Russell 2000, Hang Seng Index, Brent Crude

[ad_1] Market Recap Recommended by Jun Rong Yeap Get Your Free Equities Forecast The new trading week kickstarted with a drift higher in Wall Street overnight (DJIA +0.28%; S&P 500 +0.15%; Nasdaq +0.21%), as sentiments remain largely on its cautiously optimistic state ahead of more big tech earnings releases and the US job report this

[ad_1]

Market Recap

Recommended by Jun Rong Yeap

Get Your Free Equities Forecast

The new trading week kickstarted with a drift higher in Wall Street overnight (DJIA +0.28%; S&P 500 +0.15%; Nasdaq +0.21%), as sentiments remain largely on its cautiously optimistic state ahead of more big tech earnings releases and the US job report this week. As we head into August, seasonality suggests that the month tends to be more subdued in terms of US market performance. Along with market breadth and sentiment indicators pointing towards overbought conditions, calls are growing that we could see some near-term cooling ahead, although it could still be difficult to overturn the upward trend without a series of growth scares.

The day ahead will leave the US ISM manufacturing PMI data in focus, which is expected to deliver its ninth straight month of contraction (46.8 versus previous 46.0). The US job opening numbers will be released as well, with further moderation expected (9.61 million from previous 9.82 million).

While historical instances suggest that a fall in job openings tend to correlate with an increase in US unemployment rate, that has not been playing out this year, which is looked upon to support soft landing hopes. Nevertheless, any sharp decline in job openings will remain on watch to provide signs for a weakening labour market in the lead-up to the US non-farm payroll report this week.

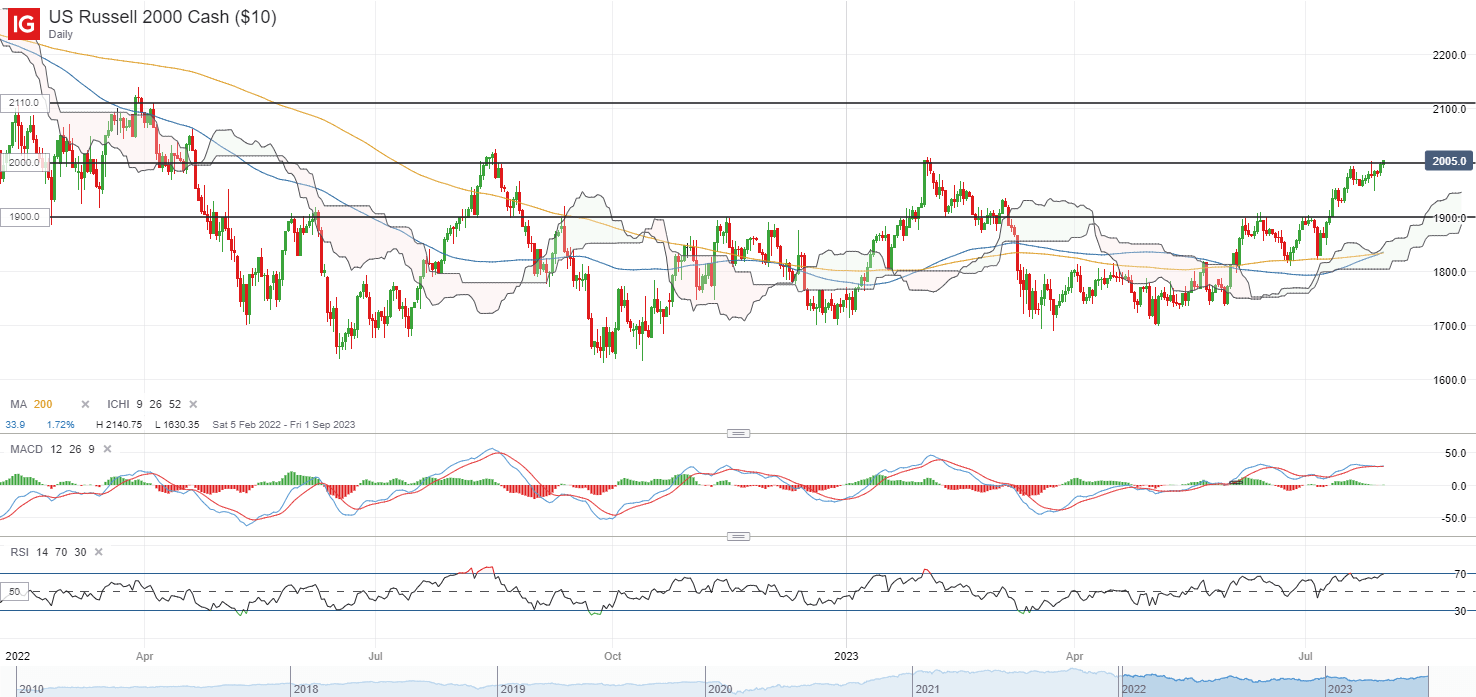

Overnight, the Russell 2000 index has pulled ahead with a 1% gain, with another attempt to reclaim its key resistance at the psychological 2,000 level. A bullish crossover was formed between its 100-day and 200-day moving average (MA), with RSI above its 50 level reflecting buyers in control. Further upside may place the 2,110 level on watch next, with potential for some catch-up performance in the index as it remains in a broader consolidation pattern at a time where other major US indices are pushing to their multi-month highs.

