FX Weekly Recap: October 2 – 6, 2023

[ad_1] For most of the week, the U.S. dollar dominated the majors, but after the highly anticipated U.S. employment update on Friday, the Greenback finally gave up its crown to the European currencies with the Swiss franc taking the top spot. Missed the major forex headlines? Here’s what you need to know from this past

[ad_1]

For most of the week, the U.S. dollar dominated the majors, but after the highly anticipated U.S. employment update on Friday, the Greenback finally gave up its crown to the European currencies with the Swiss franc taking the top spot.

Missed the major forex headlines? Here’s what you need to know from this past week’s FX action:

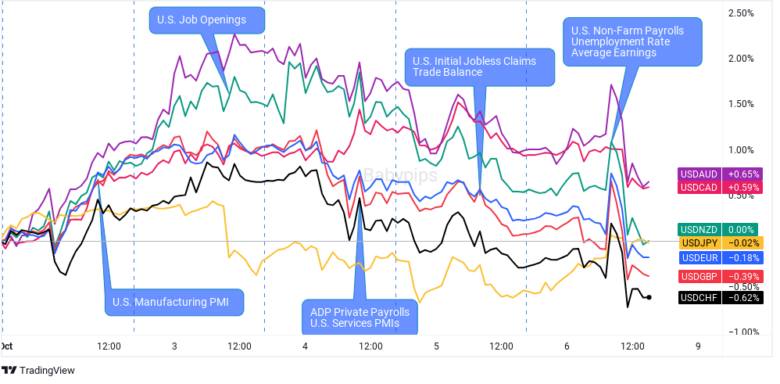

USD Pairs

Overlay of USD vs. Major Currencies Chart by TradingView

It was another boost higher for the Greenback to start the week, likely a continuation of speculation that the Fed will raise interest rates at least one more time in 2023, and keep rates high through 2024.

U.S. data this week broadly supported that notion as jobs updates and business sentiment signaled continued resiliency in the U.S. economy, but we did see the Greenback start to fade starting on Wednesday, correlating with weaker-than-expected ADP Private payrolls data. This may have prompted traders to lighten up on long positions ahead of the highly anticipated U.S. Non-farm Payrolls event on Friday.

Well, those trader may have been kicking themselves on Friday, at least initially, as the net jobs change surprised way to the upside with September showing 336K net job adds (more than double the forecast) and the August number was revised higher to 227K from 187K.

The Dollar spiked on the headlines, but it didn’t take long for sentiment to reverse as the average hourly earnings data and unemployment rate came in below expectations, signaling less of a need for the Fed to stay hawkish.

This quickly brought in USD sellers of all kinds, taking away the Greenback’s dominant performance right before the weekly close.

🟢 Bullish Headline Arguments

Congress passed a bill to keep the government open, averting a shutdown for at least 45 days

JOLTs U.S. Job Openings: 9.61M (8.6M forecast; 8.92M previous)

ISM U.S. Manufacturing PMI for September: 49.0 (48.1 forecast; 47.6 previous); Prices Index decreased to 43.8 (48.9 forecast; 47.9); Employment Index increased to 51.2 vs. 48.5 previous

ISM Services PMI for September: 53.6 vs. 54.5 previous; Employment Index: 53.4 vs. 54.7 previous; Prices Index stayed at 58.9

U.S. initial jobless claims at 207K (vs. 211K expected, 205K previous)

U.S. trade deficit narrowed to a three-year low of $58.3B as exports (+1.6%) outpaced imports (-0.7%)

U.S Non-Farm Payrolls Change in September: 336K (150K forecast; August revised up to 227K from 187K); 🔴 Bearish Headline Arguments

ADP U.S. Private Payrolls for September: 89K (160K forecast; 180K previous)

U.S. mortgage rates rose again this week to 7.49%

U.S. Average hourly earnings came in below expectations at 0.2% (0.3% forecast); the unemployment rate ticked higher to 3.8% from 3.7%

