Japanese Yen, USD/JPY, RSI Divergence – Technical Update:

- Japanese Yen closes at weakest against USD in over a month

- USD/JPY broader upside path places focus on the June high

- 4-hour chart shows fading upside momentum at resistance

Recommended by Daniel Dubrovsky

Get Your Free JPY Forecast

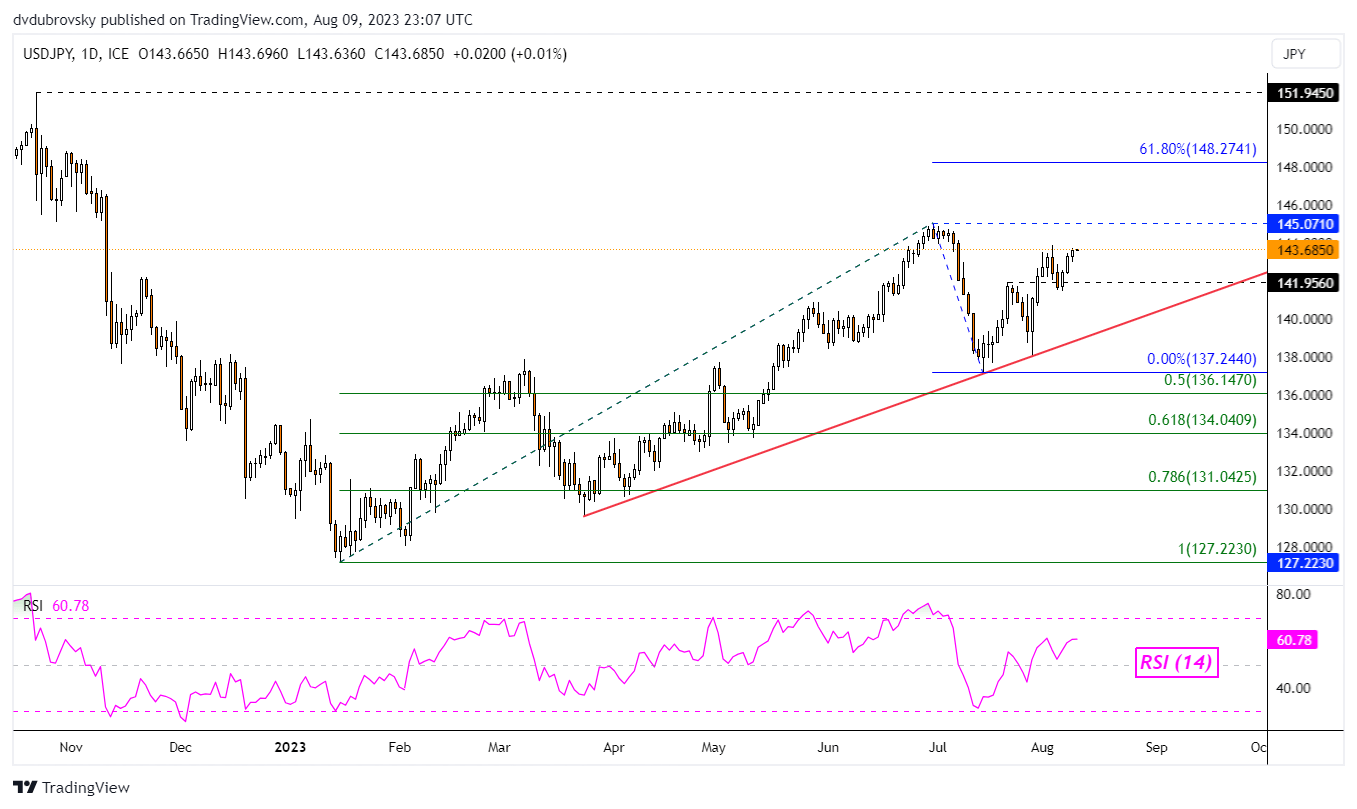

The Japanese Yen recently closed at its weakest point against the US Dollar in over a month. In fact, on the daily chart below USD/JPY can be seen reversing the abrupt and short-lived drop that occurred early last month. A closer look shows that the rising trendline from March has been maintaining the broader upside technical focus.

From here, further gains would place the focus on the June high of 145.07. Clearing this price with a confirmatory upside push opens the door to extending the upside focus. That expose the 61.8% Fibonacci retracement level at 148.27 before the October high of 151.94 kicks into focus. Otherwise, in the event of a turn lower, the rising trendline may maintain the upside focus.

