POUND STERLING ANALYSIS & TALKING POINTS

- BoE guidance & UK housing price report weigh negatively on GBP.

- US in focus later today.

- Head & shoulders breakout opens up subsequent support zones.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound faced some stiff competition from the US dollar yesterday after US ISM services PMI’s outperformed, resulting in a firming greenback. This morning, cable is marginally lower considering the central bank speak at the BoE MPC Treasury Committee Hearings that suggested a more dovish stance relative to market pricing. Data dependency was emphasized by the BoE’s Governor Bailey while other officials cited moderating inflation across the CPI basket.

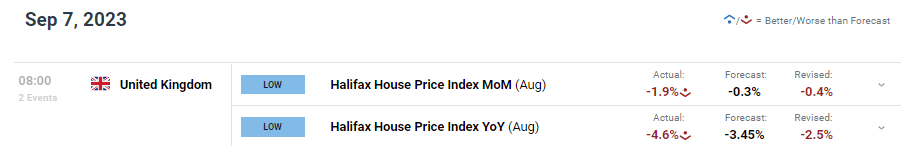

This morning, the UK Halifax House Price Index report (see economic calendar below) was released, showing prices declining by the largest percentage year-to-date. A net negative for GBP as per economic theory as a reduction in housing prices tends to lend itself to a decrease in consumer spending, leading to lesser inflationary pressures and subsequently less pressure on the BoE to maintain a hawkish monetary policy stance.

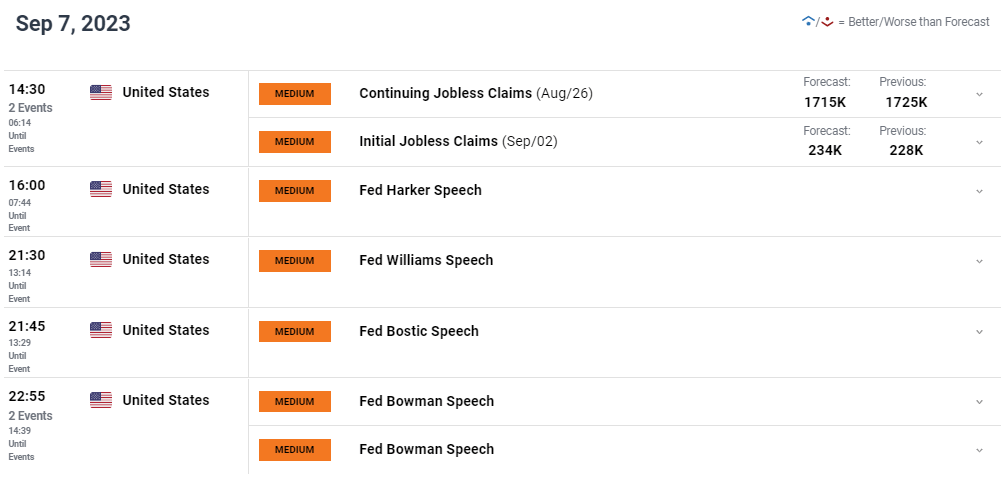

Later today, the US economy will be in focus with jobless claims data expected alongside several Fed speakers. Should jobless claims (particularly initial jobless claims) miss estimates, the pound could be in for further downside to come.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

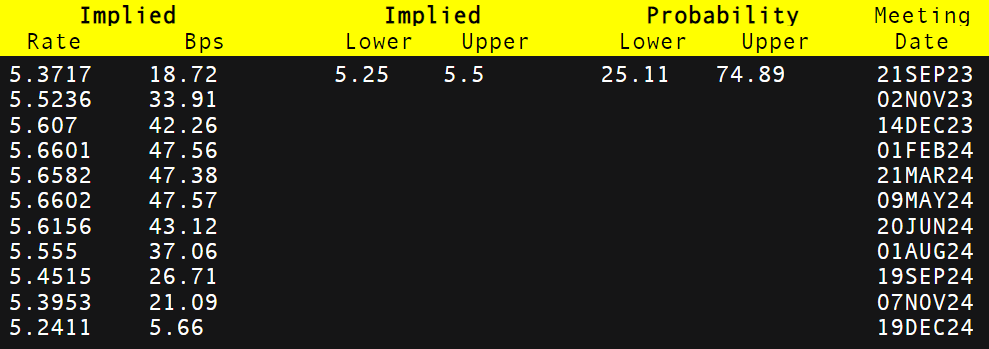

Looking at market pricing for the Bank of England’s (BoE) rate cycle (refer to table below), projections have drastically softened down to 47bps of tightening as opposed to 57bps just yesterday. This dovish repricing has been reflected in the weaker pound throughout yesterday and today.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

