How to Trade Forex Successfully with Minimal Risk

[ad_1] Are you finding it hard to deal with the ups and downs of the forex market? Many traders struggle to find the right balance between making money and managing risks. The forex market is huge, with $6.6 trillion traded every day. But it can also be very risky, leading to big losses for new

[ad_1]

Are you finding it hard to deal with the ups and downs of the forex market? Many traders struggle to find the right balance between making money and managing risks. The forex market is huge, with $6.6 trillion traded every day. But it can also be very risky, leading to big losses for new traders.

But there’s hope! With the right strategy, you can reduce risks and increase your chances of winning. This guide will show you how to trade forex safely and effectively. You’ll learn how to make smart choices and reach your financial goals.

Key Takeaways

- Forex market is the largest financial market globally.

- Risk management is key to long-term success.

- Having a good strategy and learning are vital.

- Keeping your emotions in check is important.

- Always keep learning and adapting to get better.

Understanding the Forex Market Fundamentals

The forex market is the biggest in the world. It trades over $7.5 trillion every day. Every second, about $850 million is traded.

This big size means there’s a lot of money moving around. It makes it easy for traders to buy and sell without changing the value too much.

The World’s Largest Financial Market

Forex trading is open 24/7, five days a week. It starts on Sunday at 5 p.m. ET and ends on Friday at 4 p.m. ET. This means traders can trade all day, every day.

This non-stop trading is what makes the forex market special. It’s open to traders all over the world.

Key Market Participants

Many groups are involved in the forex market. These include banks, big companies, central banks, and individual traders. Each group plays a big role in how the market works.

Banks do big deals, while individual traders might do smaller trades. They can use a lot of money, which can be risky.

Market Hours and Trading Sessions

Forex trading happens all over the world. It follows the sun from east to west. There are three main sessions:

| Session | Major Centers | Hours (ET) |

|---|---|---|

| Asian | Tokyo, Hong Kong | 7 PM – 4 AM |

| European | London, Frankfurt | 3 AM – 12 PM |

| North American | New York, Chicago | 8 AM – 5 PM |

Knowing when these sessions happen is key. For example, when Europe and North America overlap, there’s a lot of activity in EUR/USD.

Learning about the forex market is the first step to success. It helps you understand the ups and downs. Remember, steady, small gains can lead to big success over time.

Selecting the Right Trading Style

Choosing the best forex trading style is key to success. Each style fits different people and schedules. Let’s look at the main forex trading styles and what they’re like.

Day Trading Approach

Day trading means opening and closing trades in one day. It’s for those who can watch the market all day. Day traders make many small profits, doing 10 to 30 trades a day.

They need to make quick decisions and stay disciplined. This style is fast-paced.

Swing Trading Benefits

Swing trading is good for those who can’t watch the market all the time. Traders keep their positions for days to weeks. They usually hold for 5 to 10 days.

This style lets traders do deeper analysis. Swing traders often win 50-70% of the time. It’s a popular choice.

Position Trading Strategy

Position trading means holding trades for weeks to months. It’s for patient traders who like to see long-term trends. They aim for big wins, risking 1:3 or more.

Position traders do fewer trades but hope for bigger gains. They focus on long-term trends.

| Trading Style | Average Trades Per Day | Typical Hold Time | Win Rate |

|---|---|---|---|

| Day Trading | 10-30 | Intraday | 40-60% |

| Swing Trading | 1-3 | 5-10 days | 50-70% |

| Position Trading | 0.1-0.5 | 3-6 months | Varies |

Choosing the right trading style depends on your personality, time, and risk level. Being consistent is important. Studies show consistent traders can improve by 20-30%.

Try out different styles to see what fits you best.

Essential Risk Management Techniques

Forex risk management is key for long-term success in trading. It helps protect your capital and boosts profitability. Let’s look at some important techniques to reduce risk in the forex market.

Using stop-loss orders is a basic strategy. These orders close a trade when the price hits a set level, capping losses. For example, with $5,000, you should risk no more than 2% per trade, or $100.

Position sizing is also critical. It’s about figuring out how much to invest in each trade. With a $1,000 deposit and 100:1 leverage, you control $100,000. But remember, more leverage means more risk.

