GBP/USD Awaits NFP as GBP/JPY Cheers Ueda’s Dovish Views

[ad_1] GBP/USD ANALYSIS The British pound gained ground against the U.S. dollar, but its advance was limited, as traders embraced a cautious position and avoided taking large directional bets ahead of the August U.S. payrolls report due for release on Friday. Given the Fed’s data-dependent approach, labor market incoming information will play a crucial role

[ad_1]

GBP/USD ANALYSIS

The British pound gained ground against the U.S. dollar, but its advance was limited, as traders embraced a cautious position and avoided taking large directional bets ahead of the August U.S. payrolls report due for release on Friday.

Given the Fed’s data-dependent approach, labor market incoming information will play a crucial role in determining the FOMC’s next moves, with strong job gains bolstering the case for more monetary tightening and weak employment growth diminishing the prospects of further policy firming.

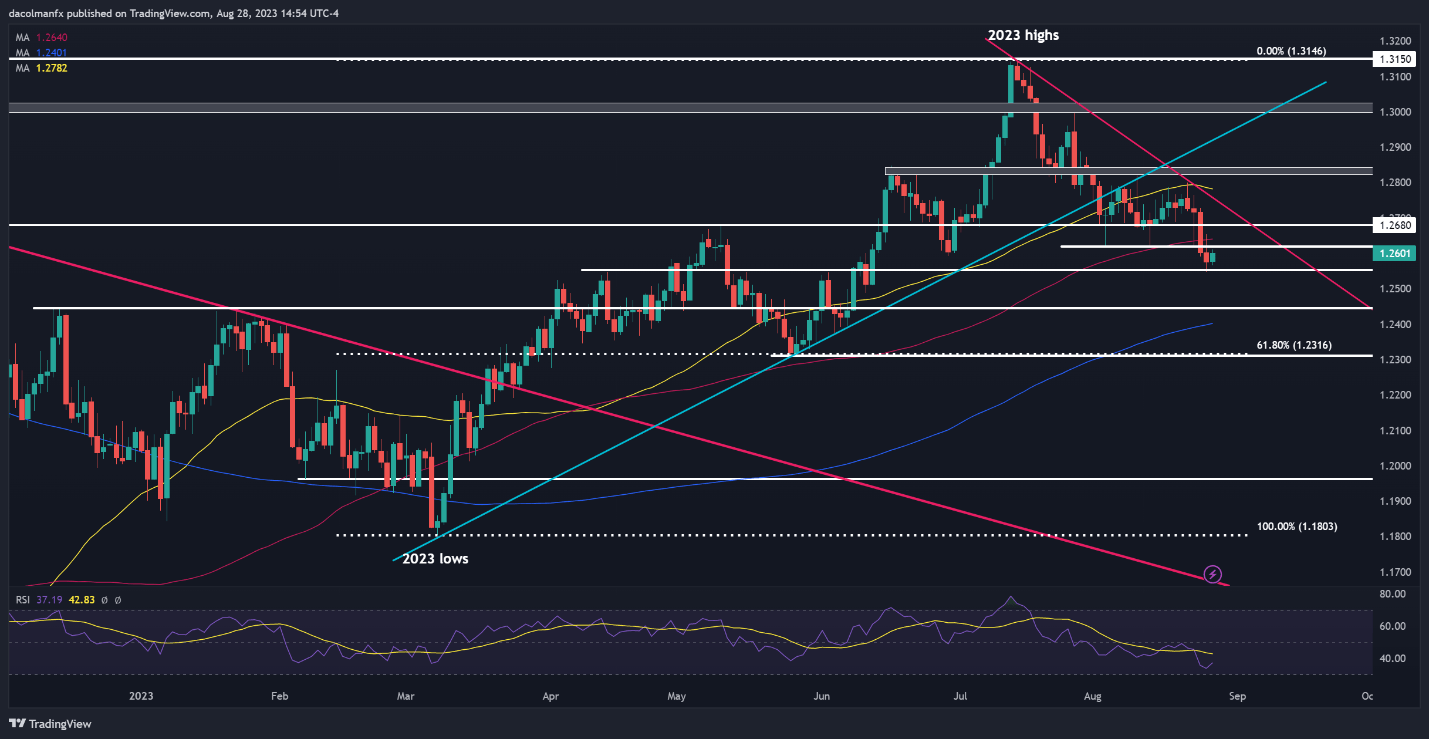

Taking a look at the technical picture, GBP/USD has started to perk up after encountering support at 1.2555 late last week following a sharp sell-off, but the bounce seems to lack conviction on Monday, a sign that cable is not out of the woods yet.

For clues on the outlook, traders should closely watch price action in the coming days. That said, if GBP/USD manages to extend its rebound, the first ceiling to consider rests at 1.2620, followed by 1.2680. On further strength, the bulls could muster the momentum for an attack on trendline resistance at 1.2750.

Conversely, if sellers regain the upper hand and spark a bearish reversal, initial support appears at 1.2555, and 1.2445 thereafter. In the event of a breakdown, the crosshairs will be fixed on the 200-day simple moving average, followed by 1.2315, the 61.8% Fib retracement of the 2023 rally.

Don’t miss out on expert insights: Download our ‘How to Trade GBP/USD’ guide and enhance your trading skills today!

