Momentum and Meta Neural Forex Trading Strategy

[ad_1] Forex traders face big challenges with market ups and downs and lots of data. Old ways don’t work well, leading to frustration and lost money. The Momentum and Meta Neural Forex Trading Strategy is a new hope. It mixes momentum signs with smart neural networks to use AI for trend analysis and smart trading

[ad_1]

Forex traders face big challenges with market ups and downs and lots of data. Old ways don’t work well, leading to frustration and lost money. The Momentum and Meta Neural Forex Trading Strategy is a new hope. It mixes momentum signs with smart neural networks to use AI for trend analysis and smart trading choices.

This new method tackles forex trading’s big hurdles. It looks at lots of market data quickly, finding patterns humans might miss. The strategy keeps up with market changes, giving traders an edge in the quick world of currency trading.

Key Takeaways

- Combines momentum indicators with neural networks for enhanced trading decisions.

- Utilizes AI to analyze complex market data in real time.

- Adapts to changing market conditions for improved performance.

- Processes large datasets to identify hidden patterns.

- Offers a chance for more accurate predictions than old methods.

Understanding Neural Networks in Forex Trading

Neural networks change forex trading by acting like the human brain. They use AI to analyze market data. This helps traders make better choices in the huge $5 trillion forex market.

Basic Principles of Neural Networks

Forex neural networks use lots of data through nodes. They learn from patterns and adjust to market changes. This makes them great for fast-changing currency pairs like EUR/USD, which are traded a lot.

Role in Market Analysis

AI in trading helps with market analysis by finding complex patterns. Neural networks do better than old methods, with some being 75% accurate. They look at technical indicators and big economic factors for deep insights.

Processing Market Data

Neural networks are good at handling different market data. They mix technical indicators like MACD with big economic data like interest rates. This helps make more precise forex trading predictions.

| Data Type | Examples | Impact on Analysis |

|---|---|---|

| Technical Indicators | MACD, RSI, Bollinger Bands | Short-term price movement predictions |

| Macroeconomic Factors | Interest Rates, Inflation, S&P 500 | Long-term market trend analysis |

| Market Sentiment | News Analysis, Social Media Trends | Real-time market mood assessment |

Neural networks in forex trading are very useful for analyzing market data. They handle complex info, spot patterns, and send out trading signals that get more accurate. As AI in trading grows, these systems keep changing how we look at the forex market.

Deep Neural Network Power in Trading

Deep learning forex strategies are changing how traders analyze markets. These systems use neural networks to handle lots of data. They find complex patterns quickly.

Real-time Momentum Analysis

Deep neural networks are great at analyzing data as it happens. They can spot market trends and good times to buy or sell fast. This is much quicker than old methods.

Pattern Recognition Capabilities

These networks can spot patterns that humans might miss. They find detailed market structures, like price and volume patterns. They even catch changes in news sentiment.

Adaptive Learning Features

Adaptive trading is a big plus for deep-learning forex. These systems learn from new data and adjust their plans. This keeps them up-to-date with the fast-changing forex market.

| Feature | Benefit | Impact on Trading |

|---|---|---|

| Real-time Analysis | Faster decision making | Improved entry and exit timing |

| Pattern Recognition | Identification of complex setups | More accurate trade signals |

| Adaptive Learning | Continuous strategy refinement | Consistent performance across market conditions |

The power of deep neural networks in forex trading is clear. They handle huge data sets and make quick decisions. As they get better, they will make trading more efficient and profitable.

Momentum and Meta Neural Forex Trading Strategy

The Momentum and Meta Neural Forex Trading Strategy uses momentum indicators and advanced neural networks. It combines old-school technical analysis with new AI. This mix helps traders deal with the forex market’s complexity.

Meta neural trading looks at key market momentum factors. It makes sure trades are placed wisely. This strategy avoids the risks of grid or martingale systems. It’s based on safe trading rules.

The forex AI part learns from the market. It gets better at making decisions over time. This helps traders make more money.

| Component | Function | Benefit |

|---|---|---|

| Momentum Indicators | Identify price trends | Improved trend recognition |

| Meta Neural Networks | Process market data | Enhanced decision-making |

| Forex AI | Adapt to market changes | Increased strategy flexibility |

This strategy has big advantages over old ways of trading. It manages risk better with smart position sizing and stop-loss. It works well with different currency pairs and timeframes.

