Grid and FX Snipers T3 CCI Forex Trading Strategy

[ad_1] Are you having trouble finding a good forex trading strategy? The forex market is huge, with over $5 trillion traded daily. Yet, many traders lose money. The Grid and FX Snipers T3 CCI strategy might be what you need. This method uses grid trading and the FX Snipers T3 CCI indicator. It could make

[ad_1]

Are you having trouble finding a good forex trading strategy? The forex market is huge, with over $5 trillion traded daily. Yet, many traders lose money. The Grid and FX Snipers T3 CCI strategy might be what you need.

This method uses grid trading and the FX Snipers T3 CCI indicator. It could make your market analysis better and increase your profits. Most trades involving the U.S. dollar, it focus on major currency pairs. Learn how this forex trading strategy can help you in the complex world of currency trading.

Key Takeaways

- Combines grid trading with FX Snipers T3 CCI indicator

- Targets major currency pairs for optimal results

- Enhances market analysis and profit

- Uses CCI values for overbought/oversold conditions

- Implements risk management with strategic stop-loss placement

- Aims for a 12:1 risk-to-reward ratio

- Incorporates multiple indicators for higher success probability

Understanding the Grid and FX Snipers T3 CCI Trading System

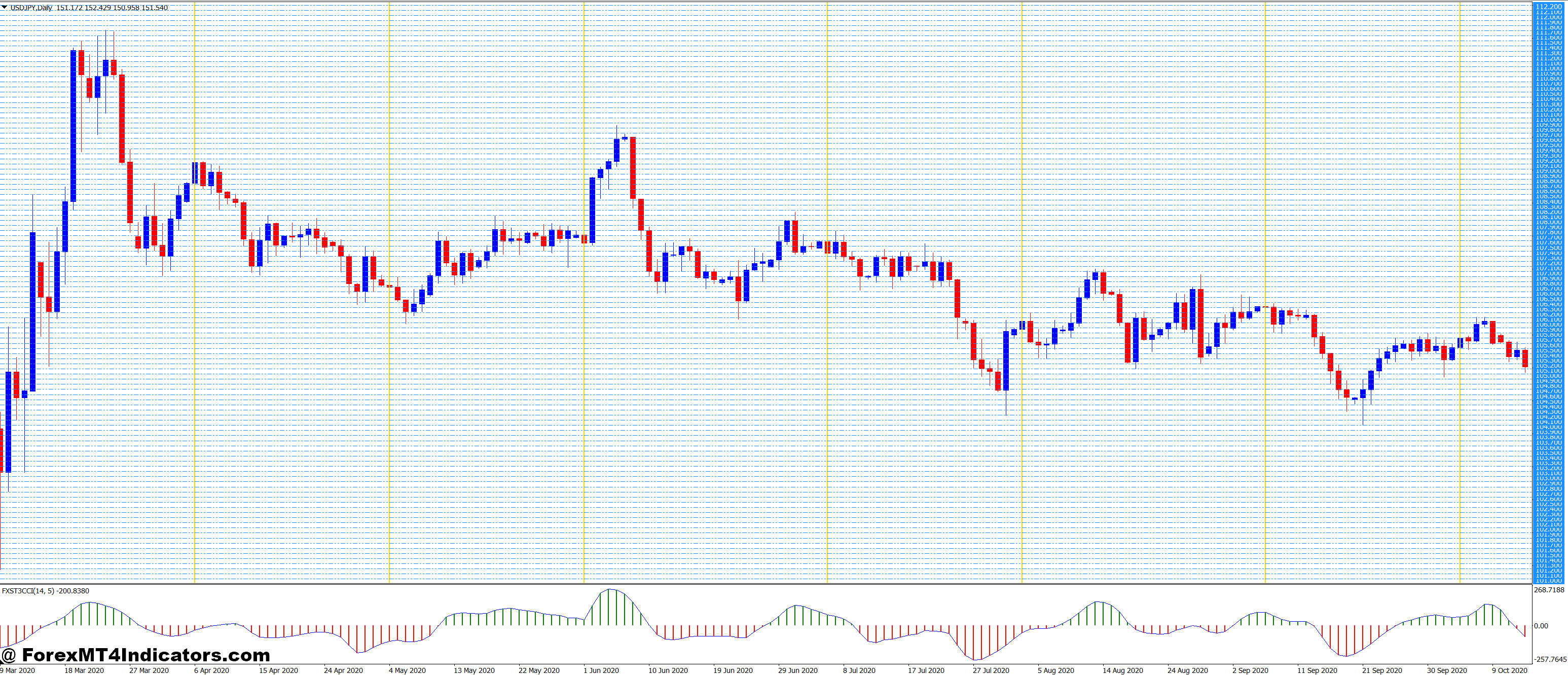

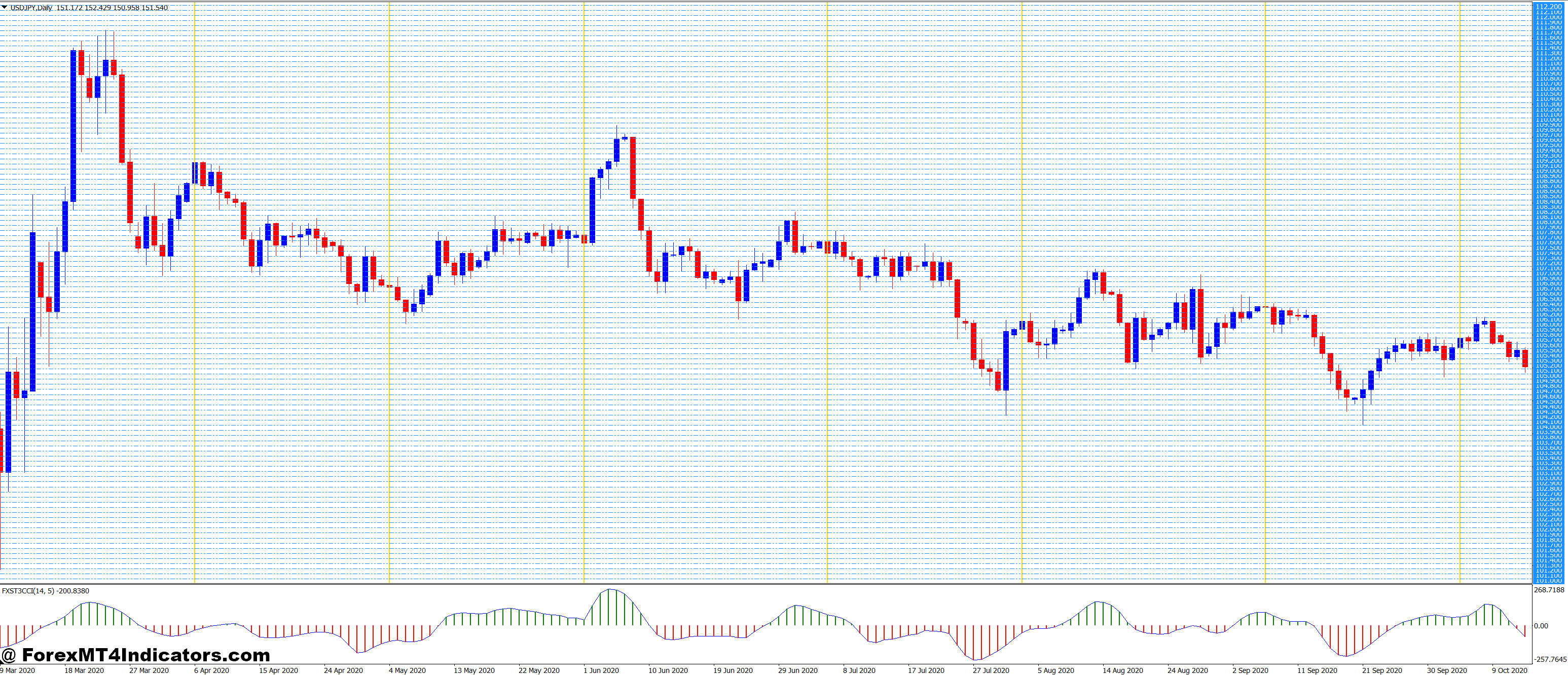

The Grid and FX Snipers T3 CCI trading system is a strong tool for forex traders. It mixes the CCI indicator with grid trading. This makes a solid strategy. It works with many forex time frames and currency pairs, giving traders flexibility.

