Risk-off Sentiment in place, BoJ Meeting on the Radar

[ad_1] Market sentiments continue to reel in from the post-Fed meeting jitters (DJIA -1.08%; S&P 500 -1.64%; Nasdaq -1.82%), as the US 10-year Treasury yields rose to another fresh 17-year high near the 4.50% handle amid a high-for-longer rate outlook. Some resilience in the US labour market, reflected from lower-than-expected read out of US jobless

[ad_1]

Market sentiments continue to reel in from the post-Fed meeting jitters (DJIA -1.08%; S&P 500 -1.64%; Nasdaq -1.82%), as the US 10-year Treasury yields rose to another fresh 17-year high near the 4.50% handle amid a high-for-longer rate outlook. Some resilience in the US labour market, reflected from lower-than-expected read out of US jobless claims overnight, just provided more room for the Fed to retain its hawkish stance further.

For now, while Fed funds rate futures continue to reflect some doubts that the Fed may not follow through with its final rate hike this year, the timeline for rate cuts are now pushed back to a later timeline of 2H 2024. The US dollar saw some slight profit-taking (-0.1%) overnight, while gold prices remain weighed (-1.3%). On the other hand, crude oil prices have managed to eke out slight gains after a short blip from oversold technical conditions.

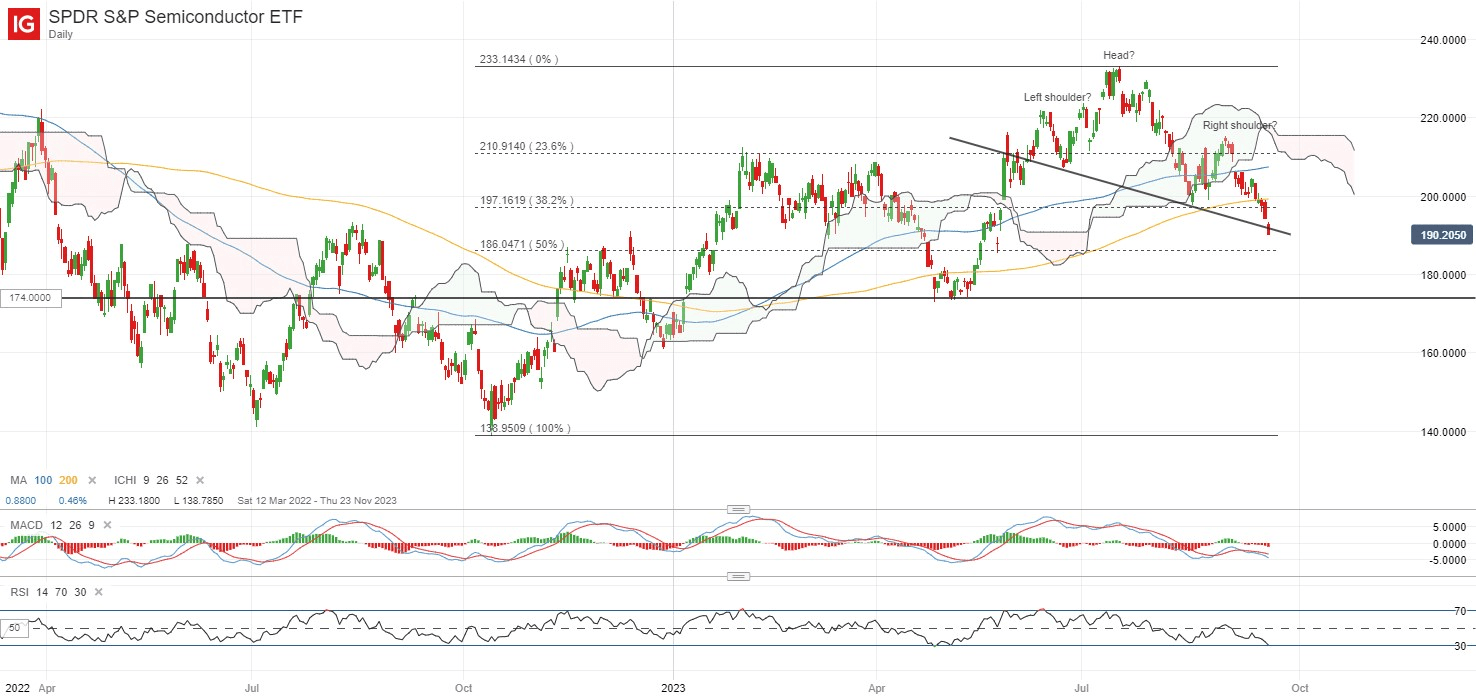

Major US indices are finding themselves at a critical juncture, with the S&P 500 back to retest a key support at the 4,330 level. Similarly, the Nasdaq 100 faces a key test for dip-buyers at the 14,680 level. Rate-sensitive growth sectors have been bearing a greater brunt of the sell-off lately, with the SPDR S&P Semiconductor ETF seemingly breaking below its neckline of a head-and-shoulder formation on the daily chart. There is still the potential for a bullish divergence to be formed on the daily relative strength index (RSI), provided that the index turned higher over coming days, but the neckline resistance will have to be reclaimed. Failure to do so may leave the May 2023 low on watch for a retest at the 174.00 level.

