Pound Sterling Price Action Setups: GBP/USD, EUR/GBP, GBP/JPY

[ad_1] Pound Sterling (GBP/USD, EUR/GBP, GBP/JPY) Analysis Pound Sterling Takes a Back Seat as US, EU Data Takes the Wheel Markets continue to exhibit enhanced sensitivity to news flow this week. Earlier US jobs data (JOLTs, ADP) sent the US dollar lower over the last 3 trading days and today’s EU inflation data has seen

[ad_1]

Pound Sterling (GBP/USD, EUR/GBP, GBP/JPY) Analysis

Pound Sterling Takes a Back Seat as US, EU Data Takes the Wheel

Markets continue to exhibit enhanced sensitivity to news flow this week. Earlier US jobs data (JOLTs, ADP) sent the US dollar lower over the last 3 trading days and today’s EU inflation data has seen a response in the euro, trading lower as core inflation eased in August as expected. UK-focused data has been rather scarce meaning sterling has been starved of a decent catalyst that would prompt a volatility revival.

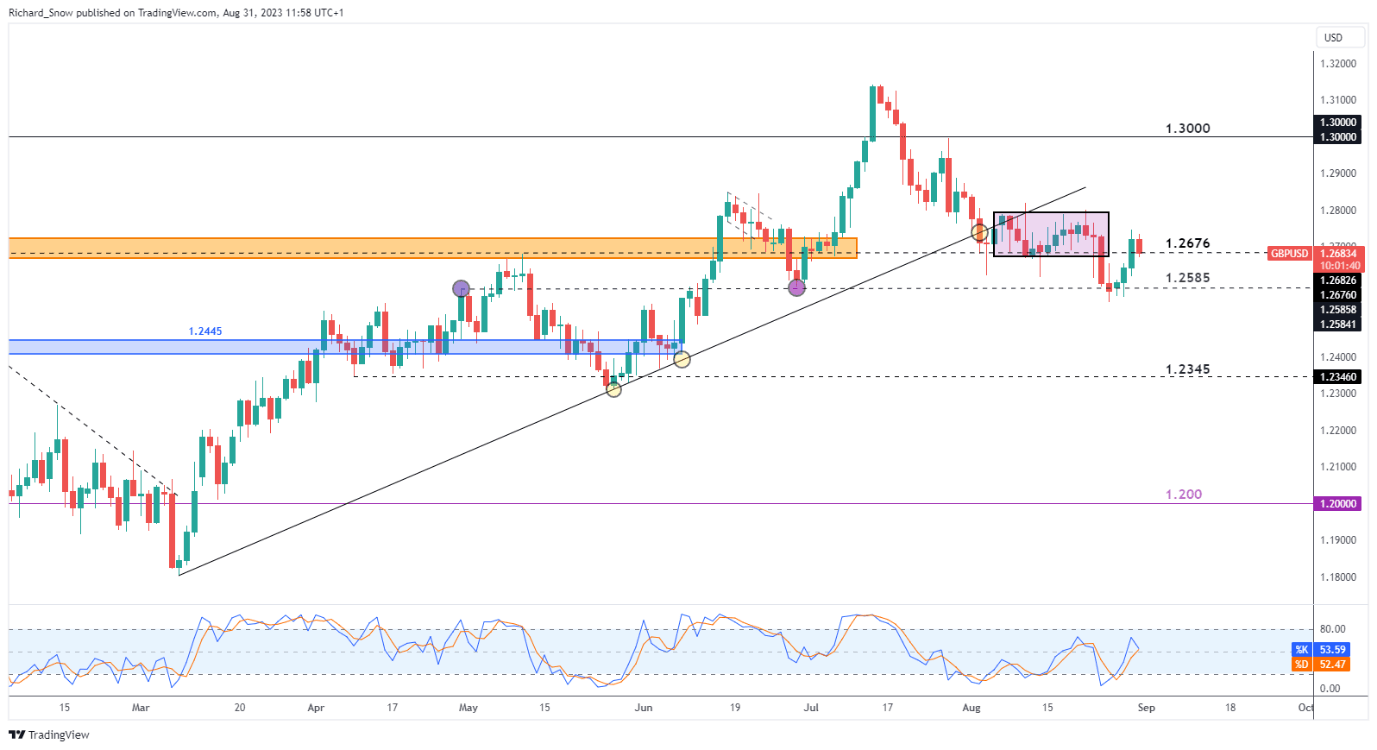

GBP/USD: Lack of momentum and a changing US economic landscape drives cable

As mentioned earlier, UK data has been few and far between this week, with markets very focused on the potentially changing economic landscape in the US, as early signs of a softer jobs market add up. There are fewer people quitting and job openings have declined to the lowest level in almost two and a half years. On top of that, the ADP estimate of private job creation in August missed estimates of 195k, coming in at 177k. The print also represents a massive decline from July which suggested that 371k jobs had been added in the month.