Technical Requirements and Setup

Setting up a good forex trading setup needs careful thought. You must consider hardware, software, and hosting. Let’s look at what you need for a successful trading space.

Hardware Specifications

Your trading system needs strong processing power. A multi-core CPU and at least 16GB of RAM are best. Fast internet is also key for quick data and trade execution.

Software Requirements

Your trading software is very important. MetaTrader 4 or 5 are good choices. They work well with many trading strategies. You also need Python libraries like TensorFlow and Keras for neural networks.

VPS Hosting Recommendations

VPS hosting is key for 24/7 trading. It keeps your strategy running smoothly and keeps risks low from power outages or internet issues. Pick a VPS with low latency and high uptime.

| Component | Recommendation |

|---|---|

| CPU | Multi-core processor |

| RAM | 16GB minimum |

| Internet | High-speed, stable connection |

| Trading Platform | MetaTrader 4/5 |

| Programming Libraries | TensorFlow, Keras |

Your forex trading setup should grow with your needs. Keep your trading software up to date for the best results.

Trading Platform Compatibility

The momentum and meta-neural forex trading strategy works well with popular forex platforms. MetaTrader 4 and TradeStation are top picks for this advanced method. They have strong features for complex algorithms and fast data processing.

MetaTrader 4 is easy to use and has many broker options. It handles the strategy’s momentum calculations well. TradeStation is great for making custom indicators needed for this strategy.

| Feature | MetaTrader 4 | TradeStation |

|---|---|---|

| Neural Network Support | Strong | Advanced |

| Momentum Analysis | Built-in | Customizable |

| Data Handling | Efficient | Comprehensive |

Using both platforms together has its challenges. Time zones, price quotes, and data ranges can differ. Traders need to consider these when testing and using the strategy on different platforms.

Choosing between MetaTrader 4 and TradeStation depends on what you need. MetaTrader 4 is good for those who want simplicity and many broker options. TradeStation is better for those who want to customize more. Both platforms support machine learning techniques for strategy optimization, making this neural forex approach better.

Strategy Performance and Backtesting

Forex backtesting is key to checking how well a trading strategy works. The Momentum Deep Neural strategy gives clear results, avoiding fake data. We’ll look at its performance from 2022 to 2024 using EURUSD M5 data.

Historical Performance Data

The strategy has great numbers. It has won more than 84% of trades, showing it’s good at making money. It also grew about 5% each year, which is steady.

But, it had a big loss of -$61,412.50, which was -43.58% of its total. This shows the risk involved.

Risk Management Metrics

Risk metrics help us see how stable the strategy is. The profit factor is just over 1, meaning it’s close between wins and losses. The Sharpe Ratio is small and positive, showing it could do better in returns.

| Metric | Value |

|---|---|

| Win Rate | 84% |

| Profit Factor | 1.0 |

| Max Drawdown | -$61,412.50 |

| Annual Return | 5% |

Performance Analysis 2022-2024

The strategy had mixed results for different trades. Long trades made over 36% from 2018-2020. But, they had a big loss of more than -$97,000.

Short trades lost almost -$59,000. These numbers show how important it is to keep improving and managing risks in forex trading.

Risk Management and Position Sizing

Smart position sizing is key to managing forex risks. Limiting risk to 1-2% of your account balance per trade protects you from big losses. For a $10,000 account, risking 1% means you can lose up to $100 per trade.

This method lets you handle 50 losing trades before losing your account. If you risk 5%, you can only handle 20 losing trades.

Calculating position sizes is important. The formula is: Position Size = Account Risk / (Stop-Loss Distance × Pip Value). For example, risking $100 with a 50-pip stop-loss and $1 pip value means a 2-lot position size.

Volatility changes these calculations. In volatile markets, you need wider stops and smaller positions.

Trading psychology is also vital in risk management. Emotional trading can lead to overtrading or understanding. This disrupts your disciplined approach.

