Gold (XAU/USD) Analysis, Price, and Chart

- US 2yr yields near highs last seen in 2007.

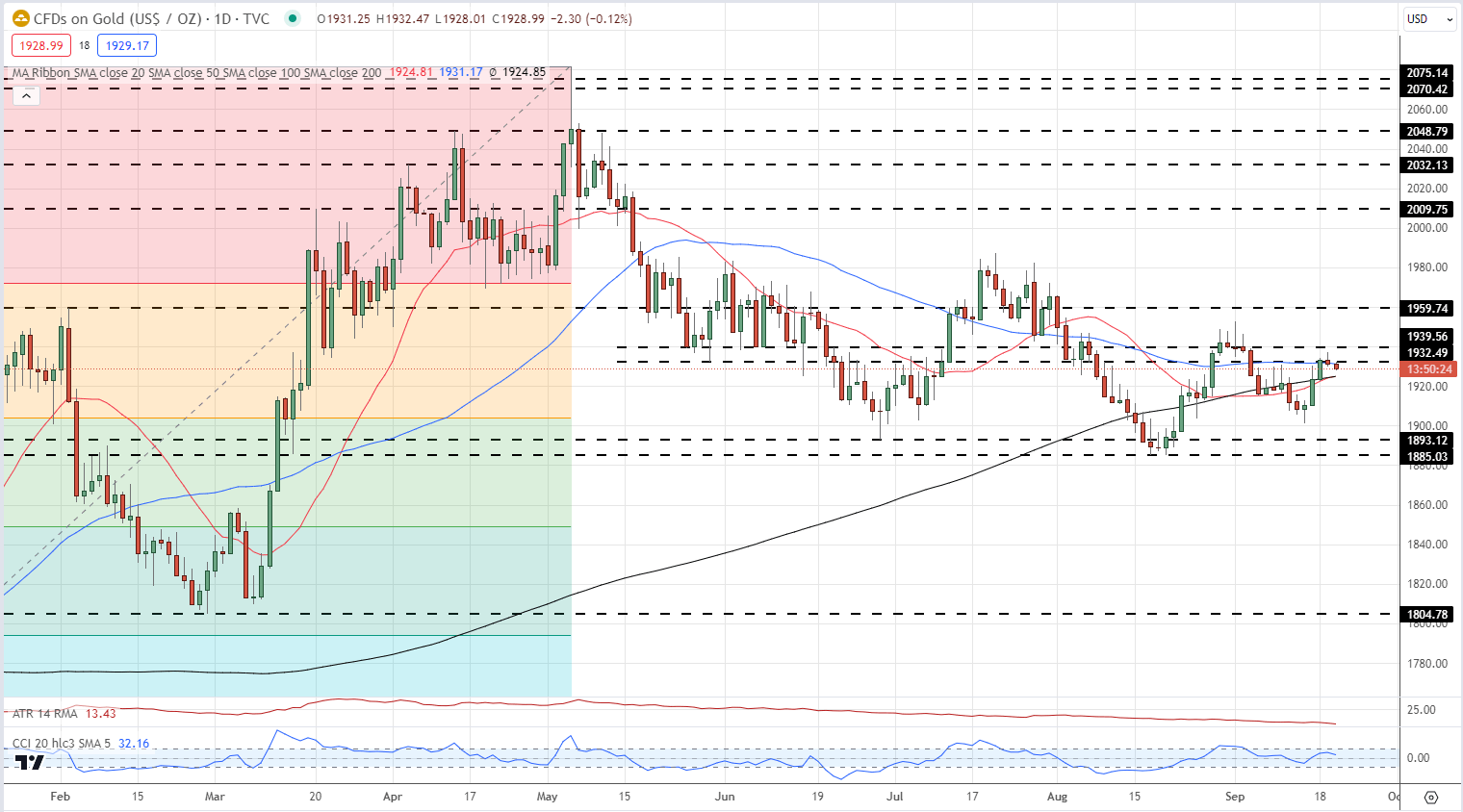

- Gold unable to break resistance ahead of the latest Fed decision.

