Japanese Yen, USD/JPY, US Dollar, Treasuries, JGBs, China, Commodities – Talking Points

- The Japanese Yen wilted today after the US Dollar resumed strengthening

- Treasury yields are outstripping JGBs today, adding to US Dollar lustre

- China’s outlook remains mired, impacting the region. Will that boost USD/JPY?

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

The Japanese yen declined to its lowest level since November last year against the US Dollar today touching 145.22. It then retreated below 145.00.

On a day when risk assets were generally undermined, the big dollar gained across the board with Treasury yields continuing to trade higher into the Monday session.

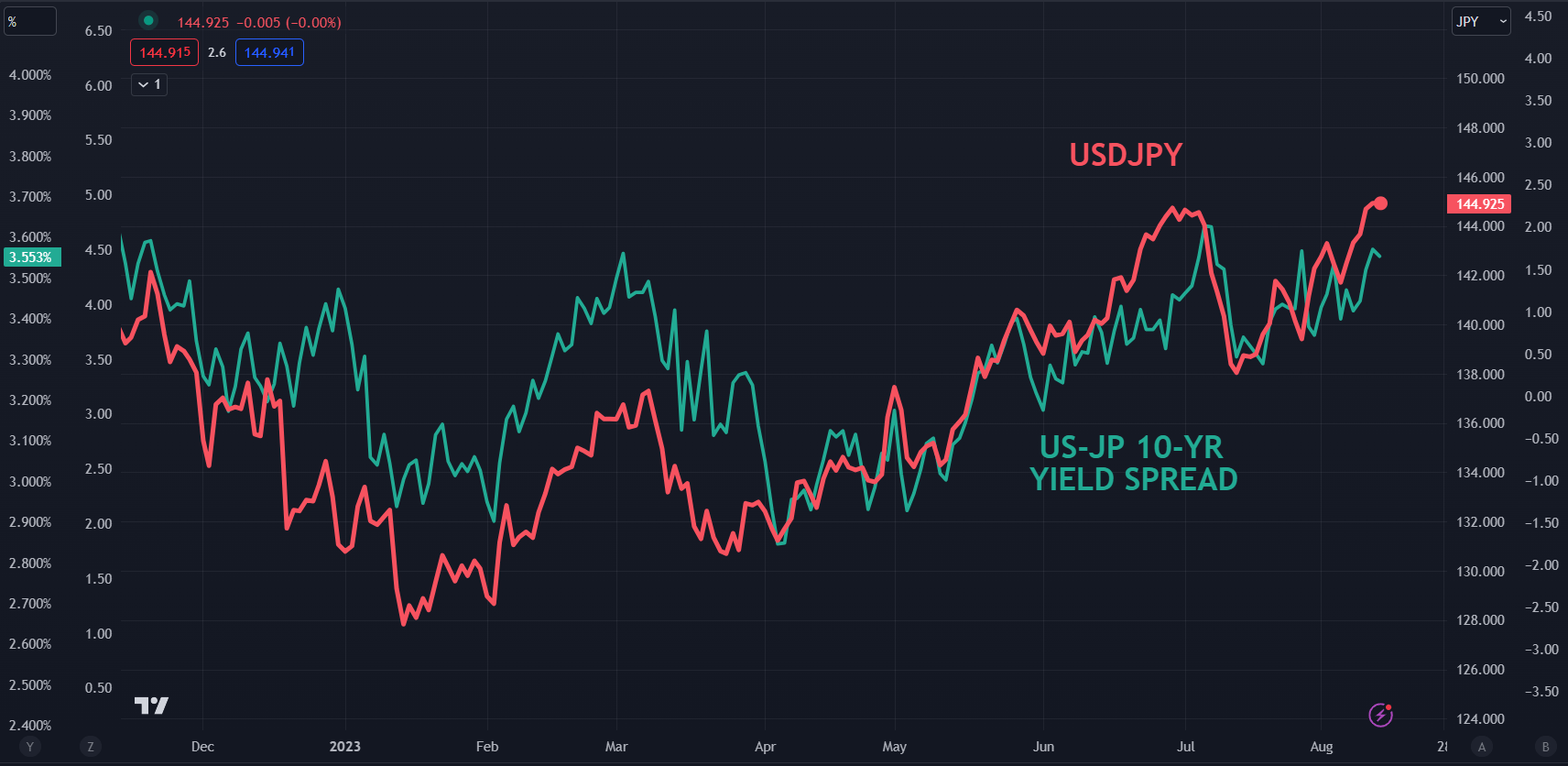

The benchmark 10-year note is trading close to 4.20%, a level not seen since November 2022 as well. Japanese Government bonds (JGB) are steady above 0.60% but the yield spread continues to favour the US Dollar.

Chart created in TradingView

Typhoon Lan is anticipated to hit landfall in central Japan on Tuesday with airlines and rail networks anticipated to see significant disruptions. The latest Japanese GDP data will be released tomorrow.

The high beta Aussie and Kiwi Dollars are the notable underperformers so far today while the Swiss Franc has been the ‘least worst’ currency against the US Dollar.

