POUND STERLING ANALYSIS & TALKING POINTS

- German GFK Consumer Confidence places EUR on the backfoot.

- US CB Consumer Confidence & JOLTs under the spotlight later today.

- Hesitancy shown on both GBP/USD & EUR/GBP charts.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD & EURGBP FUNDAMENTAL BACKDROP

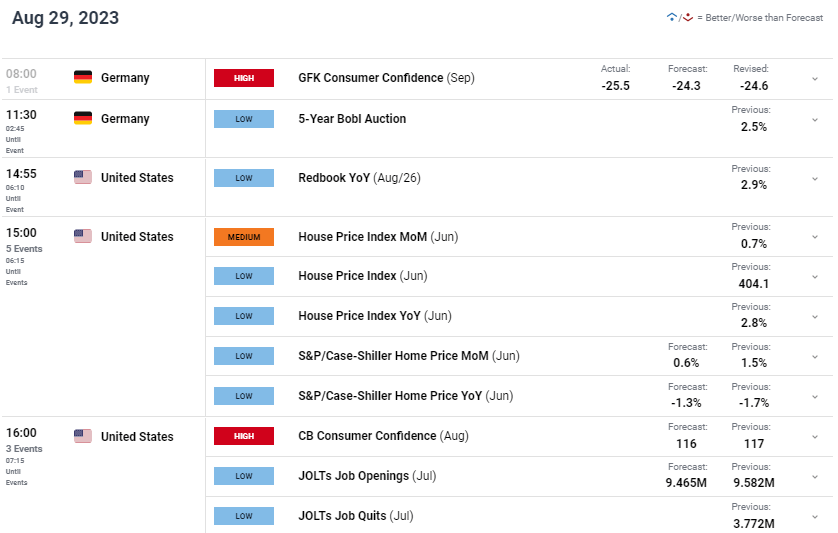

The British pound managed to find some bids this Tuesday morning against both the euro and US dollar respectively. The morning kicked off with German GFK Consumer Confidence data for September (see economic calendar below) which missed estimates, highlighting the pessimism shown via survey candidates around the nations economic health. This comes as no surprise considering the recent slew of concerning production data despite hawkish guidance given by the ECB’s President Christine Lagarde alongside other officials including Holzmann and Nagel.

From a US perspective, the Jackson Hole Economic Symposium did not provide any significant changes from Fed Chair Jerome Powell placing more emphasis on upcoming US data. Later today, US house price index, CB Consumer Confidence and JOLTs figures will be in focus with particular importance on JOLTs to ascertain whether or not there is any weakness showing in the robust labor market ahead of Friday’s Non-Farm Payroll (NFP) release.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GBP/USD & EUR/GBP ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

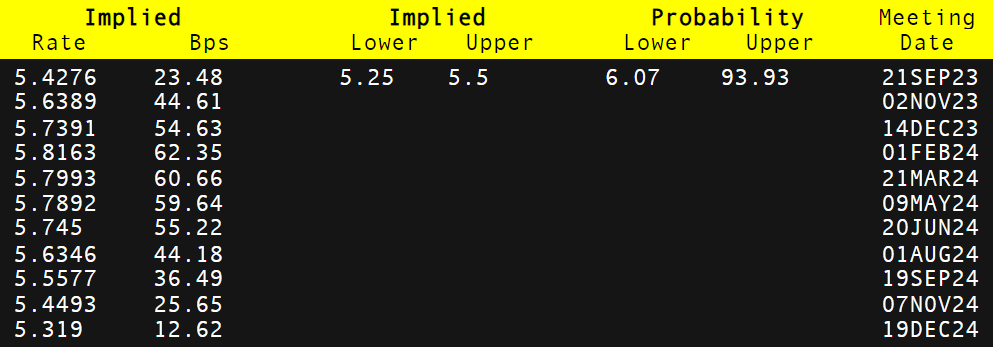

The Bank of England’s (BoE) interest rate cycle projections (refer to table below) remain comparatively more aggressive than the other two central banks due to elevated inflationary pressures in the UK. Keeping rates at higher levels for a sustained period of time was reiterated by the BoE’s Broadbent over the weekend but with the UK economic calendar fairly light this week, primary drivers will likely stem from euro and USD fundamental factors.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