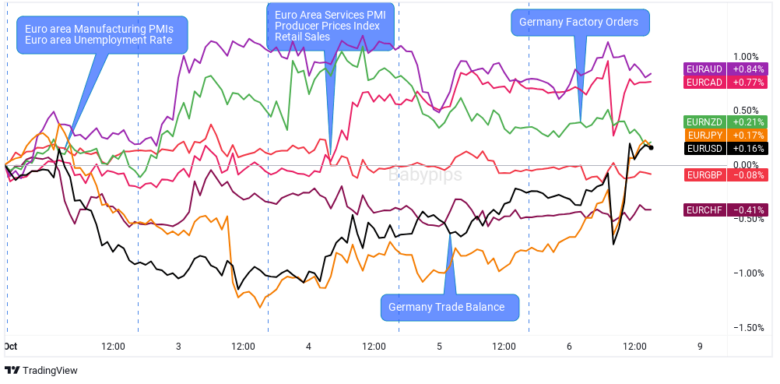

EUR Pairs

Overlay of EUR vs. Major Currencies Chart by TradingView

There was no major uniform moves in the euro this week, acting more as a counter currency, likely due to the lack of major catalysts from the Euro area.

Overall, the euro was a net winner by the Friday close, possibly on the back of an arguably net positive stream of economic & sentiment updates from Europe–not necessarily that the environment is good, but probably more on the idea that negative conditions seemed to have bottomed out…at least for now.

🟢 Bullish Headline Arguments

Euro area unemployment rate for August 2023: 6.4% (6.5% forecast / previous)

Germany’s HCOB services PMI revised higher from 49.8 to 50.3

Euro area Industrial Producer Prices for August: 0.6% m/m (0.5% m/m forecast; -0.5% m/m previous)

Germany’s trade surplus widened from 16.0B EUR to 16.6B EUR in August but both the exports (-1.2%) and imports (-0.4%) weakened compared to July

Germany’s factory orders rose by 3.9% in August (vs. 1.6% expected, -11.3% previous), with demand decreasing more than analysts had expected

🔴 Bearish Headline Arguments

HCOB Eurozone Manufacturing PMI for September: 43.4 vs. 43.5 previous; new orders rapidly feel; prices charged fell for the fifth month in a row

HCOB Germany Manufacturing PMI for September: 39.6 vs. 39.1 in August; factory employment fell for 3rd month in a row; input and purchasing prices continue to fall

European Central Bank Chief Economist Philip Lane commented on Tuesday that more work is still needed as inflation rate is still well above 2%

Euro area Retail Sales for August: -1.2% m/m (-0.1% m/m forecast / previous)

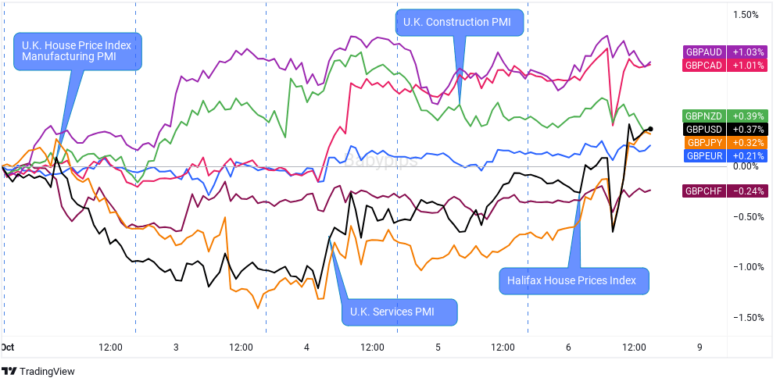

GBP Pairs

Overlay of GBP vs. Major Currencies Chart by TradingView

The British pound came out of this week as a net winner despite business sentiment that pointed to contractionary conditions in the U.K. and falling rates of inflation.