It’s important to stick to your risk parameters for all trades. Adjusting your position sizes based on market conditions is key to success.

| Account Balance | Risk Per Trade | Stop-Loss | Pip Value | Position Size |

|---|---|---|---|---|

| £10,000 | 2% (0.02) | 50 pips | £10 per pip | 0.4 standard lots |

Review your position-sizing strategies often. This is important after big changes in your account balance or market conditions. This approach to risk management works for many assets, making your trading strategy strong.

Market Conditions and Timing

Forex market timing is key to trading success. The 24-hour forex market, with its $6.6 trillion daily volume, offers both chances and challenges. Knowing the market and picking the best times to trade can greatly improve your results.

Optimal Trading Sessions

The forex market has three main trading sessions: Asian, European, and North American. Each has its traits that affect market activity and liquidity. The EUR/USD pair, the most traded globally, sees different levels of activity in these sessions.

Market Volatility Considerations

Market volatility is a big deal in forex trading. High volatility often happens when major trading sessions overlap. This can offer more chances but also more risk. Neural network algorithms like LSTM and ANN can adjust to volatility changes, helping with predictions.

Time Frame Selection

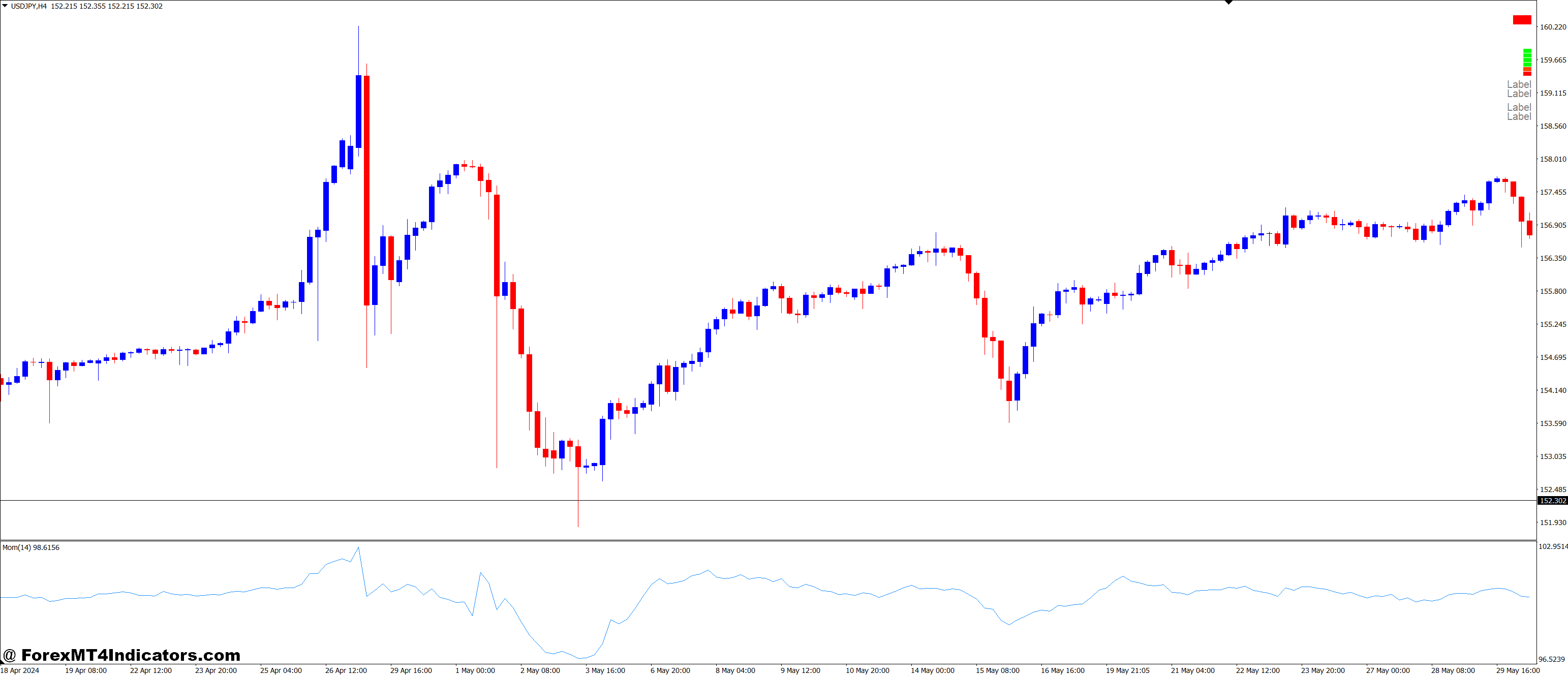

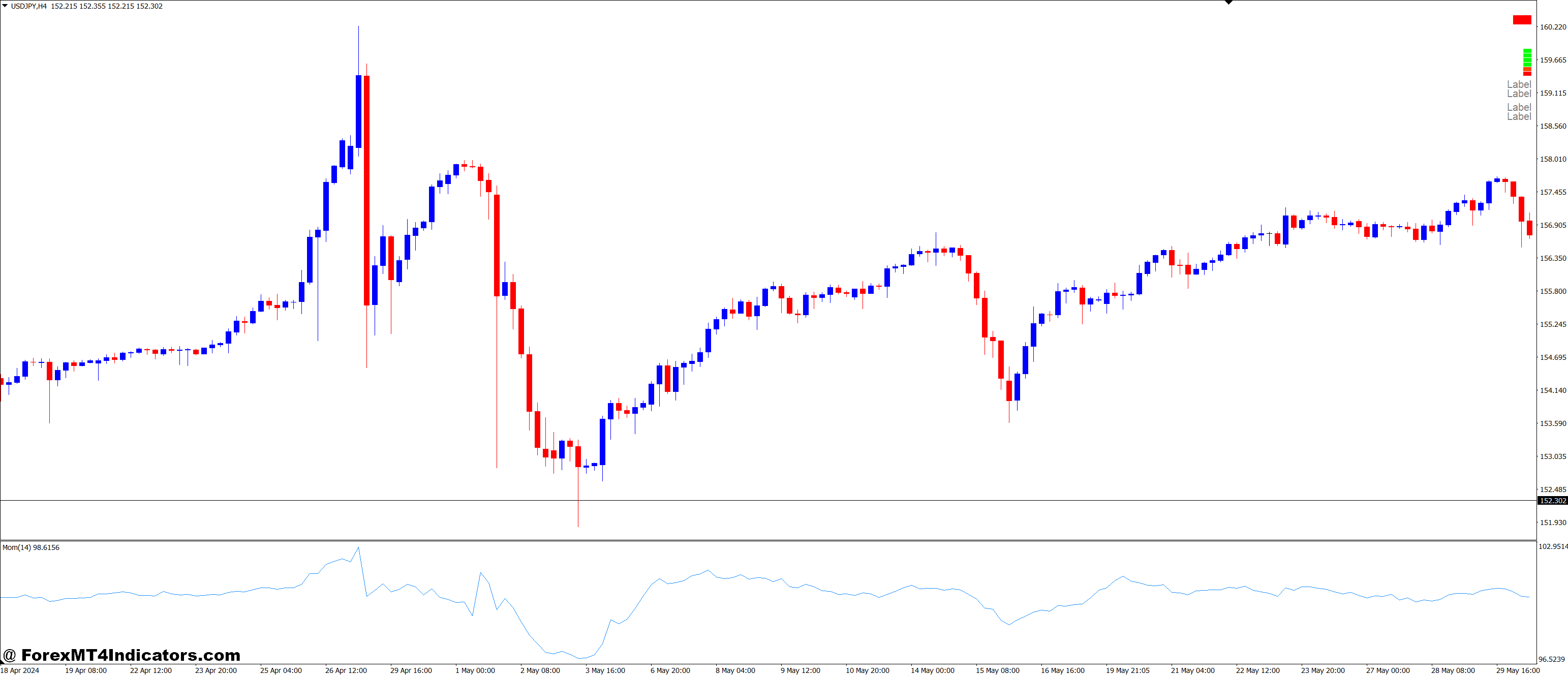

Picking the right time frame is vital for your strategy. For example, the Momentum Deep Neural EA works on the M5 chart of EUR/USD. This short time frame takes advantage of fast market changes but needs strong risk management.

| Time Frame | Advantages | Challenges |

|---|---|---|

| M5 (5-minute) | Quick trades, more opportunities | Higher noise requires constant monitoring |

| H1 (1-hour) | Less noise, clearer trends | Fewer trading opportunities |

| D1 (Daily) | Long-term trends, less stress | Lower frequency of trades |

You can improve your performance by matching your strategy with the right market conditions and time frames. This way, you might become one of the 2% retail traders predicting currency movements well.

