Japanese Yen Rallies on Bank of Japan’s Ueda Comments. Will USD/JPY Reverse?

[ad_1] Japanese Yen, USD/JPY, US Dollar, BoJ, Ueda, Intervention, JGB, Yields, – Talking Points USD/JPY recoiled lower on Monday after remarks from BoJ Governor Ueda The BoJ might be prepping the market for policy adjustments further down the track The yield spread between JGBs and Treasuries might be worth watching Recommended by Daniel McCarthy Trading

[ad_1]

Japanese Yen, USD/JPY, US Dollar, BoJ, Ueda, Intervention, JGB, Yields, – Talking Points

- USD/JPY recoiled lower on Monday after remarks from BoJ Governor Ueda

- The BoJ might be prepping the market for policy adjustments further down the track

- The yield spread between JGBs and Treasuries might be worth watching

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

The Japanese Yen has had a wild start to the week after comments from Bank of Japan Governor (BoJ) Kazuo Ueda opened the door to speculation for the end of its negative interest rate policy (NIRP).

In early Asian trade on Monday morning, USD/JPY retreated from its 10-month peak of 147.87. It traded down to 146.67 before steadying around 147. Today’s low was just above Friday’s low of 146.59.

The Yomiuri Shimbun newspaper is reporting that Ueda san may tilt monetary policy if wages and prices rise, citing that there are various options.

He made it clear that any policy adjustment will be dependent on circumstance by saying, “We have a variety of options if economic and price conditions turn upward.”

However, the market might have got ahead of itself in seeking tightening from the BoJ. Ueda also remarked, “There is still some way to go before the price target can be realized. We will continue our persistent monetary easing policy.”

The BoJ has a policy rate of -0.10% and is maintaining yield curve control (YCC) by targeting a band of +/- 0.50% around zero for Japanese Government Bonds (JGBs) out to 10 years.

The bank has become flexible on YCC implementation, recently allowing the 10-year Japanese Government Bond (JGB) to yield above 0.50%. It traded at 0.69% today, its highest return in almost 10 years.

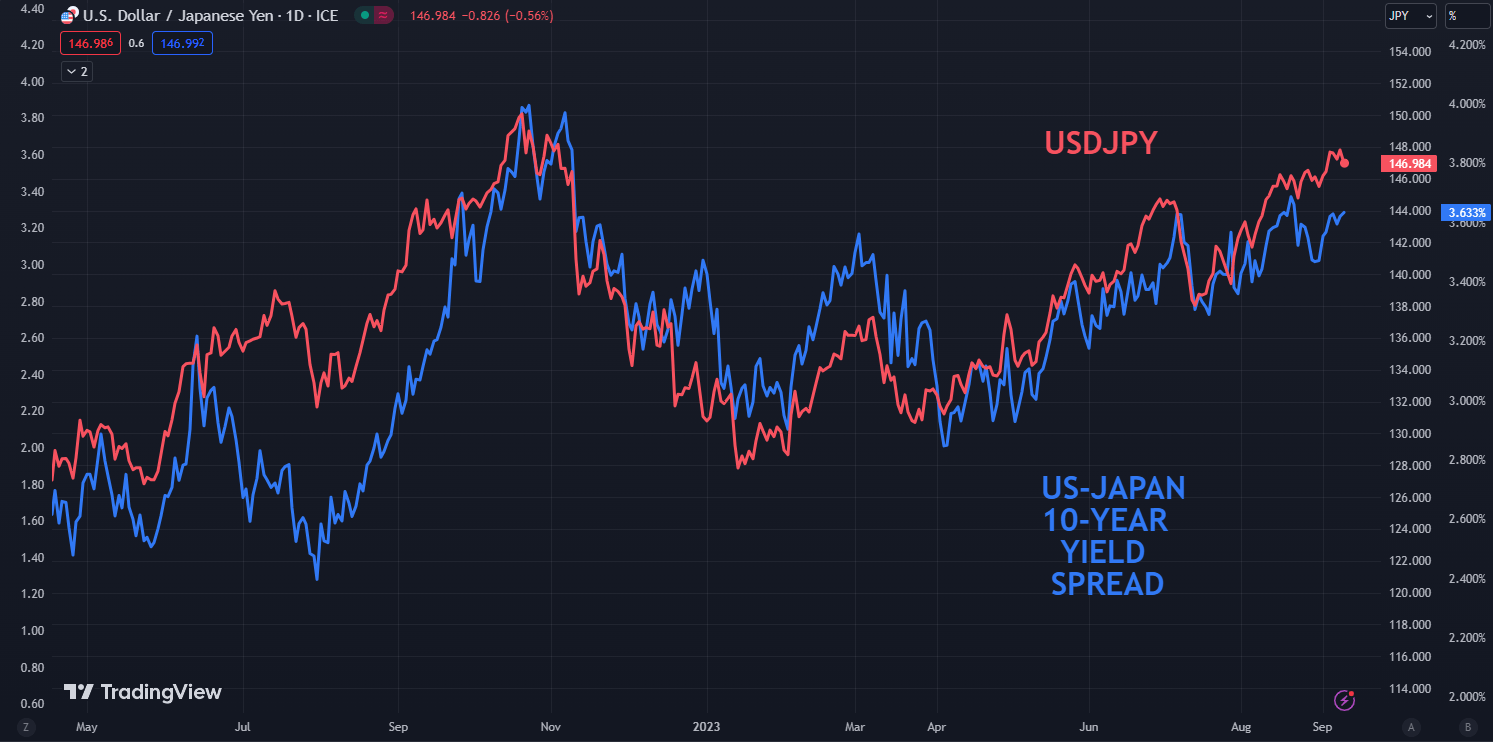

The spread between JGBs and Treasury yields might be worth paying attention to as there has traditionally been a strong correlation to USD/JPY. The next few sessions may see some volatility in this part of the market.

