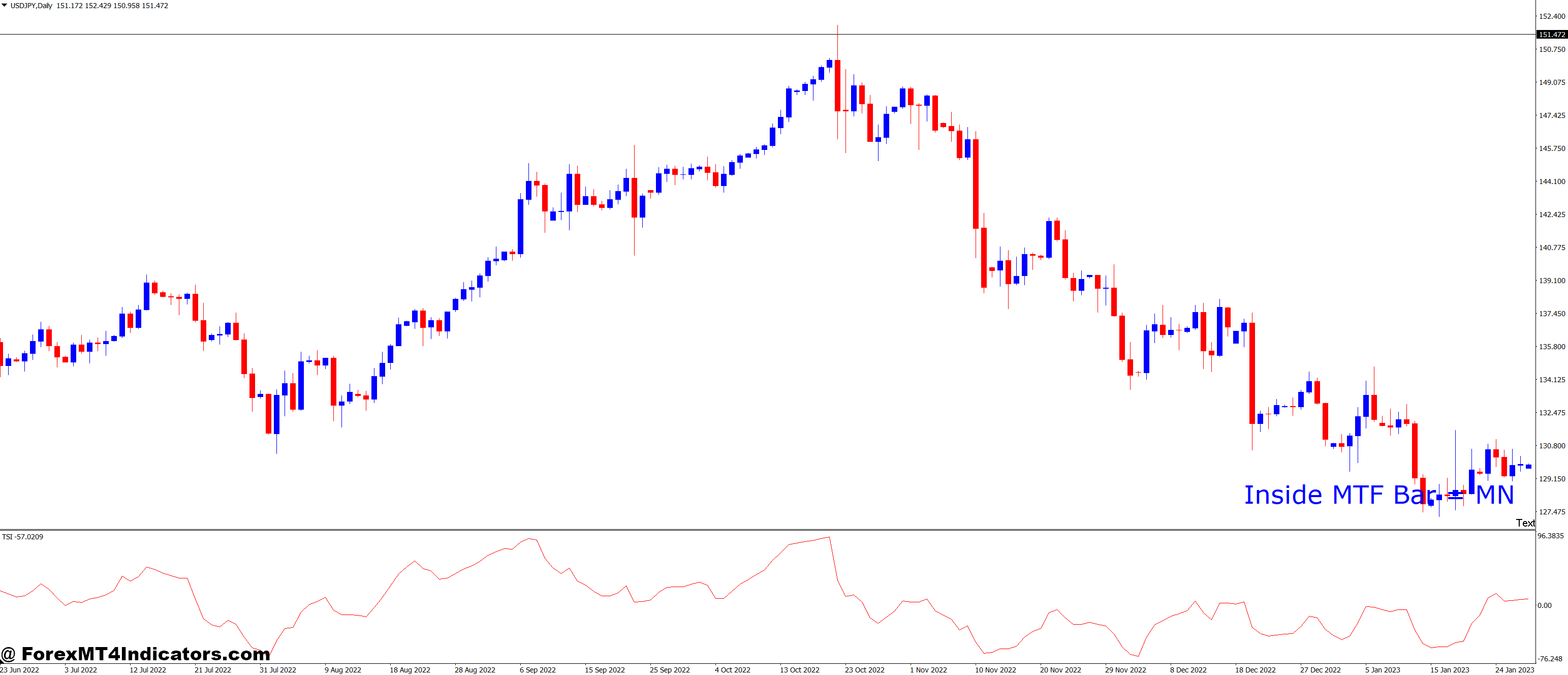

MTF Inside Bar and TSI Forex Trading Strategy

[ad_1] Are you finding it hard to understand forex trading? The MTF Inside Bar and TSI Forex Trading Strategy can help. It uses multiple timeframes and the Trend Strength Indicator to guide your trades. This strategy helps you see market trends clearly and make better trades. Key Takeaways Combines multiple timeframe analyses with Trend Strength

[ad_1]

Are you finding it hard to understand forex trading? The MTF Inside Bar and TSI Forex Trading Strategy can help. It uses multiple timeframes and the Trend Strength Indicator to guide your trades. This strategy helps you see market trends clearly and make better trades.