Source: IG charts

Asia Open

Asian stocks look set for a positive open, with Nikkei +0.28%, ASX +0.32% and KOSPI +1.00% at the time of writing. China’s new measures to stimulate consumer spending were seen as more conservative by stopping short of direct stimulus, triggering a more lukewarm reaction in Chinese equities. The Hang Seng Index closed 0.7% higher yesterday, while the Nasdaq Golden Dragon China Index is up by a similar scale overnight as well.

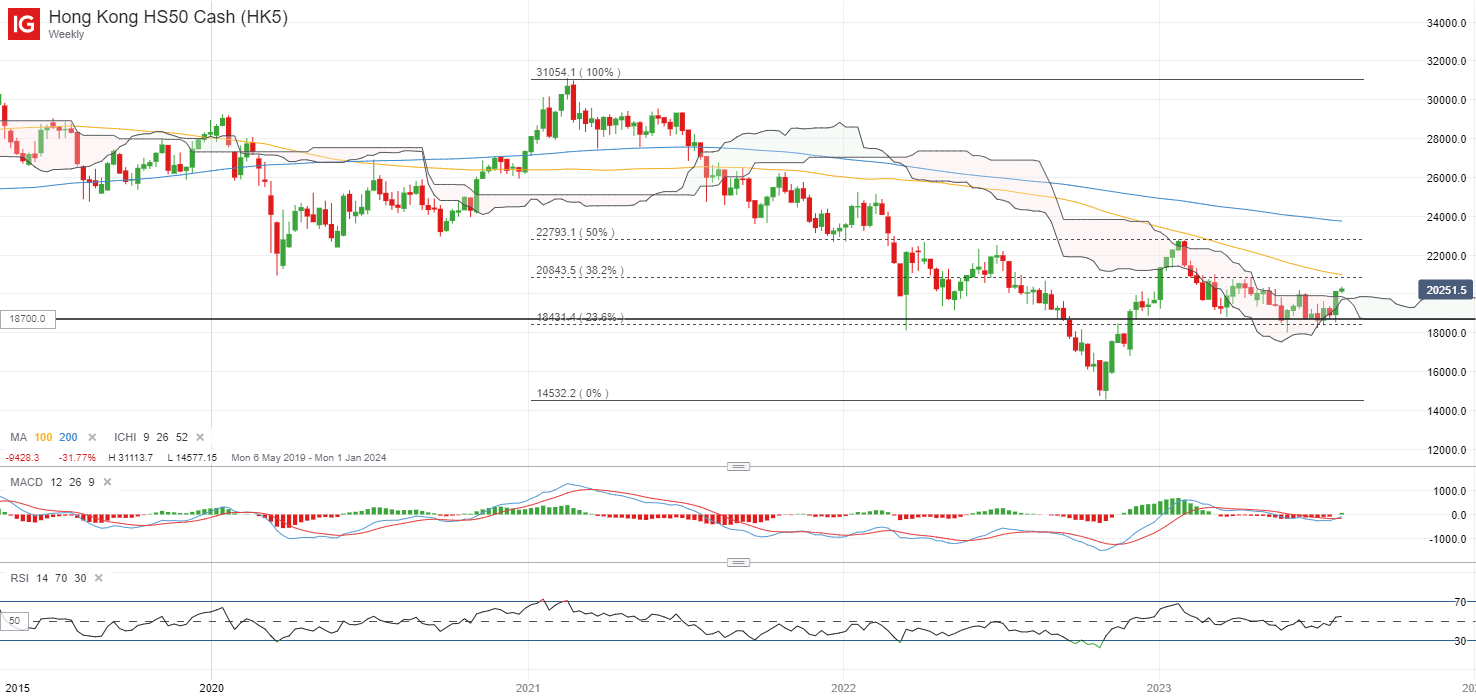

Nevertheless, on the weekly chart for the Hang Seng Index, buyers are attempting to take greater control by overcoming its Ichimoku cloud resistance, where past interactions since the start of the year have not been successful. A bullish crossover on weekly moving average convergence/divergence (MACD) is presented as well, as its relative strength index (RSI) attempts to head above zero. Sustaining above its key psychological 20,000 level may be crucial, while further upside may leave the 20,800 level on watch for a retest next.

