Fresh Highs as Concerns About Further Cuts from Saudi Arabia Linger

[ad_1] OIL PRICE FORECAST: Oil Continues to Advance as Supply Concerns and a Potential Rebound in Demand Keep Prices Elevated. Saudi Energy Minister to Provide a Further Update this Week on the Potential for Further Cuts or an Extension into 2024. IG Client Sentiment Shows Traders are 64% Net-Short on WTI at Present, Down from

[ad_1]

OIL PRICE FORECAST:

- Oil Continues to Advance as Supply Concerns and a Potential Rebound in Demand Keep Prices Elevated.

- Saudi Energy Minister to Provide a Further Update this Week on the Potential for Further Cuts or an Extension into 2024.

- IG Client Sentiment Shows Traders are 64% Net-Short on WTI at Present, Down from 79% on Thursday Last Week.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices remained elevated this morning continuing its advance as a slightly weaker US Dollar and concern of further production cuts from Saudi Arabia this week kept the bulls in charge. Oil prices are on course for their largest quarterly increase since Russia’s invasion of Ukraine in the first quarter of 2022.

For the Best Tips to Trading Oil, Download Your Complimentary Guide Below

Recommended by Zain Vawda

Understanding the Core Fundamentals of Oil Trading

WIDENING SUPPLY DEFICIT CONCERNS

The rally in Oil continue to surprise and has come against the backdrop of a slowing Euro Area economy and problems in China with the Economic recovery. It is important to note however, despite the concerns around the recovery in China, the Oil demand for the world’s second largest economy has remained at record breaking levels. The economic concerns however are having a negative impact on other countries and weighing on Oil prices from a different angle if you will. There have been attempts by Chinese Authorities of late with a series of stimulus measures implemented to help bolster the economy. There does remain some concern by market participant that should China not find a sustainable economic growth path moving forward it could begin to hinder Oil demand as well.

The Saudi Energy Minister is keeping market participants on their seats at present following confirmation that both Russia and Saudi Arabia will maintain production cuts through to the end of 2023. There is concern that this may be extended even further while the possibility of further production cuts as well has not been ruled out. This together with the slight weakness in the US Dollar has kept Oil on the advance today ahead of the FOMC meeting on Wednesday.