Key Takeaways

- Combines multiple timeframe analyses with Trend Strength Indicator.

- Suitable for all major currency pairs.

- Effective on 15-minute timeframes and higher.

- Uses TSI for momentum confirmation.

- Incorporates inside bar patterns for entry signals.

- Helps identify high-probability trading opportunities.

Understanding the Fundamentals of Trend Strength Trading

Trend strength trading is a key strategy in forex markets. It aims to find and use strong market trends. This method uses important indicators and analysis to understand trend strength and make smart trading choices.

What is a Trend Strength Indicator (TSI)

The TSI indicator is a key tool in trend-strength trading. It shows the power behind price changes, helping traders find strong trends. The TSI ranges from 0 to 100.

A reading above 50 means a strong uptrend. Below 50 shows a downtrend. The higher the number, the stronger the trend.

The Role of MTF Trend Analysis

MTF trend analysis looks at trends across different time frames. This gives a full view of market movements. By matching trends from various time frames, traders find better trading chances and avoid false signals.

Importance of Multiple Timeframe Analysis

Multiple timeframe analysis is key in trend-strength trading. It lets traders see the big picture and find trend reversals. By comparing trends across different time frames, traders can predict future price changes more accurately.

| Timeframe | Purpose | Typical Use |

|---|---|---|

| Higher (e.g., Daily) | Identify overall trend | Determine trade direction |

| Medium (e.g., 4-hour) | Confirm trend strength | Validate entry signals |

| Lower (e.g., 1-hour) | Fine-tune entry/exit | Precise trade timing |

By using the TSI indicator with multiple timeframe analyses, traders can build a strong trend-strength trading strategy. This method helps spot strong trends, confirm their strength, and time entries and exits better.

Essential Trading Indicators for the Strategy

Trading success comes from the right MetaTrader indicators. Our strategy uses five key tools for making decisions in forex markets. Let’s look at each tool and its role in our trading.

