Risk mood remains cautious, USD/SGD at nine-month high

[ad_1] Major US indices attempted to bounce off their respective near-term support last Friday, but gains failed to sustain into the latter half of the session as selling pressures dominate. This came as the Federal Reserve’s (Fed) recent hawkish hold remains the overarching theme for the risk environment, which was further followed up by hawkish

[ad_1]

Major US indices attempted to bounce off their respective near-term support last Friday, but gains failed to sustain into the latter half of the session as selling pressures dominate. This came as the Federal Reserve’s (Fed) recent hawkish hold remains the overarching theme for the risk environment, which was further followed up by hawkish Fed officials’ comments to end the week. More notably, Governor Michelle Bowman, a Fed’s voting member, downplayed recent inflation progress and called for the need for additional rate hikes.

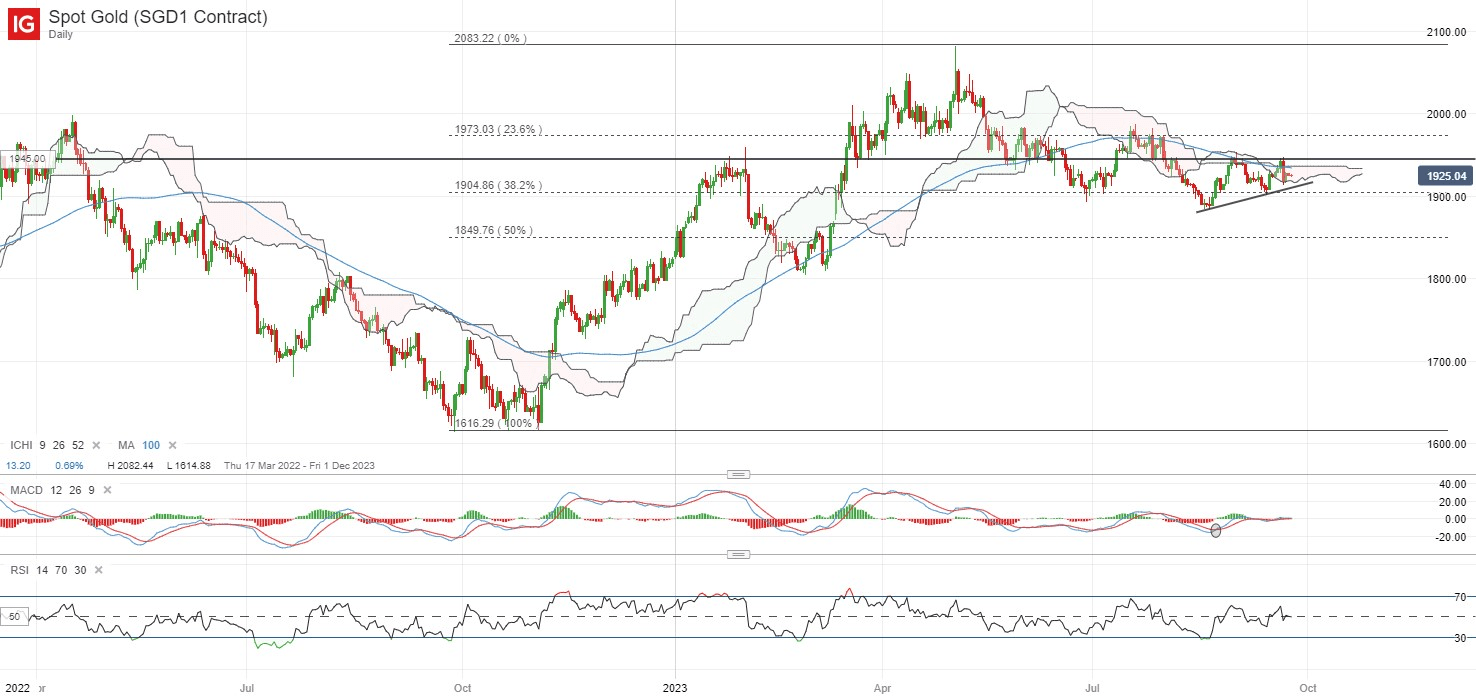

US Treasury yields remain elevated near their 16-year high, despite some cooling on Friday. That kept a lid on gold prices, which have been struggling to overcome a key resistance confluence at the US$1,945 level, where its 100-day moving average (MA) stands alongside its Ichimoku cloud on the daily chart. The formation of a near-term ascending triangle may still reflect buyers attempting to take back some control lately, but the US$1,900 level may have to see some defending ahead. Failure to do so may potentially open the door to retest the US$1,850 level next.

Source: IG charts

Asia Open

Asian stocks look set for a subdued open, with Nikkei +0.13%, ASX -0.54% and KOSPI +0.02% at the time of writing. Despite the downbeat showing in Wall Street, Chinese equities have been resilient, with some dip-buying near key technical support. The Hang Seng Index was up 2.6% last Friday, after retesting its August 2023 low, while the Nasdaq Golden Dragon China Index was also up 2.9% – a divergence in performance from the US session. Profit-taking in outperforming markets, such as in US equities, may drive some potential rotation of capital into Chinese equities for now, where conditions have been far more undervalued while hopes are in place that recent positive economic surprise are reflecting early signs of policy success.