Source: IG charts

Ahead, the Reserve Bank of Australia (RBA) interest rate decision will be the key event on the calendar. Given the downside surprise last week in inflation (6% year on year versus 6.2% expected) and retail sales data (-0.8% versus 0.0% expected), broad expectations are that the central bank may look past its still-strong labour market and keep its rates unchanged for now. That said, cash rate futures are not suggesting that it will be the end of the hiking cycle yet. Expectations are still pricing for the possibility of another 25 basis-point (bp) rate hike over coming months, which leaves the RBA’s guidance on watch for any validation, although a more data-dependent stance is still the likely scenario.

Recommended by Jun Rong Yeap

Get Your Free AUD Forecast

On the watchlist: Oil prices aiming for a retest of its 2023 high?

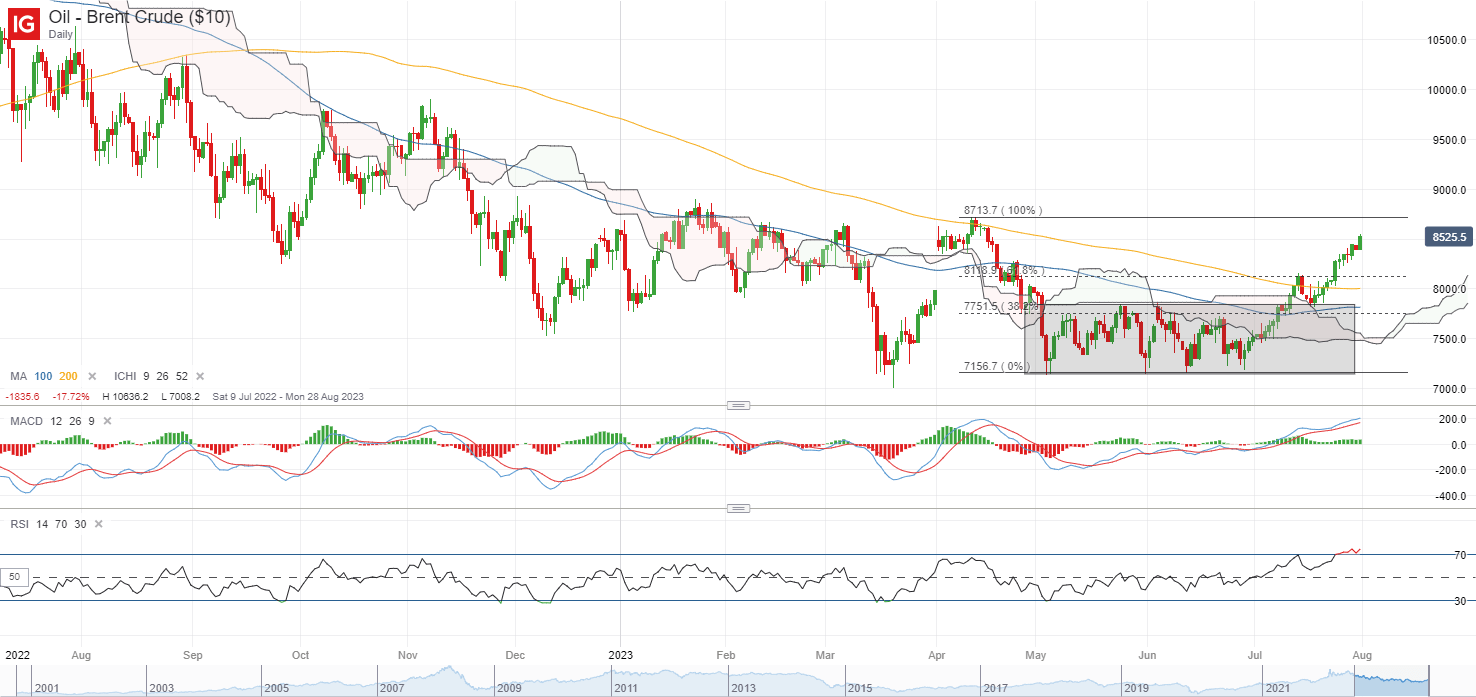

Brent crude prices continue to push to a new higher high this week, as bearish sentiments continue to unwind on improving supply conditions and hopes for China’s supportive measures to underpin some demand into the second half of the year. Brewing expectations are for Saudi Arabia and Russia to extend their voluntary output cuts for another month to include September. The firming in the US dollar lately has been largely shrugged off by oil prices, as rising MACD and RSI point to some building upward momentum.

On the daily chart, prices have managed to overcome its Ichimoku cloud resistance, along with its 200-day MA for the first time since August 2022. Further upside could seem to place its year-to-date high on watch for a retest, which could determine if prices can break out of its medium-term range. Breaking above its year-to-date high may potentially pave the way to retest the US$98.00 level next.

Recommended by Jun Rong Yeap

Get Your Free Oil Forecast

Source: IG charts

Monday: DJIA +0.28%; S&P 500 +0.15%; Nasdaq +0.21%, DAX -0.14%, FTSE +0.07%

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0