How to Trade with Momentum and Meta Neural Forex Trading Strategy

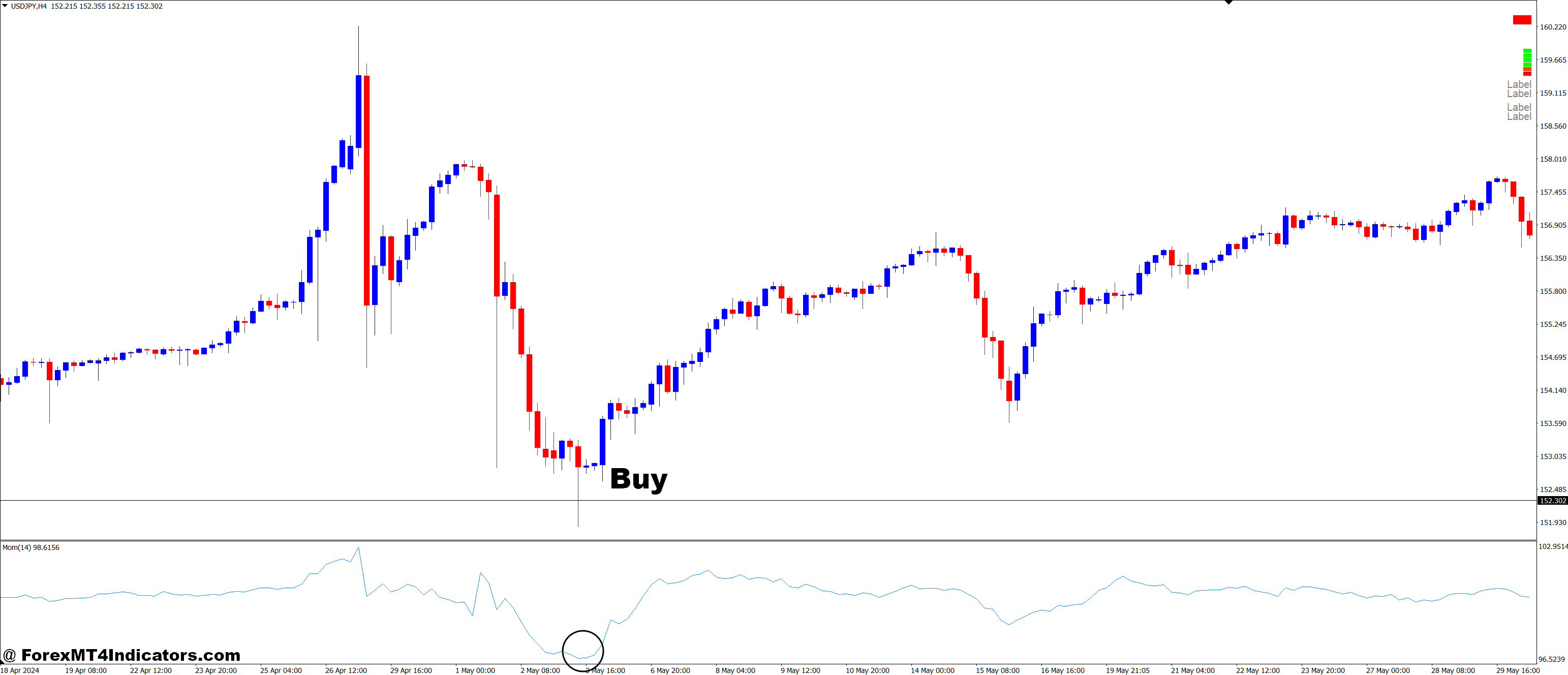

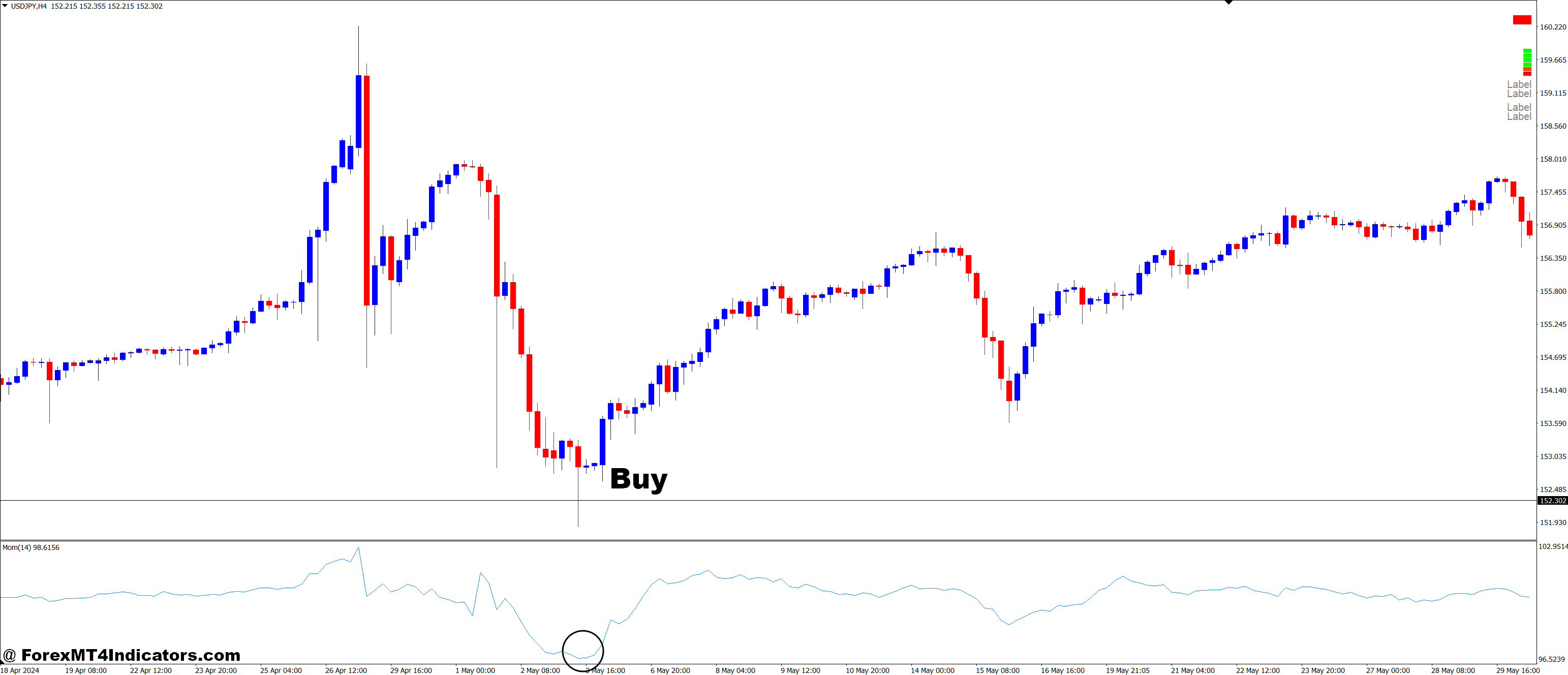

Buy Entry

- RSI: Should be above 30 but ideally under 70 (indicating the currency is in a trend, but not overbought).

- ADX: Must be above 25 (indicating a strong trend).

- MACD: The MACD line crosses above the signal line (indicating bullish momentum).

- Price Action: Look for higher highs and higher lows on the chart (confirming an uptrend).

- Meta Neural Network: The neural network model predicts the continuation of the uptrend based on historical data patterns and trend analysis.

- Enter the buy trade when:

- RSI is above 30 and trending upwards.

- ADX is above 25, confirming the strength of the uptrend.

- MACD shows a bullish crossover.

- The neural network model confirms a positive prediction for the currency pair’s future movement.

- Look for pullbacks or retracements within the uptrend for better entry points.

- Place stop-loss below the most recent swing low or the support level.

- Set take-profit near the next resistance level or use a trailing stop to ride the trend.

