Lukewarm Reaction to Fed Meeting

[ad_1] In a widely expected move, the Federal Reserve (Fed) hiked its policy interest rate by 25 basis-point (bp) to the 5.25%-5.5% range and left the door open for another hike in September. But given that Fed Chair Jerome Powell also guided for rate decisions to be on a “meeting-by-meeting” basis, additional tightening moves still

[ad_1]

In a widely expected move, the Federal Reserve (Fed) hiked its policy interest rate by 25 basis-point (bp) to the 5.25%-5.5% range and left the door open for another hike in September. But given that Fed Chair Jerome Powell also guided for rate decisions to be on a “meeting-by-meeting” basis, additional tightening moves still lack commitment at current point in time. In light of the Fed’s data-dependent stance, along with the broader trend of moderating US inflation, Fed rate expectations remained firm for an extended pause through the rest of the year.

Perhaps something to keep on the back of mind is that the Fed Chair still does not see inflation returning to the Fed’s 2% inflation goal until 2025, which may suggest that he foresees a more arduous process in pushing pricing pressures down moving forward. The abating of base effects and some firming in commodities prices lately could present some potential challenges.

Wall Street managed to pare earlier losses to close flat for the day, with after-market moves edging higher on Meta’s results. A beat on all fronts (top and bottom line, active users base, average revenue per user), along with a better-than-expected guidance for the third quarter, were more than sufficient to put a 6.8% gain in its share price in after-hours trading.

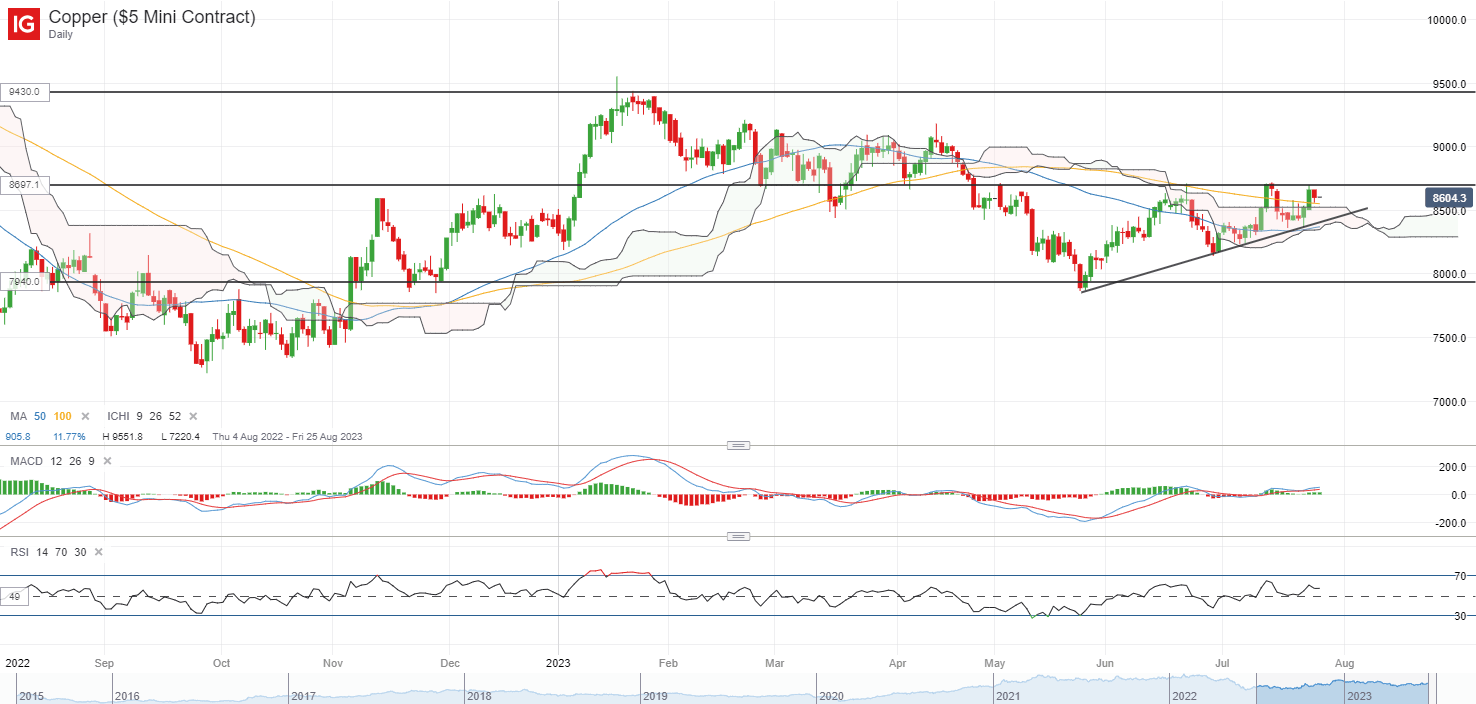

The US dollar were 0.3% lower, alongside a downtick in US Treasury yields. One to watch in the commodities space on a more subdued US dollar may be copper prices. Prices have been trading within an ascending triangle pattern over the past two months, with recent retest of the upper trendline resistance at the US$8,700/tonne level once more. Near-term upward momentum is supported by an increasing moving average convergence/divergence (MACD) and relative strength index (RSI) above 50, with any successful break above the level potentially paving the way to retest the US$9,000/tonne level next.

