MultiMAX – The Multi-Symbol Position Trading EA – Other – 16 June 2023

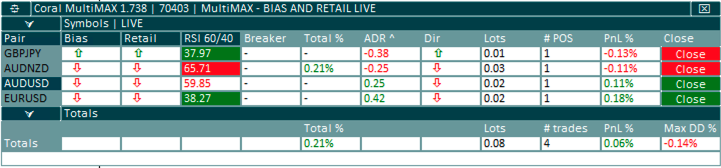

[ad_1] INTRODUCTION Coral MultiMAX is an MT4 EA for automating Portfolio Management while Position Trading a Mean Reversion strategy on multiple pairs. Coral MultiMAX is built on top of a single-symbol position trading EA called CoralMAX. CoralMAX is built-in to MultiMAX; you don’t need a separate EA to run MultiMAX. Everything is self-contained in the

[ad_1]

INTRODUCTION

Coral MultiMAX is an MT4 EA for automating Portfolio Management while Position Trading a Mean Reversion strategy on multiple pairs.

Coral MultiMAX is built on top of a single-symbol position trading EA called CoralMAX. CoralMAX is built-in to MultiMAX; you don’t need a separate EA to run MultiMAX. Everything is self-contained in the MultiMAX EA.

In short, Coral MultiMAX runs a bunch of child EAs for position trading. Each child EA takes entries based on a mean reversion strategy, using RSI/ADR extensions and reversals as entry conditions. MultiMAX will control which EAs can take trades based on a number of factors that would usually need to be managed by hand: Exposure, Bias, and Portfolio Size, and a number of other rules. There are also options for performing automatic drawdown control (DDC) when things go against you. All combined it is a nearly completely automated approach to position trading mean reversion. You would only need to update your trading bias as you like; and occasionally take some action if one of your trades moves too far against you, a condition that MultiMAX will alert you to.

MultiMAX cannot be used in the MT4 strategy tester, which is designed for testing EAs on a single pair. If you want to backtest for a single pair, CoralMAX does support this.

There is also a more comprehensive downloadable PDF guide available for MultiMAX, attached to this blog post.

QUICK START GUIDE

- Symbols – All of the pairs you want to trade must be available in Market Watch in your MT4 instance. If your broker uses a prefix or suffix on symbol names, be sure to add those in the inputs. If the symbol name is greyed out in Market Watch, it is NOT available for trading.

- Choose the symbols you want Max to trade in the “SYMBOL SETTINGS” section of the inputs. By default it is configured to trade 28 Forex pairs, but you have complete freedom to change it.

- Put MultiMAX on a chart.

- Symbol – The symbol on the chart does not matter, the EA will trade the pairs you configure it for regardless of what chart it’s on.

- Timeframe – The chart timeframe controls when each child EA will consider taking a trade. If you’re trading the H1/M5 Mean Reversion strategy, for example, then put this on an M5 chart.

- Set the Magic Number to something unique. This will be used by all trades taken by MultiMAX across all pairs. The EA won’t have any trouble keeping all of its own trades on different pairs separate, but you may not want it to attempt to manage trades that are taken manually or with other EAs. If you set the magic number to zero then MultiMAX will manage ALL trades in your portfolio for which it has a symbol loaded, even those taken manually and by different EAs. Not recommended.

- Bias – If you’re using Bias, use the arrows next to each symbol in the “Bias” column to set the direction to permit each child EA to trade. This data is saved to a file and reloaded as needed so you don’t have to reset these each time you start up.

That’s pretty much it. Configure it to your preferences and let it go. Every so often you may want to update Bias as that changes over time (or just use Bias as kind of an on/off switch for individual child EAs).

OPTIONS

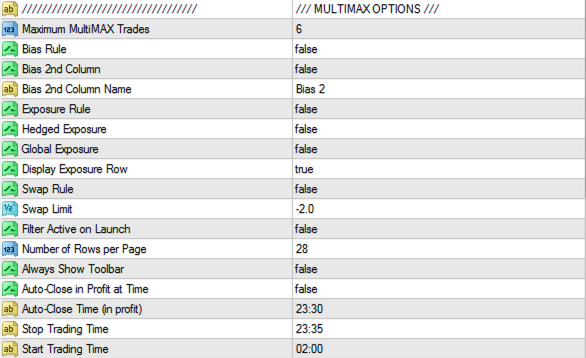

- MAXIMUM MultiMAX Trades – The maximum number of trades that MultiMAX will allow to be taken at the same time (i.e., the maximum number of pairs that will be traded at the same time).

- BIAS RULE – Whether bias rules will be used to control if a CoralMAX instance can take a trade. If you set this to “false,” the Bias column is not displayed.

- BIAS 2nd COLUMN – A second Bias column that you can use to track additional bias data. For instance, if you use the first Bias column for an overall setting, and want to also track a secondary measure such as COT direction, retail sentiment etc, you can track that here. The BIAS 2nd COLUMN NAME is the label that will be displayed in the header of the column and in the Toolbar, so you can call it anything you like.

