SEPTEMBER LABOR MARKET REPORT

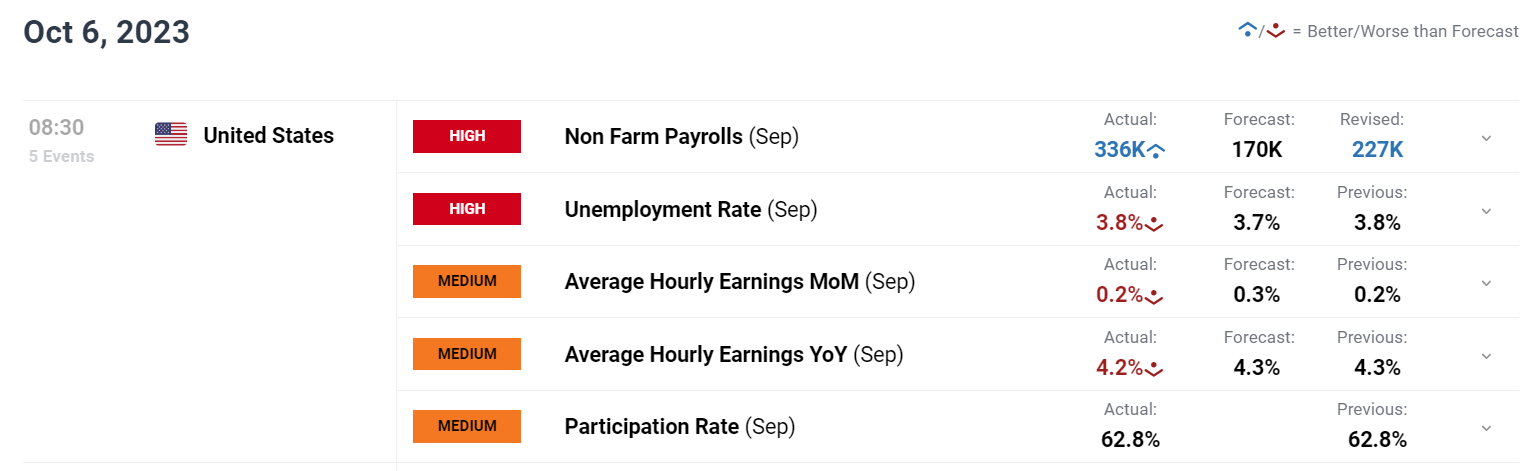

- September U.S. nonfarm payrolls increased by 336,00 versus 170,000 expected.

- The unemployment rate held steady at 3.8%, one-tenth of a percent above estimates.

- Average hourly earnings clocked in 0.2% m-o-m and 4.2% y-o-y, slightly below forecasts

Most Read: Seasonality and Historical Q4 Performance of U.S Equities: S&P 500 and Nasdaq 100

U.S. employers expanded their workforce and grew headcount at a brisk pace last month, undaunted by the advanced stage of business cycle and the Federal Reserve’s fast-and-furious tightening campaign, highlighting the remarkable resilience of the labor market and its ability to sustain the overall economy through the latter part of 2023.

According to the most recent statistics from the U.S. Department of Labor, the country generated 336,000 jobs in September, compared to the 170,000 expected, following an upwardly revised gain of 227,000 payrolls in August. Meanwhile, household data showed that the unemployment rate held steady at 3.8%, indicating a persistent imbalance between demand and supply for workers.

Elevate your trading skills and gain a competitive edge. Get your hands on the U.S. dollar‘s Q4 outlook today for exclusive insights into the pivotal catalysts that should be on every trader’s radar.

Recommended by Diego Colman

Get Your Free USD Forecast

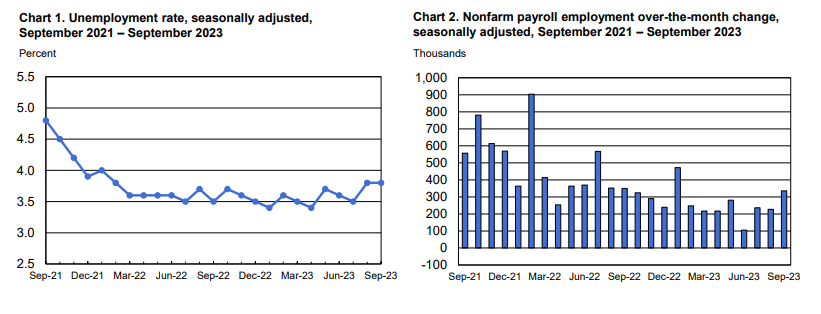

UNEMPLOYMENT RATE AND NONFARM PAYROLLS

Source: BLS

Elsewhere in the establishment survey, average hourly earnings, a powerful inflation gauge closely tracked by the Federal Reserve, rose by 0.2% monthly, bringing the annual rate to 4.2% from 4.3% previously, one-tenth of a percent below forecasts in both cases.

