Japanese Yen Price Action Setups: USD/JPY, GBP/JPY

[ad_1] USD/JPY, GBP/JPY PRICE, CHARTS AND ANALYSIS: Most Read: Short USD/JPY: A Reprieve in the DXY Rally and FX Intervention by the BoJ (Top Trade Q4) USD/JPY, GBP/JPY FUNDAMENTAL BACKDROP The Japanese Yen has resumed its struggles following the Bond purchase offensive by the Bank of Japan (BoJ) on October 2. The biggest winner has

[ad_1]

USD/JPY, GBP/JPY PRICE, CHARTS AND ANALYSIS:

Most Read: Short USD/JPY: A Reprieve in the DXY Rally and FX Intervention by the BoJ (Top Trade Q4)

USD/JPY, GBP/JPY FUNDAMENTAL BACKDROP

The Japanese Yen has resumed its struggles following the Bond purchase offensive by the Bank of Japan (BoJ) on October 2. The biggest winner has actually been the GBP as the Greenback has been on a retracement following a brief spike on Monday. The US Dollar has face selling pressure largely on the back of dovish rhetoric from Fed policymakers this week. This was further reinforced today by Fed Policymaker Waller who stated that financial markets are tightening and will do some of the work for the FED.

Elevate your trading skills with an extensive analysis of the Japanese Yens prospects, incorporating insights from both fundamental and technical viewpoints. Download your free Q4 guide now!!

Recommended by Zain Vawda

Get Your Free JPY Forecast

The Great British Pound on the other hand has benefitted from hawkish comments from MPC member Katherine Mann who warned about higher inflation and rising consumer inflation expectations. She also suggested that she supports a more aggressive approach and further tightening in order to achieve the Central Banks 2% target.

Japan’s Top currency diplomat Masato Kanda has changed his tune with regard to FX intervention and this could be a sign of things to come. Mr Kanda stated that steady Yen falls over a protracted period could also warrant intervention. This is in contrast to the BoJ and Kanda’s previous statements which hinted at excessive moves and extreme volatility as reasons for potential FX intervention.

