Relief Rally to Start the Week Ahead of Key Macro Data

[ad_1] Wall Street managed to get through the Jackson Hole Symposium unscathed (DJIA +0.73%; S&P 500 +0.67%; Nasdaq +0.94%), despite a hawkish takeaway from Fed Chair Jerome Powell last Friday. The general view may be that market participants were already priced for a hawkish outcome in the lead-up to his speech, which allows room for

[ad_1]

Wall Street managed to get through the Jackson Hole Symposium unscathed (DJIA +0.73%; S&P 500 +0.67%; Nasdaq +0.94%), despite a hawkish takeaway from Fed Chair Jerome Powell last Friday. The general view may be that market participants were already priced for a hawkish outcome in the lead-up to his speech, which allows room for some unwinding on little surprises.

In his speech, the Fed Chair highlighted that the US central bank is prepared to raise interest rates further if needed, noting that a resilient economy comes with risks that inflation could reaccelerate. Rate expectations took that as a sign for an additional hike on the table, with the odds of a November rate hike (25 basis-point) increasing to 48%, up from 33% a week ago. Treasury yields firmed as a result, with the two-year yields edging back to retest its multi-year high around the 5.100% level.

This week will bring focus to a series of key macro data, such as the US job report and PCE inflation data, in which the Fed will want to see softer numbers on both fronts to reassure on the success of current tight policies. Aside, overall trading volume may be lighter as we head into the US Labour Day weekend, which could be a trigger for higher volatility.

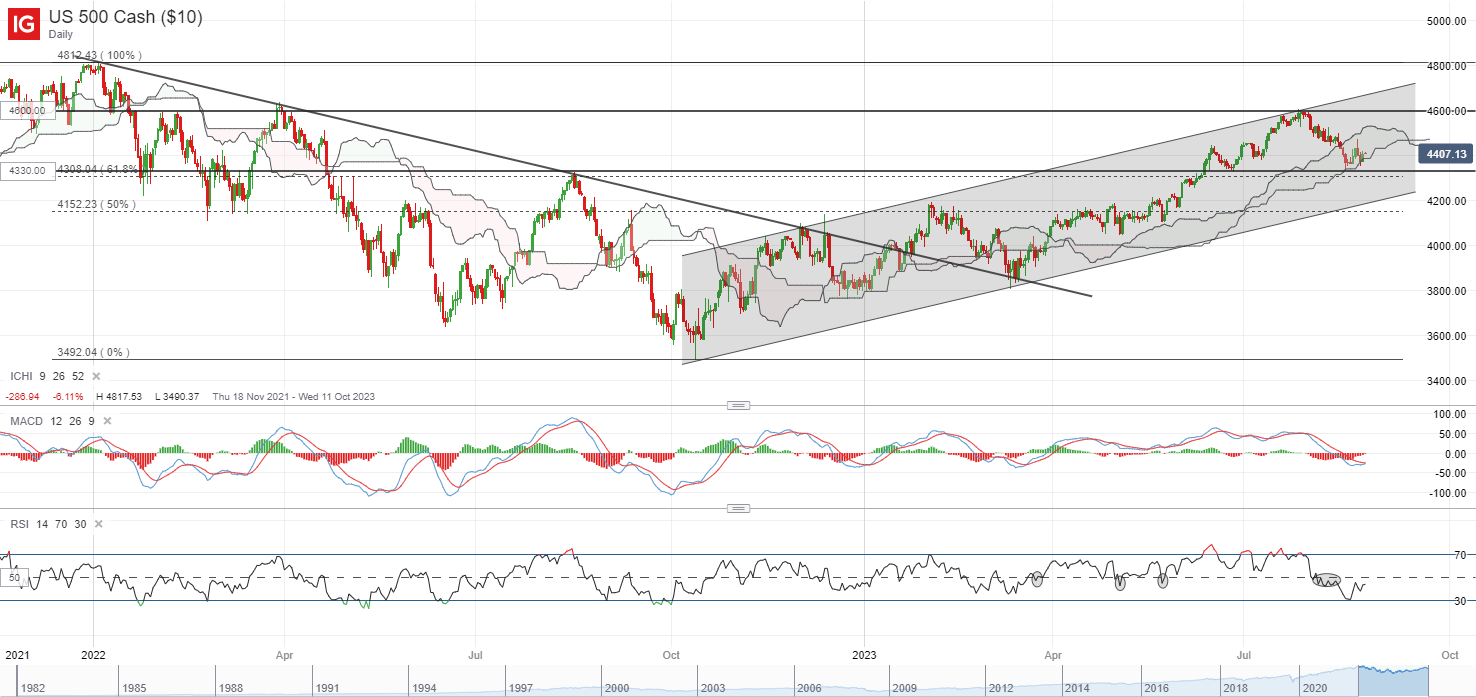

For now, the S&P 500 is attempting to pare back some losses from its Thursday sell-off, after nearing the lower edge of its Ichimoku cloud support on the daily chart. The 4,330 level may be an immediate support to hold, where the neckline of a potential head-and-shoulder formation coincides with its 100-day moving average (MA). Failing to defend this level may potentially pave the way to retest the 4,150 level next. Much may still await on how far the near-term relief may go, considering that we are heading into September, which tends to be the worst month for US equities seasonally.