- Limit risk to 1-2% of your trading account per trade

- Set stop-loss orders at least 1.5 times the current high-to-low range

- Use moving averages as benchmarks for stop-loss and take-profit points

- Diversify your investments to reduce possible losses

By using these methods regularly, you can manage risk better. This improves your chances of success in forex trading.

| Risk Management Technique | Description | Example |

|---|---|---|

| Stop-Loss Orders | Automatically close positions at predetermined levels | Set stop-loss at 50 pips for a $100 risk per trade |

| Position Sizing | Determine the appropriate investment amount | Trade 1 mini lot with $50 risk per 50 pips |

| Risk-Reward Ratio | Balance possible losses against possible gains | 1:3 ratio – $200 risk for $600 possible gain |

How to Trade Forex Successfully with Minimal Risk

Trading forex can be exciting, but it’s important to be careful. We’ll look at ways to reduce risk and make more money in the forex market.

Setting Realistic Trading Goals

Setting realistic goals is key to success in forex. Start with small goals, like making 1-2% profit per trade. This builds confidence and keeps your money safe. The forex market is huge, with over $6 trillion traded daily, giving you many chances to succeed.

Implementing Stop-Loss Orders

Stop-loss orders are a must for managing risk. They set a limit on how much you can lose. Studies show they can cut losses by 15-30% compared to not using them. This simple step can greatly improve your trading results.

Position Sizing Strategies

Position sizing is key for controlling risk. It’s about how much money to use for each trade. A good rule is to risk no more than 1-2% of your account on one trade. For example, with a $1,000 account, risk no more than $10-$20 per trade.

| Account Size | Max Risk per Trade (2%) | Lot Size (EURUSD) |

|---|---|---|

| $1,000 | $20 | 0.02 |

| $5,000 | $100 | 0.1 |

| $10,000 | $200 | 0.2 |

By setting realistic goals, using stop-loss orders, and smart position sizing, you can trade forex safely. These steps help keep your money safe and boost your chances of success in the forex market.

Choosing a Reliable Forex Broker

Finding the right broker is key to success in forex trading. A good broker can greatly improve your trading and profits.

Regulatory Compliance and Safety

Look for brokers regulated by top bodies. In the U.S., check if they are with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These groups make sure brokers follow rules and keep your money safe.

Platform Features and Tools

Trading platforms are your entry to the forex world. Choose brokers based on their platform features. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are favorites for their easy use and detailed charts. Some brokers have their platforms with special tools.

Cost Structure Analysis

Knowing broker fees is important for making money over time. Look at spreads, commissions, and fees for overnight trades. For example, IG has an average spread of 0.98 pips for EUR/USD, while AvaTrade offers 0.93 pips. IG needs £250 as a minimum deposit, and AvaTrade asks for $100.

| Broker | EUR/USD Spread | Minimum Deposit |

|---|---|---|

| IG | 0.98 pips | £250 |

| AvaTrade | 0.93 pips | $100 |

| eToro | 1.00 pips | $50 – $10,000 |

Between 51% and 89% of retail investor accounts lose money with CFDs. Pick a broker that fits your trading style and goals. This can help you avoid losses and increase your gains.

