Gold Price (XAU/USD), Silver Price (XAG/USD) Analysis, Price, and Chart

- Gold’s volatility touches a multi-month low.

- Silver struggling to hold a prior level of resistance turned support.

Recommended by Nick Cawley

Get Your Free Gold Forecast

Financial markets are in the middle of a holiday-thinned trading lull with volume and volatility suffering. Later on this week, there are a few potential market-moving events and data releases. On Thursday the latest look at US ISM services will need to be followed, while a host of big-name US earnings releases will be announced after the stock market closes on the same day. Amazon and Apple will grab the most attention while Bock and Coinbase will also be worth monitoring. On Friday, the latest look at the US jobs market (NFPs) will set up price action for next week.

DailyFX Economic Calendar

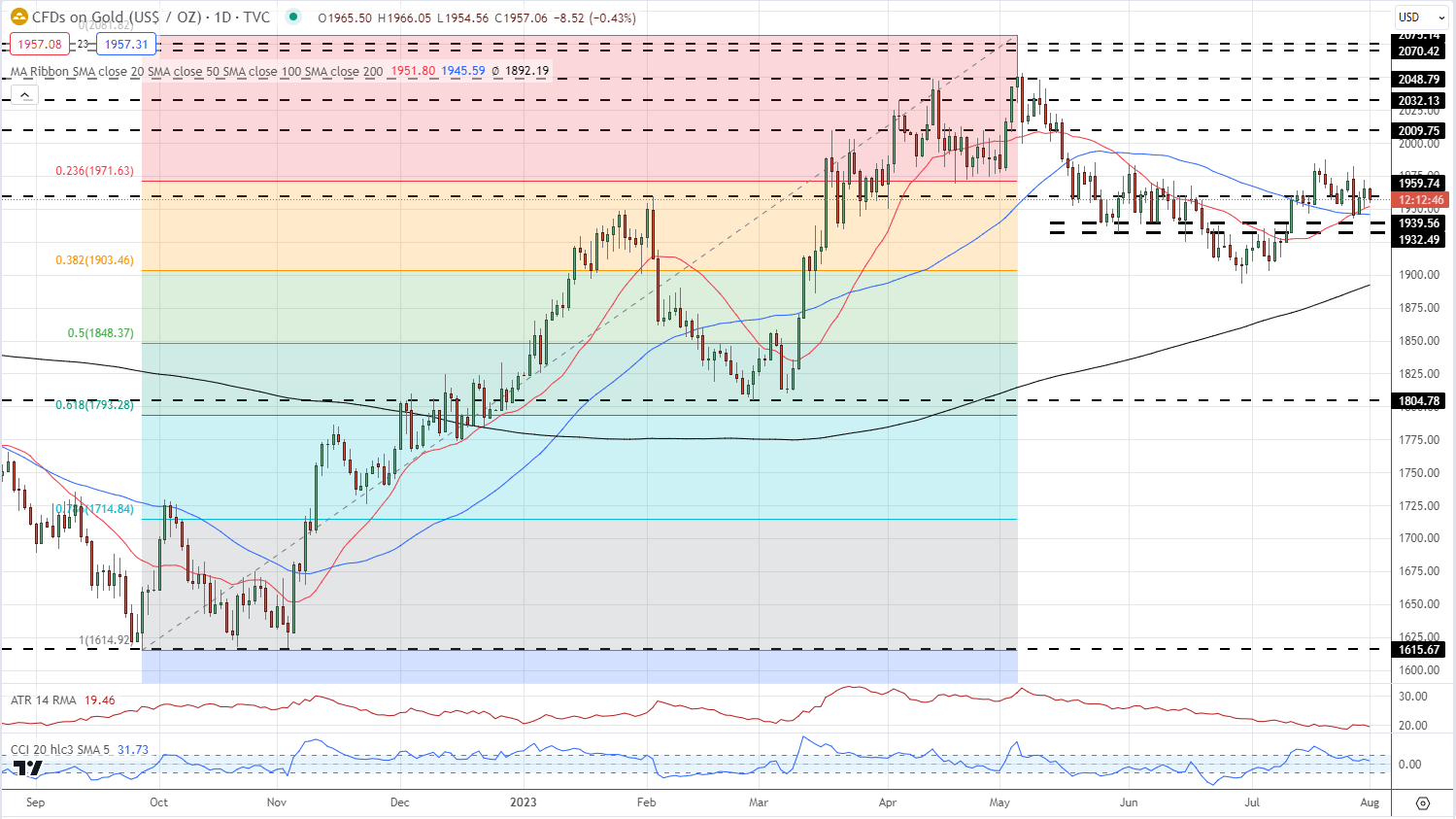

Gold is stuck in a short-term sideways range with little reason to make a break. Volatility is very low – using the 14-day ATR indicator – and the precious metal is neither overbought nor oversold using the CCI indicator. The recent 20-day/50-day moving average crossover does give the chart a mildly-positive look although gold is finding it difficult to make a confirmed break of $1,960/oz. resistance and the 23.6% Fibonacci retracement level at $1,971.6/oz. Support remains between $1,940/oz. and $1,932/oz.

Recommended by Nick Cawley

How to Trade Gold

Gold Daily Price Chart – August 1, 2023

Chart via TradingView

Silver is also in a range but the three simple moving averages give the chart a positive feel with the 20-day sma in particular providing short-term support. A prior level of resistance turned support around $24.50 is under pressure but holding so far. If silver breaks lower, the 20-day sma should provide initial support ahead of the 50-day sma at $23.67. The July 20 multi-week high at $25.26 should provide resistance.

Silver Daily Price Chart – August 1, 2023

Gold and Silver Client Sentiment

Retail traders are 67% net-long in gold and 80% net-long in silver. Download the latest sentiment guides (below) to see how daily and weekly positional changes affect the pair’s outlook.

| Change in | Longs | Shorts | OI |

| Daily | 7% | -8% | 2% |

| Weekly | 5% | -14% | -1% |

| Change in | Longs | Shorts | OI |

| Daily | -4% | 1% | -3% |

| Weekly | 1% | -15% | -3% |

What is your view on Gold and Silver – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0