Source: IG charts

Asia Open

Asian stocks look set for a positive open, with Nikkei +1.31%, ASX +0.47% and KOSPI +0.67% at the time of writing, tapping on the positive handover in Wall Street for some relief to start the new week. Key focus in the region this week may be on Australia’s monthly consumer price index (CPI) data on Wednesday, followed by China’s purchasing managers index (PMI) data on Thursday.

Chinese stocks will once again be in focus, with authorities stepping in to support its stock market with a reduction of the stamp duty on stock trades and a slower pace of initial public offerings. Previous round of reduction in levy on stock trades in September 2008 was met with an initial move higher, but gains were short-lived (lasting for a week) before the CSI 300 index eventually moved to hit a new low. Therefore, while the recent move may be met with a positive reaction in Chinese equities in today’s session, it may still have to take a more sustained recovery in economic conditions to bolster investors’ confidence over the longer term.

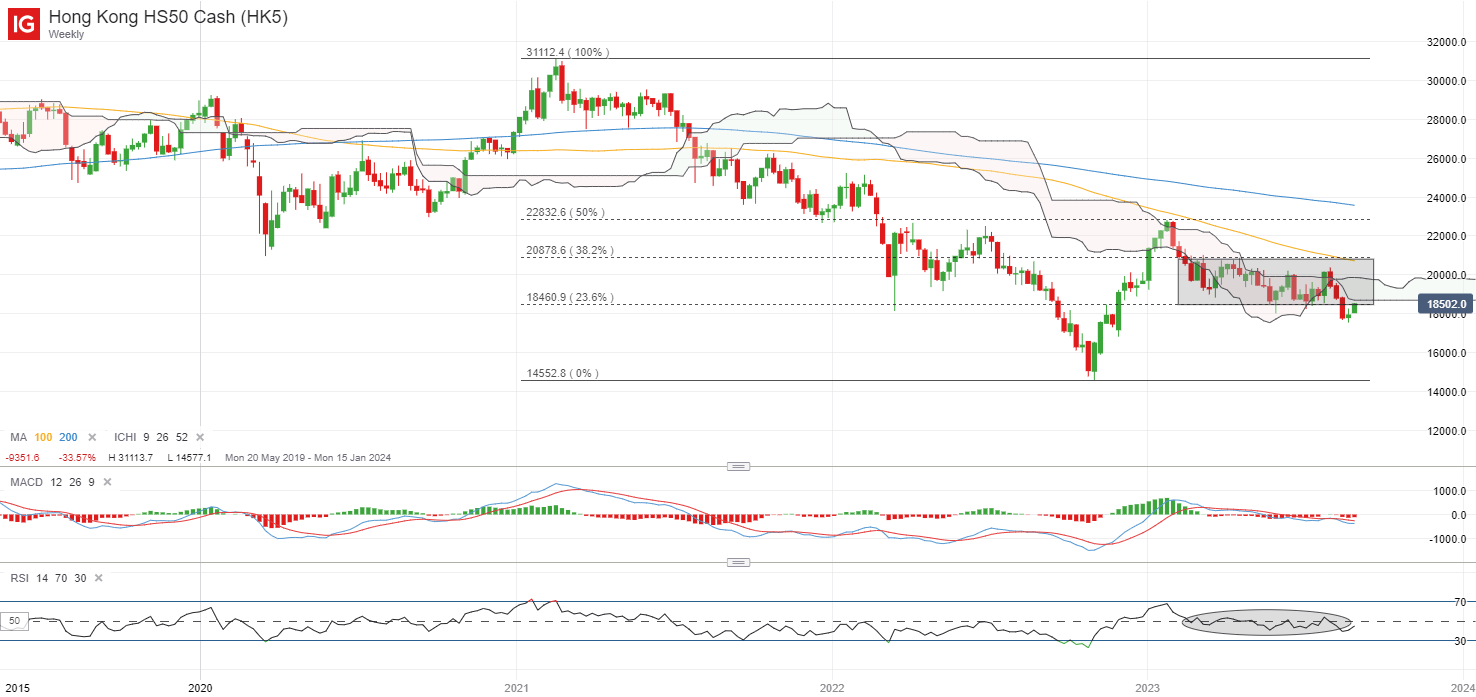

Recent bounce in the Hang Seng Index has brought the index back to retest the lower bound of its previous consolidation zone on the weekly chart at the 18,500 level, which will serve as near-term resistance to overcome. A bullish moving average convergence/divergence (MACD) formation is seen on the daily timeframe for now, but the lower highs and lower lows since the start of the year still put an overall downward trend in place. Greater conviction for buyers may have to come from a move back above the psychological 20,000 level, where the upper edge of its Ichimoku cloud resistance stands on the weekly chart, which it has failed to overcome on three previous occasions this year.