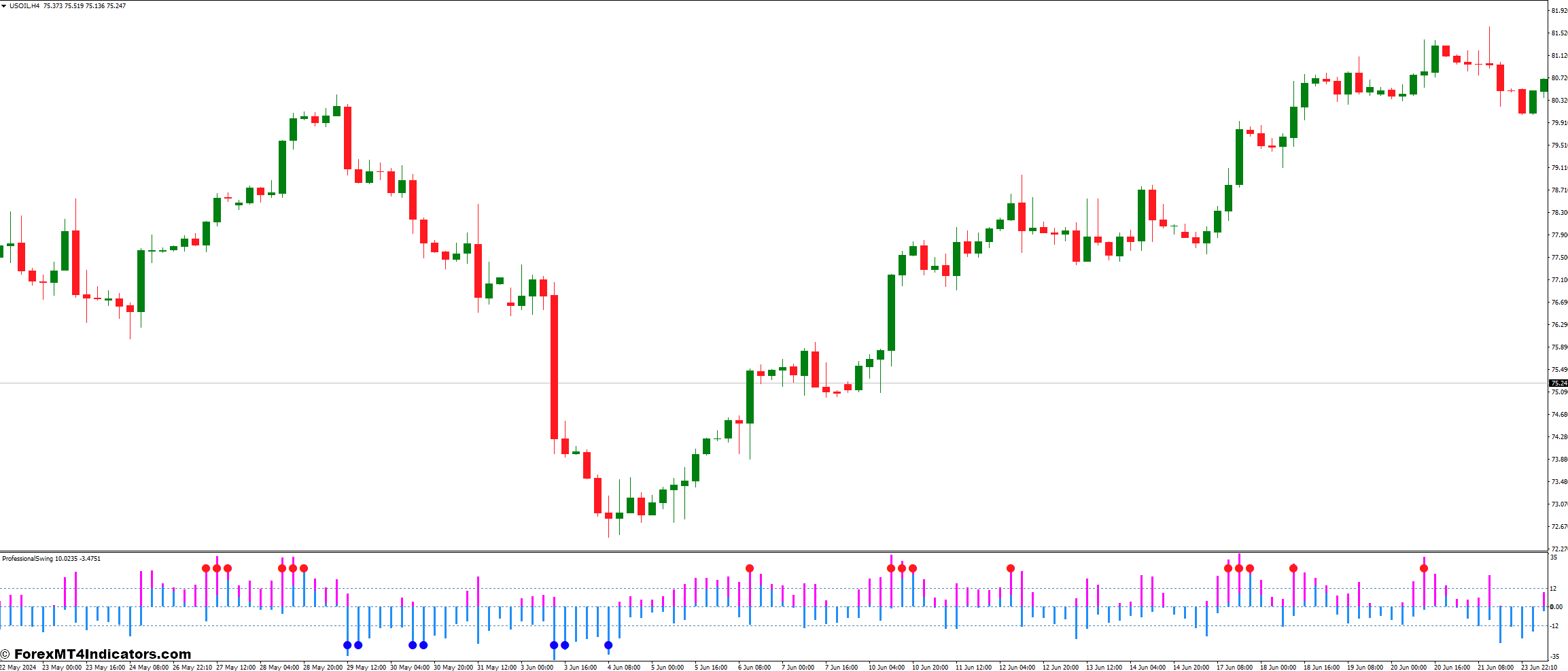

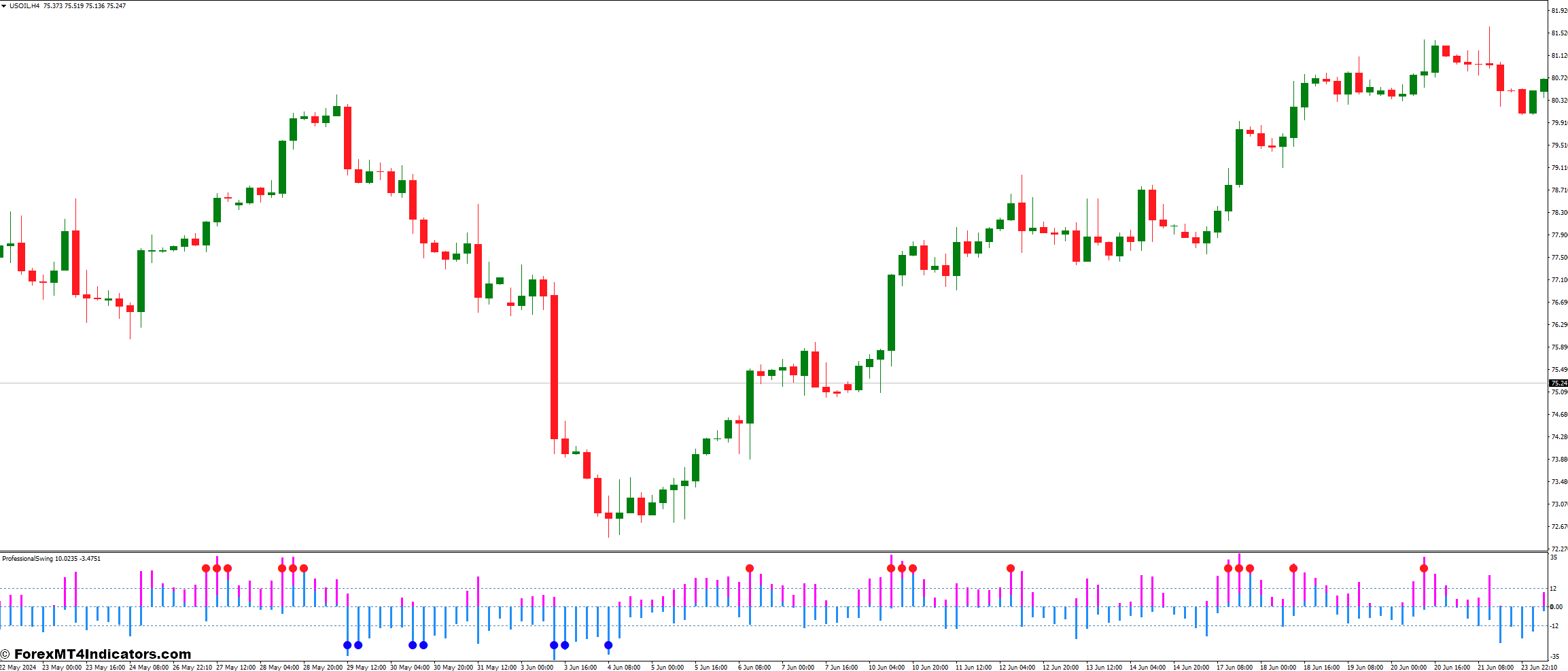

Technical Analysis for Risk Reduction

Forex technical analysis is key for traders to reduce risk. It helps them understand price patterns and trends. Technical indicators like moving averages and RSI spot market changes.

Fibonacci retracement is a great tool for managing risk. It uses math to find support and resistance levels. Traders use these levels to set limits on their losses and gains.

Chart patterns also help reduce risk. Patterns like head and shoulders warn of trend changes. By spotting these early, traders can adjust to avoid big losses.

| Risk Percentage | Consecutive Losses to Drain $10,000 |

|---|---|

| 1% | 100 |

| 2% | 50 |

| 3% | 33 |

| 5% | 20 |

Using technical analysis with smart risk management is essential. Experts say risk is no more than 1-2% per trade. This keeps your capital safe for more trading chances.