Source: IG charts

Asia Open

Asian stocks look set for a slightly positive open, with Nikkei +0.11%, ASX +0.54% and KOSPI +0.57% at the time of writing. The Nasdaq Golden Dragon China Index were up 2.8% overnight, following a more lacklustre session in the earlier session, with cautious optimism still at play for further follow-through in China’s economic stimulus. Closer to home, the focus is on UOB’s 2Q 2023 result release this morning.

The bank continues to benefit from the net interest income tailwind, with a 31% year-on-year jump in the segment uplifting overall profits by 27%, in line with forecasts. Net interest margin continues to moderate for the second straight quarter (2.12% from previous 2.14%), but some may find comfort in the softer pace of decline, which could suggest some stabilising above the 2% level for the months ahead. Loan growth and net fee income remains more subdued with single-digit decline from a year ago, but thus far, management’s guidance may have provided a positive spin on outlook, pointing to some economic resilience in the region. Dividends were raised to S$0.85/share from last year’s S$0.60/share, potentially leaving a forward dividend yield of 5.5%.

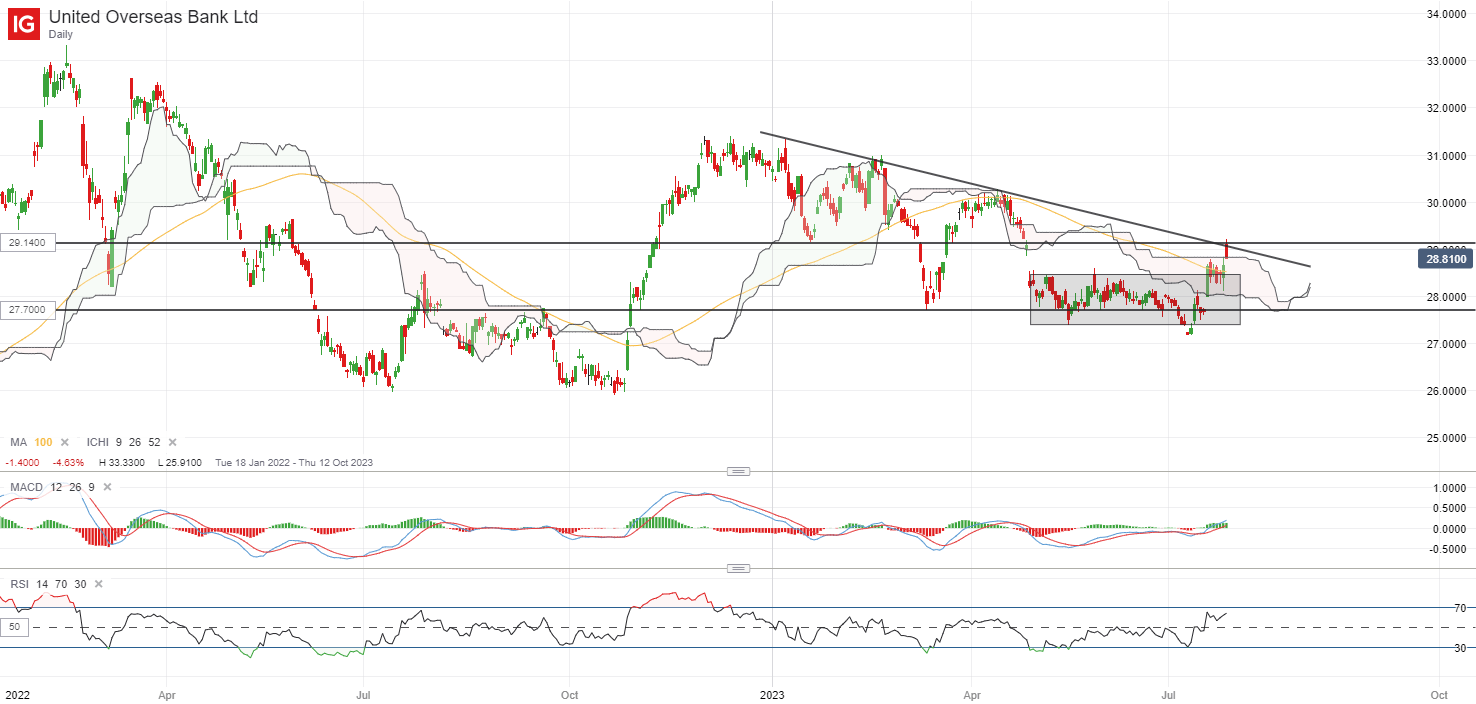

For UOB’s share price, a gap higher this morning has led to a retest of key resistance confluence at the S$29.14 level. While buyers remain in control, with its MACD heading above zero and RSI sustaining above the key 50 level, a break above the S$29.14 resistance may be warranted to support further upmove to the psychological S$30.00 level. On the downside, the previous consolidation range at the S$28.45 level may serve as near-term support.