- EXPOSURE RULE – Whether exposure rules will be used to control if a CoralMAX instance can take a trade. If HEDGED EXPOSURE is “false” then you Max will only trade in one direction per currency up to the limit. When “true” then the limits apply in each direction For instance, with a limit of 2 and hedged exposure is “true” you can have up to 2 long and 2 short on a currency. When hedged exposure is “false,” once you’re in a currency in one direction, Max will not open a trade for that currency in the opposite direction.

ℹ️ NOTE: If you enable hedging (Allow Hedged Baskets) then HEDGED EXPOSURE is automatically turned on. Otherwise Max would never take hedged trades.

ℹ️ NOTE: You can customize the exposure limit per currency, see Exposure Limits above.

- EXPOSURE ROW – When the EXPOSURE RULE is turned on you can also optionally display a row at the bottom of the window to display your current exposure per currency.

- SWAP RULE – Whether the swap rule will be used to control if a CoralMAX instance can take a trade. When true, if the swap costs for a pair in a direction exceed the swap limit, a trade in that direction will not be permitted. For instance, if the swap costs for a pair to trade short is -2.50, and you have the limit set to -2.00, then the EA will not trade this pair short.

- In addition, the colors used for other values in the Symbols list will be shown in a lighter color when the swap rule is turned on and a trade is disallowed in that direction.

- FILTER ACTIVE ON LAUNCH – The first thing I always do when I start up MultiMAX is expand both sections and filter the list. I did it so often I got tired of doing it, so I added this option to set that state automatically. But the default for this option is “false,” because if you start up MultiMAX for the first time and don’t see any symbols in the list (it’s filtered to only show active trades, but there are no active trades), it could be confusing.

- NUMBER OF ROWS PER PAGE – If you have a large number of trades open, the number of trades can exceed the size of your chart. This parameter sets the number of rows to show in the Symbols list at a time, and you can page forward and backward through the list by using the paging controls on the toolbar or the keyboard shortcuts.

- ALWAYS SHOW TOOLBAR – When true, the toolbar at the bottom of the Symbols list will always be displayed (when the Symbols section is expanded). When false, the toolbar will only be displayed when the number of rows exceeds the NUMBER OF ROWS PER PAGE parameter (i.e., it only shows when it’s needed for paging).

- AUTO CLOSE IN PROFIT AT TIME – When true, any trades that are in profit at the specified time will automatically be closed.

- TIME TO AUTO-CLOSE TRADES IN PROFIT – A string of the format “HH:MM” on a 24-hour clock. NOTE, this time must be a multiple of the chart timeframe where MultiMAX is running. We will check for this time on a new bar, so if you’re on an M5 chart and the time says “23:49”, it will not match.

- STOP / START TRADING TIME – Strings of the format “HH:MM” on a 24-hour clock. Allows you to specify a time range for disabling trading, for instance overnight when spreads are often wider. When disabled no processing from any child EAs will be done, and a message is displayed in the status bar indicating when trading will resume. To disable this feature set both the start time and stop time to the same time.

- STOP TRADING AT DD % – If your total portfolio drawdown reaches this value, MultiMAX will not take any new trades. Existing trades will still be able to scale in as their conditions permit. Set this value to 0.0% to disable. This limit does not send its own alert, since you’d also be getting alerts from ALERT AT TOTAL DD%.

⚠️ NOTE: This refers to the trades open in an instance of MultiMAX, not to all orders open in your MT4. If your account is in 25% of drawdown and you have STOP TRADING AT DD% set to 20%, but the trades open in Max are only at 5% drawdown, Max will continue to trade.

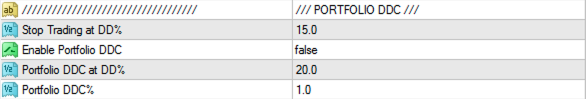

PORTFOLIO DRAWDOWN CONTROL

MultiMAX has the ability to monitor the drawdown on your entire portfolio and take action in case it is getting out of hand.

- Stop Trading at DD% – When you reach this amount of drawdown in your portfolio, do not allow any new trades to be taken. Any trades that are currently open can still scale-in as usual.

- Enabled Portfolio DDC – Turn this setting on to enable this feature. Having a separate switch for this ensures that trades in loss are not accidentally closed by MultiMAX when you start it up.

- Portfolio DDC at DD% – When your portfolio reaches this amount of drawdown, the DDC action is initiated.

- Portfolio DDC% – Reduce this amount of drawdown from your portfolio. MultiMAX will first find the symbol being traded with the highest drawdown, and then for that symbol and direction will find the trade that is the farthest away from current price. It will attempt to do a partial close from this trade of up to Portfolio DDC%. There are a couple of important things to note:

- If the trade is smaller than the Portfolio DDC%, then the entire trade is closed. Not the whole position on this symbol! Just the farthest trade from current price.