It’s possible that this may have been mainly a positioning move, in that bears are lightening up on short positions and taking profits on a broad downtrend in Sterling that goes back to mid-August, and to when the Bank of England signaled that policy restrictive enough in early September.

🟢 Bullish Headline Arguments

U.K. shop price inflation eased from 6.9% to 6.2% in September, its lowest in a year – BRC

🔴 Bearish Headline Arguments

U.K.’s house price growth unchanged in September, down 5.3% y/y – Nationwide

S&P Global / CIPS UK Manufacturing PMI for September: 44.3 vs. 43.0 previous

S&P Global / CIPS U.K. Services PMI for September: 49.3 vs. 49.5 previous; cost pressures moderated for the third time in the past four months

U.K.’s construction PMI dropped from 50.8 to 45.0 in September and marked its steepest decline May 2020

U.K. House Prices Index: -0.4% m/m (-0.2% m/m forecast; -1.8% m/m previous)

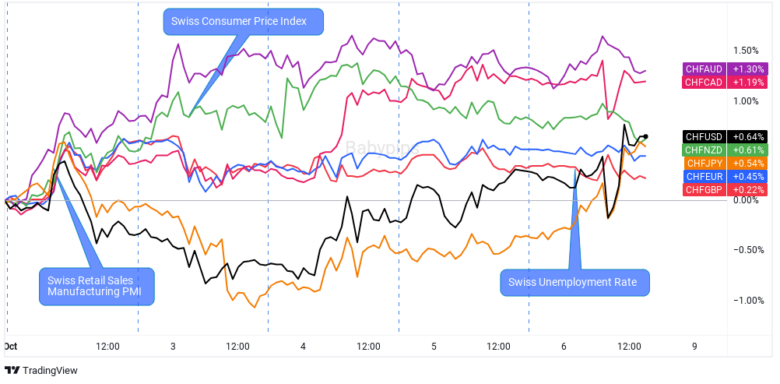

CHF Pairs

Overlay of CHF vs. Major Currencies Chart by TradingView

The Swiss Franc went from last place last week to the top spot this week. It’s possible that a better-than-expected Swiss retail trade and manufacturing PMI may have been the catalyst for the early bullish move, but the broad move in European currencies higher also suggests possible repositioning flows.

Remember that like the British pound, the Swiss franc has had a pretty rough time since mid-August, falling mainly against the comdolls and U.S. dollar by as much as 2.00% to 4.00%, so it’s possible that signs of recent driving themes running out of steam means it was time to take some pips to the bank.

🟢 Bullish Headline Arguments

Switzerland Manufacturing PMI for September: 44.9 (41.1 forecast; 39.9 previous)

Switzerland’s unemployment rate remained at 2.1% as expected in September

🔴 Bearish Headline Arguments

Switzerland’s real retail trade turnover fell by -1.8% y/y in August as expected (vs. a revised lower read of -2.5% in July)

Switzerland’s consumer prices decreased by -0.1% in September (vs. 0.0% expected, 0.2% previous)

AUD Pairs

Overlay of AUD vs. Major Currencies Chart by TradingView

The Aussie dollar was hit early this week, possibly a reaction to Caixin Chinese business survey data released during the weekend that optimism in China faded a bit in September.

We also got inflation and job data from Australia on Monday that came in lower-than-expected, likely sparking some traders to take profits on the Aussie rally, ahead of the Reserve Bank of Australia’s monetary policy statement on Tuesday.

Speaking of the RBA, they held their main policy rate at 4.10% as expected, but it was a more dovish than expected statement. They noted concerns that economic growth risks and asset price risks are elevated, likely prompting the big slide in the Aussie after the event, which the Aussie was not able to recover from by the Friday close.