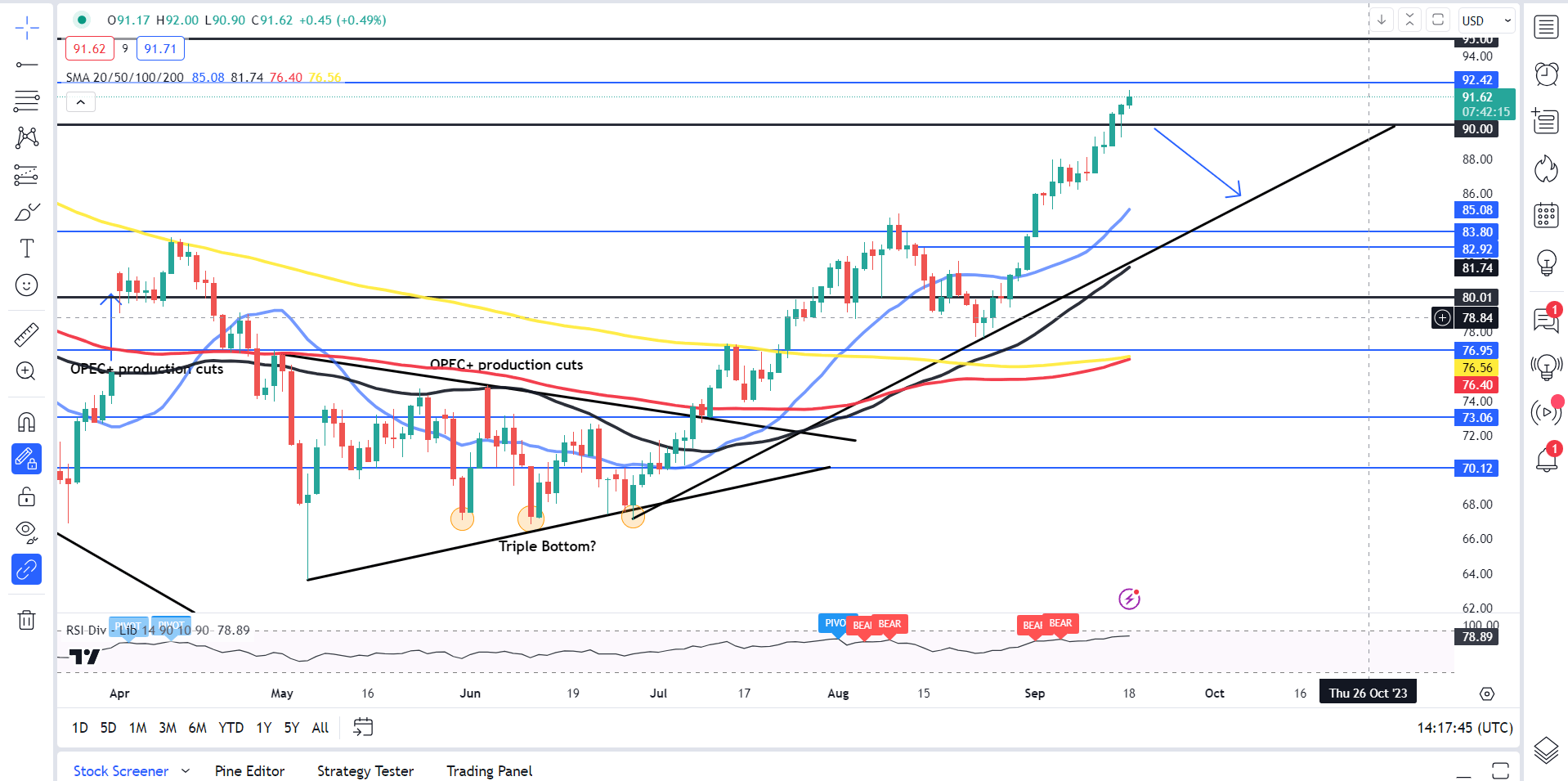

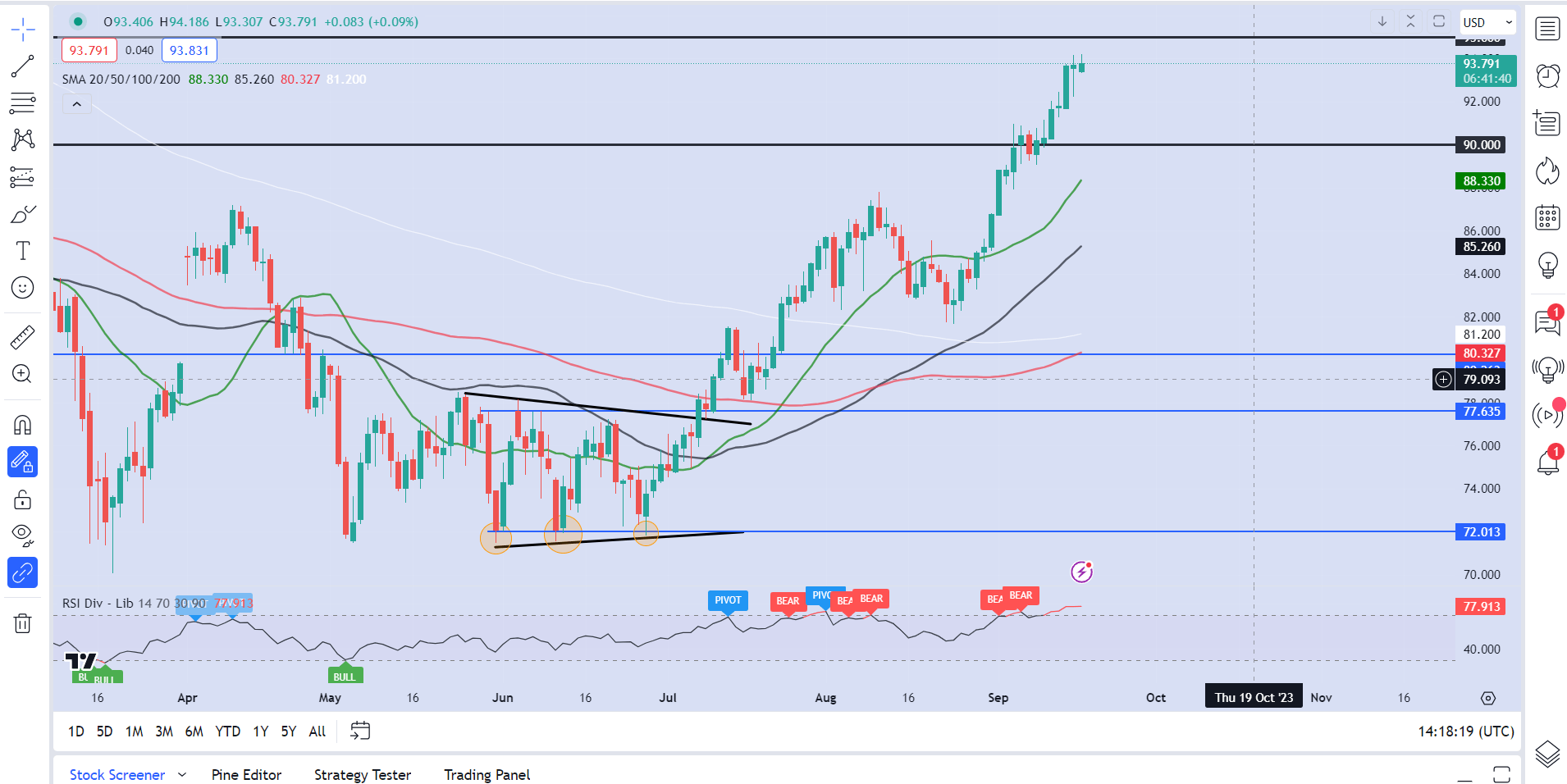

CENTRAL BANK MEETINGS AHEAD

Central Banks dominate markets this week as expectations continue to grow about the Central Bank hiking cycle. Hints by the ECB and policymakers that the peak may be in has emboldened market participants despite the recent rise in Oil prices likely to weigh heavily on the inflation front. Are we in for resurgent inflation as we head into Q4?

Wednesday will bring the FOMC meeting which could have an impact on WTI prices while