Further Pain in Store for the Aussie Dollar?

AUDUSD PRICE, CHARTS AND ANALYSIS: Recommended by Zain Vawda Get Your Free AUD Forecast Most Read: The Reserve Bank of Australia: A Trader’s Guide AUD FUNDAMENTAL BACKDROP, CHINA CONCERNS GROW The Australian Dollar is attempting to snap a three-day losing streak against the Greenback. Reserve Bank of Australia (RBA) Governor Lowe provided the Aussie Dollar

AUDUSD PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free AUD Forecast

Most Read: The Reserve Bank of Australia: A Trader’s Guide

AUD FUNDAMENTAL BACKDROP, CHINA CONCERNS GROW

The Australian Dollar is attempting to snap a three-day losing streak against the Greenback. Reserve Bank of Australia (RBA) Governor Lowe provided the Aussie Dollar with some ammunition following comments which lent on the hawkish side as he maintained the RBA is committed to the inflation fight, not ruling out further rate hikes.

Governor Lowe stated the Central Banks core prediction is for CPI inflation to be approximately 3¼ percent by the end of next year, and to be back within the 2-3% goal range by late 2025. The comments have seen AUDUSD hold the line just above the 0.6500 handle heading into the European open.

The Chinese recovery continues to negatively impact the Australian Dollar as evidenced by this week’s poor import and export numbers coinciding with renewed weakness in the Australian Dollar. There have been some positive developments however as China have lifted tariffs imposed on Australian Barley with the Asia-Pacific nation looking at the possibility of restriction being lifted in other sectors as well. The bigger concern in my view, however, remains the uneven recovery by China which continues to hamper the growth story in Australia and could have an impact on the possibility of further rate hikes from the RBA.

For Tips on the Best Way to Trade AUD/USD Download Your Free Guide Below

Recommended by Zain Vawda

How to Trade AUD/USD

The diverging paths and economic conditions between the US and Australia doesn’t bode well for a sustained AUD recovery while the technical picture is flashing signs that further downside may be ahead.

Looking at the day ahead, we do have some US data in the form of PPI and the preliminary Michigan Consumer Sentiment data which will be released and could keep the US Dollar supported. Overall, even if US data fails to come in positive today any gains by the Australian Dollar is likely to face selling pressure with the technical breakdown likely to provide a better idea of key areas to focus on.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

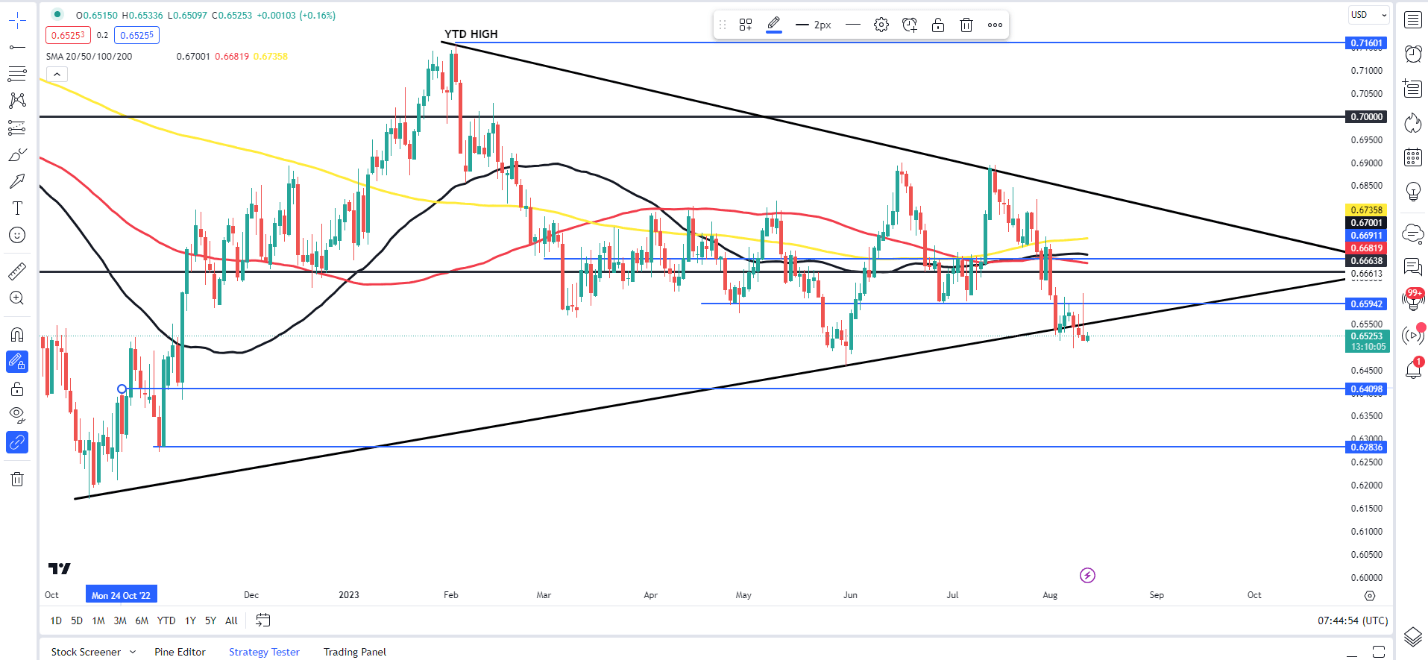

The technical outlook on AUDUSD and price has finally broken below the symmetrical triangle pattern with a retest and rejection yesterday resulting in a shooting star candle close. Comments from Governor Lowe have lent the Aussie Dollar some support this morning, but the selling pressure may keep gains capped around the 0.6550 and 0.6600 levels from an intraday perspective.

If we are to see a deeper pullback to the upside there remains a key confluence area around the 0.6660-0.6690 range. I for one do not see a break above that key are anytime soon without a significant change in the macro picture.

Key Levels to Keep an Eye On:

Support Levels

Resistance Levels

- 0.6550

- 0.6600

- 0.6680 (100-day MA)

AUD/USD Daily Chart – August 11, 2023

Source: TradingView

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment Data which shows retail traders are 82% net-long on AUD/USD with the ratio of traders long to short at 4.54 to 1.

For a more in-depth look at GBP/USD sentiment and the changes in long and short positioning, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 10% | 0% | 8% |

| Weekly | 0% | 17% | 3% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