Key Components and Indicators

The CCI indicator is at the core, set at 20 periods. It’s teamed up with The Wave, using EMA34 for High, Close, and Low prices. These parts help spot trading chances.

Time Frames and Currency Pairs

This strategy fits many time frames, starting at 15 minutes. It works with all currency pairs. This makes it easy to find chances in different markets.

Basic Setup Requirements

To start this strategy, you need:

- A trading platform with CCI and EMA indicators

- Access to real-time Forex data

- A solid grasp of forex market dynamics

- Skills in risk management to keep your capital safe

With these things, you’re set to use the Grid and FX Snipers T3 CCI trading system. You can use it with different currency pairs and time frames.

The Power of CCI Indicator in Forex Trading

The Commodity Channel Index (CCI) is key in forex trading. It helps spot market reversals and trend strength. Let’s see how to use the CCI for better forex trading.

CCI Signal Interpretation

Understanding CCI signals is vital. The CCI moves around a zero line. Readings above +100 show overbought, and below -100 show oversold. Traders use these to find trend reversals or continuations.

Optimal CCI Settings for Different Markets

Choosing the right CCI settings is important. The default is 14, but many use CCI 20 for forex. This mix of quick and reliable responses works well. Adjusting settings for market changes can improve results.

| Market Condition | Recommended CCI Period | Overbought Level | Oversold Level |

|---|---|---|---|

| Trending | 20 | +100 | -100 |

| Ranging | 14 | +80 | -80 |

| Volatile | 28 | +120 | -120 |

Understanding CCI Crossovers

CCI crossovers give traders important entry signals. A CCI above +100 might mean a bullish trend. A drop below -100 could signal a bearish trend. Using these with other indicators can make trading more accurate.

Wave Pattern Analysis and Trading Mechanics

Wave pattern analysis is key in Grid and FX Snipers T3 CCI forex trading. It uses the EMA34 to spot trends and signal when to enter the market. The EMA34 makes a wave pattern on the chart by looking at high, close, and low prices.

Traders watch the 15-minute and 1-hour charts during the US session, from 7:00 to 17:00 Eastern Time. They use a CCI indicator with a 14-period setting. Horizontal lines at +50, +166, and -166 help spot when prices are too high or too low.

The strategy also uses 3SMA and 9SMA with the EMA34 wave. When these lines match, it’s a good time to enter the market. For example, a EUR/USD trade at 1.4926 could make a 40-pip profit in stable markets. The goal is to make 1:2 profit margins, with monthly gains of 10% to 30%.

Backtesting shows a 55% to 65% win rate for well-chosen trades. Trades last from 30 minutes to 4 hours, based on market conditions. This method lets traders use their capital 2x to 3x, making 5 to 15 daily trades during busy times.