Source: IG charts

Asia Open

Asian stocks look set for a downbeat open, with Nikkei -1.16%, ASX -1.13% and KOSPI -0.90% at the time of writing, largely following through with the negative handover from Wall Street. The key focus today will be on the Bank of Japan (BoJ) meeting. With the BoJ Governor Kazuo Ueda floating the idea that the central bank could have enough data by year-end to determine whether to end negative rates, markets seem to perceive it as an imminent rate hike into early-2024. Therefore, all eyes will be on the Governor’s communications at the press conference for any slightest signs of hawkishness to validate such timeline.

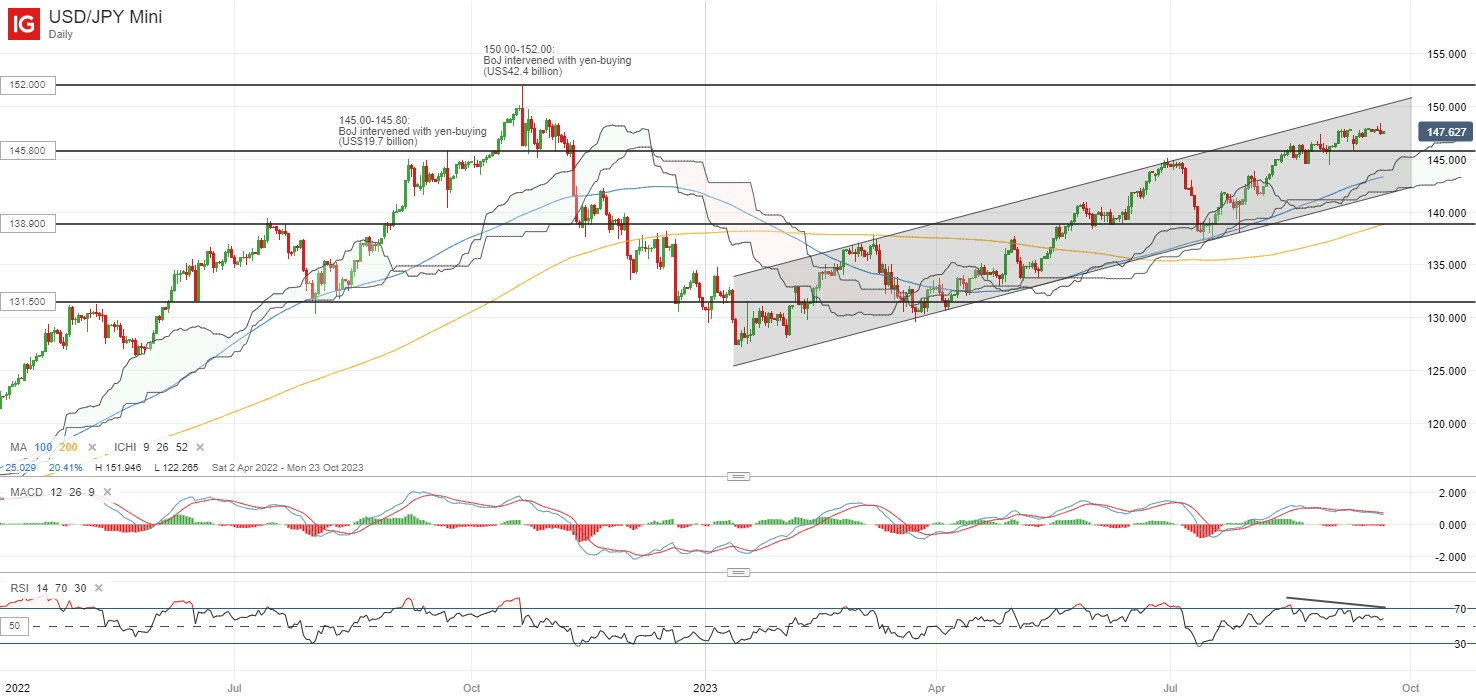

The USD/JPY has touched a new year-to-date high this week, with the pair still trading above the 145.00-145.80 range, where the BoJ had intervened with US$19.7 billion of yen-buying back in September 2022. With that, focus at the upcoming BoJ meeting will also be on how policymakers may address the weak yen and their willingness to tolerate a pull-ahead in the Japanese 10-year bond yields to levels last seen in 2013.

A bearish divergence on the daily RSI points to some near-term exhaustion for now, but staying above its Ichimoku cloud pattern and various moving averages (MA) on the daily chart still leaves an upward trend intact for the pair. Rising yield differentials between the US and Japan government bond yields have touched a new 10-month high, which may still provide some upward bias for the pair.

Source: IG charts

On the watchlist: Silver prices attempt to stay supported with some dip-buying

Silver prices have been resilient lately, with a post-Fed sell-off on Thursday met with some dip-buying overnight, as seen by the formation of a bullish pin bar on the daily chart. Thus far, prices have been edging higher upon a retest of an upward trendline support in place since August 2022, with higher lows on Moving Average Convergence/Divergence (MACD) pointing to some upward momentum.

Further upside may leave the US$24.50 level on watch for a retest, where the upper edge of its months-long consolidation pattern resides. Whereas on the downside, the upward trendline support will be an immediate support to defend by the bulls.

Source: IG charts

Thursday: DJIA -1.08%; S&P 500 -1.64%; Nasdaq -1.82%, DAX -1.33%, FTSE -0.69%

Article written by IG Strategist Jun Rong Yeap

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0