Source: IG charts

On the watchlist: Copper prices facing key test of resistance confluence ahead

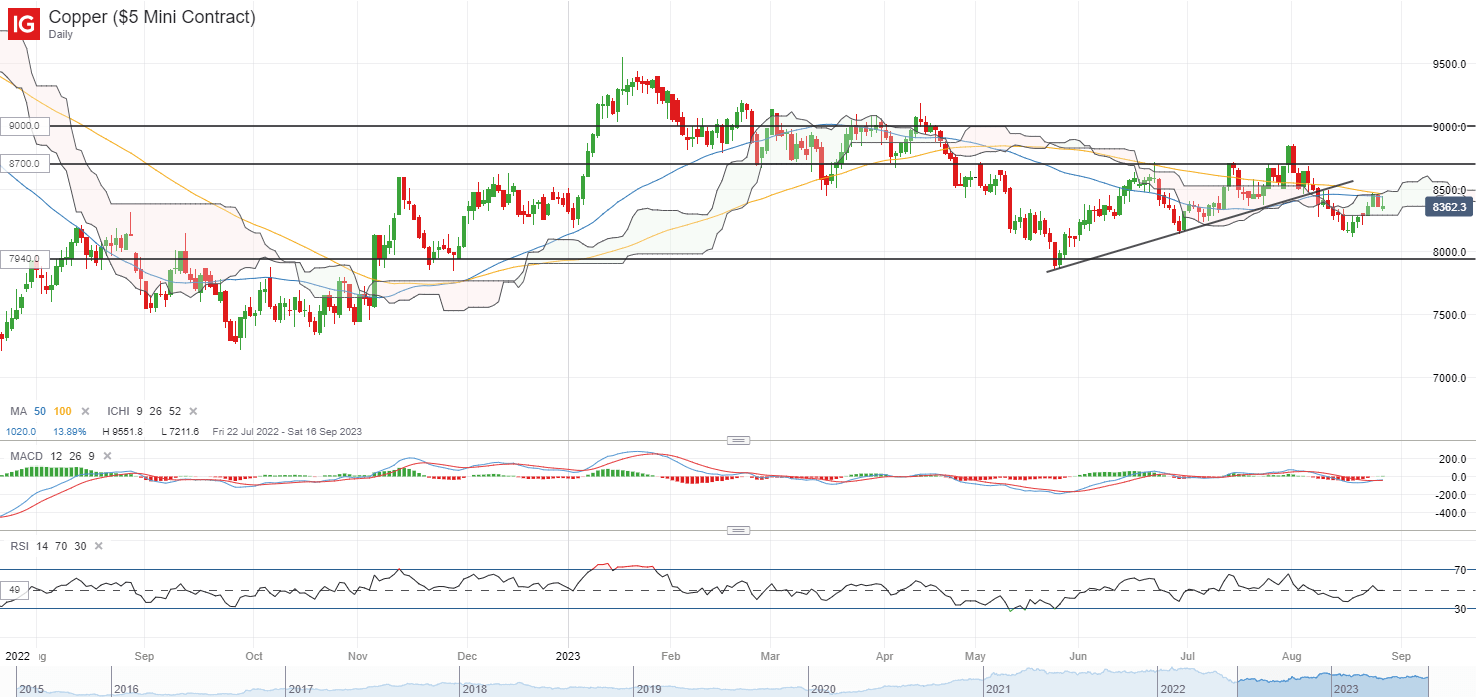

Copper prices have recovered close to 4% over the past two weeks, but are now facing a key test of resistance confluence at the US$8,500/tonne level. This is where a series of MA lines (50-day MA, 100-day MA) stands alongside the upper edge of its Ichimoku cloud on the daily chart. Heading past this level may potentially leave the US$8,700/tonne level in sight next.

Overall, some indecision is still in place, with its weekly relative strength index (RSI) hovering around the key 50 level, while its weekly MACD flatlines. On the downside, the US$8,145/tonne level may be an immediate support to hold.

Source: IG charts

Friday: DJIA +0.73%; S&P 500 +0.67%; Nasdaq +0.94%, DAX +0.07%, FTSE +0.07%

Article written by IG Strategist Jun Rong Yeap

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0