USD/JPY AND YIELD SPREAD BETWEEN 10-YEAR TREASURIES AND JGBS

Chart created in TradingView

Governor Ueda’s comments follow some soft jawboning last week from Masato Kanda, Japan’s Vice Minister of Finance for International Affairs and BoJ board member Hajime Takata.

It might be reasonable to expect more remarks from Japanese officials if USD/JPY makes another move to the topside.

The market is generally not anticipating physical intervention until the price moves toward 152.00, if at all. The November 2022 high was 151.95.

To learn more about how to trade USD/JPY, click on the banner below.

Recommended by Daniel McCarthy

How to Trade USD/JPY

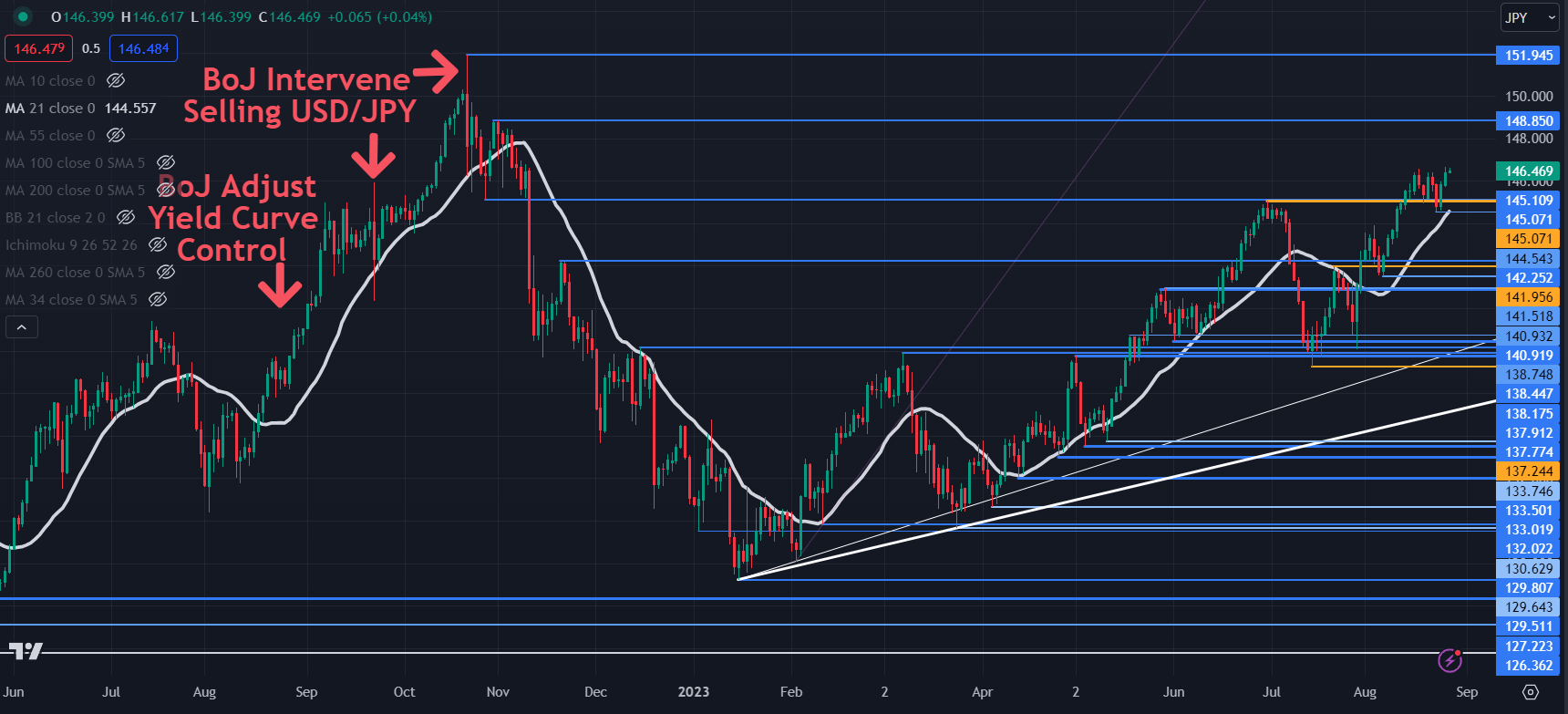

USD/JPY TECHNICAL ANALYSIS SNAPSHOT

USD/JPY made a 10-month high last Tuesday before consolidating in a 146.59 – 147.87 range. A breakout on either side of the range could see momentum evolve in that direction.

If a bullish run emerges, resistance might be at the prior peaks of 148.85 and 151.95.

On the downside, support may lie at the breakpoints in the 145.05 – 145.10 area ahead of the prior lows near 144.50 and 141.50.

The 34-day Simple Moving Average (SMA) is also near 144.80 and may lend support.

Chart created in TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0