Japanese Yen Drops as BOJ Keeps Policy Unchanged: What’s Next for USD/JPY?

US Dollar, Japanese Yen, USD/JPY, Bank of Japan – Talking Points: BOJ kept ultra-loose policy settings unchanged. JGB 10-year yield target and band maintained. What is the outlook for USD/JPY and what are the signposts to watch? Recommended by Manish Jaradi Get Your Free Top Trading Opportunities Forecast The Japanese yen dropped against the US

US Dollar, Japanese Yen, USD/JPY, Bank of Japan – Talking Points:

- BOJ kept ultra-loose policy settings unchanged.

- JGB 10-year yield target and band maintained.

- What is the outlook for USD/JPY and what are the signposts to watch?

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

The Japanese yen dropped against the US dollar after the Bank of Japan’s (BOJ) kept its ultra-loose policy settings and maintained the cap on the JGB 10-year yield but said it would guide yield curve control more flexibly to respond to upside and downside risks.

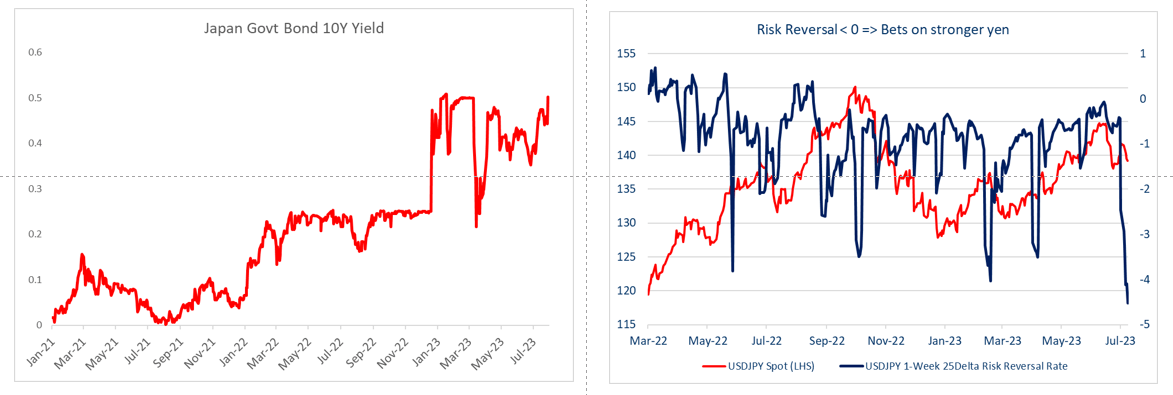

The BOJ maintained the band around the JGB 10-year yield band of +- 0.5% with the yield target of around 0%. Earlier Friday, the Nikkei reported BOJ will discuss tweaking its yield curve control policy at today’s board meeting by letting long-term interest rates rise beyond its cap of 0.5% by a certain degree. The proposed change would keep the rate ceiling but allow for moderate rises beyond that level.

As a result, before the BOJ rate decision announcement, USD/JPY fell sharply, one-week 25-delta risk reversals slipped further in favour of JPY calls, and the Japan 10-year government bond yield hit jumped above BOJ’s cap of 0.5% in reaction to the report. Post the policy announcement, USD/JPY has reversed its earlier loss.

USD/JPY 5-Minute Chart

Chart Created Using TradingView

The Japanese central bank was widely expected to keep its policy settings unchanged at today’s meeting as policymakers wait for more evidence of sustained price pressures. The key focus on fresh quarterly projections and discussions regarding phasing out the controversial yield curve control (YCC) policy after BOJ summary of opinions at the June policy meeting quoted one board member saying the central bank should debate tweaking YCC to improve market function and mitigate its “high cost”.

JGB 10-Year Yield and USD/JPY Risk Reversals Before BOJ Policy Decision

Source data: Bloomberg; chart created in Microsoft Excel

BOJ Governor Kazuo Ueda has said the central bank expects inflation to slow below 2% toward the middle of the current fiscal year, but the country’s corporate price-setting behaviour was showing changes that could push up inflation more than expected.

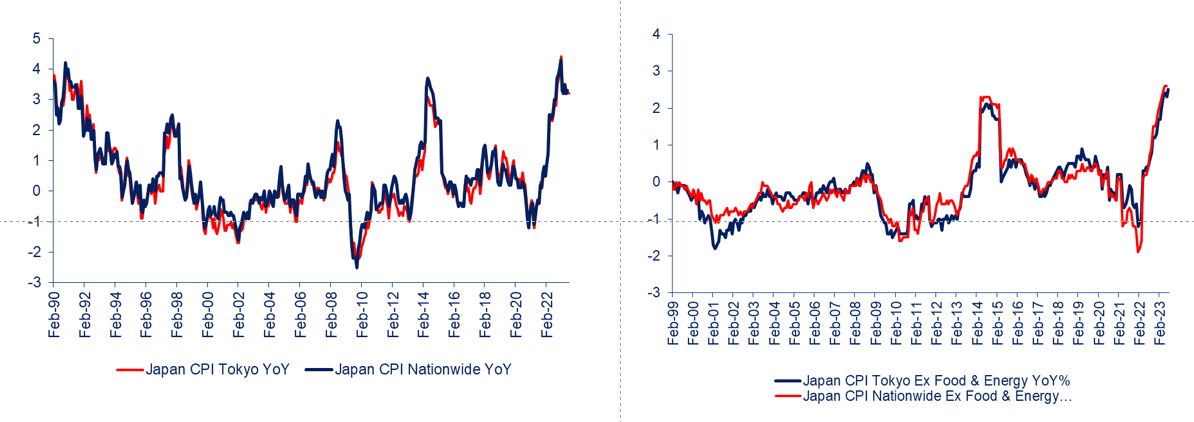

Data released early Friday showed Tokyo’s core inflation hit 3.0% on-year in July Vs 2.9% forecast. Nationwide core CPI rose 3.3% in June from 3.2% in May. The so-called core-core inflation gauge (which excludes both food and energy) slowed to 4.2% on-year from 4.3% in May.