Learn How to Trade Gold

Recommended by Nick Cawley

How to Trade Gold

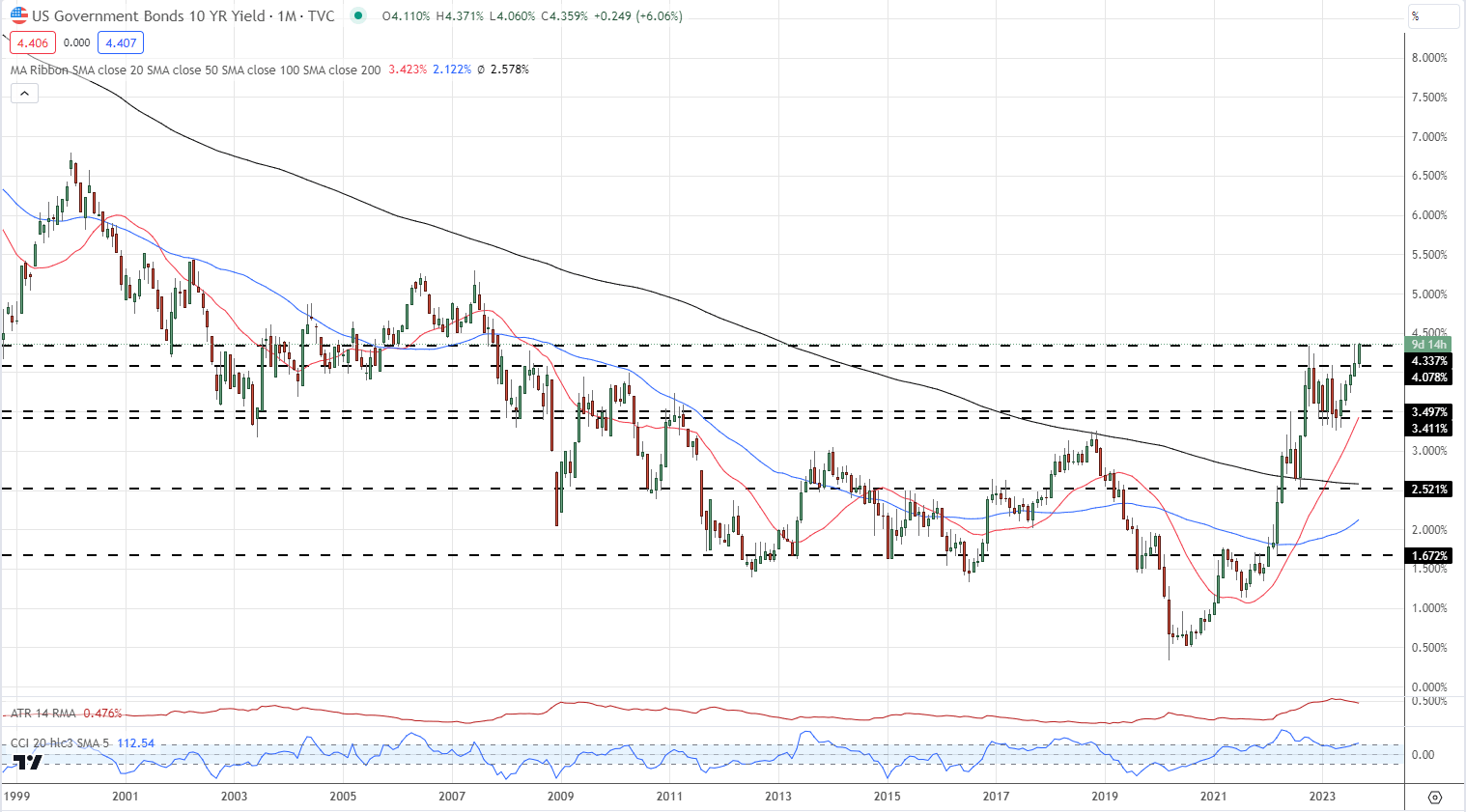

US Treasury yields are pressing against multi-year highs as markets continue to price in higher inflation expectations. The UST 2yr is within a handful of basis points of levels last seen in mid-2006, while the 10yr benchmark yesterday hit levels last seen in November 2007. The recent push higher in oil prices is helping to fuel the inflation narrative, while traders are also pricing in a hawkish hold by the Federal Reserve later today. In addition, market participants are also demanding more yield for their money in the face of the increased US Treasury issuance this year. The US Treasury last week sold around $103 billion of longer-term US Treasuries, placing upward pressure on UST yields.

US Treasury 2yr Yields Monthly Chart

US Treasury 10yr Yields Monthly Chart

DailyFX Economic Calendar

The Federal Reserve is fully expected to keep interest rates unchanged (525-550) at their latest policy meeting later today. The focal point of today’s meeting will be the post-decision press conference and the latest Summary of Economic Projections or dot plot. This chart shows where each FOMC voting member thinks that interest rates will be over the coming years. The dot plot is closely watched by traders for clues in the Fed’s overall thinking on interest rates.

FOMC Preview: Hawkish Pause to Reignite the Dollar Index (DXY) Rally?

Recommended by Nick Cawley

Traits of Successful Traders

Gold is struggling against the current backdrop with a prior zone of resistance between $1,932/oz. and $1,940/oz. proving difficult to overcome. All three simple moving averages are also clustered just below this area – $1,924/oz. to $1,931/oz. – adding to the mixed outlook. If gold breaks below these moving averages then $1,900/oz. is the next target ahead of $1,893/oz. and $1,885/oz.

Gold Daily Price Chart – September 20, 2023

Charts via TradingView

Download the Latest IG Gold Report to See the Latest Daily and Weekly Sentiment Changes

| Change in | Longs | Shorts | OI |

| Daily | 6% | -8% | 2% |

| Weekly | -7% | 1% | -5% |

What is your view on Gold and Silver – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