Cable is slightly lower today however, as markets look ahead to US PCE at 13:30 and NFP tomorrow. Do not discount the effect of a higher PCE print resulting in a stronger dollar, unwinding some of the losses throughout this week thus far. GBP/USD has traded below 1.2676 – the September 2020 spike low – with the next level of support around 1.2585. Choppy price action has ensued ever since the downside breakdown of the prior long-term trend, highlighting the sensitivity to incoming news and lack of trend bias. In these types of market conditions, trading ranges can develop with significant horizontal levels playing a more prominent role.

Upside levels of not include the high of the prior channel of consolidation at 1.2800 before the psychologically important 1.3000 comes into focus.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade GBP/USD

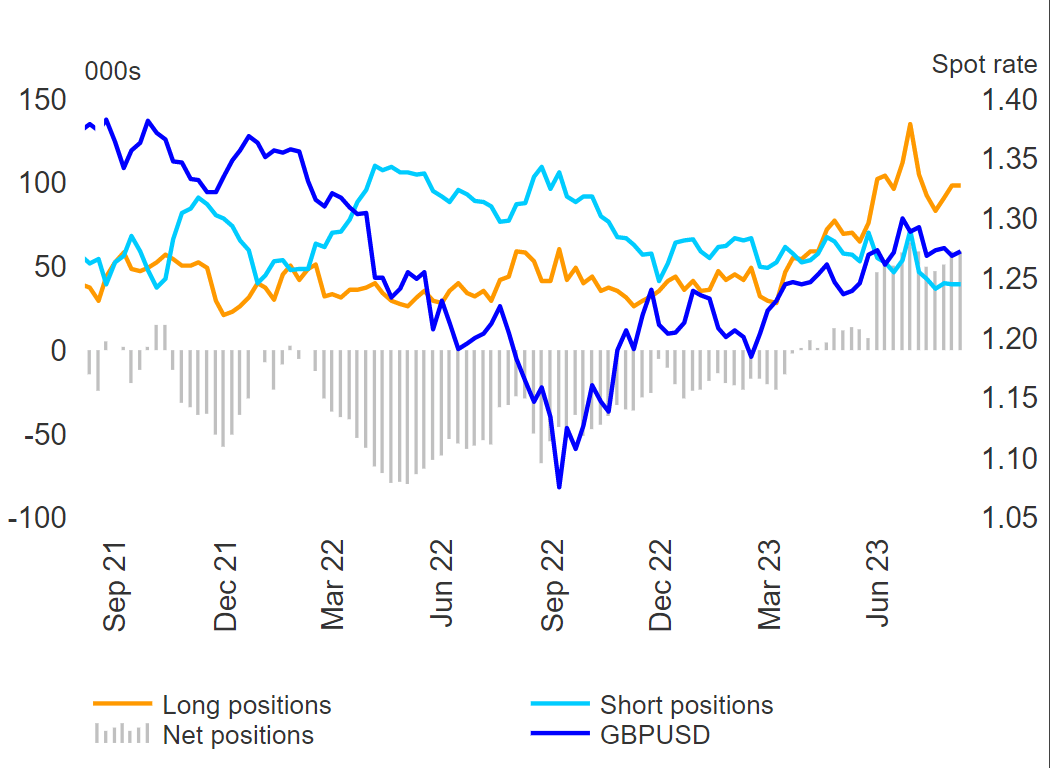

Institutional money continues to favour cable upside, with net-longs continuing to hold. According to the most recent commitment of traders data, net-longs outnumber net-short positions in sterling as interest rate expectations keep the pound elevated. Earlier today BoE economist Huw Pill signaled that he favoured maintaining rates at elevated levels rather than hiking – seeing some GBP weakness in the interim.