APAC equity indies are a sea of red to start the week with Hong Kong’s Hang Seng Index (HSI) leading the way lower, down over 2%.

Chinese stocks have also been hampered as concerns around Country Garden continue to swirl after trading in the Chinese property giant’s bonds was suspended on Monday.

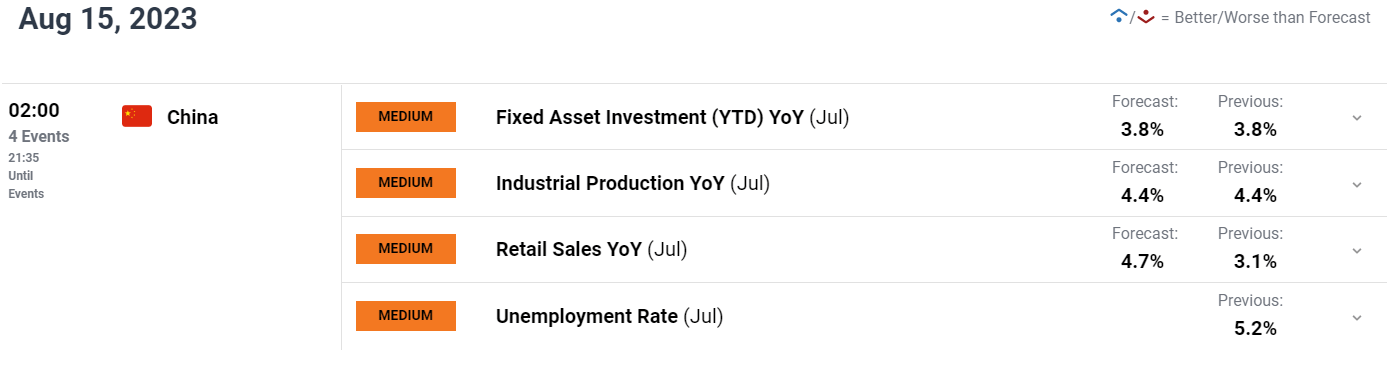

Beijing announced that they want to encourage foreign investment in targeted areas by providing tax incentives. China industrial production and retail sales data will be released Tuesday.

CHINESE DATA AHEAD (GMT)

Source; DailFX Calendar

Wall Street futures are pointing toward a soft start to their cash session and European bourses may also face some headwinds.

Gasoline prices are lower to start the week after making new highs on Friday. Crude oil has also eased today with the WTI futures contract trading under US$ 82.50 bbl while the Brent contract is a touch approaching US$ 86 bbl.

The stronger USD has manifested itself in lower base metals prices, particularly aluminium, copper and nickel. Gold has sunk to its lowest level since early July but is steady near US$ 1,910.

For all the events coming up this week, the full economic calendar can be viewed here.

Recommended by Daniel McCarthy

Understanding the Core Fundamentals of Oil Trading

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0