RAND TALKING POINTS & ANALYSIS

- ZAR exploiting weaker USD and stronger commodity prices.

- Big week ahead that includes China rate announcement, BRICS summit & Jackson Hole.

- Technical analysis suggesting a pullback?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/ZAR FUNDAMENTAL BACKDROP

The rand has managed to claw back some lost gains today despite a rather hawkish slant to yesterday’s FOMC minutes. US 2-year Treasury yields have softened slightly leaving the US dollar trading lower (DXY) while the rand has capitalized on this with short term South African bond yields in the green – 3-month and 5-year respectively.

In addition, the weaker greenback has supported commodity prices including South Africa’s major commodity exports gold, iron ore, coal and platinum. This trend is being seen across Emerging Market (EM) currencies after recent risk aversion placed many EM’s on the backfoot.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

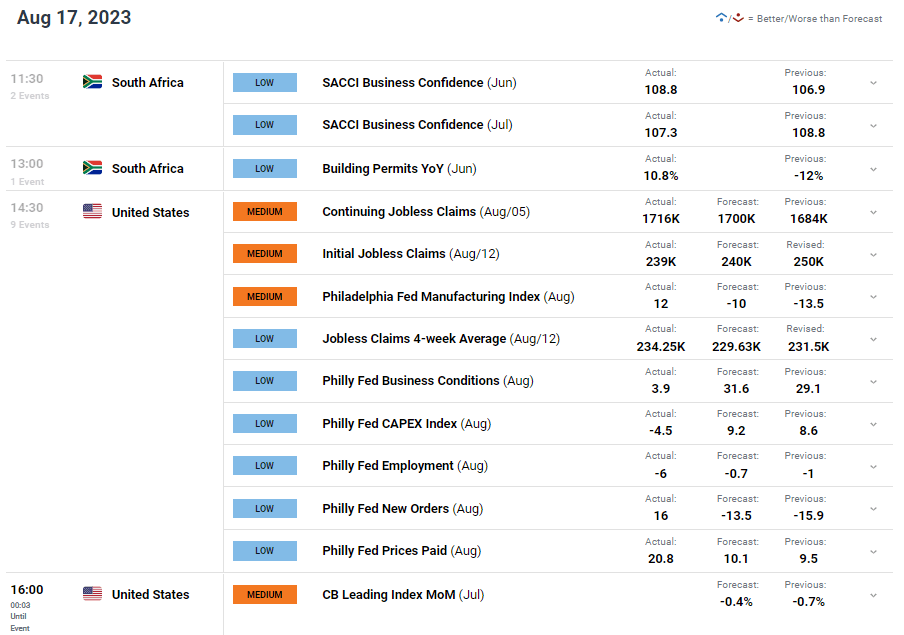

Some positive news out of South Africa (see economic calendar below) earlier today helped augment the upside ZAR move via building permit data that progressed into positive territory YoY up to 10.8%. The SACCI business confidence report showed a marginal drop off from the June read but still remained stable indicative of no major shift in business mindset.

From a US perspective, jobless claims data reiterated the robust labor market in the US and although the initial jobless claims figure declined, the move is not enough to take away from the ‘higher for longer’ narrative. More significant cracks will need to be uncovered in the jobs market to create a reorientation of the Fed’s and the markets outlook.

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

With little in the way of economic data scheduled for the rest of the trading week, investors now look towards the China LPR announcement, BRICS summit, South African inflation and the Jackson Hole Economic Symposium next week. Any increase in concern over China’s economy as well as a continuation of the current Fed rhetoric could once again see a selloff in the rand and vice versa.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

TECHNICAL ANALYSIS

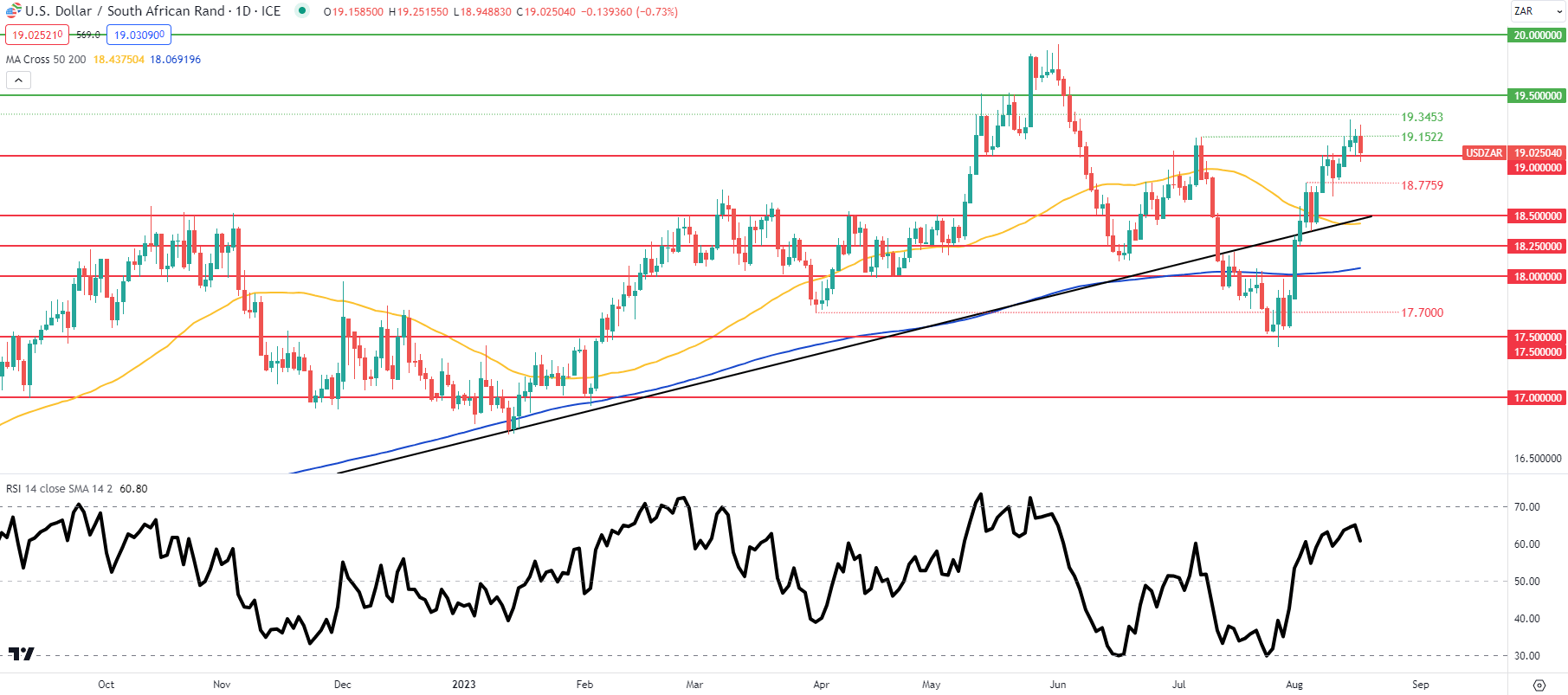

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/ZAR price action has been flirting with the 19.0000 psychological handle throughout the trading day and will continue to do so as market mull over the recent US economic data mentioned above. While the Relative Strength Index (RSI) is nearing overbought territory, there is room for further upside. A daily candle close below 19.0000 could negate another move higher in the short-term and possible bring into consideration the 18.7759 swing low. The current weekly chart candle is forming a long upper wick and should this close the week in this fashion, next week could develop into a favorable outcome for the rand.

Resistance levels:

Support levels:

- 18.5000/Trendline support/50-day MA

- 18.2500

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0