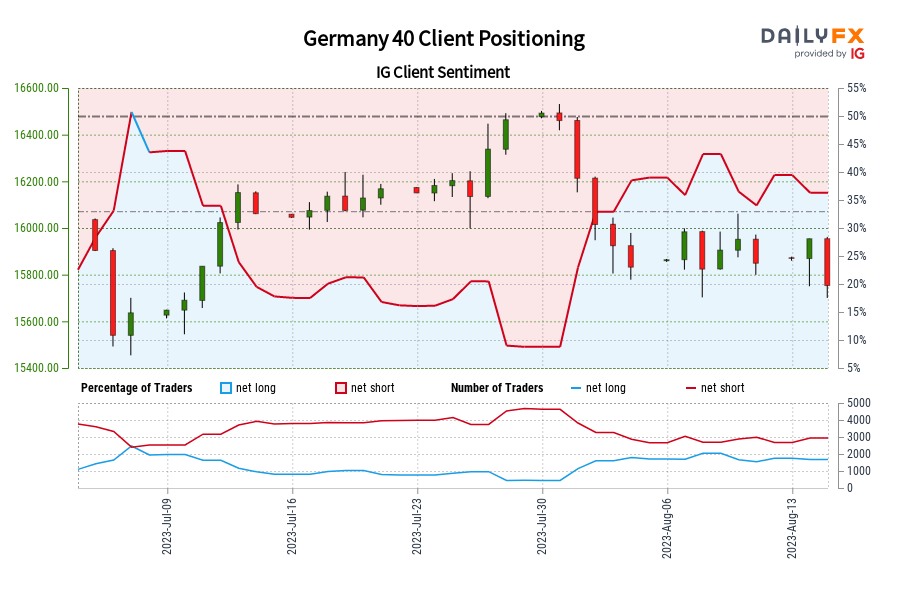

Number of traders net-short has decreased by 9.61% from last week.

| SYMBOL | TRADING BIAS | NET-LONG% | NET-SHORT% | CHANGE IN LONGS | CHANGE IN SHORTS | CHANGE IN OI |

|---|---|---|---|---|---|---|

| Germany 40 | BEARISH | 50.10% | 49.90% |

50.19% Daily 11.66% Weekly |

-23.23% Daily -9.61% Weekly |

1.67% Daily -0.07% Weekly |

| Change in | Longs | Shorts | OI |

| Daily | 42% | -16% | 5% |

| Weekly | 17% | -6% | 3% |

Germany 40: Retail trader data shows 50.10% of traders are net-long with the ratio of traders long to short at 1.00 to 1. In fact, traders have remained net-long since Jul 07 when Germany 40 traded near 15,636.40, price has moved 0.75% higher since then. The number of traders net-long is 50.19% higher than yesterday and 11.66% higher from last week, while the number of traders net-short is 23.23% lower than yesterday and 9.61% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Germany 40 prices may continue to fall.

Our data shows traders are now net-long Germany 40 for the first time since Jul 07, 2023 when Germany 40 traded near 15,636.40. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Germany 40-bearish contrarian trading bias.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0