FTSE 100, Nasdaq 100, DAX 40

[ad_1] Article by IG Senior Market Analyst Axel Rudolph FTSE 100, DAX 40, Nasdaq 100 Analysis and Charts FTSE 100 on track for second week of gains The FTSE 100, which slid back to its breached July-to-August downtrend line on Thursday, is bouncing off it ahead of US Non-Farm Payrolls on Friday. The UK blue

[ad_1]

Article by IG Senior Market Analyst Axel Rudolph

FTSE 100, DAX 40, Nasdaq 100 Analysis and Charts

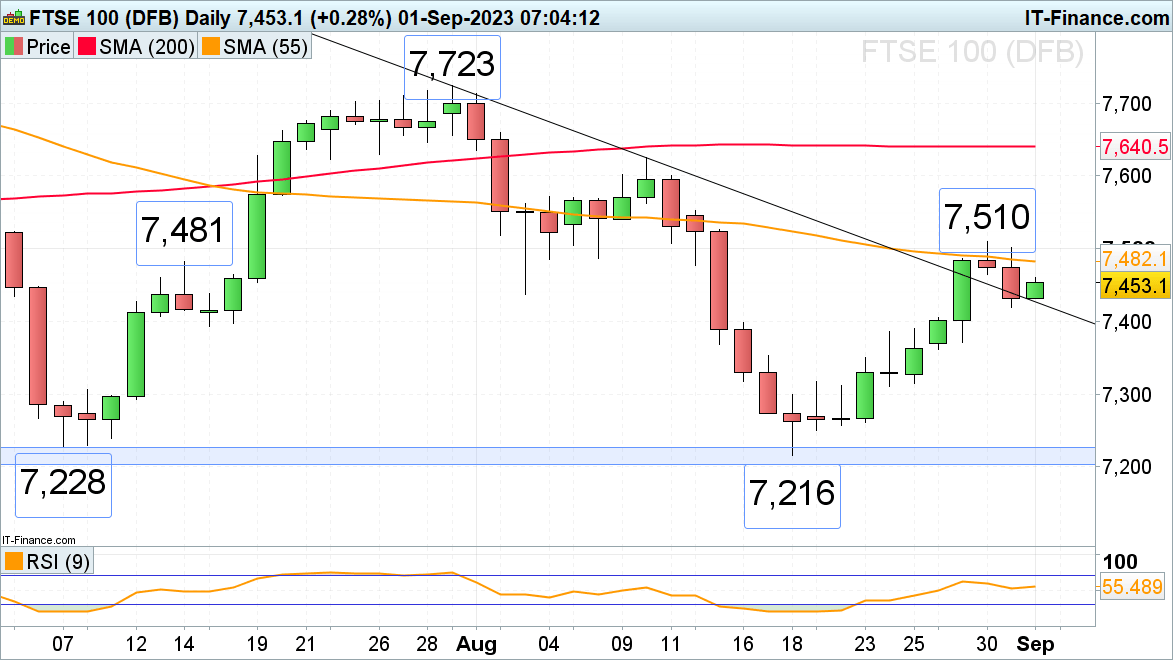

FTSE 100 on track for second week of gains

The FTSE 100, which slid back to its breached July-to-August downtrend line on Thursday, is bouncing off it ahead of US Non-Farm Payrolls on Friday. The UK blue chip index looks to be on track for a second week of gains as investors positively interpreted the weaker US growth and employment data out this week as dovish with regard to monetary policy. The 55-day simple moving average (SMA) at 7,482 is back in focus, as is this week’s high at 7,510.

Minor support can now be found along the breached July-to-August downtrend line at 7,425 ahead of more significant support made up of the May, June, and early August lows at 7,437 to 7,401.

FTSE 100 Daily Chart

DAX 40 is expected to end the week on a positive note

The DAX 40 continues its advance as China’s manufacturing activity unexpectedly expanded in August, boosting Asian stock markets, except Australia’s AU200. Thursday’s high at 16,044 and the 10 August high at 16,062 remain in sight. These highs need to be exceeded for a medium-term bullish reversal to be confirmed.

Minor support comes in at the 15,895 high seen last week, ahead of Wednesday’s low at 15,821. Further support comes in along the breached one-month resistance line, now because of inverse polarity a support line, at 15,685.

Download the Free DAX IG Sentiment Report

| Change in | Longs | Shorts | OI |

| Daily | -2% | -1% | -2% |

| Weekly | -30% | 27% | 0% |

DAX 40 Daily Chart

Nasdaq 100 is losing upside momentum ahead of US NFP data

The Nasdaq 100’s five consecutive days of gains take place among diminishing upside momentum as investors brace themselves for today’s US Non-Farm Payrolls. Nonetheless, the index regained most of its August losses within the past week as investors pursued a more dovish Fed outlook. Were this week’s high at 15,576 to be exceeded, the late July high at 15,807 would be in focus, together with the July peak at 15,932.

Slips should find support around last week’s high at 15,369. Minor support below this level is seen along the 55-day simple moving average (SMA) at 15,236.

Recommended by IG

Traits of Successful Traders

Nasdaq 100 Daily Chart

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0