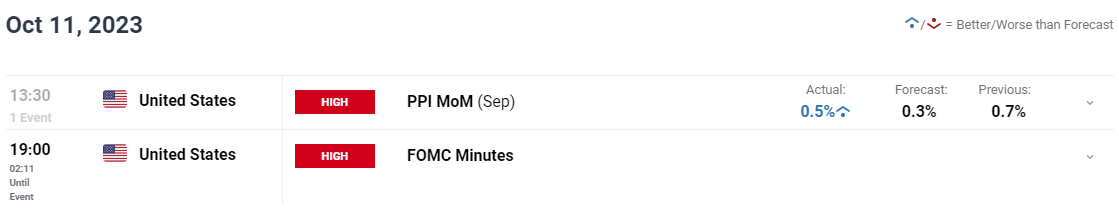

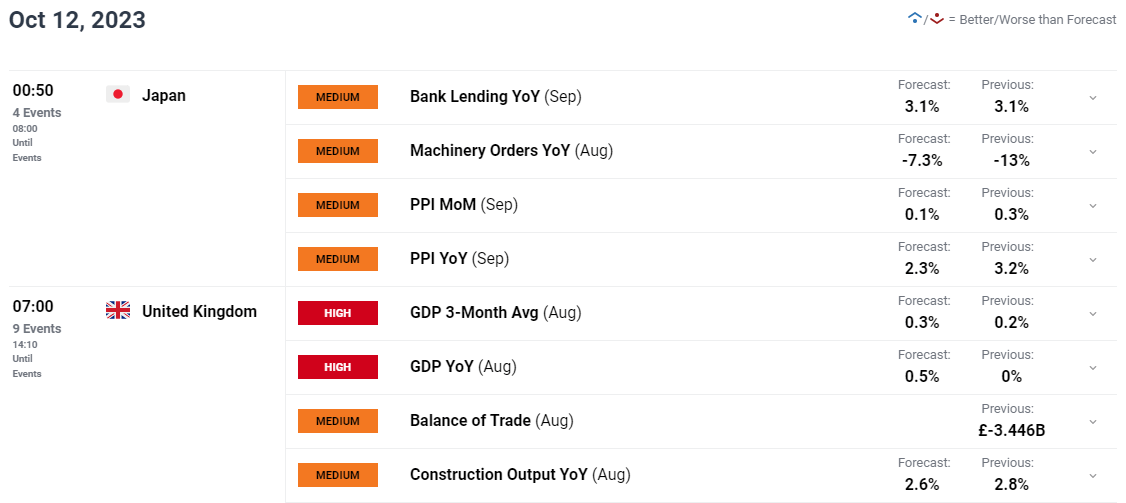

RISK EVENTS AHEAD

The economic calendar is quite packed with data over the next 24 hours with a host data releases which could have an impact on JPY pairs. However, as we have discussed before any such moves are unlikely to last in the current environment unless we have a significant shift in the overall fundamental picture.

Later this evening we have the FOMC minutes followed by a slew of data from Japan in the early hours of the morning tomorrow. Thereafter all eyes will be focused on the US inflation print which had been the standout risk event for the week ahead of the conflict which erupted in Israel over the weekend.

For all market-moving economic releases and events, see the DailyFX Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

PRICE ACTION AND POTENTIAL SETUPS

USDJPY

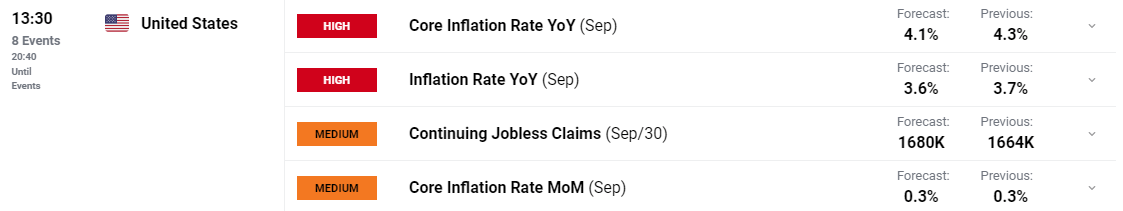

USDJPY remains confined to a 100-pip range for the last 5 trading days between the 148.30 and 149.30 mark. The weakness in the US Dollar Index has prevent the Greenback from capitalizing on the return of Yen weakness as a renewed move towards 150.00 seems inevitable. A soft US CPI print tomorrow however could put a spanner in the works and accelerate the DXY decline and thus halting any potential of an aggressive move to the upside for USDJPY.

The bullish trend remains strong for now with a daily candle close below the 146.50 mark needed for a change in structure from a daily timeframe perspective. A daily candle close above the 149.30 range high could provide traders eyeing a potential long on USDJPY an opportunity to get involved but could prove to be short lived once more.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

- 149.30

- 150.00 (Psychological level)

- 152.00 (2022 Highs)