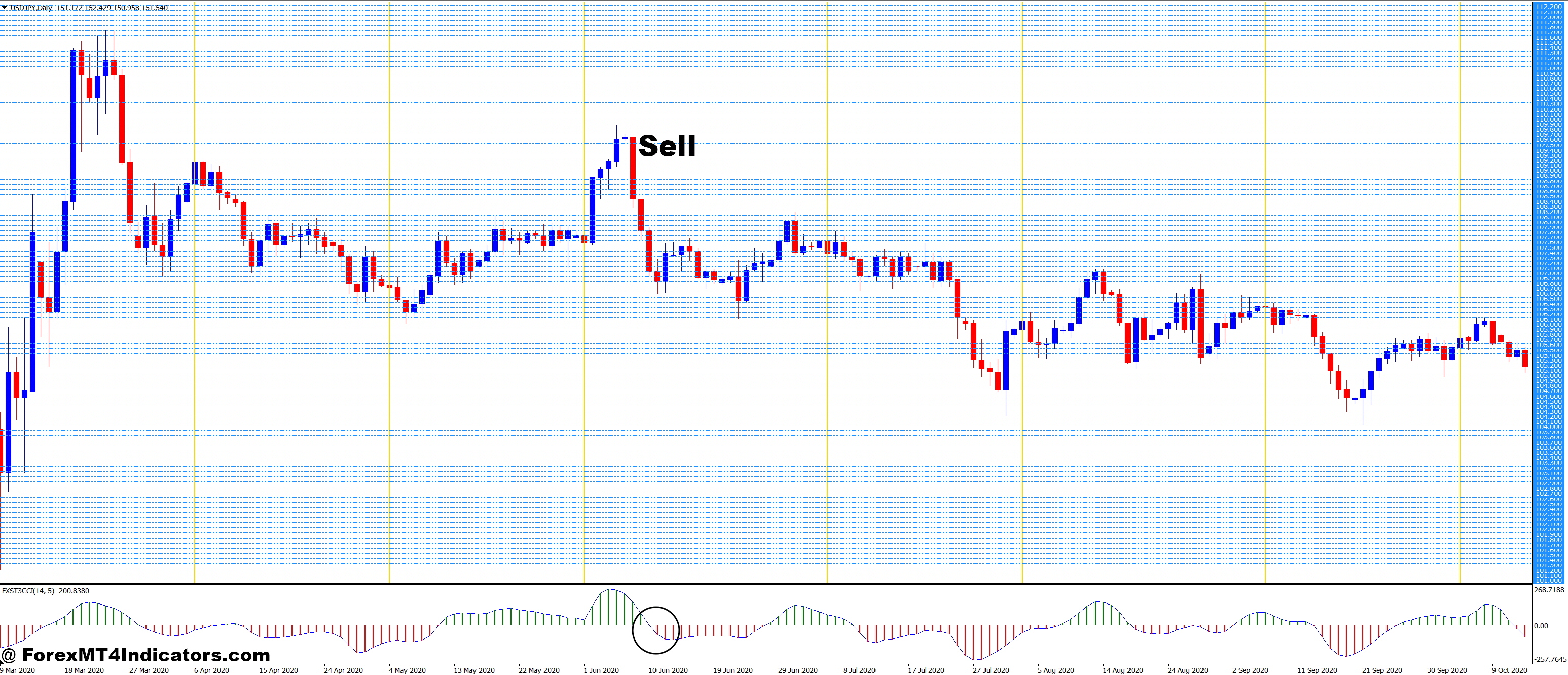

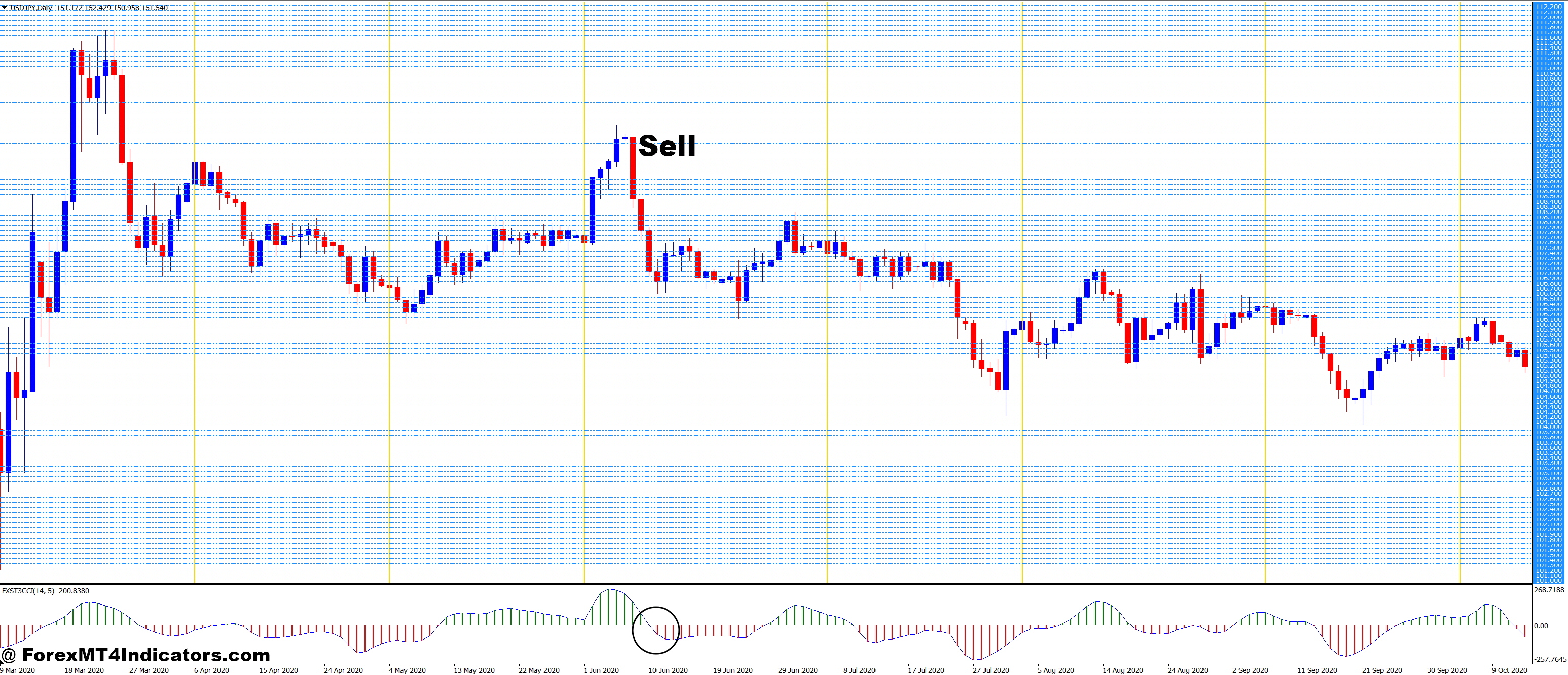

Short Trading Strategy Implementation

Forex short trading needs a sharp eye for market trends and strict entry rules. The Grid and FX Snipers T3 CCI system is a strong tool for traders aiming to profit from falling prices.

To start a short trade, traders must look for certain signs. The main signal is when the CCI goes below the -100 line. This shows a possible downtrend. It should happen when the price is falling, usually below the Wave-top. Finding good swing patterns is key to confirming the short entry.

When these signs match, traders can place a sell order and plan their exit. It’s vital to set clear profit goals and stop-loss levels to control risk. Here’s a table with important parts of the short trading strategy:

| Component | Description |

|---|---|

| Entry Signal | CCI crosses below -100 |

| Price Trend | Downward, below Wave-top |

| Pattern Confirmation | Valid swing pattern present |

| Action | Execute sell order |

| Exit Strategy | Set profit targets and stop-loss |

By sticking to these rules, traders can use short trading strategies in the Grid and FX Snipers T3 CCI system. This can help them succeed in bearish markets.

Grid and FX Snipers T3 CCI Forex Trading Strategy

This strategy mixes grid trading with advanced indicators. It aims to catch market trends and manage risks well.

Grid System Integration

Grid trading sets orders at set price levels. In the huge forex market, it’s very effective. The FX Snipers T3 CCI indicator helps by showing when trends might change.