Source: IG charts

On the watchlist: EUR/USD resting at support ahead of European Central Bank (ECB) meeting

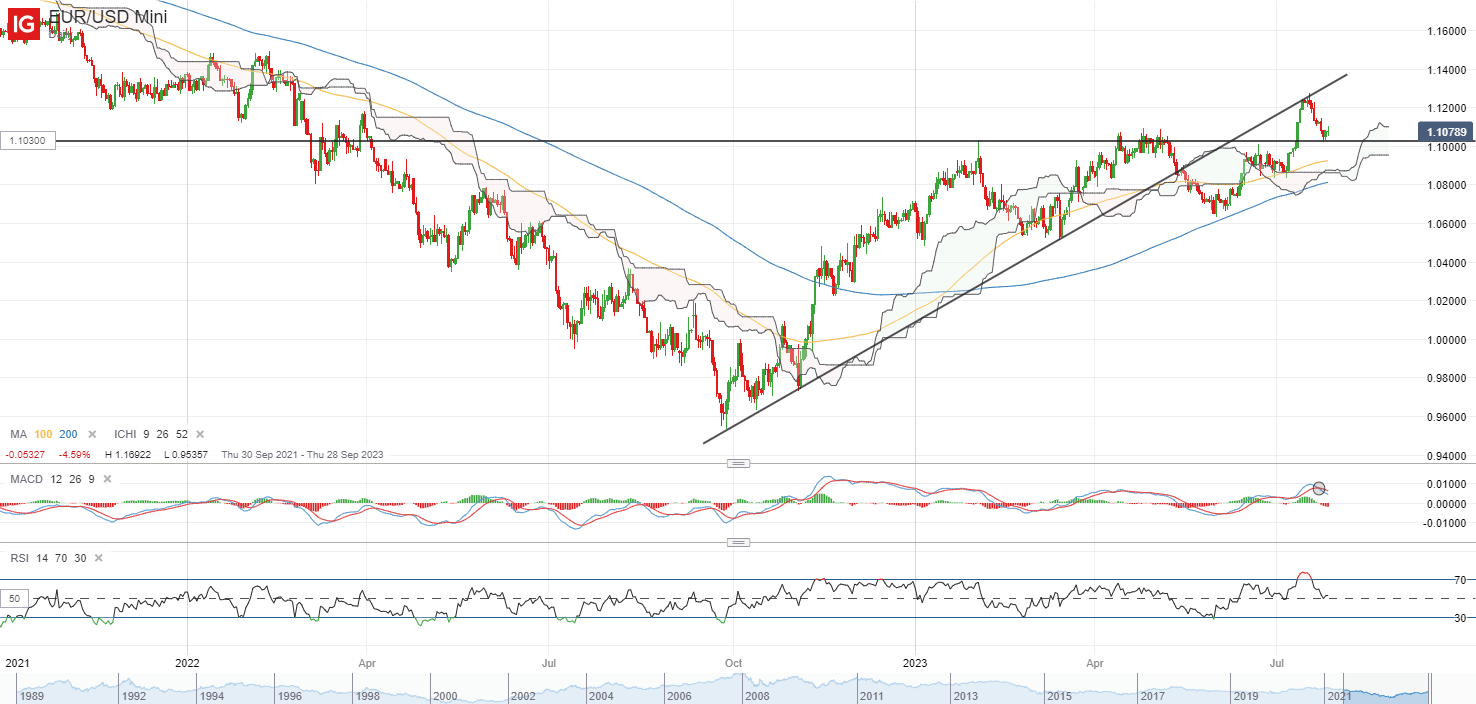

Thus far, the EUR/USD has been trading on an upward trend, with a series of higher highs and higher lows displayed since October last year. Following a lacklustre showing in the US dollar overnight post-FOMC, the EUR/USD is finding an attempt to stabilise at a near-term support around the 1.103 level, with all eyes on the ECB interest rate decision later today.

While rate expectations were firmly priced for an extended pause from the Fed moving forward, the ECB is expected to keep hiking over the next two meetings. Any validation on that front or more aggressive tone from the ECB could be supportive of the pair in the near term. With a bearish crossover on MACD and declining RSI pointing to some moderation in near-term momentum, the 1.103 level will have to see some defending ahead. Failing to do so may pave the way towards the 1.083 level as the next line of support.

Source: IG charts

Wednesday: DJIA +0.23%; S&P 500 -0.02%; Nasdaq -0.12%, DAX -0.49%, FTSE -0.19%

Article written by IG Strategist Jun Rong Yeap

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0