POUND STERLING ANALYSIS & TALKING POINTS

- BoE expected to hike by 25bps this week.

- Key EZ and US economic data scheduled with eurozone flash GDO and core inflation in focus today.

- Current momentum favors neither bulls nor bears.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD & EURGBP FUNDAMENTAL BACKDROP

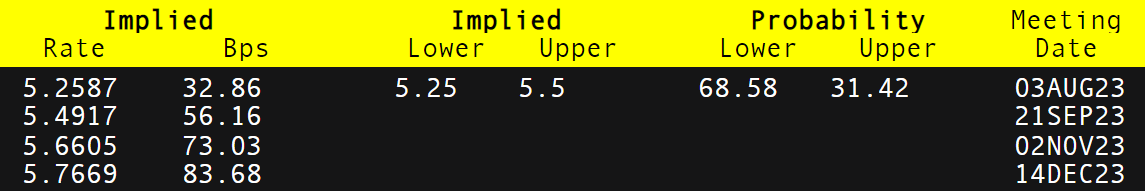

The British pound is bid this Monday morning as markets prepare for the Bank of England (BoE) to raise interest rates later this week. Current money market pricing (refer to table below) shows that there is a 68% probability of a 25bps hike. There has been some underwhelming UK specific data concerning economic growth within the region while recent CPI data has revealed both headline and core inflation moderating, which leads me to favor current expectations.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

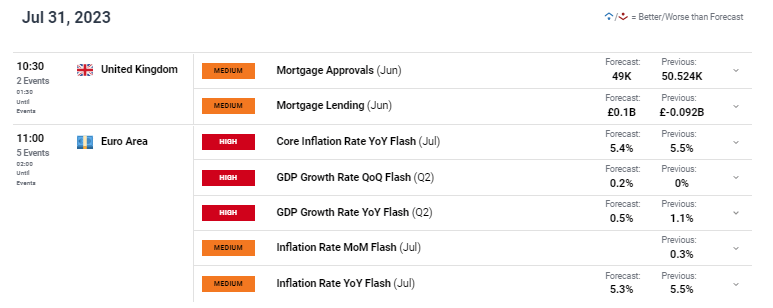

The rest of the trading day includes UK mortgage that are expected to remain subdued due to the aggressive monetary policy action by the central bank with focus on eurozone core inflation and GDP flash releases respectively (see economic calendar). ECB President Christine Lagarde reiterated that the ECB may still hike rates going forward if data warrants such action after citing Spanish, French and German GDP as “encouraging”.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

From a US dollar perspective, the greenback has remained relatively elevated considering Friday’s core PCE figures. The buoyancy is as a result of a ‘soft landing’ with recessionary fears being limited; however, the week’s upcoming data (ISM services PMI and Non-Farm Payrolls (NFP)) will be closely monitored to see whether or not these key metrics corroborate the more dovish narrative being adhered to at present.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