the S&P Global PMI data on Friday may actually have a bigger impact on Oil prices.

For all market-moving economic releases and events, see the DailyFX Calendar

Foundational Trading Knowledge

Forex Fundamental Analysis

Recommended by Zain Vawda

TECHNICAL OUTLOOK AND FINAL THOUGHTS

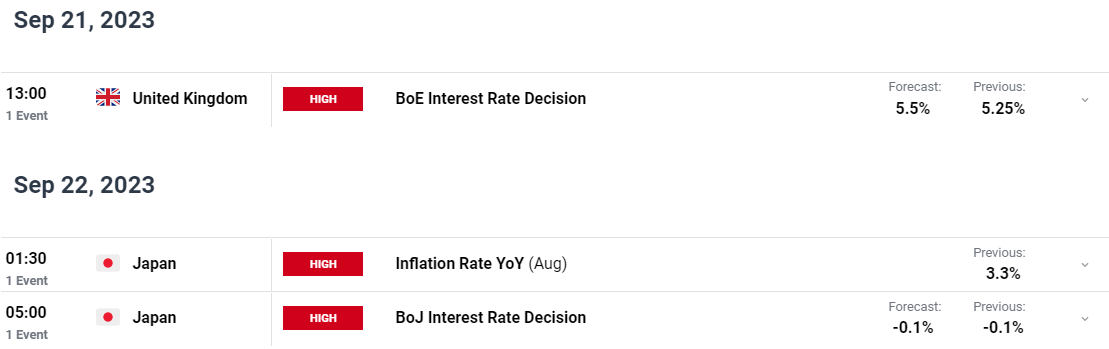

From a technical perspective both WTI and Brent have risen this morning, but it would appear WTI has the momentum. Brent has failed to convincingly take out the Friday high yet with the $95 a barrel mark in sight.