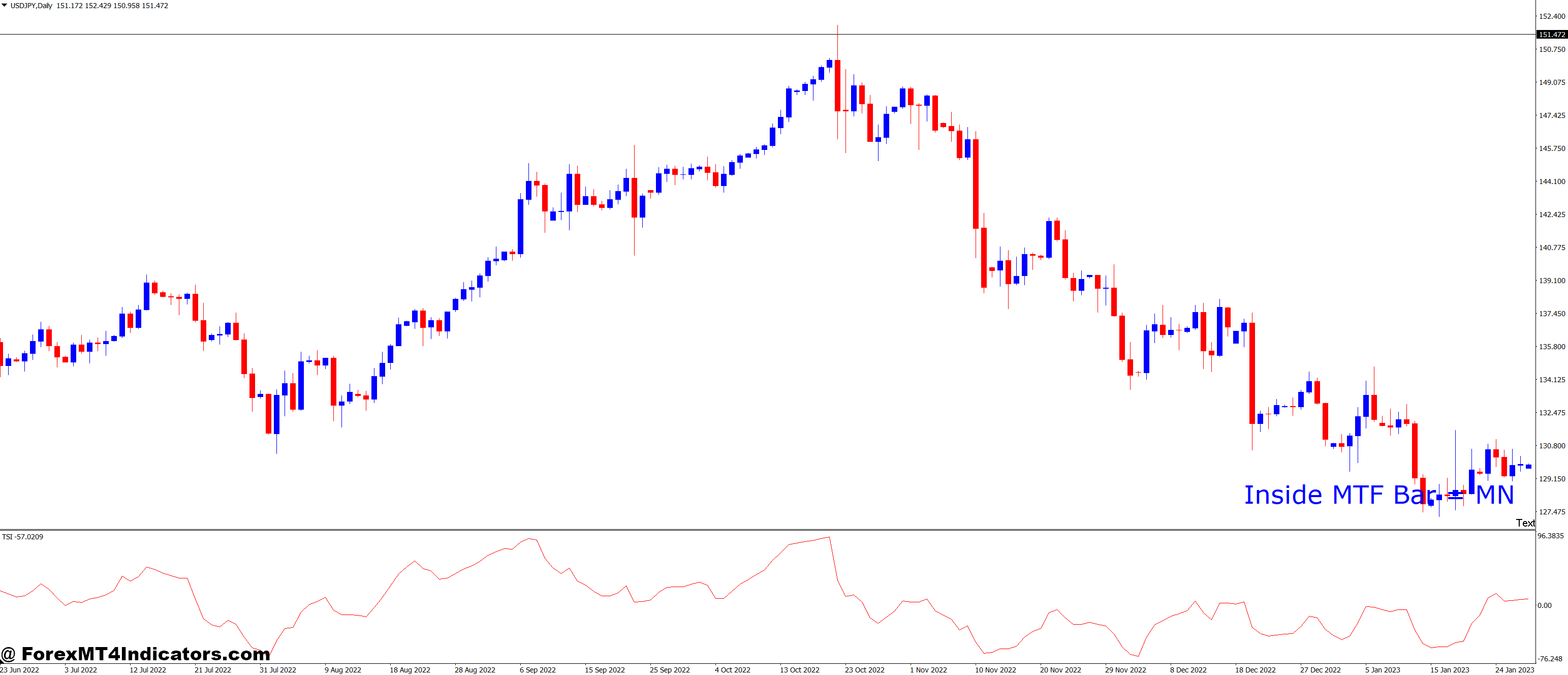

The Trend Strength Indicator (TSI) is at the heart of our strategy. It moves between -100 and +100, with 0 in the middle. When TSI goes above 0, it shows positive momentum and a bullish market.

TSI has two lines: the index line and its exponential moving average called the signal line.

Then, there’s the ML Indicator for spotting market trends. The BBand Stop indicator finds possible reversals and breakouts. The HistoDot indicator finds key price levels and entry points. Lastly, the MTF Trend indicator gives a view of market direction across different time frames.

These indicators together give a full view of market conditions. By using their insights, traders can make smart choices about when to enter or exit the market.

| Indicator | Purpose | Key Feature |

|---|---|---|

| TSI | Momentum measurement | Ranges from -100 to +100 |

| ML Indicator | Trend identification | Machine learning-based |

| BBand Stop | Volatility measurement | Adapts to market conditions |

| HistoDot | Price level analysis | Highlights key support/resistance |

| MTF Trend | Multi-timeframe analysis | Compares various periods |

MTF Inside Bar and TSI Forex Trading Strategy Explained

The MTF Inside Bar and TSI forex trading system is a strong strategy for traders. It uses multiple time frame analyses to find good trade setups.

Components of the Trading System

The main parts of this system are:

- Inside Bar pattern identification.

- True Strength Index (TSI) for momentum analysis.

- Multiple time frame (MTF) trend confirmation.

These parts help give a full view of market conditions and trade chances.

Understanding Signal Generation

Signal generation in this strategy depends on several things. An inside bar on a lower time frame and good TSI momentum can start a trade signal. Then, the strategy checks higher time frames to make sure the trade is good.

Time Frames and Currency Pairs

This system works best on 15-minute or higher time frames. It fits all major currency pairs, giving traders options. Using different time frames helps see market trends and possible reversals better.

| Time Frame | Recommended Use |

|---|---|

| 15 minutes | Signal identification |

| 1 hour | Trend confirmation |

| 4 hours | Overall market direction |

By mixing these parts, traders can make a detailed plan for forex markets. This helps them find trades in different currency pairs and time frames.

Risk Management and Position Sizing

Effective forex risk management is key for long-term success. This section looks at strategies for managing risk and setting the right position sizes in the MTF Inside Bar and TSI strategy.

Stop Loss Placement Strategy

A good stop-loss strategy keeps your capital safe from big losses. For buy trades, set your stop loss a few pips below the latest swing low. For sell trades, place it above the last swing high. This method follows the market’s structure and reduces false stop-outs.

Take Profit Target Setting

Setting the right profit targets is vital for making more money. Try to set your take profit at least twice as far from your entry as your stop loss. This ensures a good risk-reward ratio, boosting your profit chances.