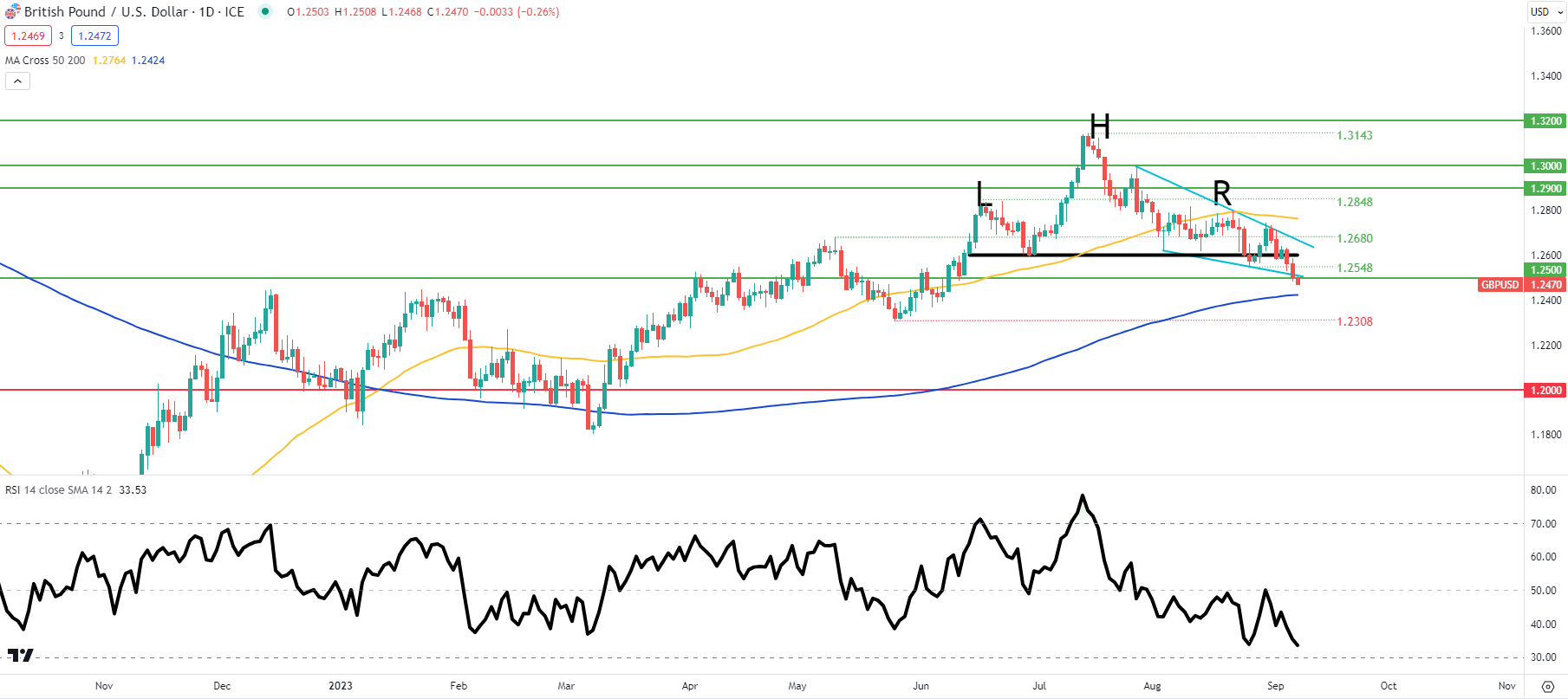

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above has broken below the short-term falling wedge (blue) thus invalidating the pattern alongside a confirmed breakout below the neckline of the longer-term head and shoulders formation. A daily close below the 1.2500 psychological handle could expose the pair for another leg lower with the first port of call being the 200-day moving average (blue).

Key resistance levels:

- 1.2680

- Wedge resistance

- 1.2548

- 1.2500

Key support levels:

- 200-day moving average (blue)

- 1.2308

BEARISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 63% of traders holding LONG positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0