The US Dollar had started the week slightly on the back foot in the Asian session but appears to be on a recovery mission as the US session gains traction. A resurgence of activity from the Dollar Index (DXY) may prove to be a saving grace as Oil prices continues their ascent.

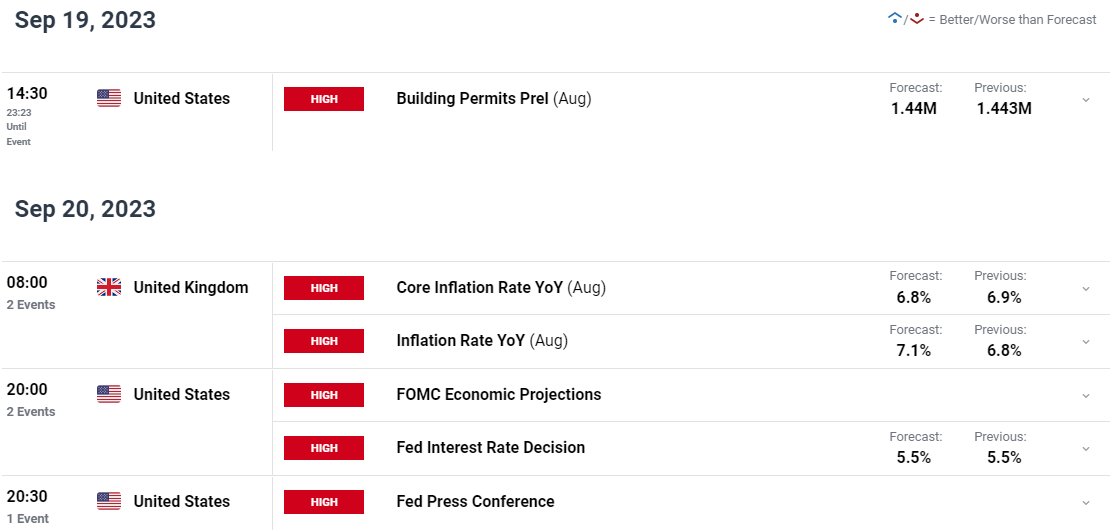

Following slight weakness around the $90 a barrel mark on Thursday last week I had hoped for a pullback and a potential 3rd touch of the ascending trendline. This however failed to materialize at the back end of last week as Friday saw Oil bulls take control once more. Fundamental factors continue to be the core driver of Oil prices at the moment with the technical picture now in extremely overbought territory as per the 14-day RSI. The fact that we continue to print higher highs and haven’t had another higher low print since the August 23 low around $77.60 a barrel is another concern from a technical point of view. A pullback cannot be that far off, only if we can see some stability from a fundamental perspective. As long as doubts linger over further production cuts a deep retracement below the $90 a barrel mark is likely to remain elusive.

WTI Crude Oil Daily Chart – September 18, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support levels:

- 90.00

- 88.10

- 85.18 (20-day SMA)

Resistance levels:

- 92.42

- 95.00 (psychological level)

Brent Crude continues to look like a mirror image of WTI with the 14-day RSI in extremely overbought territory as well. We have seen a slight shift on Friday and today as WTI seems to be gaining quicker than Brent, with Brent failing to take out the Friday high this morning.

Brent Oil Daily Chart – September 18, 2023

Source: TradingView

IG CLIENT SENTIMENT

IG Client Sentiment data tells us that 64% of Traders are currently holding short positions. This is a significant step down from the Thursday number which was around the 79% mark.

For a more in-depth look at WTI/Oil Price sentiment and the changes in long and short positioning, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 11% | 4% | 6% |

| Weekly | -5% | 13% | 6% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0