Precious Metals Ease Despite Softer USD, Yields

[ad_1] Gold, Silver Analysis Gold Extends Decline Ahead of US Inflation Print Gold extends declines midway through the week in what could land up being three consecutive weeks of declines. However, more recent price action appears detached from the commodity’s usual influencers, the US dollar and US treasury yields. The dollar benchmark or US dollar

[ad_1]

Gold, Silver Analysis

Gold Extends Decline Ahead of US Inflation Print

Gold extends declines midway through the week in what could land up being three consecutive weeks of declines. However, more recent price action appears detached from the commodity’s usual influencers, the US dollar and US treasury yields. The dollar benchmark or US dollar basket (DXY), has also been seen lower ahead of tomorrow’s US CPI print. Likewise, the US 10-year yield is marginally lower, around 4% ahead of a massive 10-year US bond auction.

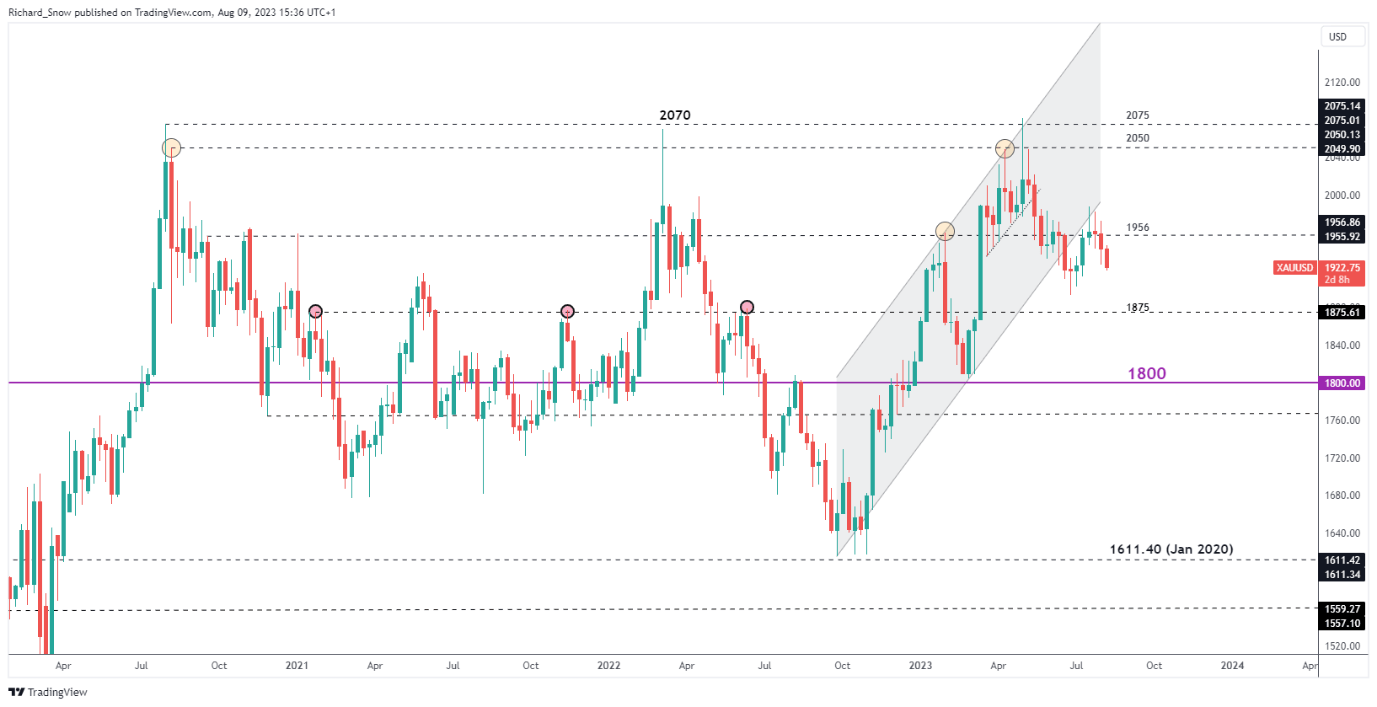

The weekly chart below reveals the long-term breakdown as prices traded below the ascending channel, retested channel support and subsequently turned lower. The major level to the downside on the weekly chart appears at $1875, which assumes a move below the psychological level of 1900.