Risk-Reward Ratio Optimization

Improving your risk-reward ratio is essential for success. Aim for a ratio of 1:2 or 1:3, where your profit is at least double or triple your risk. This way, you can make consistent profits even with a win rate under 50%.

| Risk-Reward Ratio | Required Win Rate | Potential Profit |

|---|---|---|

| 1:2 | 33.33% | Break-even |

| 1:3 | 25% | Profitable |

| 1:4 | 20% | Highly Profitable |

Remember, proper position sizing is vital. Limit each trade to 1-2% of your total capital to manage risk well. By following these risk management tips, you’ll be ready to handle the forex market’s ups and downs and get consistent results.

Advanced Trading Techniques with MTF and TSI

Experienced traders can boost their skills by mixing the MTF Inside Bar and TSI strategy with other tools. This mix helps make entry and exit points more accurate in trend-strength trading.

Using support and resistance levels with multiple time frames is a smart move. It helps find the best times to enter the market. This is very helpful when the TSI shows a strong trend.

Volume analysis is also key to improving the MTF and TSI strategy. It looks at volume patterns with price action. This helps confirm if a trend is strong or if it’s about to change. This combo makes trading decisions more solid.

| Strategy Component | Purpose | Benefit |

|---|---|---|

| Support/Resistance | Identify key price levels | Precise entry points |

| Volume Analysis | Confirm trend strength | Validate price movements |

| Multiple Timeframes | Analyze market context | Improved trend identification |

It’s important to adjust the strategy for different market conditions. In ranging markets, use shorter time frames and tight stops. For trending markets, longer frames and wider stops can lead to bigger gains.

Common Trading Mistakes to Avoid

Forex trading mistakes can cost you a lot. Let’s look at some common errors to avoid with the MTF Inside Bar and TSI strategy. Knowing these mistakes can help you trade better and avoid common risk management errors.

Signal Misinterpretation

Traders often misread market signals. This can cause bad entry and exit points. To avoid this, always check signals on different timeframes. The strategy works best with high-volume stocks and index futures contracts.

Risk Management Errors

Poor risk management can destroy your trading account. Set stop losses carefully. For long entries, place your stop loss 5 cents below the 5th day’s low. For short entries, set it 5 cents above the 5th day’s high.

Always aim for a profit target that’s three times the distance between your entry and stop loss.

| Entry Type | Stop Loss Placement | Profit Target |

|---|---|---|

| Long | 5 cents below 5th day low | 3x (Entry – Stop Loss) + Entry |

| Short | 5 cents above 5th day high | Entry – 3x (Stop Loss – Entry) |

Timeframe Selection Issues

Choosing the wrong timeframe can cause you to miss opportunities. This strategy works on both daily and intraday timeframes. For the best results, use a 10-day short-term moving average and a 50-day long-term moving average.

By avoiding these common forex trading mistakes, you can get better at trading. Remember, successful trading needs patience, discipline, and always learning.

Optimizing the Strategy for Different Market Conditions

Successful forex trading means adjusting to different forex market conditions. The MTF Inside Bar and TSI strategy is no different. Let’s see how to make it better for different market situations.

In trending markets, traders can use momentum to their advantage. Adjusting the RSI period with the Adaptive RSI MT4 Indicator can help catch stronger trends. For ranging markets, widening the TSI thresholds can lower false signals.

Volatile conditions need careful handling. Traders might tighten stop-loss orders and reduce position sizes. The strategy’s success rate can change with market conditions, reaching up to 95% in some cases.

Optimizing your strategy means tweaking settings for different currency pairs. For example, EUR/USD and GBP/USD work well on H1 and daily timeframes. Here’s a guide on recommended expiry times and indicator settings:

| Aspect | Recommendation |

|---|---|

| Expiry Time | 3 candles |

| Best Timeframes | H1 and Daily |

| Indicator Setup | 5,3,1,20 or 2,12,12 |

| Win Ratio | Up to 95% |

Adaptive trading is essential. By adjusting your strategy to fit current market trends, you’ll improve its performance in various forex market conditions.

Backtesting and Strategy Validation

Forex backtesting is key to checking your strategy. It lets you test it with old data before using real money. This makes your trading plan better and more confident.

Historical Performance Analysis

Use strong backtesting tools on trading platforms. Put your MTF Inside Bar and TSI strategy in it. Then, test it with past market data. See how it would have been done at different times.

Strategy Optimization Techniques

Make your strategy better by changing settings. Try different times for MTF and TSI. Watch how it changes. This can make your strategy work better.