- If it is not possible to do a partial close because the lot size is too small (e.g., you are already trading with minimum lot sizes), then the entire trade will be closed, even if the trade value is > Portfolio DDC%.

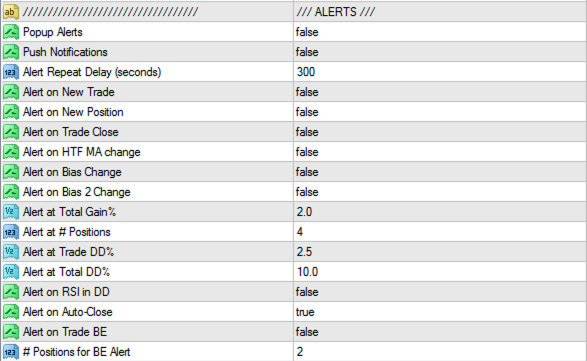

ALERTS

- Alerts & Notifications– Turns on and off the alerting features. Standard MT4 stuff.

- ALERT REPEAT DELAY – After getting an alert, how long before you get another alert for the same pair. Not all alerts are created equal:

- REPEAT DELAY: Transient alerts such a the RSI Filter, ADR Filter and HTF Breaker Filter.

- ONCE PER DAY: Alert at # positions, trade DD%, total DD%, trade BE (reset every new day, on the first tick of the day)

- EACH TIME: New trades or positions, trade closed, HTF MA direction change, RSI in DD

- ALERT ON NEW TRADE/POSITION/CLOSE – Send an alert/notification for trade operations.

- ALERT ON HTF MA CHANGE – If you have trades on a pair and the HTF direction changes, an alert will be sent.

This alert will send whether you have the HTF MA Filter on or off, but only if a change in HTF direction is detected for a pair that you have an active trade on. The idea is that if you’re using the HTF Filter for bias and you have trades open, you will probably want to take a look at those trades and decide if some action is needed.

- ALERT ON BIAS (2) CHANGE – If you’re in a trade and you have BIAS RULES or (BIAS 2 RULES) turned on, and bias was previously in the direction of your trade but then changes to no longer be in the direction of your trade, then receive an alert. You might want to consider getting out of this trade in this situation.

- ALERT AT TOTAL GAIN % – Notify you when you’ve made this much profit. This is based on the Total % for all EAs, which is the sum of daily profit for all EAs; this value is cleared every day.

- If your total gain exceeds this amount, the “Total %” cell in the totals row will be highlighted in green.

- ALERT AT # POSITIONS/TRADE DD%/TOTAL DD% – These are the alerts/notifications that could indicate it’s time to start considering some drawdown control. The trade or portfolio is getting outside of your Comfort Zone.

- If you have a trade that exceeds ALERT AT TRADE DD%, the PnL% cell for that trade will be highlighted in red.

- If your portfolio exceeds the ALERT AT TOTAL DD%, the “Total DD%” cell in the totals row will be highlighted in red.

- ALERT ON RSI in DD – When you are in a trade that is in drawdown, if RSI exceeds the RSI High (for a SELL) or the RSI Low (for a BUY), receive an alert. The alert does not require a breaker, this only considers RSI. The reason for this alert is that this represents market conditions when you may want to consider an aggressive entry.

- ALERT ON AUTO-CLOSE – If you have enabled AUTO-CLOSE AT TIME and Max closed out trades in profit, an alert will be sent with the results.

- ALERT ON TRADE BE – If you have a trade that was in drawdown but has reached BE, and it has at least # POSITIONS for BE ALERT, this will send an alert.

- The more positions a trade has, the higher the risk and the faster the gain or drawdown will rise and fall. If you’ve had a trade in drawdown and it gets to BE, you may want to be alerted to this case so you can adjust targets. For instance, if your default Target Percent is 0.25% but this trade has many positions, then it will likely hit your target very quickly and keep moving. This would be a good time to consider moving your target farther away.

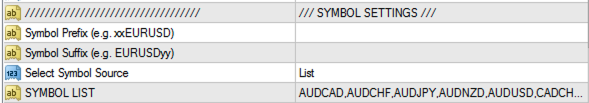

SYMBOLS

Use this section to control which symbols will be used by MultiMAX for trading. Each symbol becomes an instance of CoralMAX EA to trade that pair.

- SYMBOL PREFIX/SUFFIX. If your broker uses a prefix or suffix on the pair’s name, then you must identify that here.

- SELECT SYMBOL SOURCE.

- MARKET WATCH – All trades listed in your Market Watch will be traded

- CURRENT CHART – Just the one Symbol for this chart

- CURRENTLY OPEN TRADES – Load the pairs for which you have open trades

- MAJORS – AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF, USDJPY

- LIST – A list which you customize in the next row

- SYMBOL LIST – When “LIST” is selected above, this is the list of symbols to use.

The rest of the OPTIONS available in MultiMAX come from CoralMAX, please see the blog post here for more information.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :June ، MultiMAX ، Multisymbol ، Position ، Trading

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0