Risk Management for Long-Term Forex Traders

[ad_1] Are you having trouble making consistent profits in forex? The market’s ups and downs can eat away at your money. With daily trades worth $7.5 trillion, the risks are huge. But, there’s hope! Good risk management can protect your money and help you make more in the long run. Key Takeaways Forex market daily

[ad_1]

Are you having trouble making consistent profits in forex? The market’s ups and downs can eat away at your money. With daily trades worth $7.5 trillion, the risks are huge. But, there’s hope! Good risk management can protect your money and help you make more in the long run.

Key Takeaways

- Forex market daily trading volume: $7.5 trillion.

- Recommended risk per trade: 2% of trading capital.

- Leverage can be as high as 100:1.

- Aim for a risk-to-reward ratio of at least 1:2.

- Lower leverage often leads to higher profitability.

- Emotional control is key for steady trading.

- Keep a trading journal to improve your strategies.

Understanding the Fundamentals of Forex Trading

The forex market is huge, with $6.6 trillion traded daily. It’s open 24/7, five days a week. Knowing the basics is key for new traders.

The Global Forex Market Structure

The forex market is not controlled by one place. This means deals are made directly between people. It’s full of liquidity and fair prices. Banks, companies, and traders all play a part.

Types of Forex Markets

There are three main types of forex markets:

- Spot Market: Immediate exchange of currencies at current market rates

- Forward Market: Agreements to buy or sell currencies at a future date

- Futures Market: Standardized contracts for future currency transactions

Basic Currency Pair Mechanics

Currency pair trading is at the heart of forex. Each pair has a base and a quote currency. For example, EUR/USD has EUR as the base and USD as the quote.

Prices move in pips. One pip is 0.0001 of the quoted price.

| Currency Pair | Daily Trading Volume | Market Share |

|---|---|---|

| EUR/USD | $1.6 trillion | 24% |

| USD/JPY | $1.1 trillion | 17% |

| GBP/USD | $844 billion | 13% |

Learning these basics is the first step to trading well. It helps in making good strategies and managing risks.

Risk Management for Long-Term Forex Traders

Long-term forex trading has its own set of challenges. Traders face risks during overnight and weekend hours. They also deal with long-term economic trends and manage capital over time. It’s vital to have good risk management techniques to succeed.

Diversification is a key strategy. Trading in multiple currency pairs can lessen the impact of bad movements in one currency. This spreads risk, making your portfolio more stable.

Position sizing is also important. It’s wise to risk only 1% to 3% of your total account per trade. This keeps your capital safe during market ups and downs.

The risk-to-reward ratio is another key factor. A 1:2 ratio is common, where you risk one unit to gain two. Some aim for a 1:3 ratio, balancing losses with bigger gains when you win.

Stop-loss orders are essential for long-term traders. They close trades at set levels, limiting losses. Trailing stops are great for letting profits grow while keeping gains safe.

Leverage should be used carefully. Lower ratios like 10:1 or 20:1 are better for cautious traders. This reduces the risk of big losses while keeping profit chances open.

It’s important to regularly review and adjust your risk management strategies. Markets change, and successful traders adapt. This keeps a balance between risk and reward in the ever-changing forex market.

Position Sizing and Capital Allocation

Learning about forex position sizing and capital allocation is key to success. These methods help traders manage risk and keep their capital safe over time.

Determining Optimal Position Sizes

Finding the right position size is important in forex trading. Most traders risk no more than 2% of their capital on one trade. For example, with a $25,000 account, the risk per trade is a maximum of $500.

The 2% Rule in Forex Trading

The 2% rule is a well-known forex position sizing strategy. It limits losses and allows for steady growth. If a trader loses 10 times in a row, risking 2% each time, they lose only 20% of their capital.

Account Balance Management

Managing your account balance well is vital for success. As your account grows, so does your position size. For instance, if your capital goes from $10,000 to $20,000, your risk per trade doubles from $100 to $200.

To figure out position size, use this formula: Pips risked * pip value * lots traded = Dollar amount risked. For a $10,000 account risking 1% with a 50-pip stop loss, the right position size is 2 mini lots. This means a $20,000 notional value.

By using these capital allocation strategies, traders can greatly reduce the risk of losing a lot of money on one trade. This helps them stay in the forex market for a long time.