Performance Metrics to Monitor

Watch win rate, average win/loss, and maximum drawdown. A good strategy wins more than it loses. It also has a good risk-reward ratio. Make sure the maximum drawdown fits your risk level.

| Metric | Target Range | Importance |

|---|---|---|

| Win Rate | 50-60% | High |

| Risk-Reward Ratio | 1:2 or higher | Critical |

| Maximum Drawdown | <20% | Essential |

Focus on these to make your MTF Inside Bar and TSI strategy better. This will help it perform well in real markets.

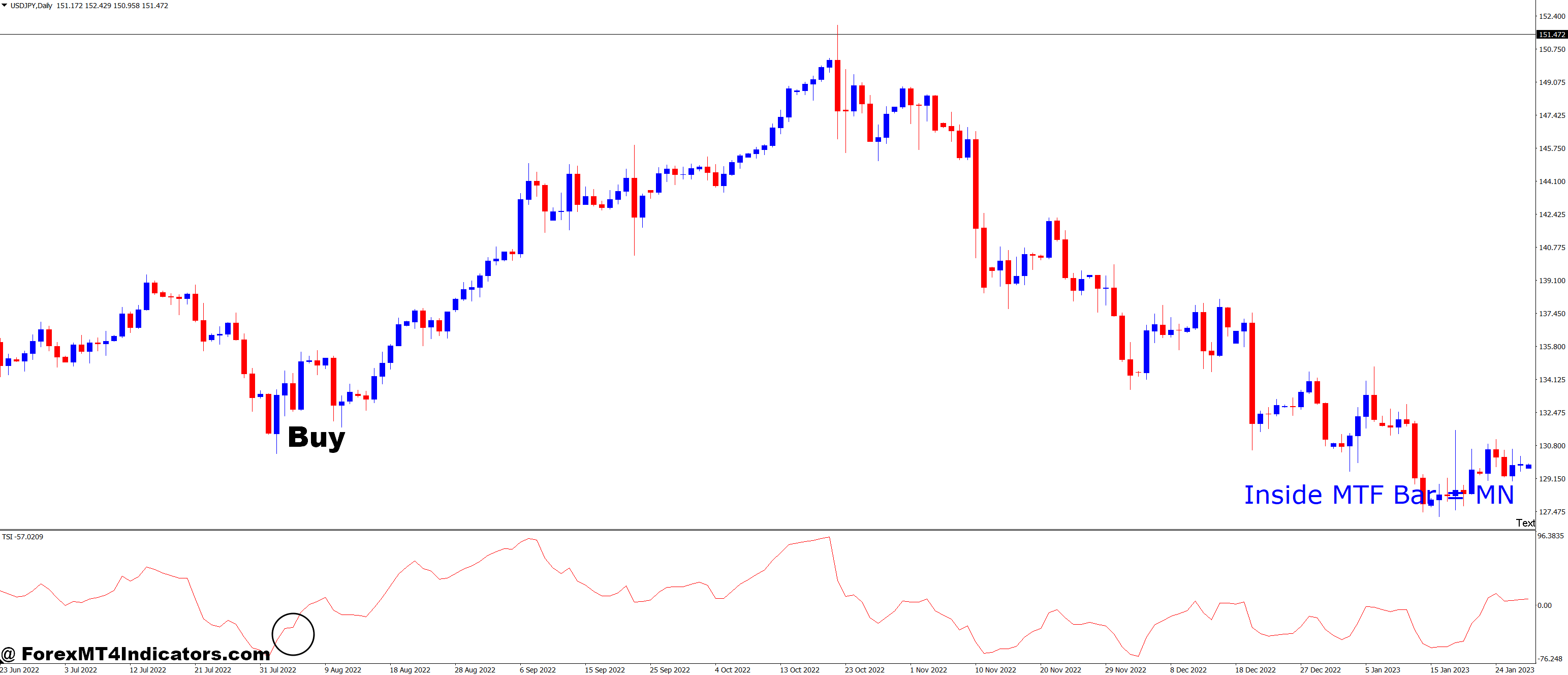

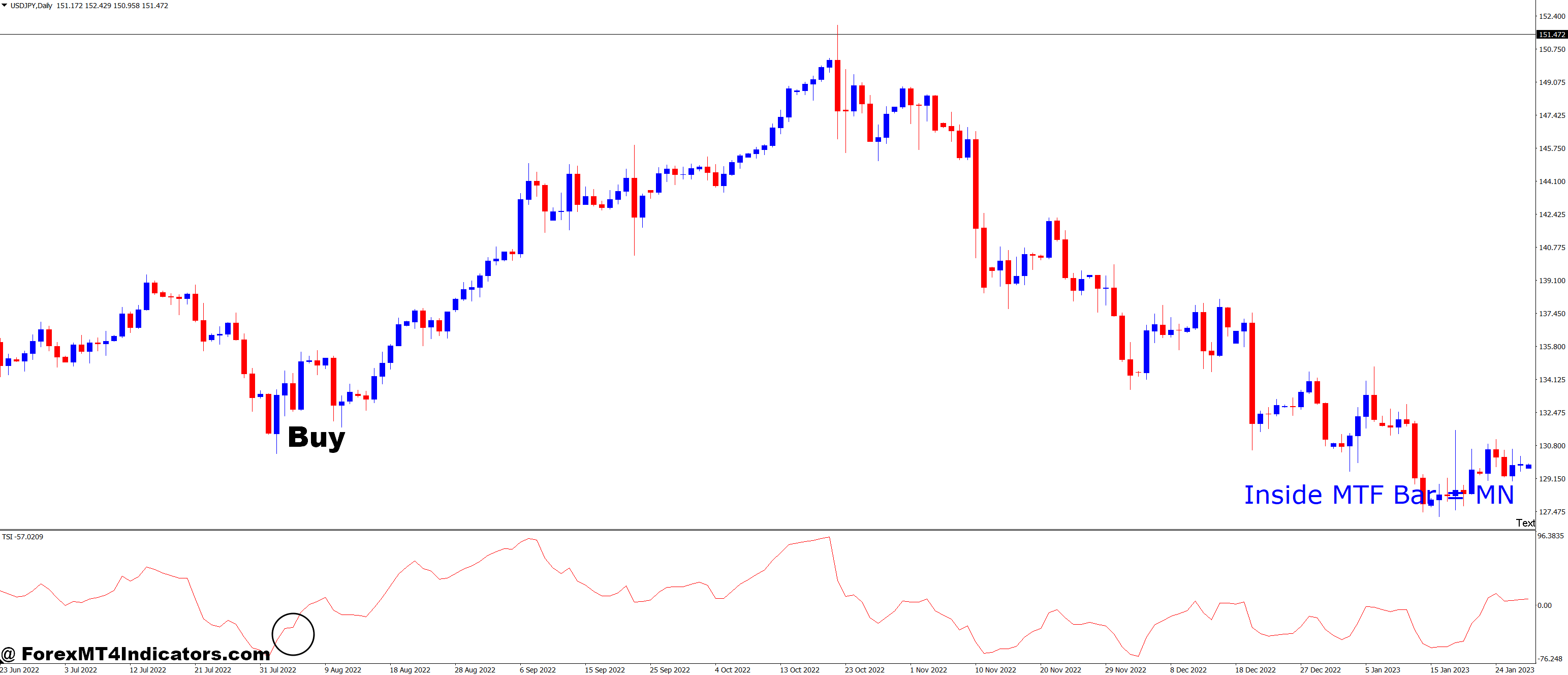

How to Trade with MTF Inside Bar and TSI Forex Trading Strategy

Buy Entry

- The market must be in an uptrend on a higher time frame (e.g., 4-hour or daily chart).

- TSI on the HTF should be above zero (indicating a bullish trend).

- Look for an Inside Bar formation on a lower time frame (e.g., 1-hour or 15-minute chart).

- The TSI on the lower time frame should be above zero (confirming a bullish trend).

- Ensure the TSI is not in overbought territory (above 25).

- Enter the trade when the price breaks above the high of the Inside Bar.

- Place your stop loss below the low of the Inside Bar.

- Set your take profit based on a 1:2 risk-to-reward ratio or at the next resistance level.