🟢 Bullish Headline Arguments

Australia’s building approvals rose by 7.0% in August (vs. 2.7% expected, -7.4% previous)

As expected, the RBA kept its interest rates at 4.10% in October; “Some further tightening of monetary policy may be required”

Preliminary RBA Commodity Prices Index for September: 3.9% m/m vs. -2.5% m/m in August

Australia’s trade surplus widened from 7.32B AUD to 9.64B AUD as exports (+4.0% m/m) outpaced imports (-0.4% m/m) in August

RBA’s financial stability review: Australia’s economy can weather strains in global financial markets, though the risks of a “disorderly” slide in asset prices or a slowdown in China were elevated

🔴 Bearish Headline Arguments

Melbourne Institute’s inflation gauge recorded zero change in consumer prices in September (vs. 0.2% uptick in August)

Australia’s job advertisements dipped by 0.1% (vs. 1.7% previous) in September; In the three months to September, “ads had been concentrated in education and healthcare, which helped offset weakness in tech and food preparation.”

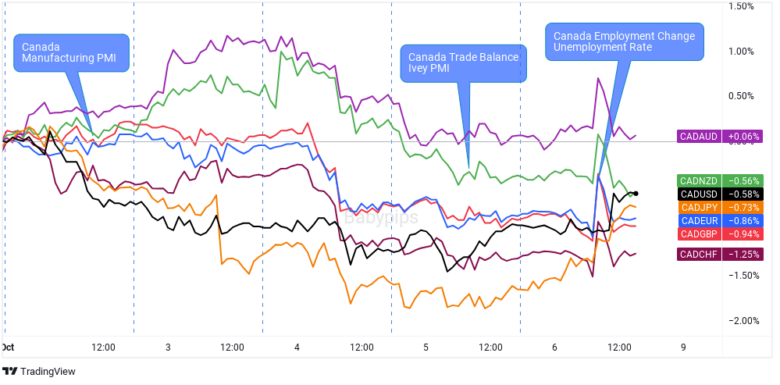

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TradingView

There was almost no love for the Loonie this week despite broadly net positive economic updates from Canada, including a big time beat in the Friday jobs report.

It was oil that likely dragged the Canadian dollar lower this week, this time without a direct catalyst. The bearish swing was likely on a combination of arguments, including speculation of no further deep oil production cuts from OPEC is expected, a strong U.S. dollar, PMIs signaling contractionary conditions, and possibly profit taking from oil’s (and the Loonie’s) massive run higher since the Summer from $68/barrel to $95/barrel at the end of September

🟢 Bullish Headline Arguments

Bank of Canada Deputy Governor Nicolas Vincent sees risk that rising corporate pricing will make efforts to lower inflation more complicated

Canada’s trade data improved from a deficit of 427M CAD to a surplus of 718M CAD in August as exports (+5.7%) outpaced imports (+3.8%)

Canada’s IVEY PMI slowed down from 53.5 to 53.1 (vs. 50.8 expected) in September

Canada Employment Change for September: +63.8K (10K forecast; 39.9K previous); Unemployment Rate stayed at 5.5% vs. 5.6% forecast; Average Hourly Earnings rose by 4.2% y/y (4.1% y/y forecast; 4.3% y/y previous)

🔴 Bearish Headline Arguments

Canada Manufacturing PMI for September: 47.5 vs. 48 previous; “jobs and purchasing activity deteriorate”

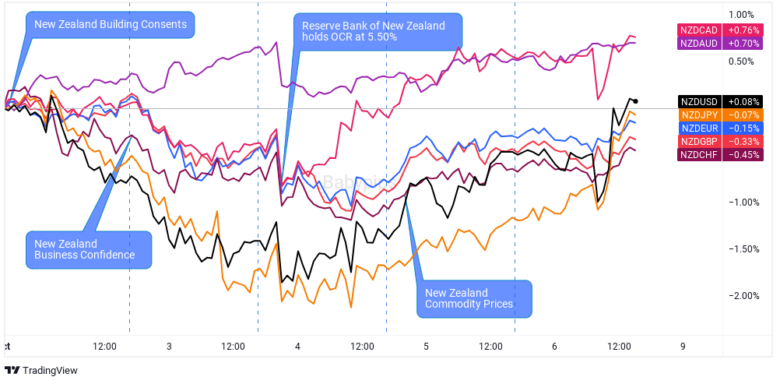

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TradingView

The New Zealand dollar closed out this week as a net loser this week, likely drawing in fundie sellers with weaker-than-expected news and data from both New Zealand and China.

