Global Bond Yield Analysis

- US and UK price pressures slow down.

- Interest rate forecasts point to a series of cuts next year.

DailyFX Economic Calendar

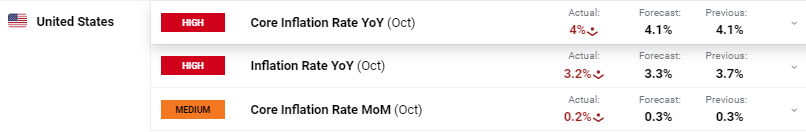

The bond market is back in the headlines again as global yields slumped yesterday after the release of the latest US inflation report. While Tuesday’s US CPI report showed both readings falling just 0.1% below forecasts, the effect on the US Treasury market, and the dollar, was marked.

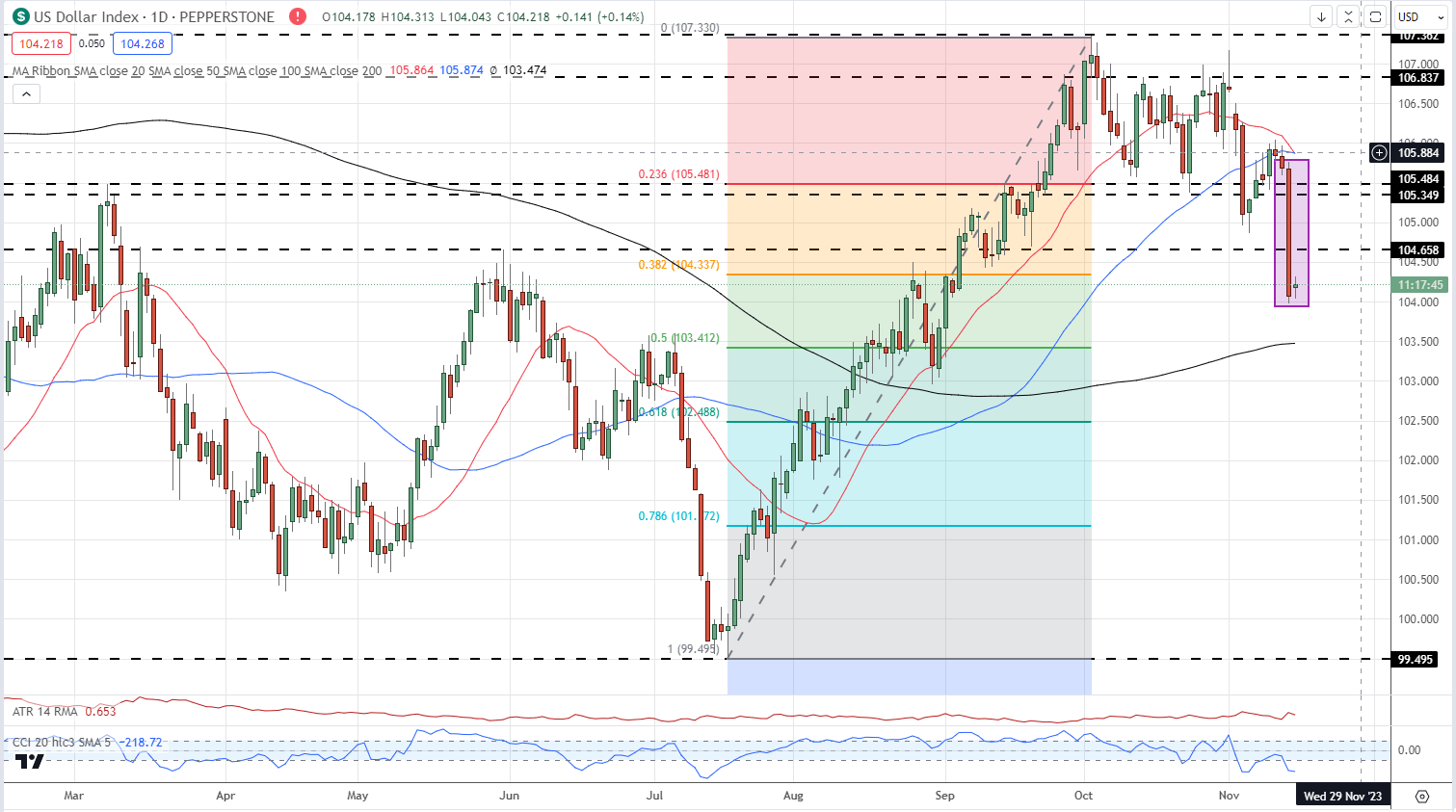

The yield on the rate-sensitive UST 2-year fell by 20 basis points to 4.85%, the UST 10-year shed 18 basis points, while the UST 30-year fell by 15 basis points on the session. The effect on the US dollar was notable with the greenback losing over one-and-a-half-points on the day.

