Japanese Yen Weakens Again, Markets Watchful For BoJ Intervention

[ad_1] USD/JPY closes in on eleven month highs Interest rate differentials continue to crush the Yen after BoJ stood pat last week Markets suspect it’s more likely to step in and bolster the Yen at current levels The Japanese Yen fell to a ten-month low against a generally stronger United States Dollar on Monday, pushing

[ad_1]

- USD/JPY closes in on eleven month highs

- Interest rate differentials continue to crush the Yen after BoJ stood pat last week

- Markets suspect it’s more likely to step in and bolster the Yen at current levels

The Japanese Yen fell to a ten-month low against a generally stronger United States Dollar on Monday, pushing USD/JPY close to the 150.00 level at which the Bank of Japan has been known to step in and support its currency in the past.

There’s little mystery behind Yen weakness. The BoJ stuck to its guns at the end of last week, maintaining ultra-low interest rates.

The Japanese central bank remains a complete outlier among developed market peers in sticking to ultra-accommodative monetary policy. The BOJ judges that inflation is purely a function of global forces and that demand in Japan is still nowhere near strong enough to permit a rise in borrowing costs. Other central banks, from the US, through to the Eurozone, United Kingdom, Canada and Australia, have raised interest rates considerably over the past two years in response to rising consumer prices.

Now, although inflation remains elevated in all cases, many seem to be at, or close to, the top of the rate-hike cycle. However, as it’s a cycle that Japan has never joined, the benefits to the Yen of a pause, or even eventually a fall in global interest rates, may not be great.

The Yen’s implied yields are below zero, which makes it an obvious source of funding for investors who then go on to buy higher-yielding currencies.

Recommended by David Cottle

How to Trade USD/JPY

Will the BoJ Intervene in the Market Again?

The BoJ bought Yen in the market last year, for the first time since 2008, and markets are on watch for it again as the currency wilts anew. Such action tends to attract international disapproval unless moves in the markets are judged to be ‘disorderly.’ At present there doesn’t seem to be much sign that they are, which could mean the bar to intervention is extremely high.

However, US Treasury Secretary Janet Yellen appeared to offer at least a degree of tolerance to the BoJ. Last week she said that Washington’s understanding of any action would ‘depend on the details.’ While this is hardly a ringing endorsement, it’s also not much of a threat.

Intervention-watch aside, the rest of the session doesn’t offer much in terms of scheduled data drivers, which is likely to see USD/JPY continue to inch nervously higher.

Minneapolis Federal Reserve President Neel Kaskhari is speaking later in the session, with US consumer confidence numbers for September due on Tuesday. Both could offer the chance of a move in USD/JPY, but probably not a lasting one.

USD/JPY Technical Analysis

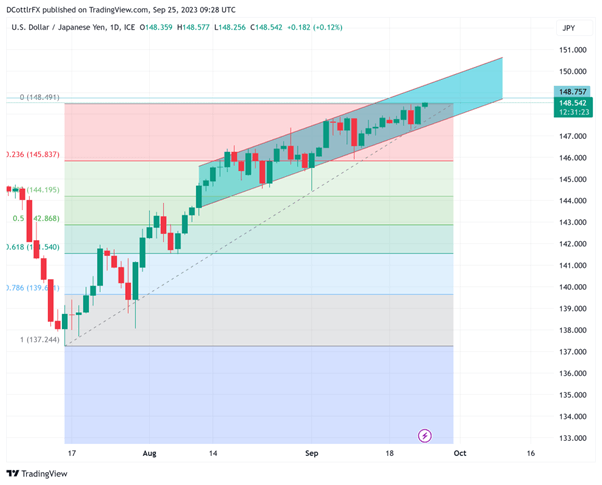

USD/JPY Chart Compiled Using TradingView

| Change in | Longs | Shorts | OI |

| Daily | 32% | 3% | 8% |

| Weekly | 1% | 1% | 1% |

The pair is edging up to highs not seen since late October last year, with near-term resistance at October 28’s intraday peak now in the bulls’ sights at 148.72. Above that, 2022’s overall peak at 152.00 likely to be a tough barrier to break.

The current, well-respected daily chart uptrend channel is an extension of the impressive rise seen since January of this year which has taken USD/JPY up from lows around 127. It currently offers resistance at 149.27, with support at 147.43.

Reversals are likely to find props at September 1’s low of 145.47, ahead of August 23’s intraday low of 144.59. Below that there’s likely major support at 145.83. That’s the first, Fibonacci retracement of the rise up from July 14’s low to the current session’s peaks.

The Relative Strength Index for the pair unsurprisingly suggests a degree of overbuying. However, at 63.49, it remains well below the 70 level which tends to mark extremes and perhaps argues for further modest near-term gains.

IG’s own sentiment index finds investors quite leery of further progress from current levels, with fully 79% of traders coming at USD/JPY from the short side now, which probably shows just how pervasive those intervention worries are.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

–By David Cottle for DailyFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0