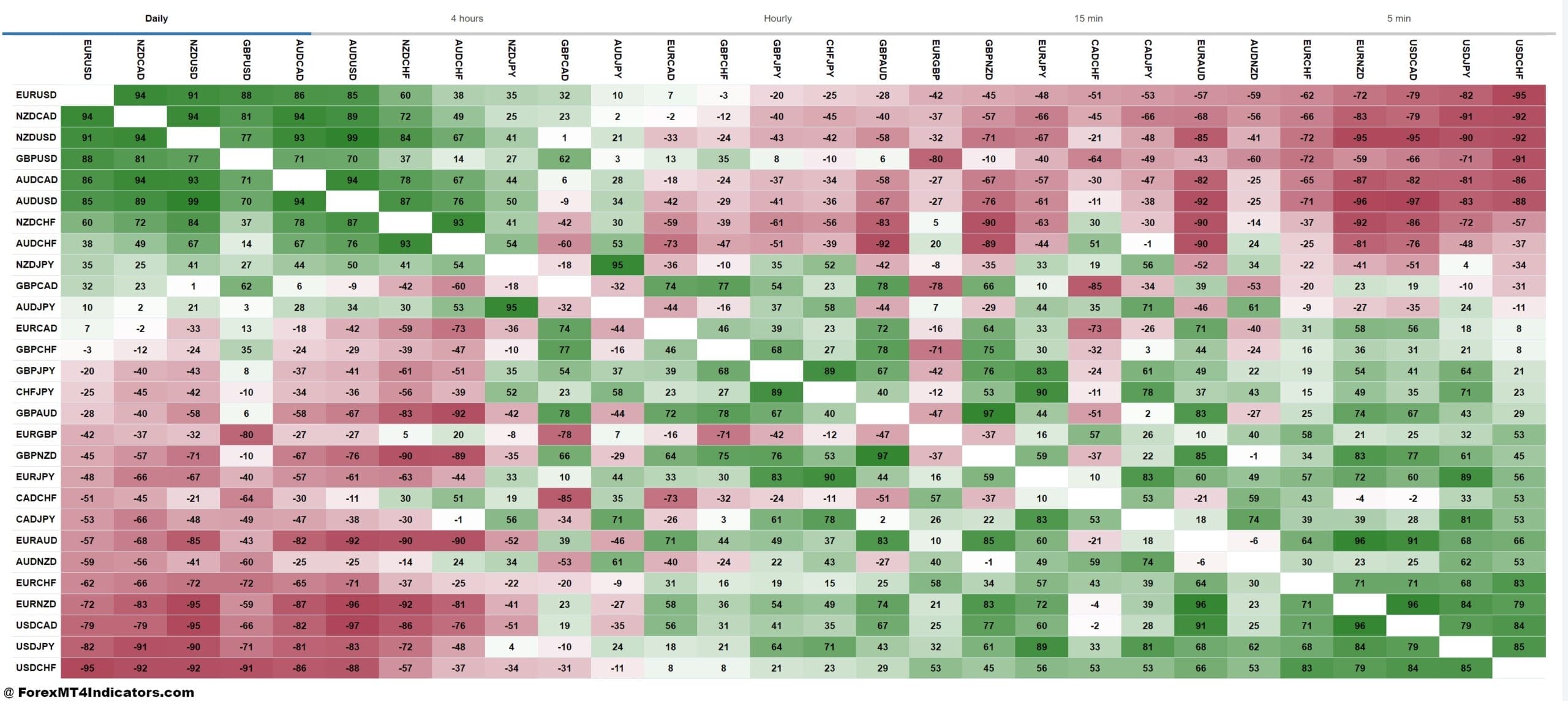

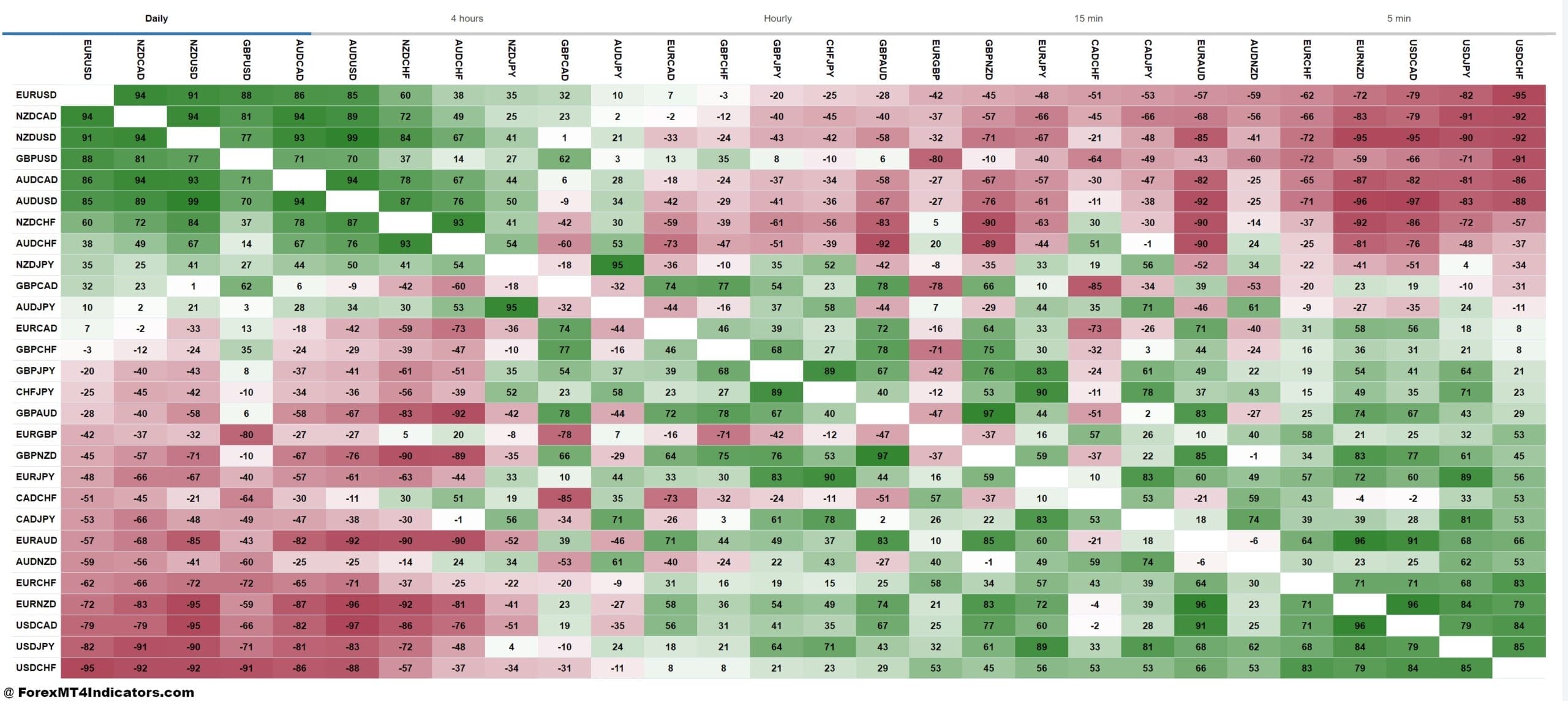

Understanding Currency Correlations

Currency correlations are key in forex trading. They show how different currency pairs move together over time. This info helps in diversifying portfolios and managing risks.

Major Pair Relationships

Major currency pairs often move together. For example, EUR/USD and GBP/USD had a high positive correlation of 0.95 in one month. This means they moved in the same direction 95% of the time.

But over six months, this dropped to 0.66. This shows how correlations can change over time.

Cross-Rate Impact

Cross-rates, or pairs without USD, also affect correlations. A trader might notice GBP/USD moving a lot while GBP/AUD stays the same. This could signal a market shift or a trading opportunity.

Diversification Benefits

Understanding correlations helps in diversifying portfolios. By choosing pairs with low correlations, traders can spread out their risk. For example, USD/CAD and USD/CHF correlation fell from 0.95 to 0.28 in just one month.

This change opens up new ways to diversify.

| Currency Pair | 1-Month Correlation | 6-Month Correlation |

|---|---|---|

| EUR/USD vs GBP/USD | 0.95 | 0.66 |

| EUR/USD vs USD/CHF | -1.00 | -0.94 |

| USD/CAD vs USD/CHF | 0.28 | 0.95 |

Psychology of Successful Trading

Forex trading psychology is key to long-term success. The mental side of trading can greatly affect your performance. Let’s look at important elements for a winning mindset.

Emotional Control Techniques

Maintaining emotional control is vital for forex traders. Only 5% of traders succeed, mainly because they manage their emotions well. To better control your emotions:

- Practice mindfulness meditation