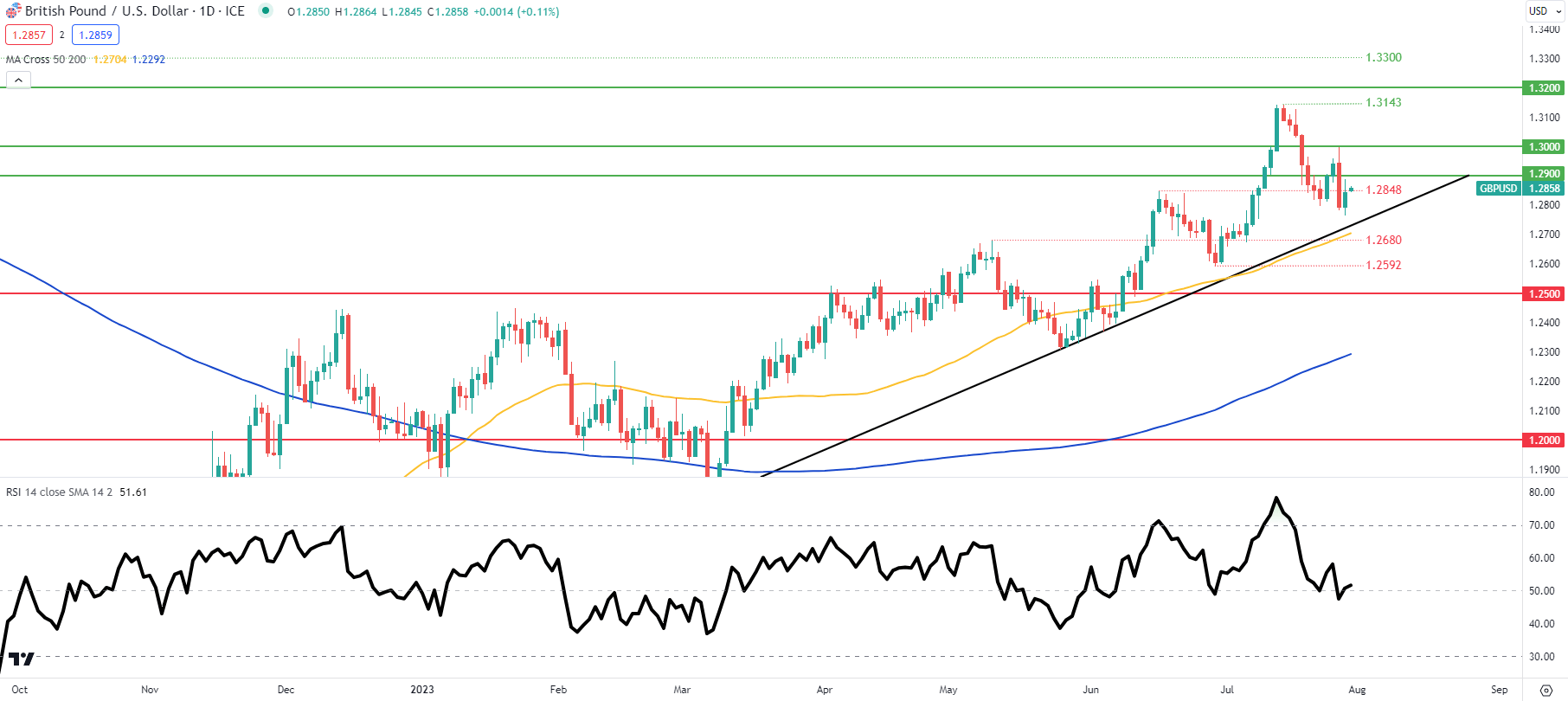

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above keeps the pair around the 1.2848 swing support handle while the Relative Strength Index (RSI) remains around the midpoint 50 level suggesting short-term uncertainty. Fundamental factors will be the primary drivers this week so traders should practice sound risk management technique as volatility is likely to pick up.

Key resistance levels:

Key support levels:

- 1.2848

- Trendline support

- 50-day MA

- 1.2680

CAUTIOUS IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net short on GBP/USD with 52% of traders holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term mixed bias.

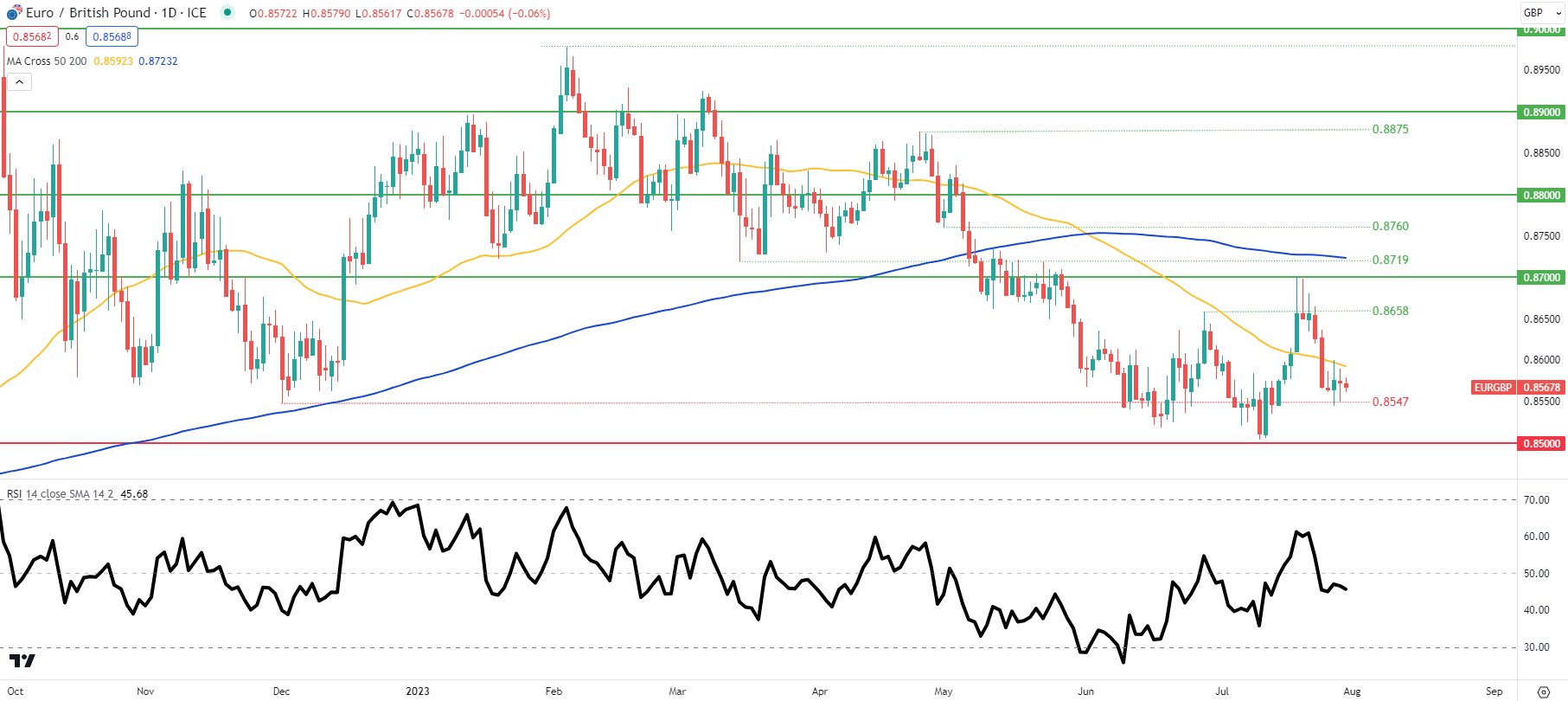

EUR/GBP DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/GBP reflects many of the same sentiments as GBP/USD with indecision displayed via several daily doji candlesticks and a similar RSI reading.

Key resistance levels:

Key support levels:

CAUTIOUS IG CLIENT SENTIMENT (EUR/GBP)

IG Client Sentiment Data (IGCS) shows retail traders are currently net long on EUR/GBP with 68% of traders holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term mixed bias.

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0