Leverage and Margin Management

Forex trading lets traders control big positions with a small deposit. The market sees over $5 trillion in daily trades. It’s a great place for leveraged trading. Knowing about forex leverage risks is key to success.

Leverage in forex can be up to 500:1, much higher than 2:1 in stocks. For example, with 100:1 leverage, a $1,000 deposit can manage a $100,000 position. This means big wins and losses. A 1% price change on a $100,000 position could be a $1,000 gain or loss, the same as the deposit.

Good margin management is important to avoid risks. Margin is the money needed to start and keep a leveraged trade. For example, a 1% margin means $1,000 is needed for a $100,000 trade. It’s important to watch margin levels to avoid margin calls, which can force you to sell your positions.

| Margin Requirement | Leverage Ratio | Position Size |

|---|---|---|

| 2% | 50:1 | $50,000 |

| 1% | 100:1 | $100,000 |

| 0.5% | 200:1 | $200,000 |

Start with low leverage, like 1:5 or 1:10, if you’re new. As you get better, you can use more leverage. But remember, high leverage can lead to big wins and losses. Smart risk management is essential for success in forex trading.

Stop Loss Strategies for Long-Term Success

Forex stop-loss strategies are key for long-term traders. They protect investments and keep emotions in check in the volatile forex market. Let’s look at some ways to keep your trading capital safe.

Types of Stop Loss Orders

Basic stop losses are the most common. They let traders set a specific exit price. Guaranteed stops ensure execution at the set price, even with market gaps. Trailing stops in forex moves with the market, locking in profits as the trade moves favorably.

Calculating Stop Loss Levels

Setting the right stop-loss levels is key. Many traders follow the one-percent rule, risking no more than 1% of their account on a single trade. For a $10,000 account, this means a maximum loss of $100 per trade. Stop losses should be set at least 1.5 times the current high-to-low range to avoid premature execution.

Trailing Stop Techniques

Trailing stops are great for long-term forex traders. They can be based on a fixed pip amount or a percentage of the current price. Some traders use moving averages, such as the 20-day or 50-day, to adjust their trailing stops. This technique allows profits to run while protecting gains if the market reverses.

| Stop Loss Type | Description | Best Use |

|---|---|---|

| Basic Stop | Fixed exit price | Short-term trades |

| Guaranteed Stop | Execution at a set price | High volatility periods |

| Trailing Stop | Moves with market | Long-term trend following |

Effective use of stop-loss strategies can greatly improve your long-term success in forex trading. Always think about your risk tolerance and market conditions when using these techniques.

Risk-to-Reward Ratios in Forex Trading

Forex risk-reward ratio is key for long-term success. It’s about balancing profit and loss in trades. Good traders look for ratios where profit is more than loss.

Setting Optimal Risk-Reward Targets

A good forex risk-reward ratio is 1:2 or higher. This means you want to make twice as much as you risk. For instance, risking $100, aim to make at least $200.

| Trader | Risk-Reward Ratio | Success Rate |

|---|---|---|

| Trader X | 1:3 | 40% |

| Trader Y | 1:5 | 30% |

| Trader Z | 1:2 | 60% |

Traders can succeed with different ratios. Trader Z’s success rate is high, even with a lower ratio. Trader Y’s high ratio helps with a lower win rate.

Multiple Time Frame Analysis

Time frame analysis helps find good trade setups. Looking at charts in different time frames shows trends and entry points. This fits well with risk management.

- Long-term charts: Identify overall market direction

- Medium-term charts: Spot possible trade setups

- Short-term charts: Fine-tune entry and exit points

The best ratio changes with your trading style and market. Always review and adjust your risk-reward strategy for long-term success in forex.

Managing Market Volatility

Forex volatility management is key to long-term trading success. The forex market’s ups and downs can affect traders’ positions and feelings. It’s important to know and use good strategies for managing volatility to stay profitable.