- Keep a trading journal to track emotions

- Set clear rules for entry and exit points

Discipline in Trade Execution

Trading discipline is essential for success in forex. It means following your strategy and avoiding quick decisions. Experts suggest risking only 2-5% of your account balance per trade. For a $20,000 account, this is $400-$1,000 per trade.

Managing Trading Stress

Stress management is key to keeping a clear mind while trading. Here are some helpful techniques:

| Technique | Benefit |

|---|---|

| Regular breaks | Prevents burnout |

| Physical exercise | Reduces stress hormones |

| Adequate sleep | Improves decision-making |

Remember, losses happen due to market volatility. By focusing on forex trading psychology, emotional control, and discipline, you can boost your success in the forex market.

Conclusion

Successful forex trading is all about finding the right balance. Good risk management is key to long-term success. Traders should aim for a 3:1 or higher risk-reward ratio to stay profitable.

Effective risk management means setting clear goals and using stop-loss orders. Beginners should risk only 2-3% per trade. Start with small positions and grow as you get better.

It’s important to test strategies over 100 trades, which takes about six months. This helps you learn and improve.

Learning and adapting are vital for success in forex trading. Analyze your performance and refine your strategies. Use demo accounts to practice without risk.

Forex trading success takes time, discipline, and patience. Focus on risk management and balance to achieve consistent earnings and long-term success.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Forex ، Minimal ، Risk ، Successfully ، Trade

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0