LABOR MARKET DATA AT A GLANCE

Source: DailyFX Economic Calendar

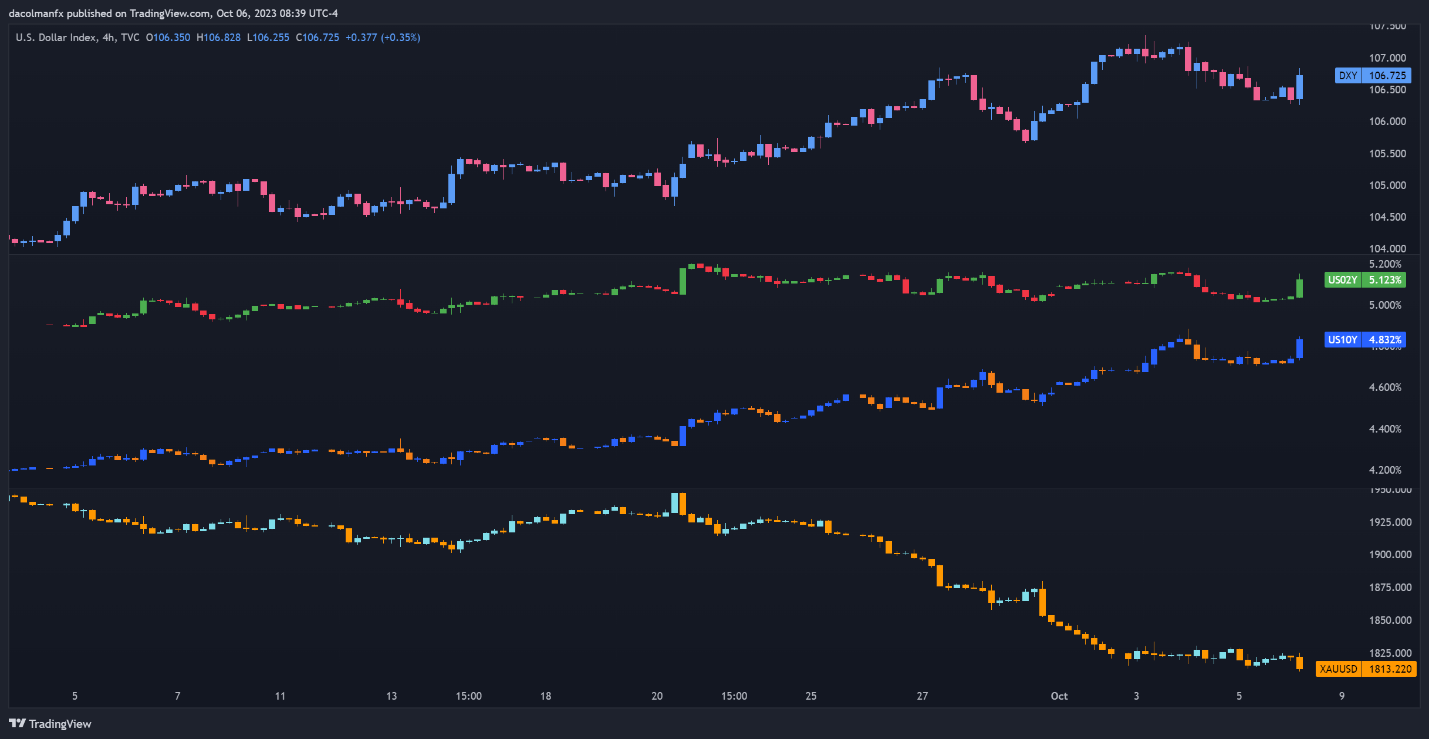

Immediately following the release of the jobs report, the U.S. dollar, as measured by the DXY index, extended its session’s advance, driven by rising U.S. Treasury yields. Meanwhile, gold prices took a downward turn, weighed by the upswing in rates and FX market dynamics.

Fed policymakers have held out the possibility of additional monetary policy tightening this year, but have not firmly embraced this course of action. Today’s NFP results could tilt policymakers in favor of another hike in 2023, keeping yields and the greenback biased to the upside. In this scenario, gold is likely to remain depressed.

Supercharge your trading prowess with an in-depth analysis of gold’s outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now!

Recommended by Diego Colman

Get Your Free Gold Forecast

GOLD PRICE, US DOLLAR, AND US YIELDS CHART

Source: TradingView

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0