Singapore’s August inflation data will be on watch today. The core pricing pressures are expected to moderate for the fourth straight month to 3.5% from previous 3.8%, while headline inflation could soften to 4% from previous 4.1% as well. Alongside the recent decision from the Fed to keep rates on hold, these factors may allow the Monetary Authority of Singapore (MAS) to further extend its pause on monetary policy tightening at its October meeting, while keeping watch on ongoing economic risks. To recall, Singapore’s non-oil exports have fallen for an 11th straight month in August as a reflection of soft global demand.

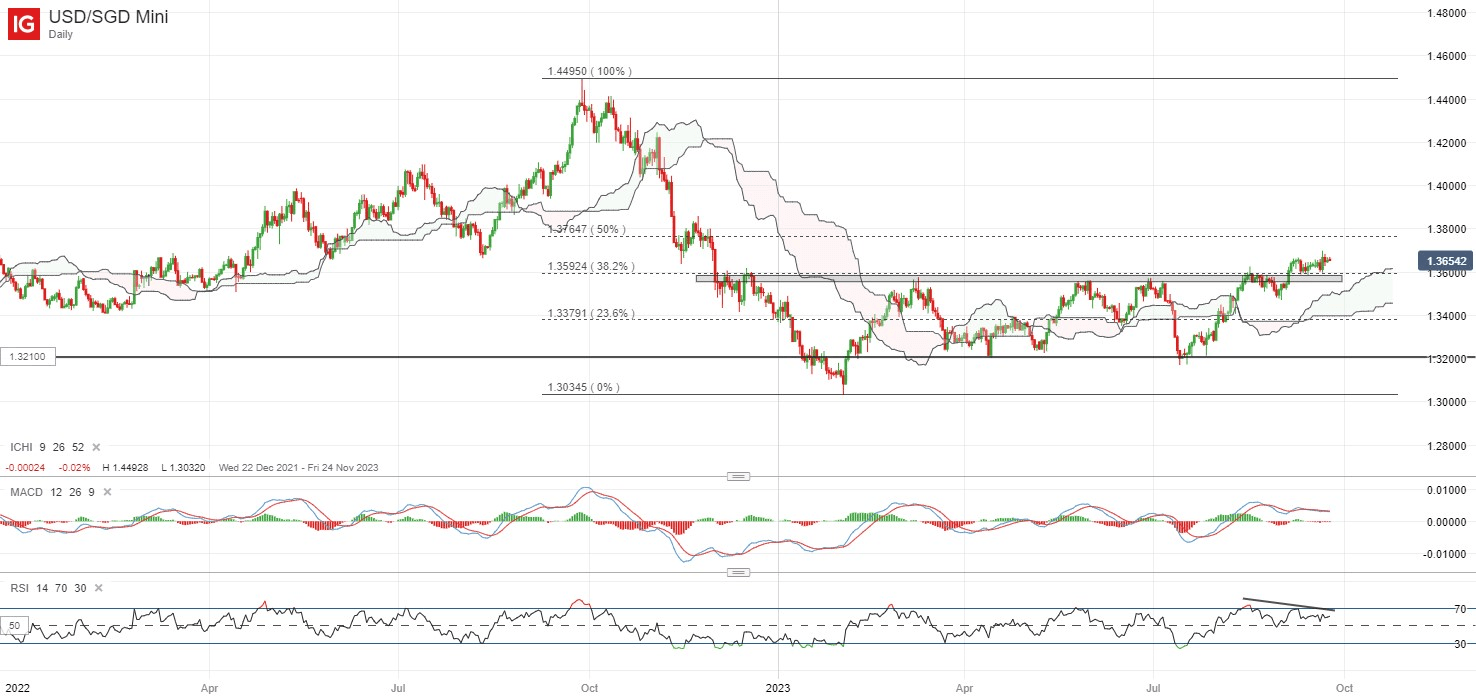

The USD/SGD has delivered a new nine-month high lately on US dollar strength, with the pair overcoming a key resistance at the 1.360 level, which marked the upper edge of a long-ranging pattern since the start of the year. Near-term lower highs on its RSI on the daily chart may point to some exhaustion for now, but the broader upward trend may stay intact as long as the 1.360 level holds. Any success in overcoming its recent tops at the 1.367 level may pave the way for further upside to retest the 1.380 level next.

Source: IG charts

On the watchlist: Dovish takeaway from Bank of Japan (BoJ) meeting keeps USD/JPY at its 10-month high

Comments from the BoJ Governor on Friday have served as a pushback to recent hawkish bets, with patience in policy normalisation being the key takeaway from the BoJ meeting. Uncertainty over the economic outlook and wanting to see more on the ‘sustainable 2% inflation’ condition for a policy pivot are factors highlighted for more wait-and-see, at least for now, although rate expectations continue to price for an end to its negative interest rates in 1Q 2024.

The USD/JPY has held firm at its 10-month high, as the Fed-BoJ policy divergence was reinforced. While the lower highs on the daily Relative Strength Index (RSI) may still point to some near-term exhaustion, the prevailing trend for USD/JPY remains upward-bias, with an ascending channel pattern in place since the start of the year. Further upside may leave the 150.00 level as a key resistance to overcome while on the downside, the 145.80 level will be an immediate support to defend for the bulls.

Friday: DJIA -0.31%; S&P 500 -0.23%; Nasdaq -0.09%, DAX -0.09%, FTSE +0.07%.

Article written by IG Strategist Jun Rong Yeap

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0