More sellers came out Wednesday after the Reserve Bank of New Zealand held the official cash rate at 5.50% once again, as expected, but came out less hawkish than expected as they noted easing economic demand growth in recent data, as well as expectations for spending growth to reduce further.

🟢 Bullish Headline Arguments

ANZ world commodity price index rose by 1.3% m/m in September after trending lower for the last three months

🔴 Bearish Headline Arguments

New Zealand’s building permits dropped by -6.7% m/m in August vs. -5.4% decline in July

NZIER quarterly business survey showed business confidence improving from -63 to -53 in Q3; “Higher interest rates are starting to dampen demand in the New Zealand economy”

As expected, the RBNZ kept its interest rates steady at 5.50% in October, but with a less hawkish-than-expected statement

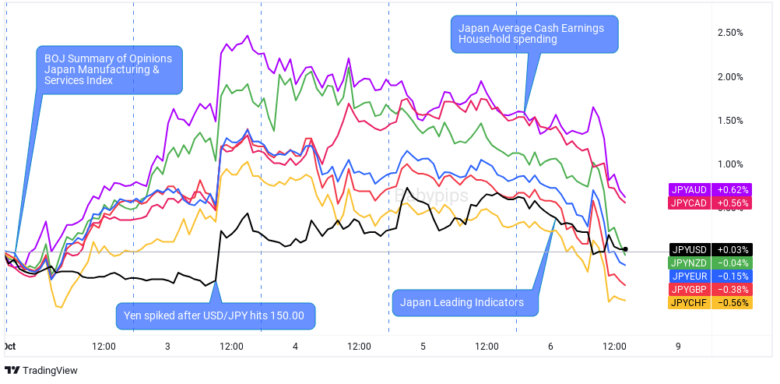

JPY Pairs

Overlay of JPY vs. Major Currencies Chart by TradingView

The Japanese yen was mostly positive this week, possibly with the help from better-than-expected large business sentiment released on Monday. The big event of the week though what when USD/JPY hit 150.00, a level widely regarded as the line in the sand that could spark intervention from Japanese officials.

Well, that level was hit on Tuesday, and it didn’t take long for USD/JPY traders to hit the sell button, spiking the yen higher across the board.

Now, the Bank of Japan did not comment on whether or not this was intervention from them or the Japanese government, but early evidence suggests that there was no intervention.

Whatever the case may be for the spike, the yen saw big gains early in the week. But those gains eroded as the week went on as anti-Dollar / risk-on sentiment rose ahead of and after the highly anticipated U.S. government jobs update. The very strong job gains and a falling wages update, sparked “soft landing” bets (i.e., selling yen) further going into the weekend.

🟢 Bullish Headline Arguments

Sentiment among Japan’s biggest manufacturers improved from 5 to 9 in Q3; Non-manufacturers’ sentiment also edged higher from 23 to 27

🔴 Bearish Headline Arguments

BOJ’s Opinions Summary report showed policymakers discussed the possibility of exiting from their ultra-loose policy; no signals of exiting yet

Japan’s au Jibun Bank manufacturing PMI revised lower from 48.6 to 48.5; “Manufacturing conditions deteriorate at sharper rate in September”

Japan’s real wages declined for a 17th consecutive month in August as consumer inflation (+3.7%) outpaced nominal pay growth (+1.1%)

Japan’s household spending shrank by -2.5% y/y in August (vs. -4.0% expected, -5.0% previous) and marked its sixth consecutive monthly decrease

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0