Position Sizing and Risk Management

Managing position size is key for success in forex. Traders use the Average True Range (ATR) to stop losses and profits. They usually risk 1-2% of their account on each trade.

| Account Size | Max Risk Per Trade | Stop Loss (Pips) | Position Size (Lots) |

|---|---|---|---|

| $10,000 | $200 (2%) | 50 | 0.4 |

| $50,000 | $500 (1%) | 50 | 1.0 |

| $100,000 | $1,000 (1%) | 50 | 2.0 |

Strategy Optimization Techniques

Improving this strategy means tweaking the T3 CCI and grid settings. Testing with past data finds the best settings. Adjusting the CCI period and overbought/oversold levels helps fit different markets.

Advanced Trading Techniques and Pattern Recognition

Forex pattern recognition is key for traders. It spots market trends and entry points. The Grid and FX Snipers T3 CCI strategy boosts trading with advanced methods.

Swing Pattern Identification

Swing trading finds repeating price patterns. These patterns show trend changes. Traders look for double tops, head and shoulders, or flag patterns. Finding these can lead to good trades.

Market Trend Analysis

Knowing market trends is vital for trading. Traders use moving averages and trend lines to see the market’s direction. The CCI indicator is great for market trend analysis. It spots when markets are overbought or oversold.

Volume Consideration

Trading volume is key in confirming trends and signals. The high volume shows strong market belief. Low volume might mean a lack of interest or a reversal. Traders use volume with price action for better decisions.

| Technique | Purpose | Indicator |

|---|---|---|

| Swing Trading | Identify short-term trends | Price action patterns |

| Trend Analysis | Determine market direction | Moving averages, CCI |

| Volume Analysis | Confirm trends and signals | Volume indicators |

By using these advanced techniques, traders can get better at forex pattern recognition. This leads to more profitable trading decisions.

Risk Management and Position Sizing

Managing risk is key to trading success. The Grid and FX Snipers T3 CCI strategy uses smart ways to size positions. This keeps trading capital safe.

Setting stop losses is important for controlling risk. For long trades, the stop loss is 5 pips below the entry. For short trades, it’s 1 pip above. These settings help limit losses and keep profits in check.

How big a position is depends on account size and market swings. When markets are volatile, positions are smaller. This careful method is vital for forex risk management.

The strategy focuses on watching prices closely, not guessing them. This way, traders can react to real market changes. It helps protect their capital.

| Aspect | Recommendation |

|---|---|

| Risk per Trade | 1-2% of account |

| Stop Loss to Profit Ratio | 1:1.1 |

| Initial Take Profit | 1:2 risk-to-reward or higher |

| Trade Monitoring | Regular, with stop loss adjustments |

Following these position sizing and risk management tips helps traders. They can protect their capital and increase their chances of success in the forex market.

