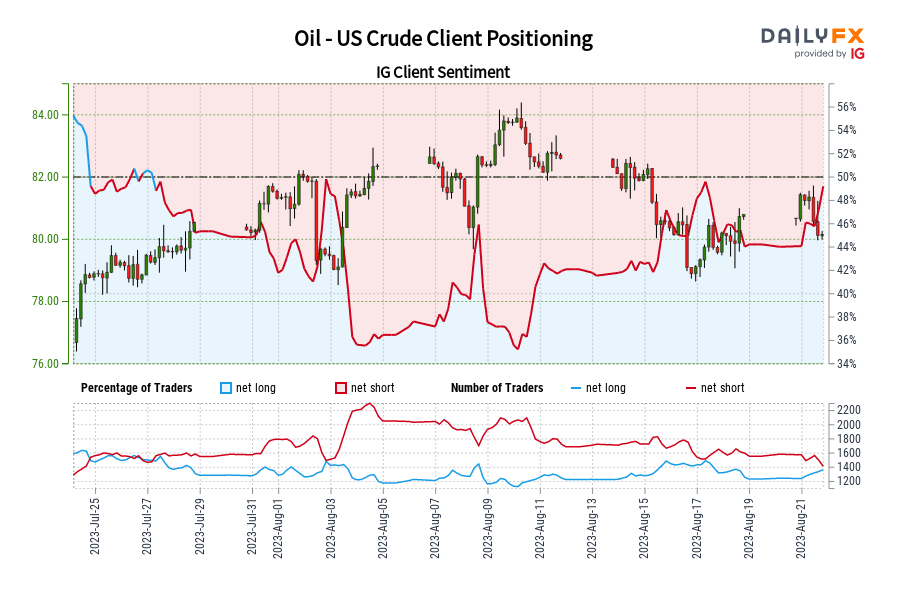

Number of traders net-short has decreased by 19.91% from last week.

| SYMBOL | TRADING BIAS | NET-LONG% | NET-SHORT% | CHANGE IN LONGS | CHANGE IN SHORTS | CHANGE IN OI |

|---|---|---|---|---|---|---|

| Oil – US Crude | BEARISH | 50.02% | 49.98% |

11.91% Daily 8.40% Weekly |

-11.99% Daily -19.91% Weekly |

-1.46% Daily -7.87% Weekly |

| Change in | Longs | Shorts | OI |

| Daily | 8% | -5% | 1% |

| Weekly | 7% | -18% | -7% |

Oil – US Crude: Retail trader data shows 50.02% of traders are net-long with the ratio of traders long to short at 1.00 to 1. In fact, traders have remained net-long since Jul 27 when Oil – US Crude traded near 79.61, price has moved 0.67% higher since then. The number of traders net-long is 11.91% higher than yesterday and 8.40% higher from last week, while the number of traders net-short is 11.99% lower than yesterday and 19.91% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil – US Crude prices may continue to fall.

Our data shows traders are now net-long Oil – US Crude for the first time since Jul 27, 2023 when Oil – US Crude traded near 79.61. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil – US Crude-bearish contrarian trading bias.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0