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

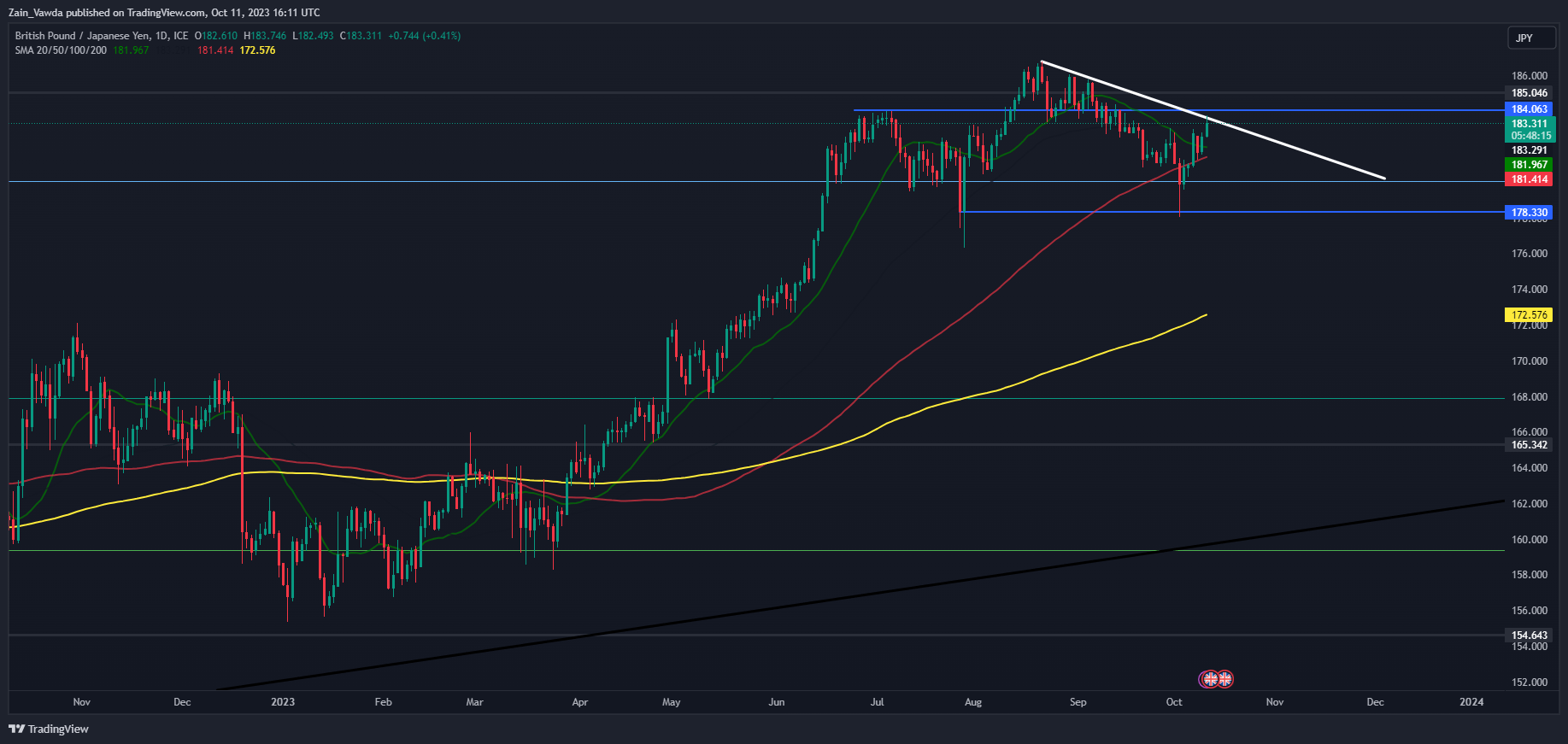

GBPJPY

As mentioned earlier, the GBP has enjoyed a better time of late against the Yen following a decent retracement over the past few weeks. This was largely facilitated by a bout of weakness for the Pound. The run in GBPJPY now faces its first significant test as the pair tests the descending trendline from the recent highs with a break likely leading to retest of the 186.80 mark in the coming days.

Meanwhile, a rejection from around here may find support with either the 20 or 100-day MA which are resting just below the current price. However, Monday did see a change in structure on the daily timeframe which could prove to be a key indicator for the next potential move even if we do get a short-term retracement of sorts.

GBP/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment Data whichshows retail traders are 70% net-short on GBPJPY. Given the contrarian view adopted here at DailyFX, is GBPJPY destined to rise back toward the 186.80 handle?

For tips and tricks regarding the use of client sentiment data, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -4% | -2% |

| Weekly | -1% | -1% | -1% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0