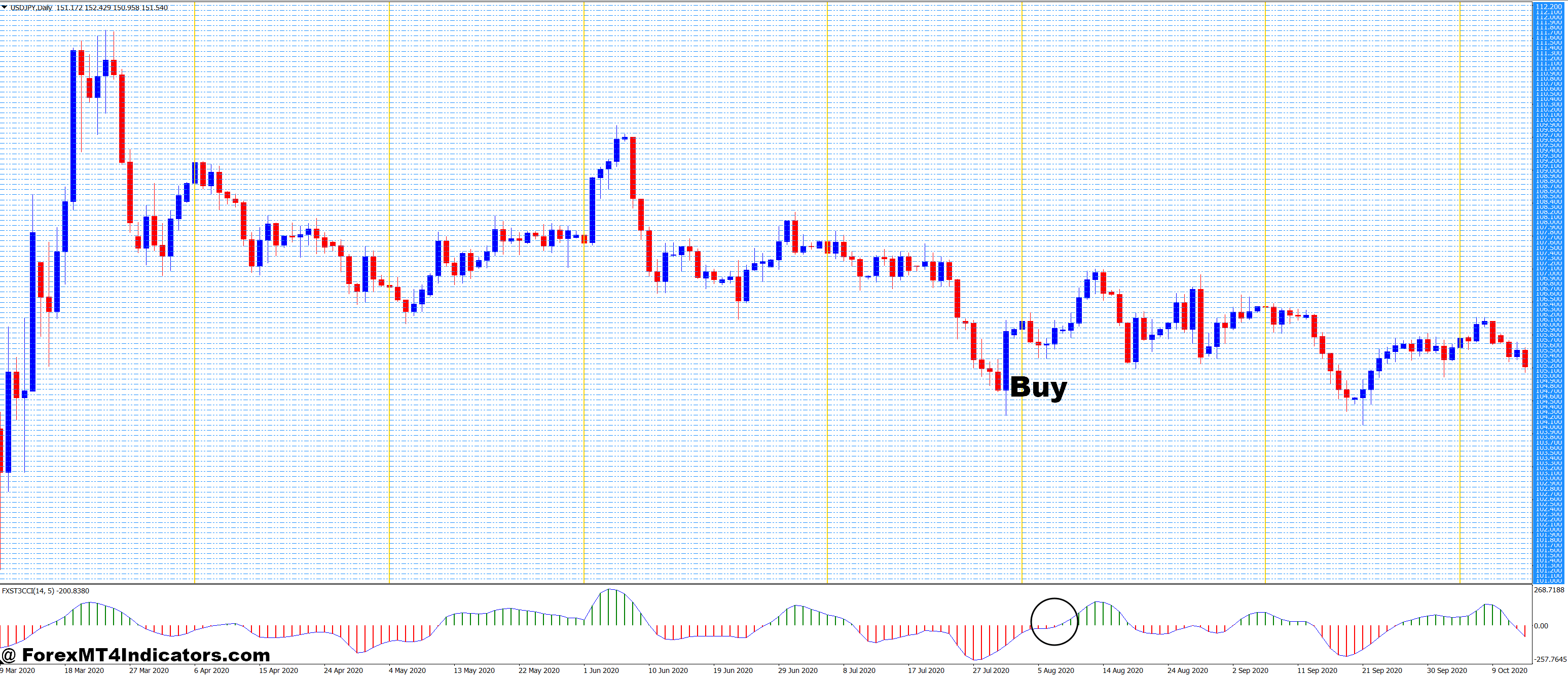

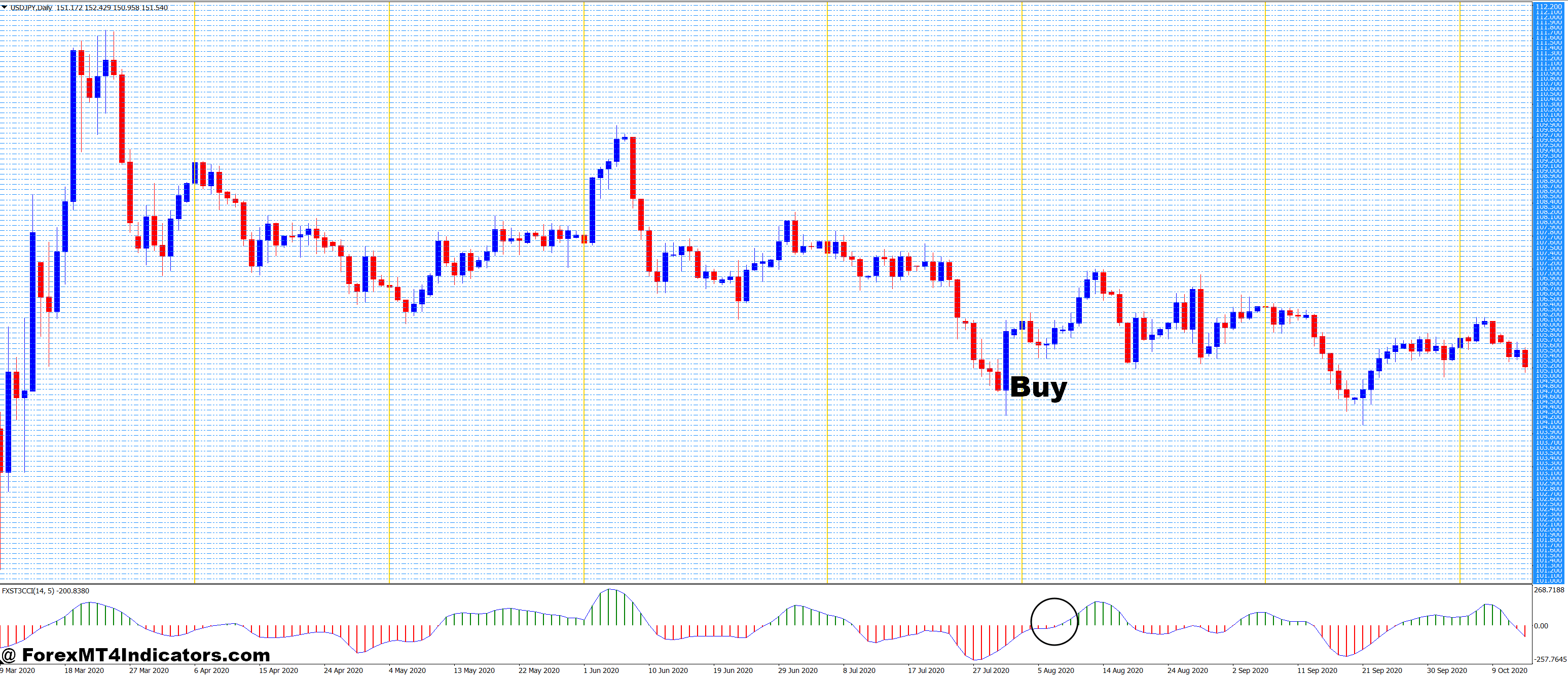

How to Trade with Grid and FX Snipers T3 CCI Forex Trading Strategy

Buy Setup

- Current price = 1.2500.

- Place buy-stop orders at 1.2520, 1.2540, and 1.2560 (at regular intervals).

- Place sell-stop orders at 1.2480, 1.2460, and 1.2440.

- The T3 CCI is above zero and has recently crossed above +100, signaling bullish momentum.

- As the price reaches 1.2520 (or any other buy level), the buy-stop order is triggered.

- Continue placing buy orders as the price increases, provided the T3 CCI is still confirming a strong bullish trend.

- Monitor the T3 CCI. If it falls below zero or +100, consider exiting your buy positions.

- Set a stop loss below the entry-level (e.g., 1.2480) and a take profit at the next resistance level or based on your risk-to-reward ratio.

Sell Setup

- Current price = 1.2500.

- Place sell-stop orders at 1.2480, 1.2460, and 1.2440.

- Place buy-stop orders at 1.2520, 1.2540, 1.2560.

- The T3 CCI is below zero and has recently crossed below -100, signaling bearish momentum.

- As the price reaches 1.2480 (or any other sell level), the sell-stop order is triggered.

- Continue placing sell orders as the price decreases, provided the T3 CCI is still confirming a strong bearish trend.

- Monitor the T3 CCI. If it moves above zero or above -100, consider exiting your short positions.

- Set a stop loss above the entry-level (e.g., 1.2520) and a take profit at the next support level or based on your risk-to-reward ratio.

Conclusion

The Grid and FX Snipers T3 CCI Forex Trading Strategy is a powerful tool for traders. It uses advanced indicators like the CCI and Stochastic Oscillator. These tools give insights into market trends and when to make moves.

The forex trading strategy benefits include better entry and exit points. This leads to higher profits for traders.

Traders can use this strategy with different time frames, from 15-minute charts to daily views. This gives a full picture of the market. The strategy uses EMAs and Stochastic Oscillator settings to find the best trade opportunities.

It has been reported to have profitability ranges of 60% to 70%. This shows it can lead to consistent gains.

Success in forex trading requires learning and adapting strategies. Markets change, and so should trading methods. Traders should practice on demo accounts, improve their skills, and keep up with market trends.

By always learning and adapting, traders can achieve long-term success in the fast-changing world of forex trading.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

Click here below to download:

Get Download Access

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0