TECHNICAL ANALYSIS

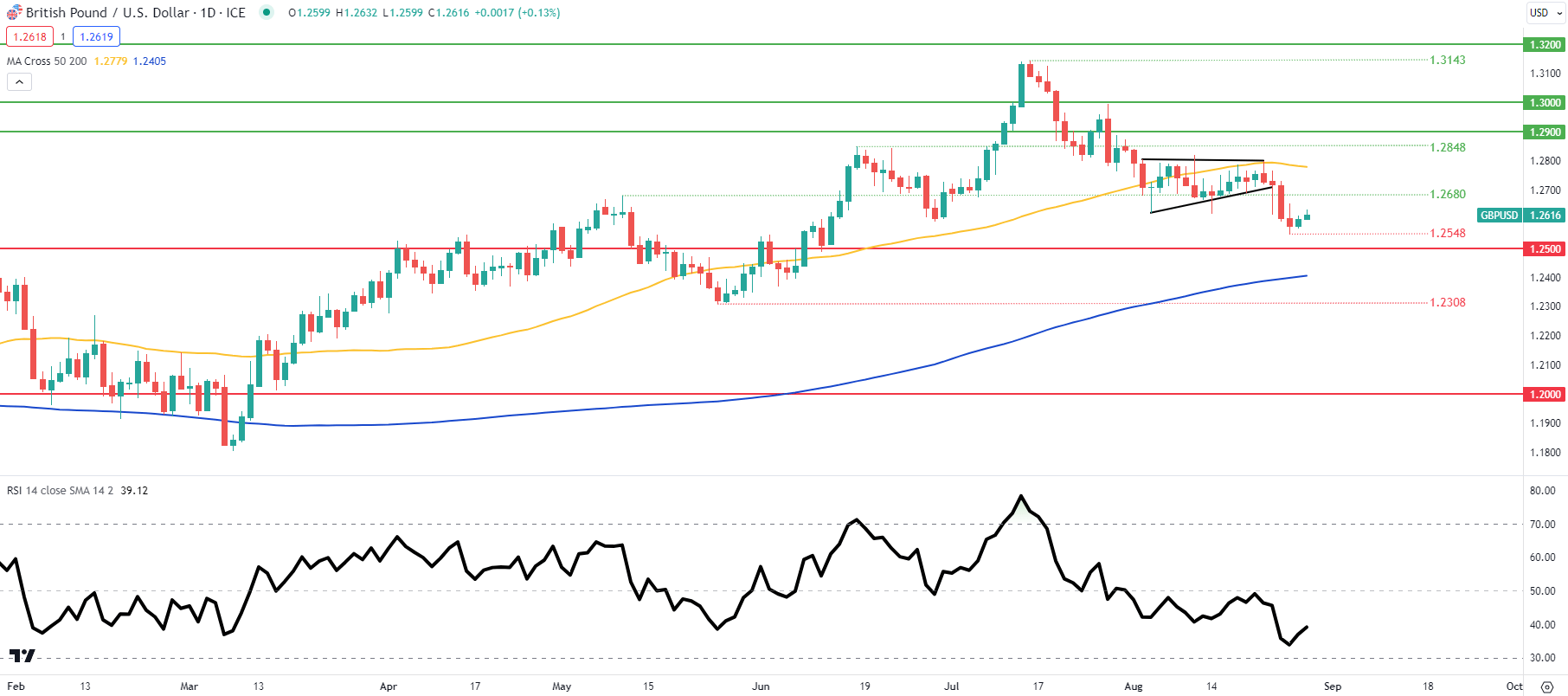

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above shows the pair in bearish territory short-term as prices trade below the 50-day moving average (yellow) while the Relative Strength Index (RSI) tracks below the midpoint 50 level. There is unlikely to be any major moves prior to US core PCE and NFP data later in the week.

