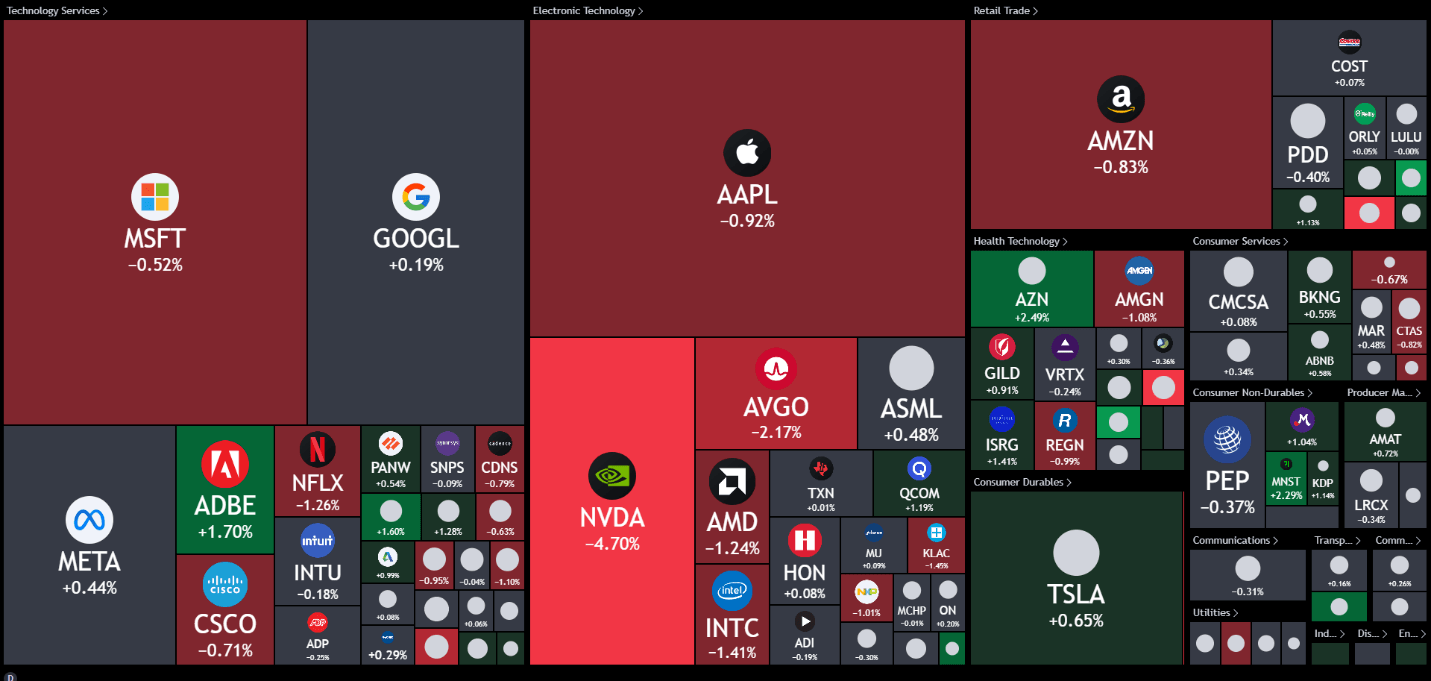

NASDAQ 100

Looking at the Nasdaq 100 and the daily chart is almost a replica of the SPX. The pressure on megacap stocks certainly weighed on the tech index with a mix of performances from the smaller constituents of the index as you can see on the heatmap below.

Source: TradingView

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment and we can see that 51% of retail traders are currently holding short positions. The data could be seen as a further indication of the current indecision prevalent in equity markets this week. Will it continue?

For a more in-depth look at Client Sentiment on the SPX and how to use it download your free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -4% | -1% |

| Weekly | -6% | 2% | -2% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Action ، ahead ، Choppy ، Earnings ، EXPERIENCE ، NAS ، Price ، Rise ، Treasuries

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