Key Takeaways:

- The South African rand has weakened due to both domestic and international factors.

- The South African Reserve Bank will not intervene to counter the recent depreciation of the rand.

- The US dollar has gained strength due to evidence of a tighter labor market, suggesting potential wage inflation and a more hawkish Federal Reserve.

- The USD/ZAR currency pair has broken out of short-term consolidation, indicating a possible short-term target of 19.80.

- Traders may consider entering long positions on the USD/ZAR after a pullback from overbought territory, with a target of the resistance level at R19.80/$.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The South African Rand (ZAR) has experienced a downturn due to a combination of domestic and international factors. This decline comes on the heels of comments made by South African Reserve Bank (SARB) Governor, Lesetja Kganyago. In his statement, Kganyago indicated that the SARB would not take any measures to offset the recent depreciation of the South African Rand.

The afternoon session, initially saw a resurgence in the US dollar. This rise in the dollar’s value can be attributed to indicators of a tightening labor market in the United States, which is the world’s largest economy.

The number of individuals filing for unemployment benefits last week was fewer than predicted by consensus estimates. This lower-than-expected figure is indicative of tighter wage inflation, which suggests a more hawkish stance by the Federal Reserve.

However, initial strength in the dollar did start to dissipate as US equity markets opened, helping the rand claw back some of its losses.

Markets are likely to find more sustainable direction from the upcoming Non-Farm Payrolls and Unemployment Claims data, which is scheduled to be released on Friday. This data is considered to be a key indicator of the health of the U.S. economy and can have a significant impact on the financial markets.

For example, if the Non-Farm Payrolls data shows a higher-than-expected increase in employment, it could signal a stronger U.S. economy. This could potentially lead to a surge in the U.S. dollar, which in turn could put further pressure on the South African Rand. On the other hand, if the data shows a lower-than-expected increase, it could signal a weaker U.S. economy, which could potentially lead to a decrease in the U.S. dollar and provide some relief to the South African Rand.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Shaun Murison, CFTe

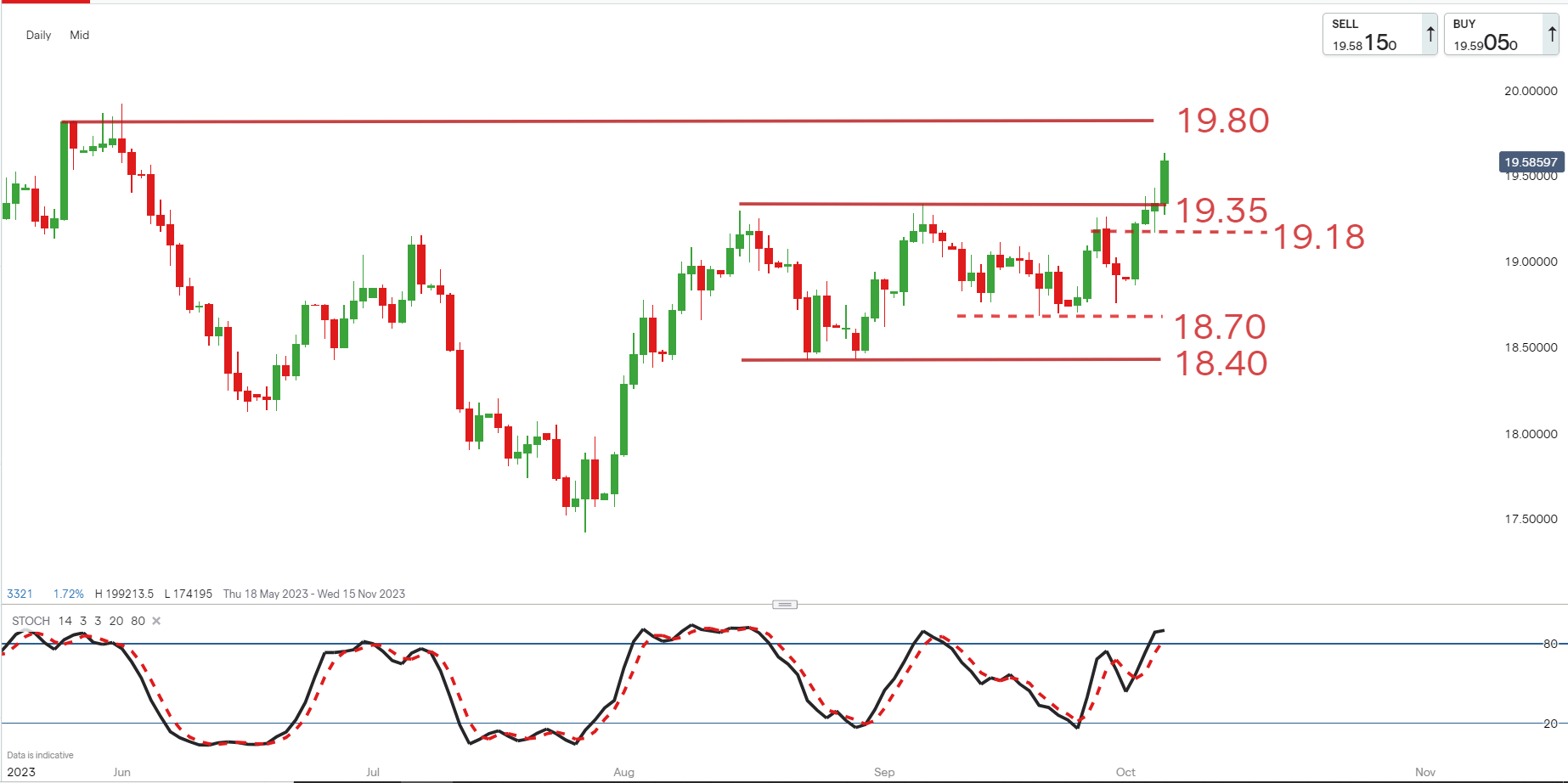

The USD/ZAR breaking out of short term consolidation

Current price actions see’s the USD/ZAR breaking resistance of the short-term range at R19.35/$. The move higher suggests 19.80 as a possible short-term target from the move.

The currency pair has however moved into overbought territory while looking to renew the short to medium term uptrend.

Traders not already long into the USD/ZAR might prefer to look for long entry into a pullback from overbought territory before looking for a move towards the R19.80/$ resistance level.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0