US Inflation Cools to 3.2% in October, US Dollar Sinks but Gold Gains

Recommended by Nick Cawley

Get Your Free Top Trading Opportunities Forecast

US Dollar Index Daily Chart

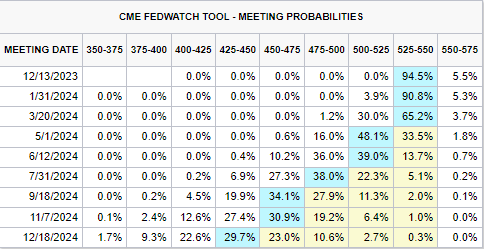

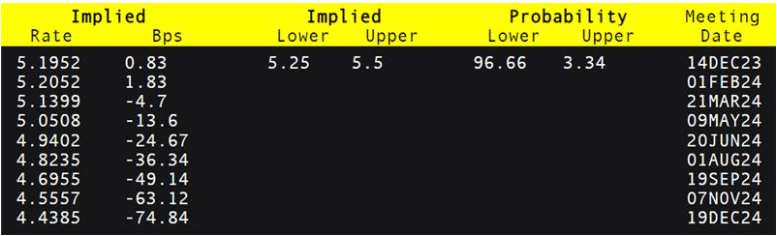

The latest CME Fed Fund predictions now show 100 basis points of rate cuts over 2024 with the first 25bp cut seen at the May FOMC meeting.

CME FedWatch Tool

Recommended by Nick Cawley

Building Confidence in Trading

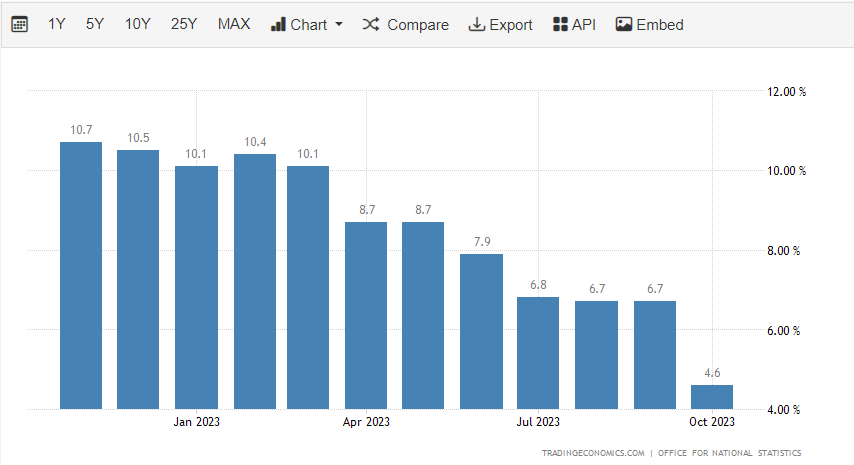

And it is not just in the US that lower rate expectations are building, with the UK and the Euro Area also now registering additional rate cuts for next year. Today’s UK inflation report showed headline inflation dropping sharply – as predicted by BoE chief economist Huw Pill recently – to 4.6% in October from 6.7% in September.

UK Breaking News: UK CPI Posts Massive Drop, GBP Offered

UK Headline Inflation

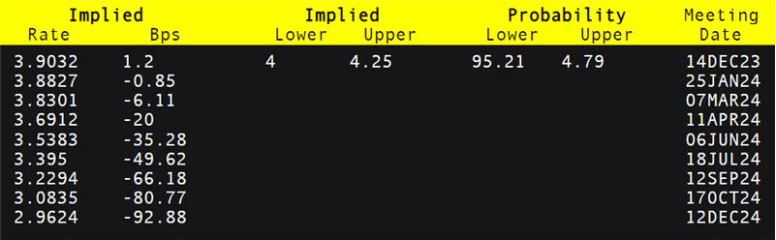

A look at UK rate expectations for next year indicates the first 25 rate cut in June with two additional quarter-point cuts over the second half of the year.

And in the Euro Area, markets are now predicting in excess of 90 basis points of rate cuts over next year with the first cut seen in June, or potentially at the April meeting.

With financial markets now actively pricing in interest rate cuts, risk markets look more attractive. The recent rallies in a range of equity markets have been driven by investors looking to put their money to work in riskier assets, and this theme looks likely to continue in the months ahead.

Charts via TradingView

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0