Gold and Silver: Near-Term Technical Update

- Gold and silver prices ready to wrap up a strong week?

- XAU/USD and XAG/USD still remain broadly bearish

- What are the key points to watch ahead of the weekend?

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

XAU/USD Analysis

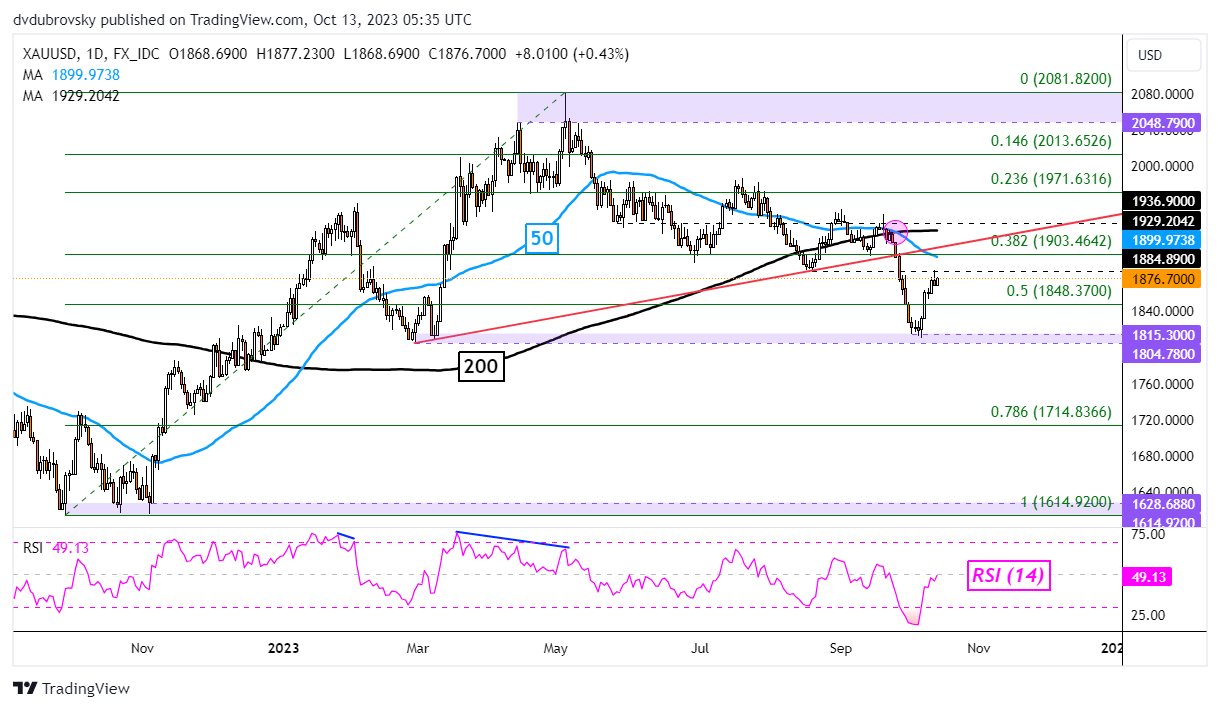

Gold prices are aiming higher heading into early European trade. At over 2.4 percent, XAU/USD is heading for the best week since the middle of March against the backdrop of increasingly cautious Fedspeak in recent days. Looking at the daily chart below, immediate resistance seems to be the 1884.89 inflection point from August.

Just above that, gold will be facing the 50- and 200-day moving averages. There was a bearish crossover in September which offered a broad downward technical bias. As such, XAU/USD is facing key levels of resistance heading into the weekend. In the event of a turn lower, the midpoint of the Fibonacci retracement level is below at 1848.37 before the 1804.78 – 1815.30 inflection point.

Recommended by Daniel Dubrovsky

How to Trade Gold

Gold Daily Chart

Chart Created in TradingView

XAG/USD Analysis

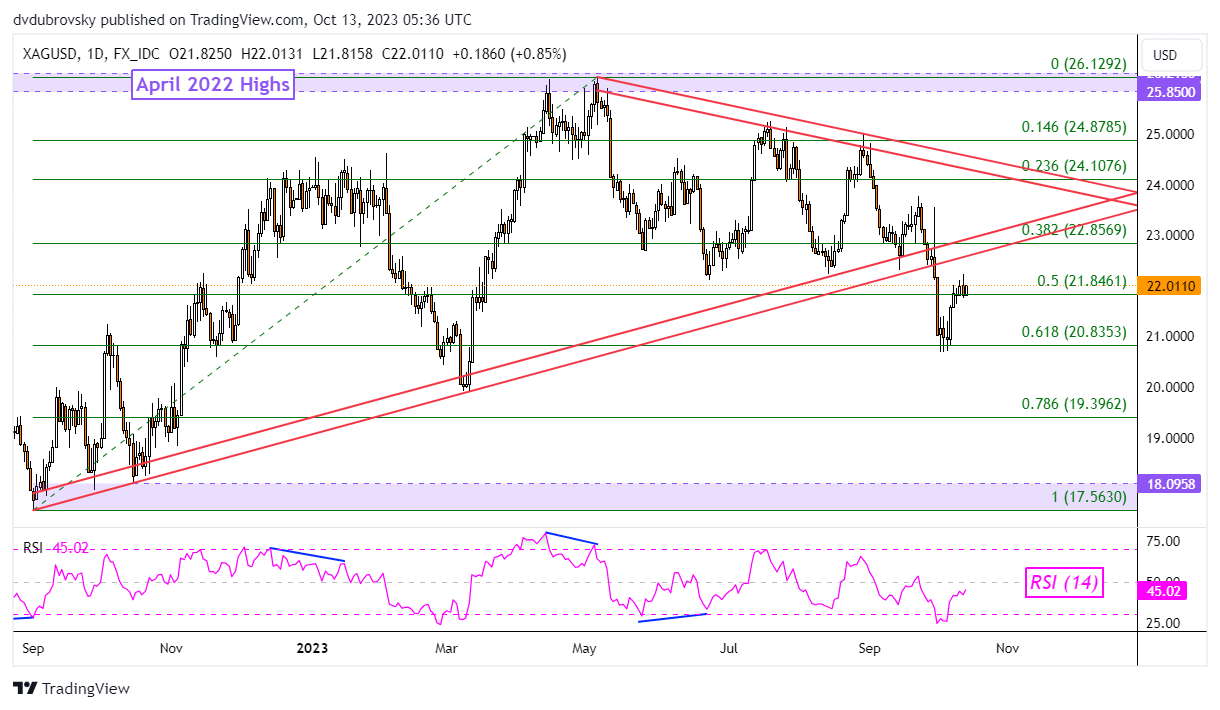

Meanwhile, silver prices are in a similar scenario. XAG/USD is up almost 2 percent this week. The last time we saw this precious metal push this aggressively was in the middle of September. From here, immediate resistance is the former rising range of support from September as well as the 38.2% Fibonacci retracement level of 22.85.

These may hold, reinstating the broader bearish bias since early May. In the event of a turn lower, immediate support seems to be the midpoint of the Fibonacci retracement at 21.84. Extending losses beyond that places the focus on the 61.8% level at 20.83. Clearing under the latter subsequently opens the door to resuming the downtrend.

| Change in | Longs | Shorts | OI |

| Daily | -3% | 15% | -1% |

| Weekly | -8% | 17% | -6% |

Silver Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Contributing Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0