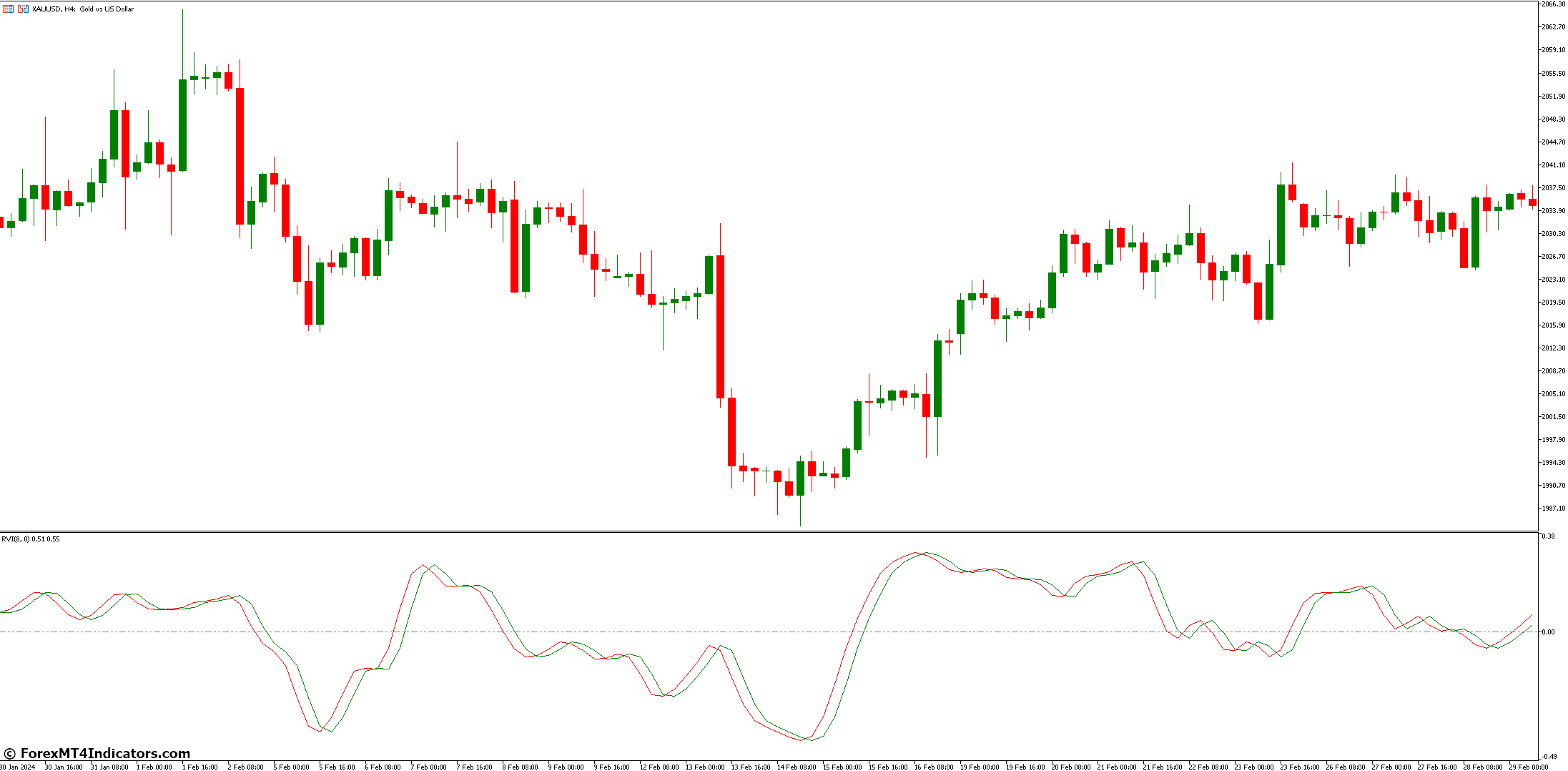

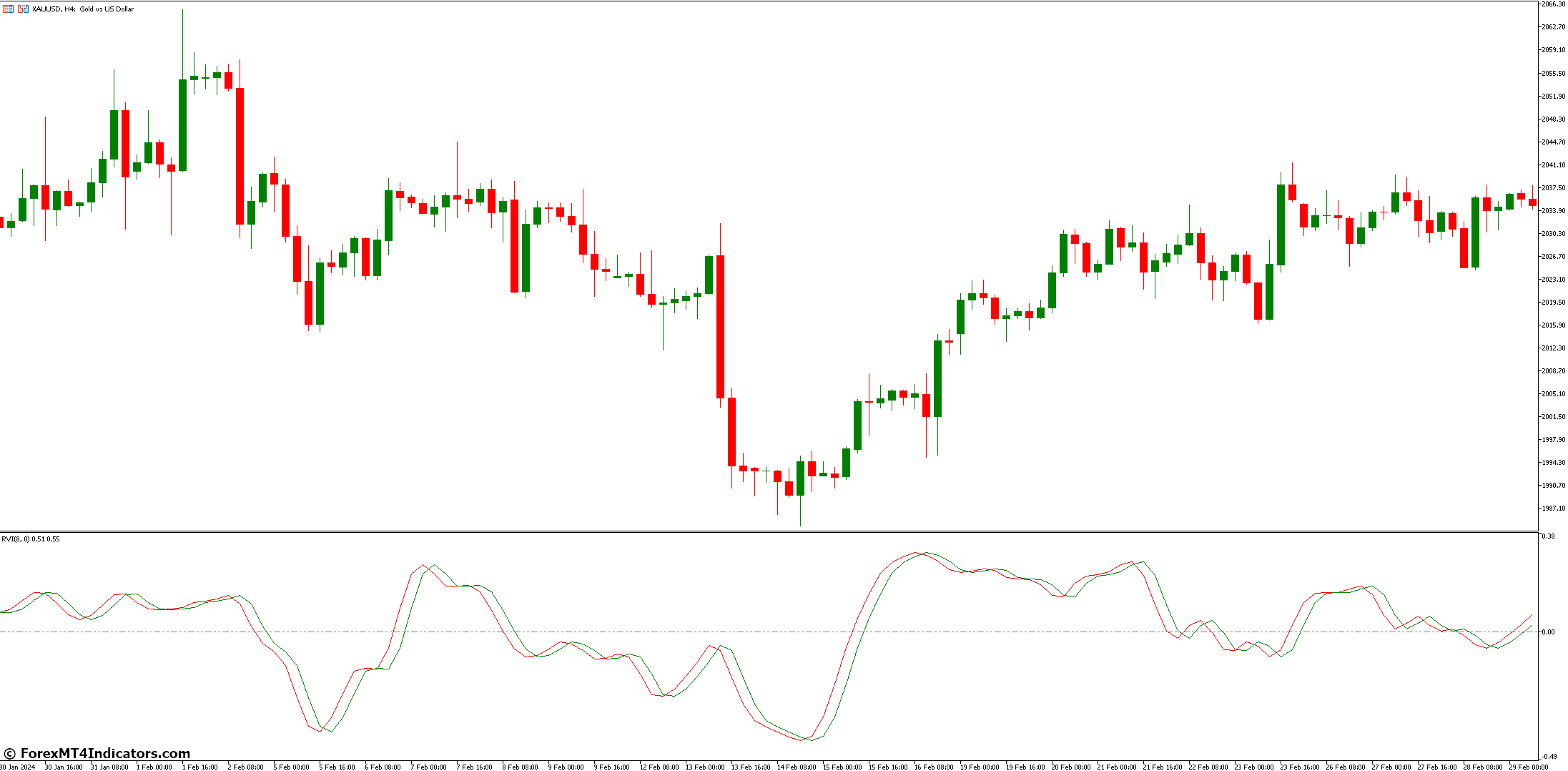

Using tools like the Average True Range (ATR) indicator is a good way to manage volatility. It helps traders see how volatile the market is and adjust their plans. For example, when the market is very volatile, traders might take smaller positions to avoid big losses.

Diversifying across different currency pairs is another long-term strategy. This can reduce risks from sudden market changes in one pair. Studies show that diversifying can lead to more stable returns over time.

Keeping calm is also vital in managing market volatility. The forex market can be unpredictable, and staying calm is important. Traders who follow their plans, not making quick decisions based on short-term changes, usually do better in the long run.

Setting stop-loss orders is also important. These orders close positions when prices hit certain levels, helping to control losses during volatile times. Experts say it’s best to risk no more than 1-2% of your trading capital on one trade to stay sustainable in the long term.

Psychological Aspects of Risk Management

Forex trading psychology is very important for managing risk. Emotional control is key to success. It helps traders make money in the long run.

Emotional Control in Trading

Feelings like fear and greed can affect trading choices. A study showed that mindfulness helps traders make better decisions. Keeping emotions in check is vital for success.

Dealing with Trading Losses

Traders will face losses. Successful ones risk only 1-2% of their capital per trade. This limits big losses and keeps emotions stable. Seeing losses as chances to learn is important.