Traders often look for a retest of key support/resistance after a breakout before assessing ideal entry points. Learn more about breakout trading below:

Recommended by Richard Snow

The Fundamentals of Range Trading

Gold (XAU/USD) Weekly Chart

Source: TradingView, prepared by Richard Snow

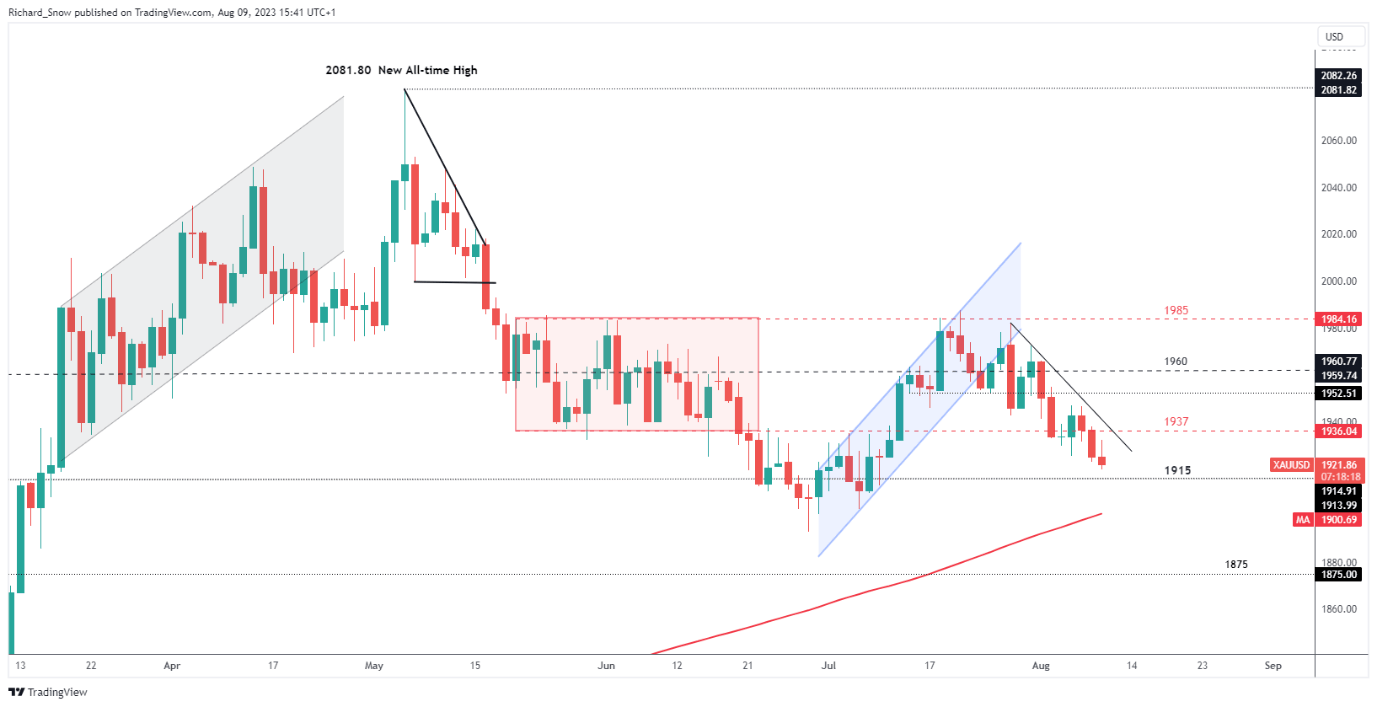

Gold Pushes Lower with $1915 and the 200-Day SMA Beckoning

In what has been a strange day of trading, the US dollar, 10-year yields, S&P 500 and gold are all trading lower simultaneously at the time of writing. Ahead of tomorrow’s CPI print, interest rate expectations appear rooted, with markets assigning an 85% chance of no movement on the interest rate front in September from the Fed. With the Fed nearing or already at peak rates, a higher CPI print may not provide the dollar with as much impetus as previous prints.

