Gold, XAU/USD, Fed, Golden Cross – Market Update:

- Gold prices slightly higher in the aftermath of the Fed

- A Golden Cross is forming between key moving averages

- Is this a sign that further upside progress is in store?

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

Gold prices were left slightly higher in the aftermath of Wednesday’s rate hike from the Federal Reserve. The most meaningful development from the central bank was not the widely anticipated tightening, but rather commentary from Chair Jerome Powell that most officials do not envision a recession in the horizon, underscoring expectations of a soft landing.

With that in mind, it is widely anticipated that the Fed will do nothing in September. Anything beyond that will be dictated by incoming economic data. For now, let us examine how the technical landscape is shaping up in gold.

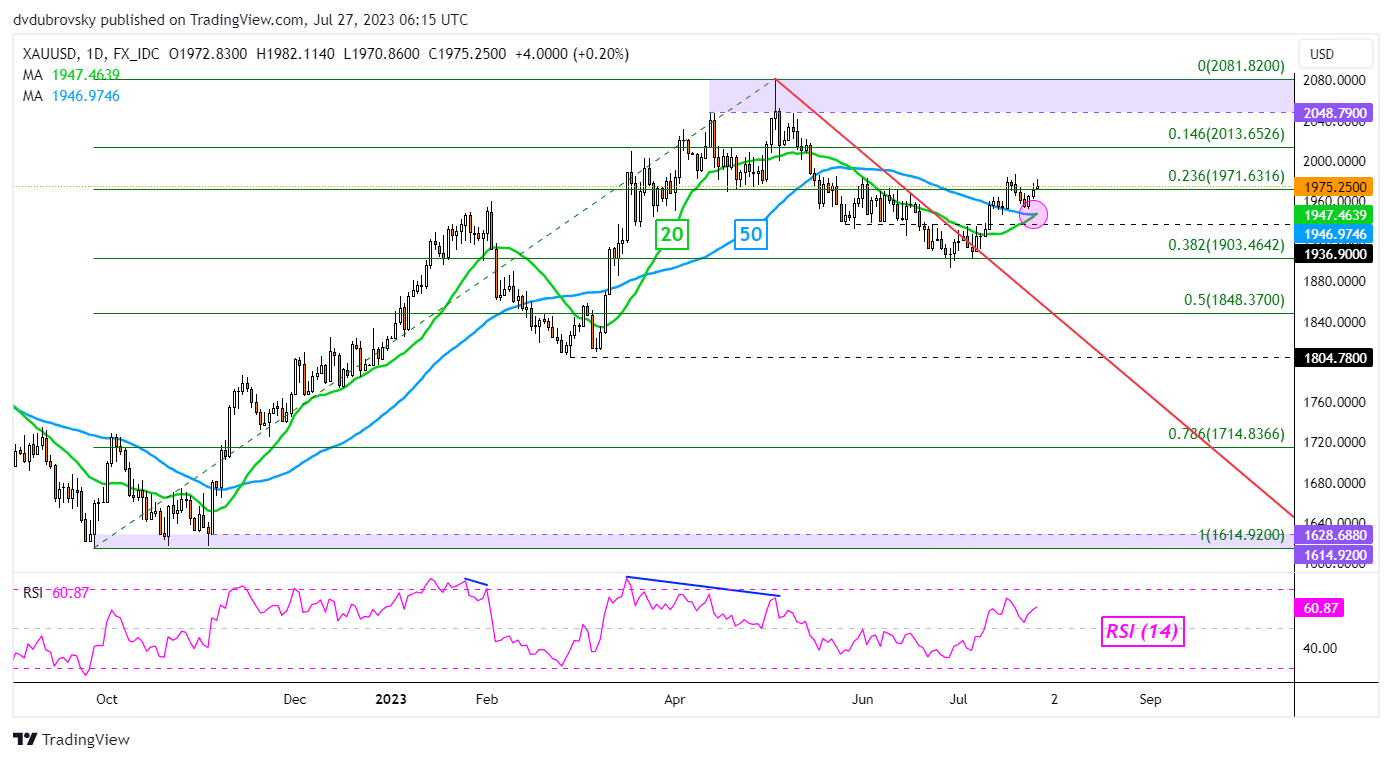

The most interesting development from the XAU/USD daily chart is that a bullish Golden Cross is taking shape between the 20-day and 50-day Moving Averages (MA). This is offering an increasingly upside technical bias and reverses the bearish Death Cross seen in May.

The Golden Cross has formed in the aftermath of prices breaking above a near-term falling trendline from May. Since then, gold seems to have found resistance around the 23.6% Fibonacci retracement level at 1971. Clearing higher exposes the minor 14.6% point at 2013 before May highs kick in. These make for a range of resistance between 2048 and 2081.

Otherwise, a turn lower and drop through the moving averages places the focus on immediate support, which is the 1936 inflection point. Beyond that sits the 38.2% level at 1903. Clearing the latter opens the door to a stronger bearish conviction.

Recommended by Daniel Dubrovsky

Get Your Free Top Trading Opportunities Forecast

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0