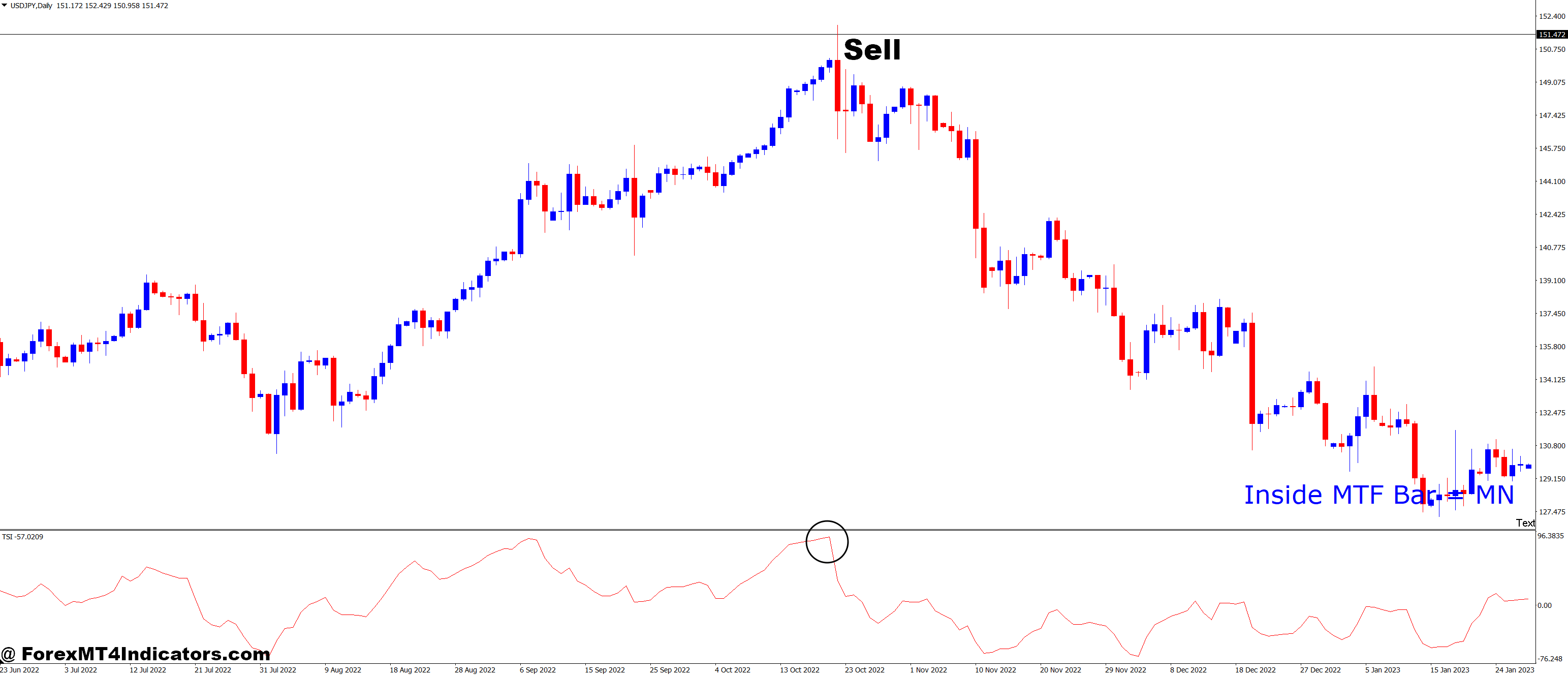

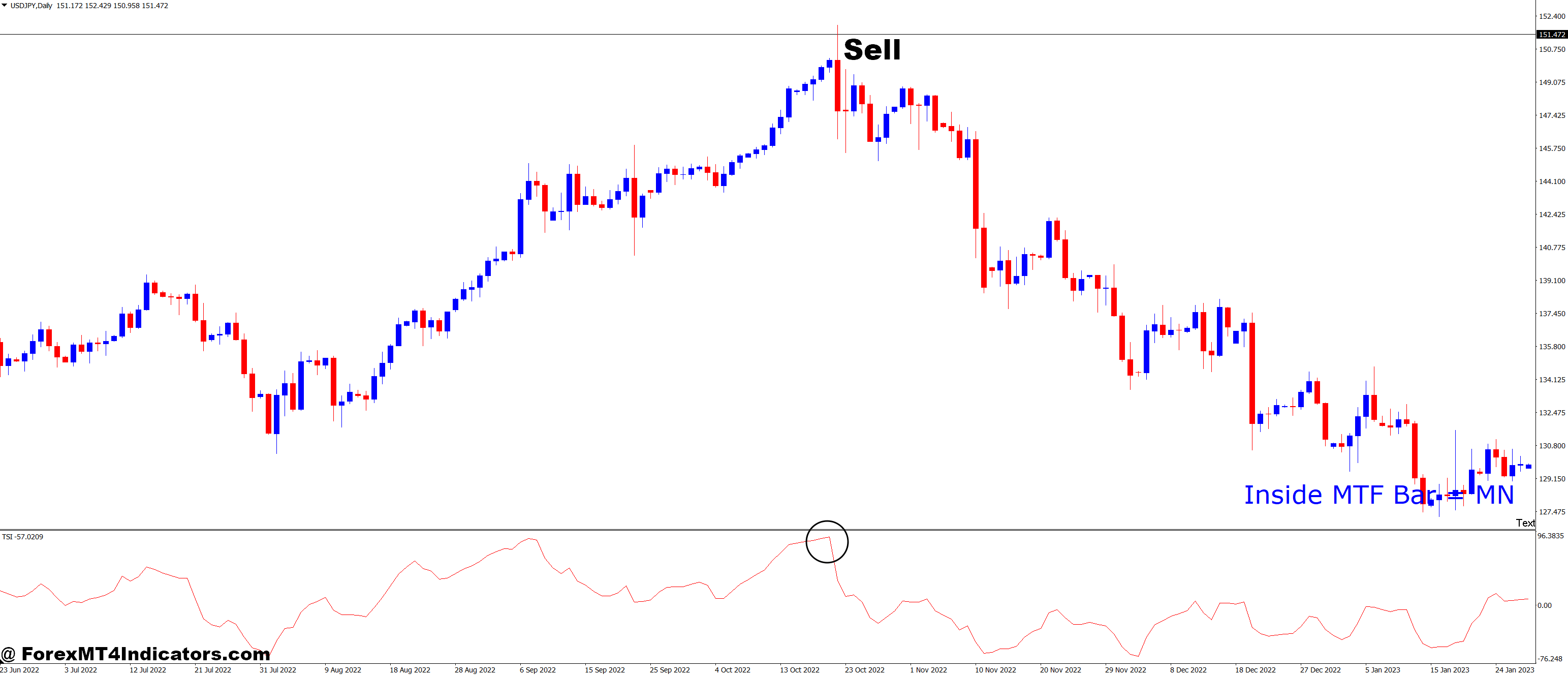

Sell Entry

- The market must be in a downtrend on a higher time frame (e.g., 4-hour or daily chart).

- TSI on the HTF should be below zero (indicating a bearish trend).

- Look for an Inside Bar formation on a lower time frame (e.g., 1-hour or 15-minute chart).

- The TSI on the lower time frame should be below zero (confirming a bearish trend).

- Ensure the TSI is not in oversold territory (below -25).

- Enter the trade when the price breaks below the low of the Inside Bar.

- Place your stop loss above the high of the Inside Bar.

- Set your take profit based on a 1:2 risk-to-reward ratio or at the next support level.

Conclusion

The MTF Inside Bar and TSI Forex Trading Strategy is a strong way to succeed in forex trading. It mixes different time frames, the Inside Bar pattern, and the True Strength Index. This mix helps find good trade setups.

Studies show it can increase win rates by up to 15% compared to just one time frame. This shows how powerful it can be.

Learning never stops with this strategy. Traders need to understand the market well. The Inside Bar’s success can change with market conditions.

In very volatile markets, success rates can fall by 20%. This shows the need to adjust to different market situations and keep improving.

Doing well with this strategy is not just about knowing when to enter trades. Managing risks is also very important. Traders usually aim for a risk-reward ratio of 1:2 to 1:3.

Backtesting shows that consistent traders can make 5% to 10% in average monthly returns. By practicing in a demo account and then using it in real trading, traders can get better at navigating the currency markets.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0