Key resistance levels:

- 1.2848

- 50-day moving average (yellow)

- 1.2680

Key support levels:

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 56% of traders holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

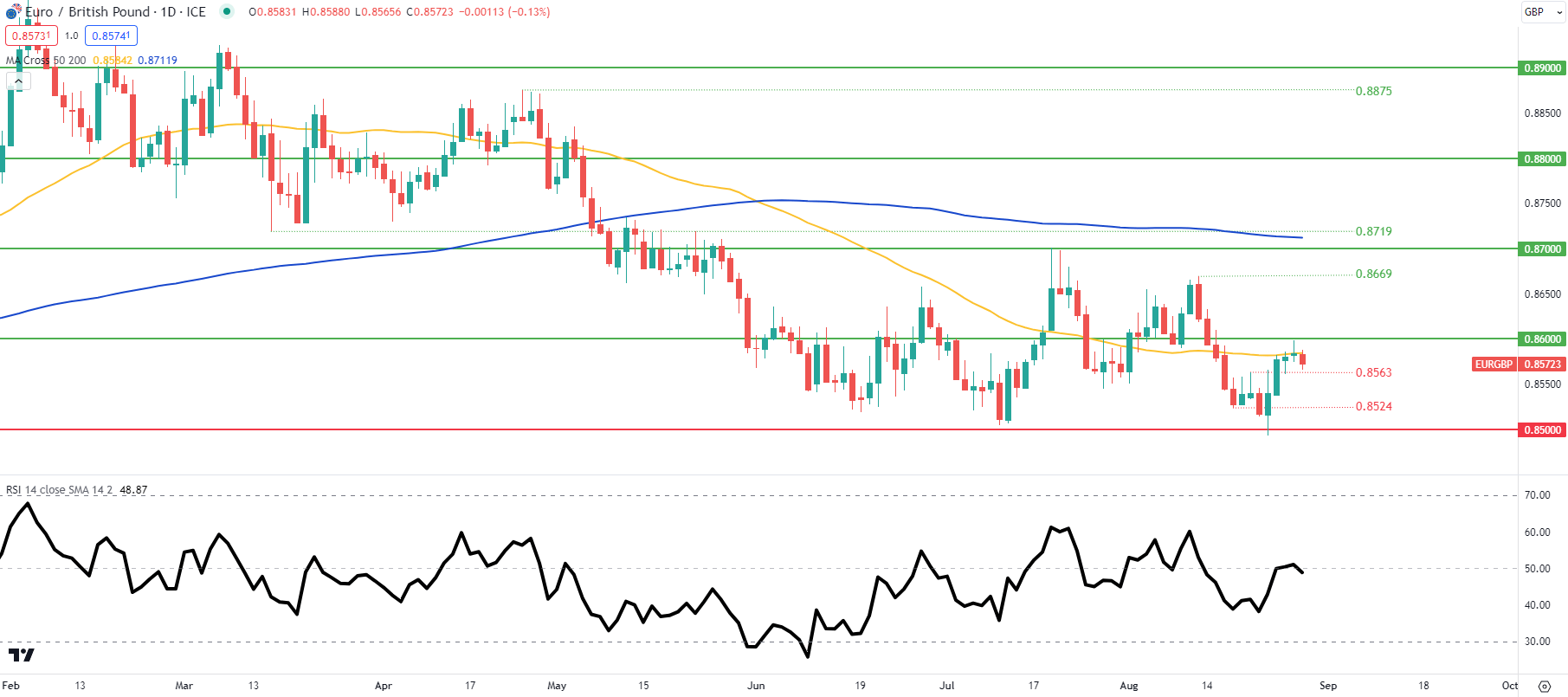

EUR/GBP DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/GBP has returned lower off the 0.8600 psychological resistance handle after yesterday’s long upper wick close. The pair is now below the 50-day moving average as well. The RSI favors neither bullish nor bearish at this point and markets will likely adopt the same attitude as with cable whereby EZ inflation data will provide the fundamental catalyst.

Key resistance levels:

- 0.8669

- 0.8600

- 50-day moving average (yellow)

Key support levels:

BULLISH IG CLIENT SENTIMENT (EUR/GBP)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on EUR/GBP with 62% of traders holding long positions (as of this writing).

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0