Pound (longs and shorts) with GBP/USD

Source: Commitment of traders report, CFTC, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | 22% | -14% | 3% |

| Weekly | -11% | 7% | -4% |

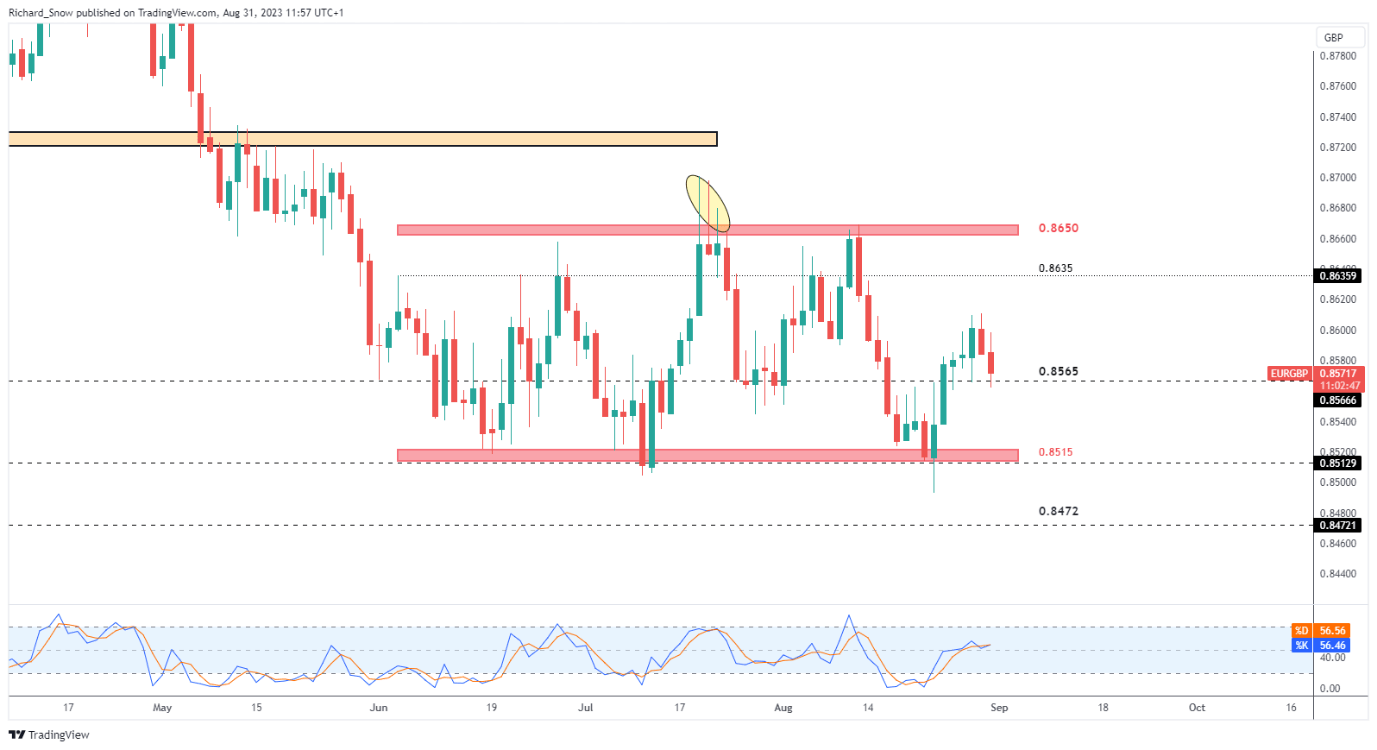

EUR/GBP: Price action Paused and Dipped Mid-Range – Euro Lower

EUR/GBP headed lower this morning after EU inflation data revealed a cooler core but hotter headline measure of inflation than what was expected. Markets appeared to focus mainly on the core print, resulting in the euro selling off, building on yesterday’s decline.

Price action appears to have turned mid-way through the broader range (0.8515 – 0.8650), currently testing support at 0.8565. Adding to the euro selloff is the fact that markets earlier priced in a 70% change of no change in the interest rate next month when the ECB rate setting committee next meet, this is up from the 50/50 split observed earlier in the week. Furthermore, ECB ‘sources’ ahead of ECB President Christine Lagarde’s Jackson Hole address, hinted that the committee is adopting a more dovish view on additional rate hikes.

Support at 0.8565 is the current level being tested with 0.8515 potentially the next level of focus. Should euro bulls find value at current levels, a move higher brings 0.8635 and 0.8650 back on the radar, but given recent inflation dynamics and an apparent dovish lean from within the ECB, the bullish outcome appears less likely for now.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