Recommended by Diego Colman

How to Trade GBP/USD

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Using TradingView

GBP/JPY ANALYSIS

Sterling also rose against the Japanese yen on Monday, extending its recovery for the second consecutive trading session after bouncing off technical support at 183.30 last Friday, with the latest advance likely bolstered by dovish comments from the Bank of Japan over the weekend.

BoJ Governor Kazuo Ueda said policymakers will maintain the current monetary easing framework as core inflation remains “a bit below target.” These statements suggest the central bank will probably not adjust its yield curve control program again this year following July’s surprise tweak, nor will it abandon negative interest rates for the foreseeable future.

BoJ’s ultra-accommodative stance will prevent the yen from gaining much traction against the British pound for now, especially if Bank of England continues to hike interest rates as part of a strategy to curb price pressures in the economy. By way of context, the UK has the most persistent inflation in G10, with headline CPI clocking in at 6.8% y-o-y in July.

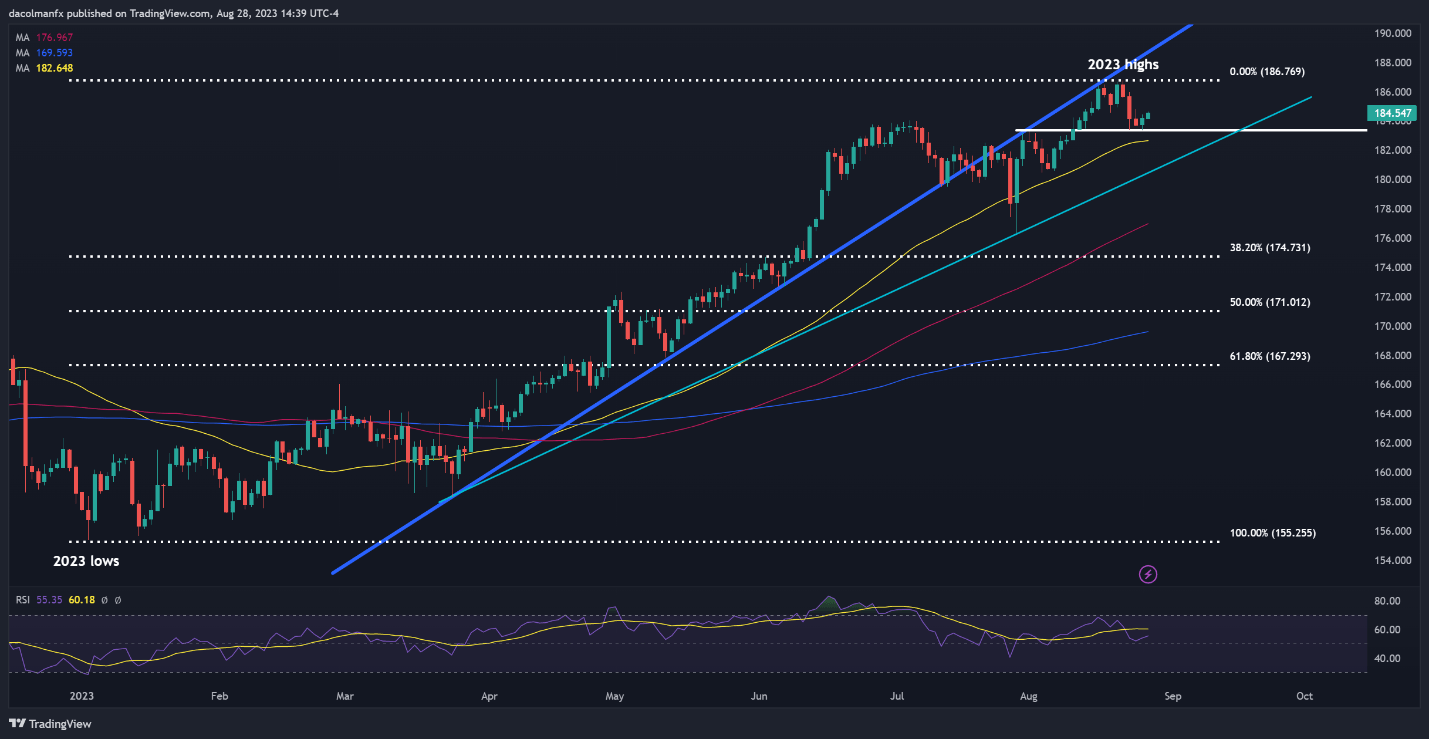

Focusing on technical analysis, GBP/JPY remains entrenched within an undisputable uptrend despite recent softness, with prices trading above key moving averages and displaying impeccable higher highs and higher lows.

However, to be confident in the bullish outlook, the pair needs to break above the 2023 peak at 186.76 in the near term. If this scenario plays out, buying interest could gain impetus, paving the way for a move to 189.00. In the event of a pullback, initial support lies at 183.30, followed by 182.65. On further weakness, we could see a drop towards 181.00.

Stay ahead of GBP/JPY trends: elevate your trades by exploring market sentiment – download your guide for free!

| Change in | Longs | Shorts | OI |

| Daily | 14% | 11% | 11% |

| Weekly | 0% | -12% | -10% |

GBP/JPY TECHNICAL CHART

GBP/JPY Chart Prepared Using TradingView

Knowledge is Power: Sign Up for Our Newsletter and Receive Essential Market Analysis and News!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0