Chart Created in TradingView

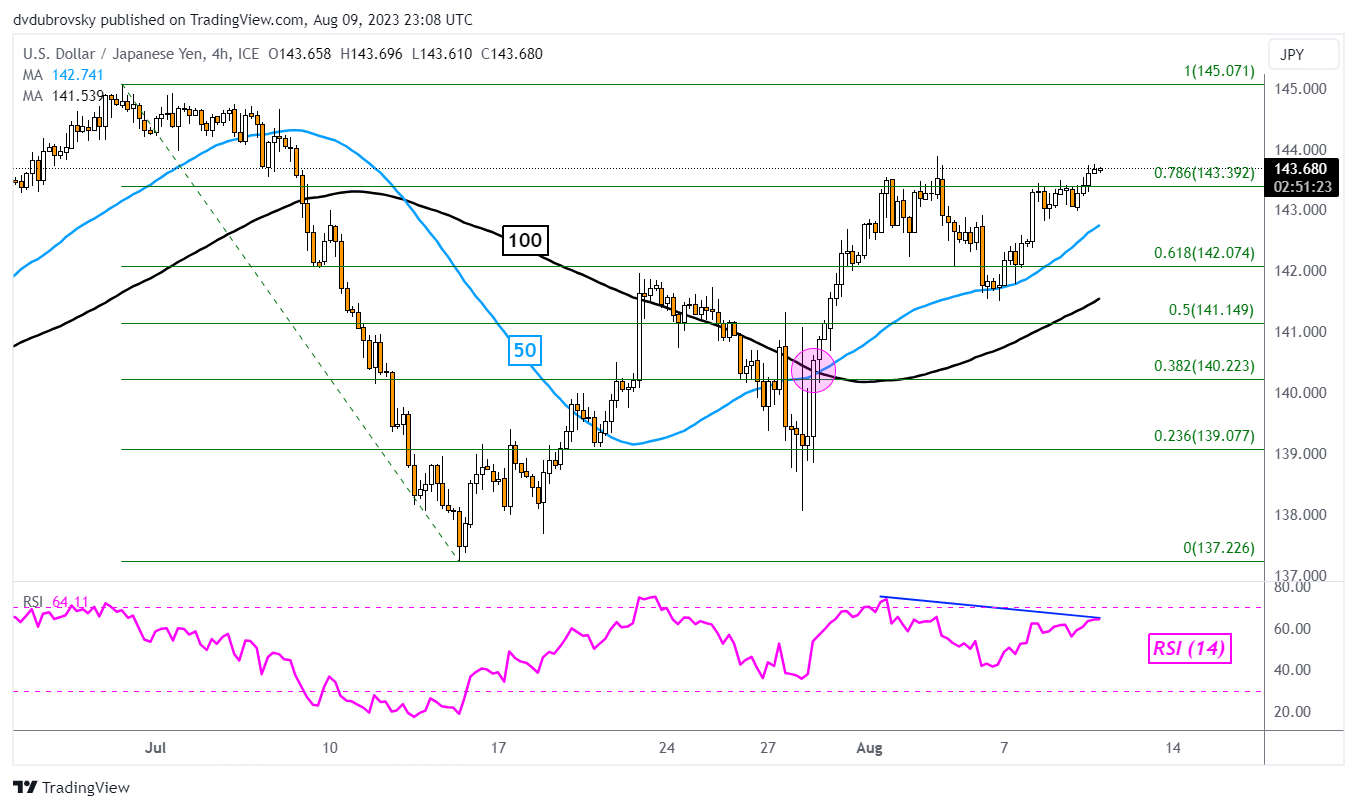

Zooming in on the 4-hour timeframe can give us a better idea of how short-term price action is setting up. The bullish Golden Cross between the 50- and 100-day Moving Averages (MA) remains in play and has since seen confirmatory upside follow-through. Now, prices are once again testing a push above the 78.6% Fibonacci retracement level of 143.39.

But, just like before, it could be a struggle. Negative RSI divergence shows that upside momentum is fading. This can at times precede a turn lower. Such an outcome would reinforce near-term resistance, undermining the price action seen on the daily chart. In the event of a turn lower, the 50- and 100-period Mas may hold as support, reinstating the upside focus.

Recommended by Daniel Dubrovsky

How to Trade USD/JPY

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0