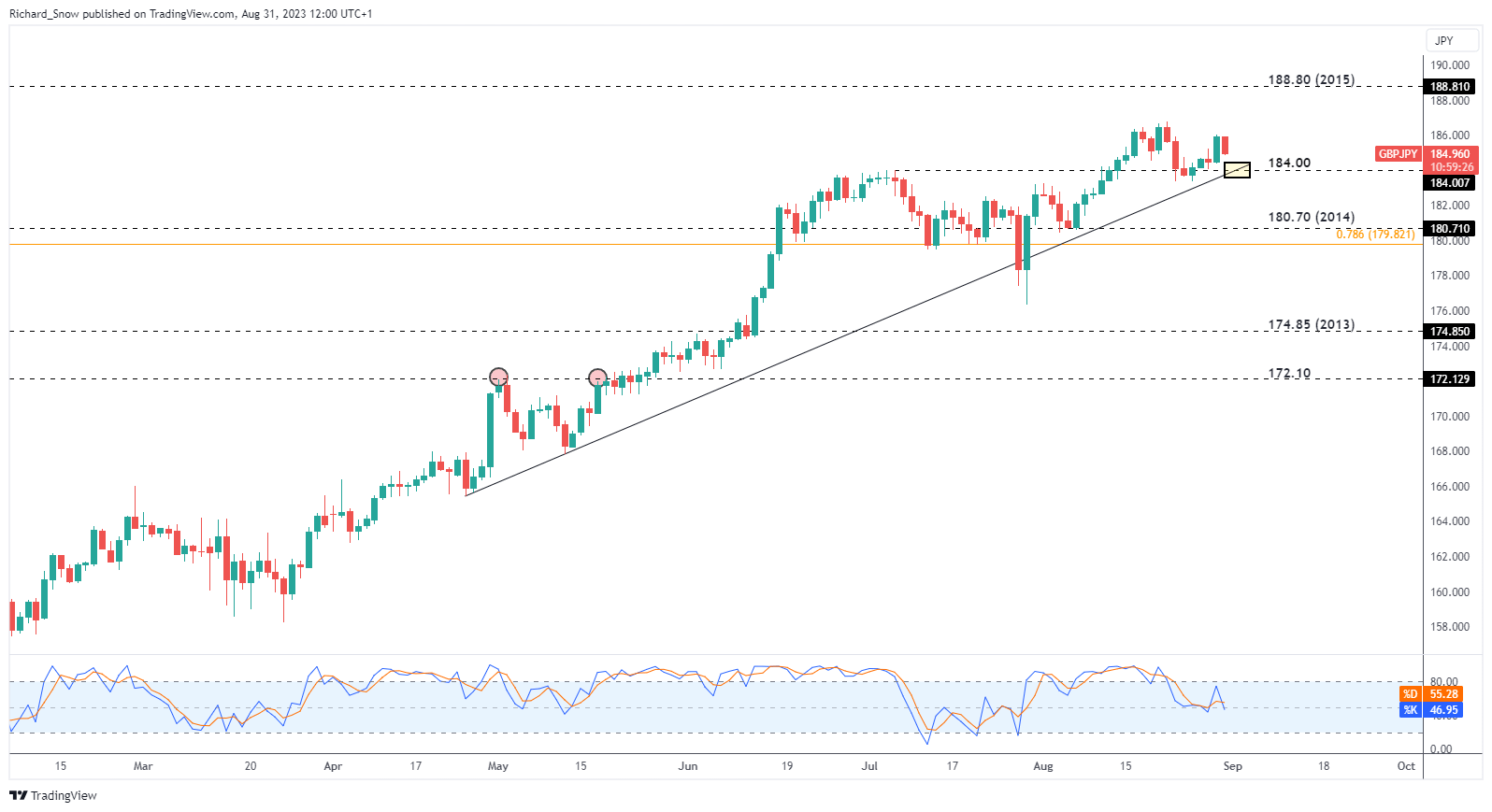

GBP/JPY: Bullish Trend Remains in Play as BoJ Official Downplays Policy Reversal

Concerns about FX intervention from the Japanese ministry of finance have diminished as another Japanese official dismisses an imminent policy overhaul. The Bank of Japan’s (BoJ) Nakamura reaffirmed that FX levels aren’t being targeted by the committee and that a more convincing economic recovery is needed before the group can discuss ending negative interest rate policy. Earlier this month, Finance Minister Suzuki allayed widespread concerns of FX intervention as USD/JPY approached levels where the ministry previously intervened to strengthen the yen.

With the BoJ in no hurry to change longstanding stimulatory policy and the Japanese government not worried about the absolute level of the yen, the longstanding uptrend is likely to remain in play. On the other side of the pair, sterling suffers form a lack of bullish drivers apart from the undercurrent of interest rate expectations, the road to 188.80 may prove to be a long one. Should the lower move in GBP/JPY continue into the weekend, 184.00 becomes a rather interesting level as it appears at the intersection of trendline support and the June swing high. Bulls may consider bullish continuation setups from here but overall bullish momentum has ebbed since reaching the yearly high at the middle of the month.

GBP/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Traits of Successful Traders

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0