FTSE 100, DAX and S&P 500 Try to Stabilize After Rout

Written by Axel Rudolph, Senior Market Analyst at IG Recommended by IG Get Your Free Equities Forecast FTSE 100 stabilizes after slip The FTSE 100, having on Monday slipped through its 200-day simple moving average (SMA) at 7,649 on the back of global risk-off sentiment, now stabilizes above this week’s low at 7,581 as the

Written by Axel Rudolph, Senior Market Analyst at IG

Recommended by IG

Get Your Free Equities Forecast

FTSE 100 stabilizes after slip

The FTSE 100, having on Monday slipped through its 200-day simple moving average (SMA) at 7,649 on the back of global risk-off sentiment, now stabilizes above this week’s low at 7,581 as the rising oil price props up the index.

Resistance remains to be seen along the 200-day simple moving average (SMA) at 7,649 and while below it downside pressure retains the upper hand.

A fall through this week’s low at 7,581 would eye the early July high at 7,562 ahead of the minor psychological 7,500 region.

Resistance above the 200-day simple moving average (SMA) at 7,649 sits at the 7,688 June high and also between the 7,723 July peak and the current September high at 7,747. These highs will need to be overcome for the psychological 7,800 mark and the 7,817 8 May high to be back in the picture.

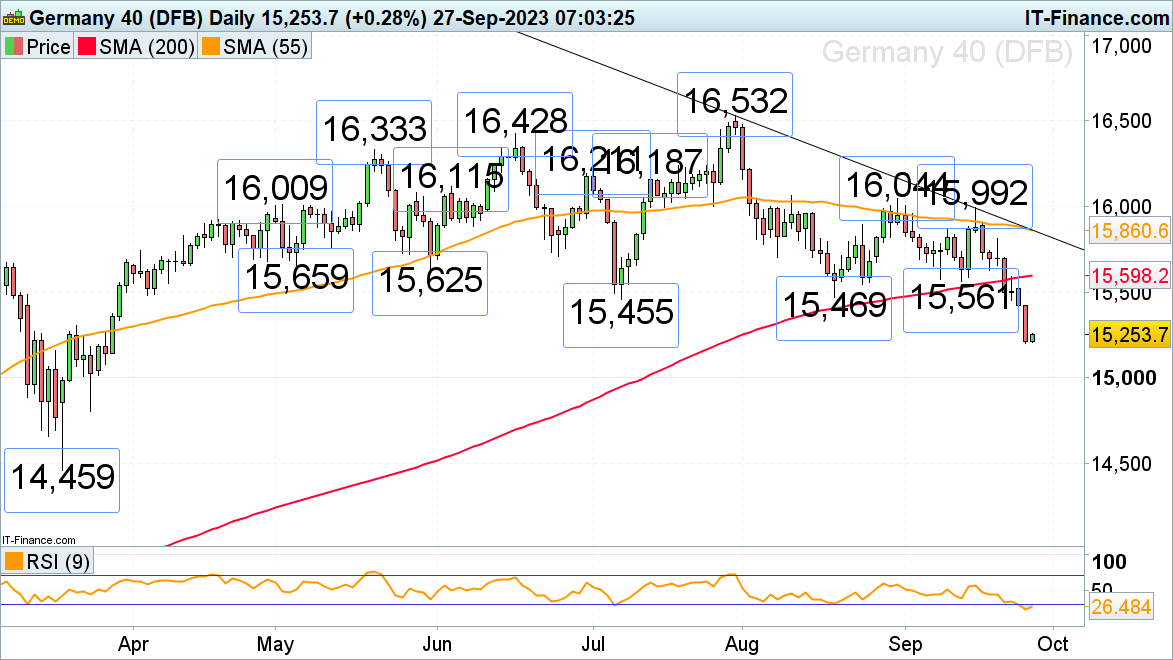

DAX 40 drops to six-month low

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The DAX 40 tumbled to a new six-month low at 15,201, made below the mid-January high at 15,272 as US equity indices drag global markets lower amid the ‘rates for longer’ scenario.

Even though the index is trying to hold, it remains fragile and a fall through 15,201 could engage the psychological 15,000 mark.

Minor resistance lies at Monday’s 15,327 low and major resistance between the July and August lows at 15,455 to 15,469.

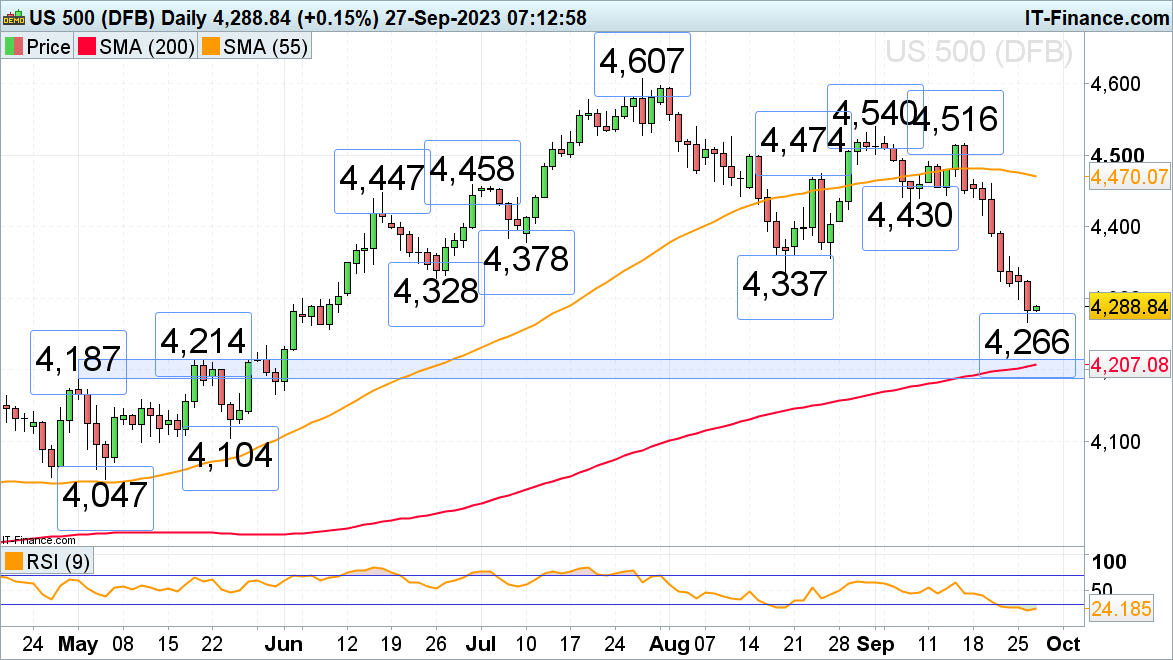

S&P 500 falls over eight consecutive days

The US Federal Reserve’s (Fed) hawkish pause, higher yields and looming potential government shutdown have led to eight straight days of losses for the S&P 500 with the index slipping by over 5% in the past couple of weeks to yesterday’s low at 4,266.

Any potential short-term bounce should encounter minor resistance around Monday’s low at 4,299 and further up around Friday’s low at 4,316. More significant resistance sits between the 4,356 to 4,378 10 July and 25 August lows.

Below this week’s current low at 4,266 lies the major 4,214 to 4,187 support area which consists of the early and late May highs and the 200-day simple moving average (SMA).

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