Building Trading Discipline

Having a trading routine helps stay disciplined. Keeping a trading journal is key. It helps track emotions and improve strategies.

| Emotional Factor | Impact on Trading | Management Strategy |

|---|---|---|

| Fear | Premature selling missed opportunities | Set clear stop-loss and take-profit levels |

| Greed | Overtrading, holding positions too long | Stick to predetermined exit strategies |

| Overconfidence | Excessive risk-taking | Regular performance reviews |

By focusing on the psychological aspects of risk management, traders can succeed in the forex market. Remember, making money long-term needs a good strategy and emotional control.

Trade Documentation and Analysis

Keeping good records and analyzing trades is key to success in forex trading. A trading journal and regular checks on performance help traders understand their strategies better. This leads to better decision-making.

Maintaining a Trading Journal

A trading journal is a must for tracking your trades. It shows your progress, patterns, and lessons from wins and losses. Here’s what to include in your journal:

- Entry and exit points

- Position size and leverage used

- Risk-reward ratio

- Emotional state during trades

- Market conditions and news events

Performance Metrics Tracking

Checking your performance regularly is important. It shows how well your strategy works. Look at these key metrics:

- Win rate: Percentage of profitable trades

- Average win/loss: Comparison of average profitable trades to losing ones

- Risk-adjusted return: Profitability relative to the risk taken

- Maximum drawdown: Largest peak-to-trough decline in account balance

By looking at these metrics, you can see what’s working and what’s not. For example, if your win rate is low but your wins are big, think about changing your position size or stop-loss strategies. This could help your overall performance.

Market Liquidity Considerations

Forex market liquidity is key to trading success. High liquidity makes it easier to buy and sell currency pairs. The forex market is very liquid, with over $5 billion traded daily for major pairs.

This high liquidity leads to tight spreads, usually 1-3 pips for popular pairs.

Liquidity risk management is about understanding market depth. During busy times, spreads are narrow (0.1-0.2%) and prices recover quickly (1-2 minutes). But during quiet times, spreads widen (2-5%) and recovery takes longer (5-10 minutes).

To handle liquidity risks, focus on major pairs and avoid off-peak hours. Watch daily trading volumes too. Volumes under 75% of the 30-day average might signal liquidity problems. For more on risk management in forex trading, check out specialized tools and indicators.

| Liquidity Indicator | High Liquidity | Low Liquidity |

|---|---|---|

| Average Daily Trading Volume | >1M shares | |

| Bid-Ask Spread | 0.1-0.2% | 2-5% |

| Price Recovery Time | 1-2 minutes | 5-10 minutes |

| Daily Price Range | 1-2% | 5-10% |

By keeping these points in mind, traders can better understand the forex market’s liquidity. This helps make smarter trading choices.

Economic Calendar and News Impact

The forex economic calendar is key for making trading decisions. It lists upcoming economic events that can change market trends. Knowing how news affects trading is vital for long-term success in forex.

High-Impact Economic Events

Big events like central bank rate changes and job reports can shake the market. These events can cause big price swings in currency pairs. Traders must watch these events to keep their positions safe.

| Event Type | Example | Potential Impact |

|---|---|---|

| Interest Rate Decision | Federal Reserve Meeting | High |

| Employment Report | Non-Farm Payroll (NFP) | High |

| Inflation Data | Consumer Price Index (CPI) | Moderate to High |

News Trading Risk Management

It’s key to manage risk during big news. Traders can adjust stop-loss levels and reduce trade sizes to cut losses. Avoiding too much exposure during volatile times is also important.

- Use wider stop-loss orders during high-impact events

- Reduce trade size to limit possible losses

- Consider staying out of the market during extremely volatile periods

By using the forex economic calendar and understanding news impact, traders can make smarter choices. This helps them manage risk better over time.

Conclusion

Risk management is key to success in long-term forex trading. The forex market is huge, with trillions traded daily. It needs a smart plan to manage risks.

Traders must be careful in this big market. It’s filled with banks and big institutions. They need to protect their money.

Good risk management is vital for making money over time. New traders should follow the 2% rule. This means risking no more than 2% of their account on each trade.

Using a 1:2 risk-reward ratio is also smart. This means a 20-pip stop-loss is matched with a 40-pip profit. These steps help keep losses small and profits big.

Long-term success in forex depends on being flexible. Traders need to know about economic news, political changes, and market ups and downs. By always checking and changing their plans, they can handle the market’s challenges.

Risk is part of every trade. But with the right approach, traders can reach their goals in the forex market.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Forex ، LongTerm ، Management ، Risk ، Traders

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0