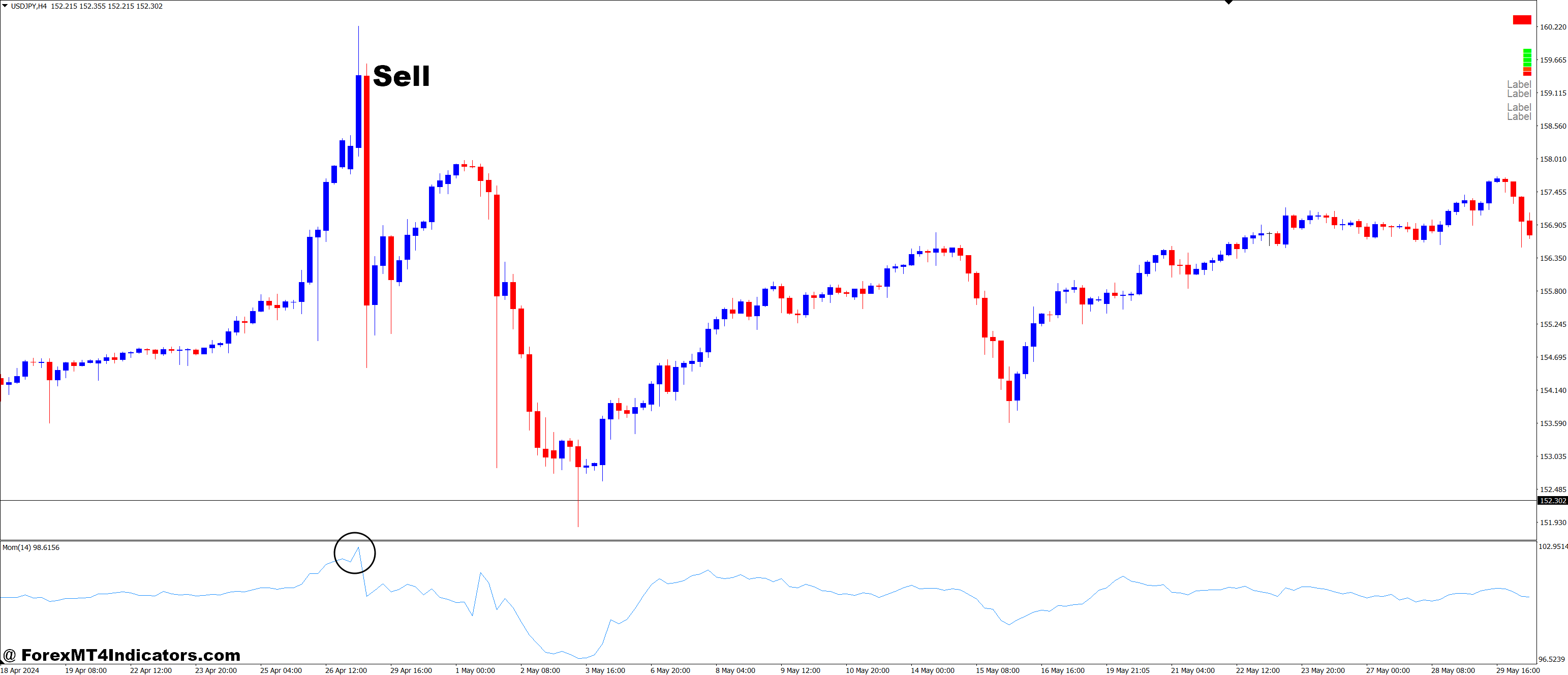

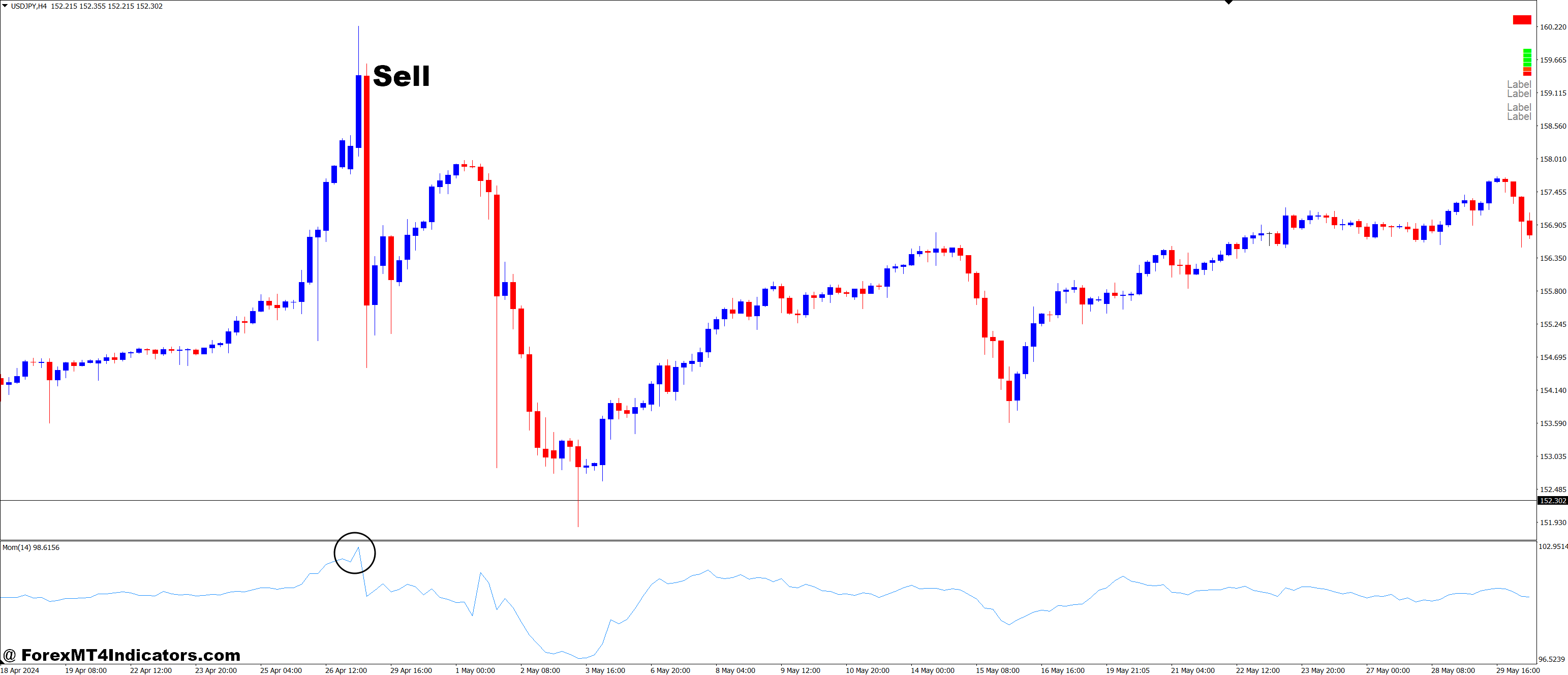

Sell Entry

- RSI: Should be below 70 but ideally above 30 (indicating the currency is in a trend, but not oversold).

- ADX: Must be above 25 (indicating a strong trend).

- MACD: The MACD line crosses below the signal line (indicating bearish momentum).

- Price Action: Look for lower highs and lower lows on the chart (confirming a downtrend).

- Meta Neural Network: The neural network model predicts the continuation of the downtrend based on historical data patterns and trend analysis.

- Enter the sell trade when:

- RSI is below 70 and trending downwards.

- ADX is above 25, confirming the strength of the downtrend.

- MACD shows a bearish crossover.

- The neural network model confirms a negative prediction for the currency pair’s future movement.

- Look for pullbacks or retracements within the downtrend for better entry points.

- Place stop-loss above the most recent swing high or resistance level.

- Set take-profit near the next support level or use a trailing stop to ride the trend.

Conclusion

The Momentum and Meta Neural Forex Trading Strategy combines old and new. It uses forex strategy benefits from both sides. This gives traders a special advantage in the fast-changing currency markets.

From 2005 to 2015, the strategy showed great results. It beat Buy and Hold by 95% in testing and 60% in real use. This shows AI can make trading smarter.

But, this strategy also has big risks. It needs better ways to handle risks. Learning more is key to success in forex.

The strategy is a big step forward in forex. It mixes theory with real use. This opens doors for better trading tools in the future.

Looking ahead, AI and old forex ways will bring new chances. Traders who are ready for change will find great opportunities.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0