Hedging Against Higher Frequency Trades – Trading Systems – 4 October 2023

[ad_1] Hedging against High-Frequency Trading (HFT) in the context of MetaTrader (MT5/MT4) trading platforms and Virtual Private Servers (VPS). Here’s a synopsis of the key points: HFT Timeframe: High-Frequency Trading (HFT) operates at a very fast pace, often in the realm of minutes or even seconds. The discussion acknowledges that HFT in the context of

[ad_1]

Hedging against High-Frequency Trading (HFT) in the context of MetaTrader (MT5/MT4) trading platforms and Virtual Private Servers (VPS). Here’s a synopsis of the key points:

-

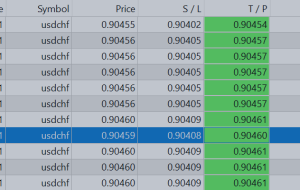

HFT Timeframe: High-Frequency Trading (HFT) operates at a very fast pace, often in the realm of minutes or even seconds. The discussion acknowledges that HFT in the context of MT5/MT4 and VPS can be on such short timescales.

-

Hedging Strategies: The text suggests several strategies to hedge against HFT systems:

-

Capturing Smaller Profits: One strategy is to capture smaller profits, which can make it less attractive for HFT systems to target your trades. This can involve scalping or short-term trading.

-

Diversification: Using many currency pairs can spread the risk, as HFT systems often focus on a single pair. Diversification can make it harder for HFT systems to target your trades simultaneously.

-

Setting Longer Stop Loss (SL) Compared to Take Profit (TP): By setting a wider SL compared to TP, you aim to withstand short-term price fluctuations that HFT systems may exploit for quick profits.

-

Using Smaller Lot Sizes: Trading with smaller lot sizes relative to your account size can reduce the impact of rapid HFT trades on your account.

-

-

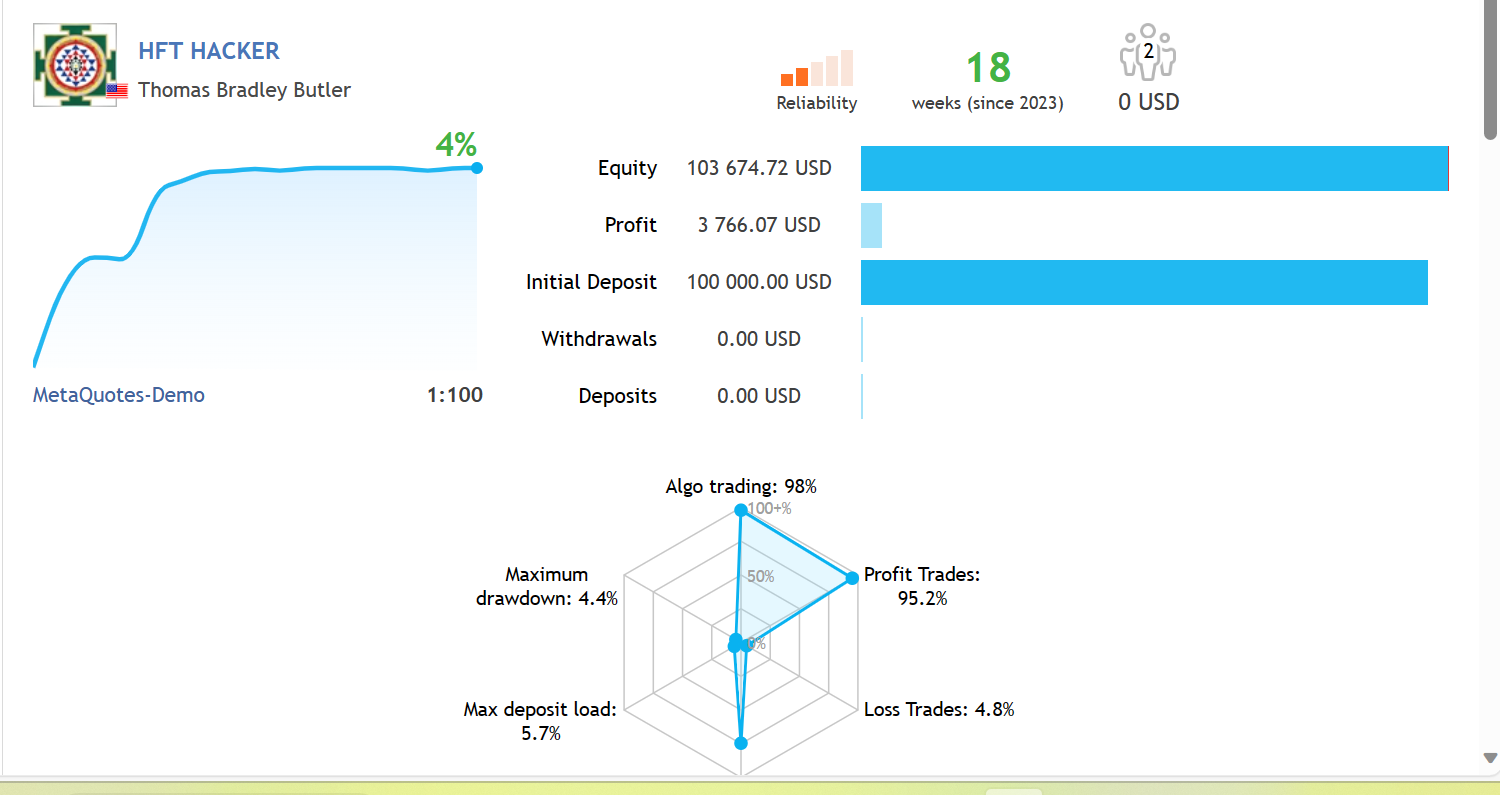

Risk Management: The importance of risk management. It suggests considering how many trades it would take to wipe out the account, indicating a focus on capital preservation.

-

Black Swan Event: The question of whether a black swan event would be needed to trigger a margin call. A black swan event refers to an extremely rare and unpredictable event that can have a significant impact on financial markets.

In summary, to hedge against HFT systems in the context of forex trading on MT5/MT4 platforms. These strategies involve optimizing trade parameters, diversifying across pairs, and managing risk. It also touches upon the potential need for safeguarding against extreme market events.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0