AUD/USD ANALYSIS & TALKING POINTS

- US bond market guides AUD lower.

- US economic data and Fed guidance in focus later today.

- AUD bulls barely holding on.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar remains on the backfoot this Tuesday after the greenback (DXY) climbed to fresh yearly highs. US 10-year Treasury yields are now trading higher than those in 2008 and could track higher going forward. Post-FOMC, the narrative of ‘higher for longer’ interest rates has gained traction leaving the AUD trailing. The message was then supplemented by the Fed’s Neel Kashkari after he stated that the Fed will need to hike rates again 2023 in order to quell inflationary pressures in the US. Now that the blackout period is over (where Fed officials are unable to speak), the week ahead will be strewn with Fed officials and their outlook on the latest data and FOMC announcement.

Higher yields traditionally suggest investors will become more risk averse which does not bode well for pro-growth currencies like the Aussie dollar. With the US dollar being valued as a safe-haven currency, an extended rally could see the AUD breakdown further.

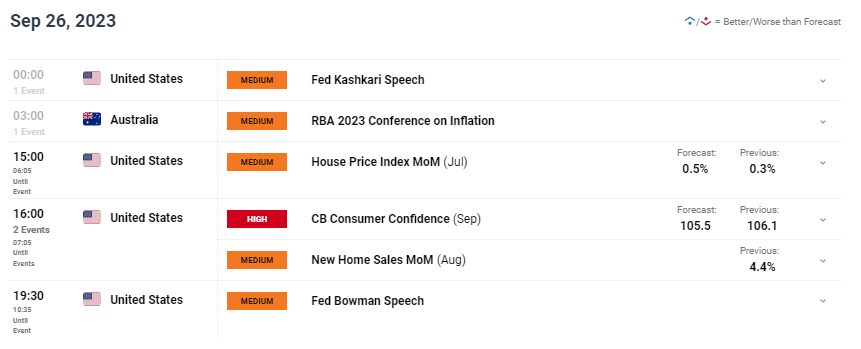

Later today, the economic calendar shown below will once again bring US factors into consideration with CB consumer confidence, housing data and Fed speak.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

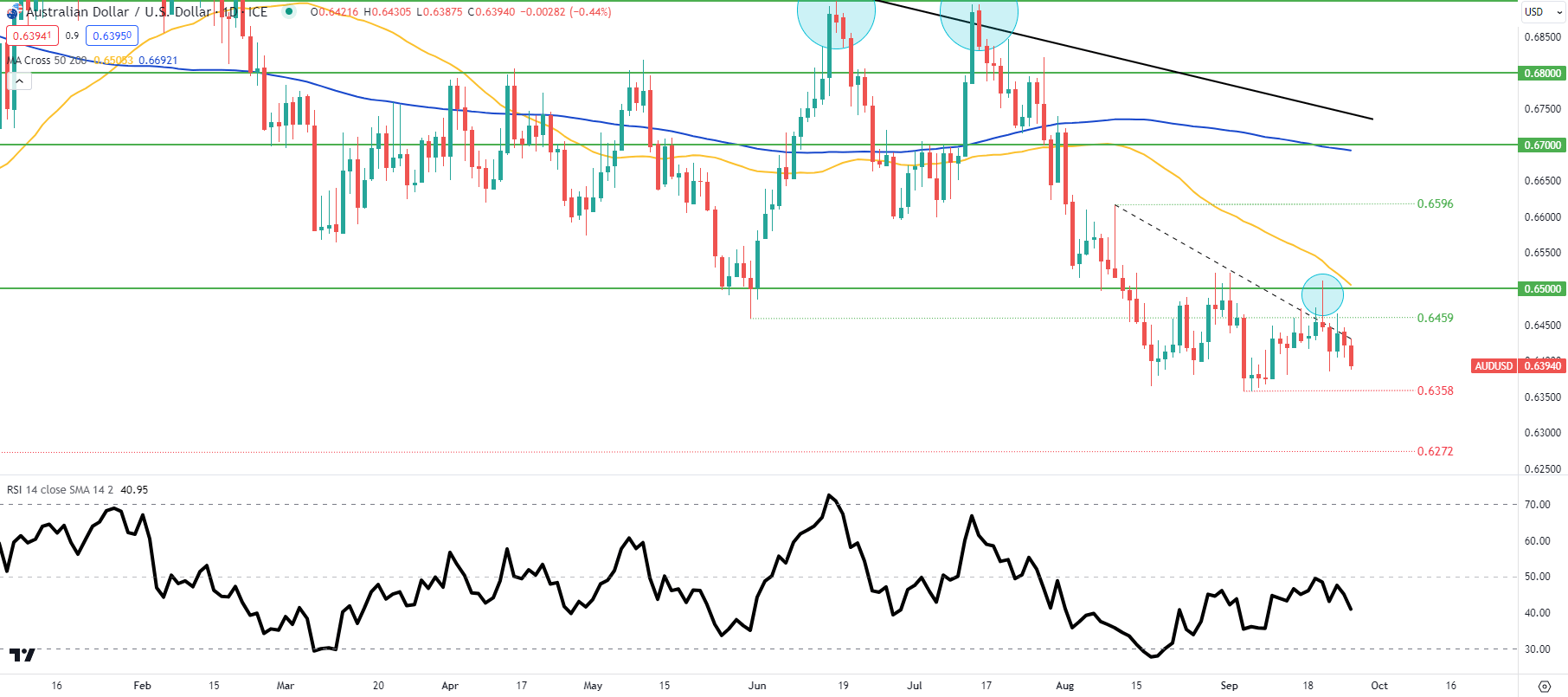

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action above shows last week’s long upper wick (blue) provide a clue into the subsequent downside move. Bulls are still restrained beneath the medium-term trendline resistance (dashed black line) as the 0.6358 swing low opens up for another test. The Relative Strength Index (RSI) is quite far away from oversold territory, leaving room for the already fragile AUD to extend its decline.

Key resistance levels:

- 50-day moving average (yellow)

- 0.6500

- 0.6459

- Trendline resistance

Key support levels:

IG CLIENT SENTIMENT DATA: BEARISH (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 82% of traders currently holding long positions. Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0