Japanese Yen, USD/JPY, US Dollar, Fitch, Nikkei, BoJ, BoE, Crude Oil, WTI – Talking Points

- Japanese Yen support wilted along with JGBs after US Dollar resumed rallying

- The markets are reappraising positioning with Treasury yields climbing again

- Risk assets remain under pressure. If that continues, will USD/JPY break 145?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Japanese Yen sunk to a 4-week low against the US Dollar today as the market continue to take stock of the tilt triggered by the US debt downgrade.

Fitch, the credit rating agency, downgraded the US to AA+ from AAA on Tuesday for the first time since 1994.

Then on Wednesday, the US Department of Treasury announced that they will seek to issue US$ 103 billion next week, up from the US$ 96 billion last time. Treasury yields are a few basis points higher across the curve, but more so at the backend.

Risk assets in general have been on the back foot ever since and APAC equities followed today with Japan leading the way lower. The Nikkei 225 index is down over 1% along with the TOPIX and JPX-Nikkei 400 indices.

USD/JPY pushed above 143.50 today but it has been the growth-linked Aussie and Kiwi Dollars that have depreciated the most in this latest risk-off rout.

To compound matters today, the Bank of Japan announced an unscheduled bond-buying program today, following Monday’s unscheduled action. The 10-year Japanese Government Bond (JGB) is still trading near 0.65%, the highest level since 2014.

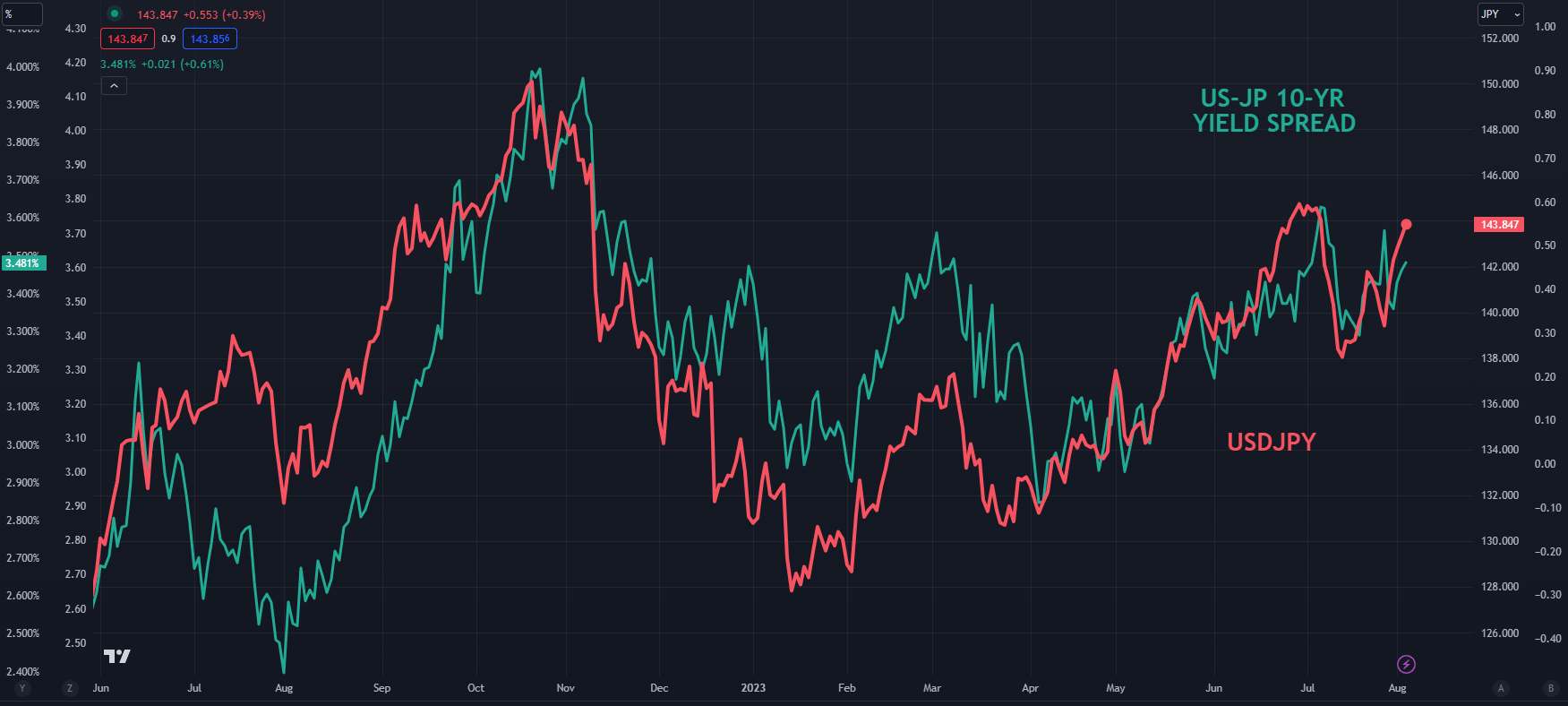

Nonetheless, the spread between 10-year Treasuries and JGBs continue to move in favour of the US Dollar as illustrated in the chart below.

Recommended by Daniel McCarthy

How to Trade USD/JPY

In other central bank news, the Bank OF England rate decision is ahead today, and a Bloomberg survey of economists is forecasting a 25 basis point lift in its target rate.

The overnight index swap (OIS) market is looking at 75 basis points of tightening in total by the end of the second quarter of next year. In any case, GBP/USD is languishing near 1.2700.

Crude oil has struggled so far through Wednesday after collapsing yesterday. The WTI futures contract is near US$ 79.50 bbl while the Brent contract is trading at over US$ 83 bbl at the time of going to print.

Spot gold is resting near 3 weeks lows just above US$ 1,930. Live prices can be found here.

Looking ahead, Wall Street futures are pointing toward a steady start to its cash session.

The full economic calendar can be viewed here.

USD/JPY Against 10-Year Treasury/JGB Yield Spread

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0