However, with rates expected to remain elevated until Q2 2024, the opportunity cost of holding gold is likely to remain a thorn in its side. Of course, you can never discount the safe haven appeal of the metal at a time when US credit card debt reached $1 trillion for the first time ever and a recent Fed survey revealed further tightening of credit conditions from US lending institutions.

$1915 appears as immediate support, with a close below highlighting the psychological 1900 level – which coincides with the 200 simple moving average (SMA). Resistance appears in the form of trendline resistance followed by $1937.

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

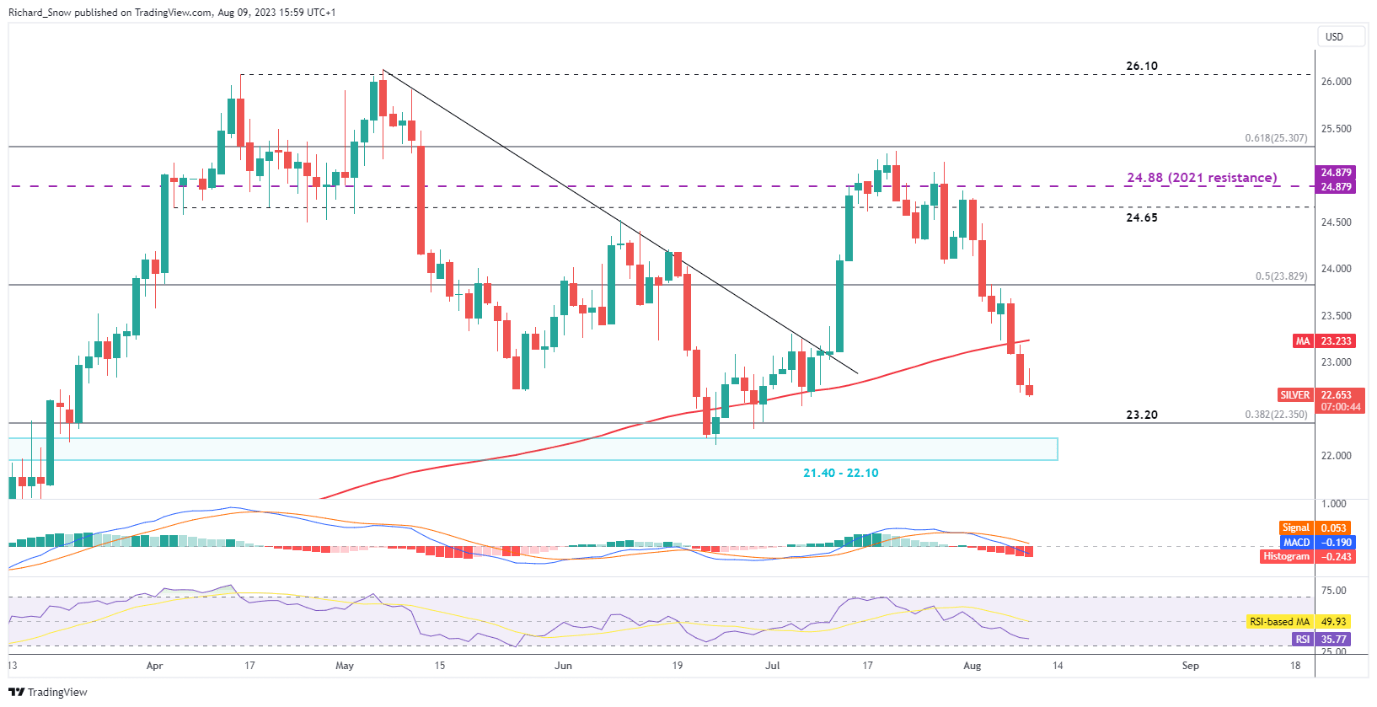

Silver Sent Lower After Clearing a Well-Known Trend Filter

The silver chart reveals a more bearish outlook than its fellow commodity, gold. Trading through the 200 SMA has implications of further downside risk. The MACD indicator suggests that momentum is skewed towards bearish price action too.

The next hurdle appears at the 38.6% Fibonacci retracement of the major 2021- 2022 decline at $22.35, followed by the zone of support around $21.40 – $22.10. Resistance appears at the 200 SMA with a long way to go until the $24.65 level becomes relevant again.

Silver (XAG/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0