Japan Inflation

Source data: Bloomberg; chart created in Microsoft Excel

Going forward, the still-wide interest rate differentials between Japan and the rest of the world could continue to weigh on the yen. However, the prospect of the BOJ nearing the end of the ultra-easy policy is likely to keep the downside in JPY supported.

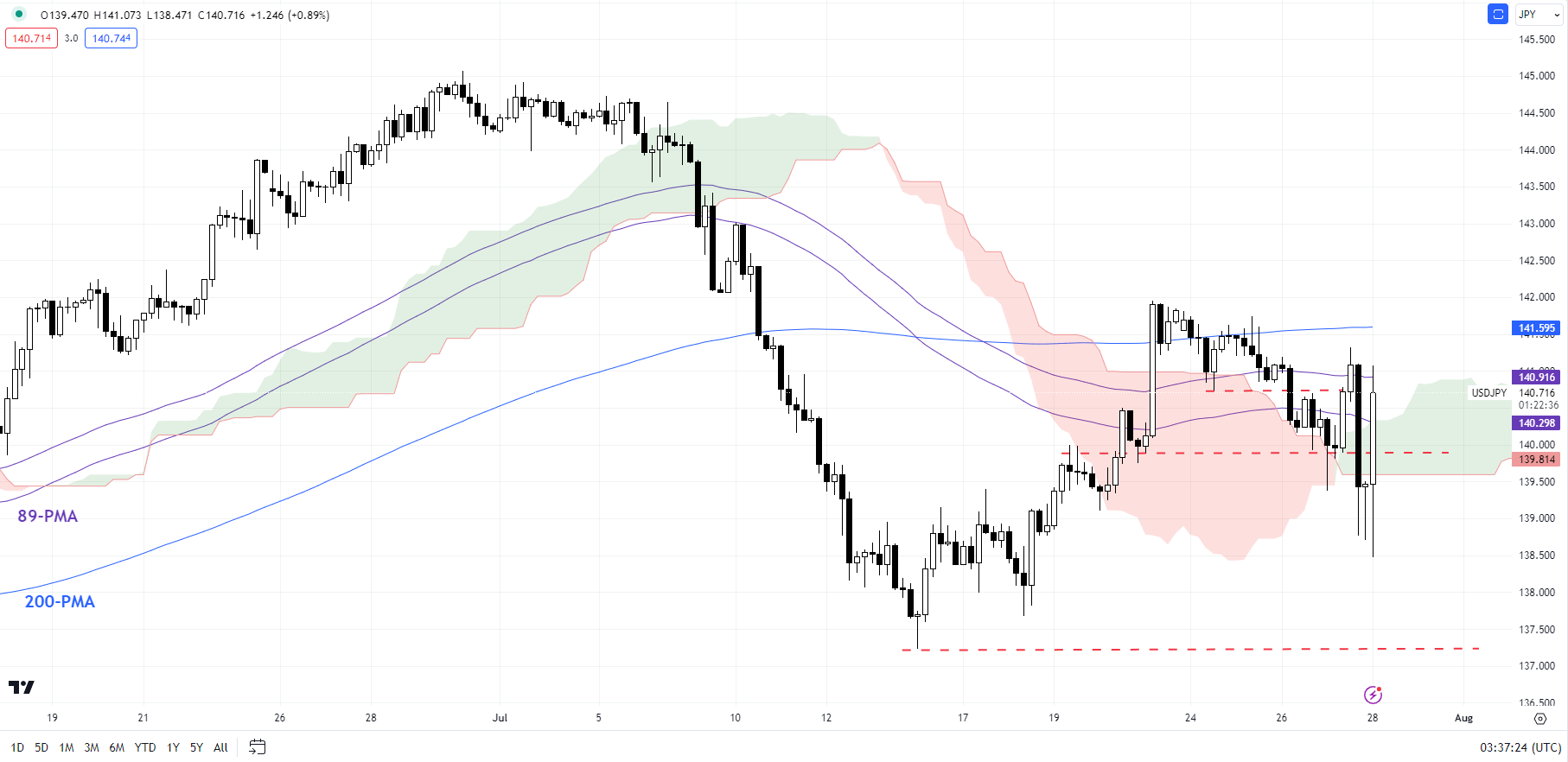

USD/JPY 240-Minute Chart

Chart Created Using TradingView

On technical charts, USD/JPY would need to clear Thursday’s high of 141.30 at the very least for the immediate downward pressure to fade. That’s because the fall below the mid-July low of 140.00 has raised the odds that USD/JPY’s rally since the middle of the month is reversing.

This follows Wednesday’s fall below the Monday’s low of 140.75, raising the chances of a false move higher last week. For more on this, see “US Dollar Scenarios Ahead of Fed Rate Decision: EUR/USD, GBP/USD, USD/JPY Price Setups,” published July 26, and “US Dollar Slips After Fed Rate Hike: What Has Changed for EUR/USD, GBP/USD, USD/JPY?”, published July 27. USD/JPY risks a drop toward the July 14 low of 137.25.

Recommended by Manish Jaradi

How to Trade USD/JPY

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