Forexlive Americas FX news wrap 25 Aug: Powell/Fed prepared to raise rates but “carefully”

Fed’s Powell’s Jackson Hole speech finally came and unlike last year when the speech was short and sweet and to the point, there was little bit of something for everyone : Regarding monetary policy and rate decisions: Prepared to raise rates further if deemed necessary. The next move will be based on data. The Federal

Fed’s Powell’s Jackson Hole speech finally came and unlike last year when the speech was short and sweet and to the point, there was little bit of something for everyone :

Regarding monetary policy and rate decisions:

- Prepared to raise rates further if deemed necessary.

- The next move will be based on data.

- The Federal Reserve will proceed ‘carefully’ when deciding to hike rates again or maintain them.

- There’s uncertainty in the economy, necessitating ‘agile’ monetary policy-making.

On economic observations:

- Inflation remains higher than desired.

- Two months of positive data are just the beginning; more is needed to gain confidence in the inflation trajectory.

- The current policy is restrictive, but the neutral rate level is uncertain.

- The Federal Reserve remains committed to a 2% inflation target.

- A decrease in inflation might also require a softer labor market.

- Signs of the job market not cooling could lead to more actions from the Federal Reserve.

- There’s evidence that inflation is becoming more responsive to labor market conditions.

Unique Economic Dynamics:

- Supply and demand dislocations in this cycle have unique effects on inflation and labor market dynamics.

- Job openings have decreased without a corresponding rise in unemployment, indicating a significant demand for labor.

- Inflation appears to be more sensitive to labor market conditions than in recent decades.

Conclusion and Outlook:

- The Federal Reserve is navigating uncertain economic conditions.

- Risk-management is crucial given the current uncertainties.

- Decisions in upcoming meetings will be based on a comprehensive assessment of data, outlook, and risks.

- The primary goal is to restore price stability, which is essential for achieving the dual mandate of strong labor market conditions and stable prices.

- The Federal Reserve is committed to continuing its efforts until the objectives are met.

Other Fed members who spoke today included Fed Harker:

- Doubt that rate cuts are on the table until next year at some point

- Reiterated his feeling that he does not see the need for more rate hikes now

Feds Goolsbee also spoke today and typically a dove, but his comments were a little bit more hedging :

- Still confident about reaching the golden path of a soft landing

- He thinks there is a long way to go on inflation

- 3% inflation was lower but largely due to energy which can move back higher as well

- We have not seen consumer spending deteriorate like you normally see given the rising yields

- He is patient about getting to a 2% target

Market Reaction:

The market’s initial reaction was a slight dip in the dollar, possibly due to the ‘carefully’ comment, which might be perceived as dovish. The dollar than reversed to the upside, only later to come off the high levels, but still closed higher.

For a September hike the odds remain around 20% but for a November hike the odds move back above the 50% level.

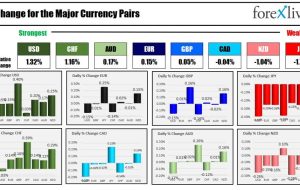

For the day , the greenback is ending as the strongest of the major currencies, but gains are relatively modest. The USDJPY was the biggest mover with the USD moving higher by 0.40%. The next largest gainer for the USD was vs. the NZD with a gain of 0.25%. Versus the USDCHF, the dollar, was virtually unchanged.

US rates are ending the day with mixed results. The shorter end is higher with the two-year closing the week over 5% at 5.0779 (up 5.9 basis points today). Meanwhile, the 10-year yield is down -0.4 basis points at 4.231%.

For the trading week the pattern was the same with the 2 year yield higher the longer end yields actually fell on the week.

- 2-year yield rose 12.7 basis points

- 5-year yield rose 4.9 basis points

- 10-year yield fell -2.6 basis points

- 30-year yield fell 10 basis points

US stocks had a volatile day. The NASDAQ index led the charge after tumbling yesterday. Today, it fell -87.63 points at its session lows but rose 169.45 points at its highs. The S&P and Dow industrial average had similar up-and-down price action throughout the day.

The final numbers are showing:

- Dow industrial average rose 247.48 points or 0.73% at 34346.91

- S&P index rose 29.40 points or 0.67% at 4405.72

- NASDAQ index rose 126.66 points or 0.94% at 13590.64

For the trading week:

- Dow industrial average fell -0.45%

- S&P index rose 0.82%

- NASDAQ index rose 2.26%

In other markets:

- Crude oil is trading at $80. For the trading week, the price fell -0.82%

- Gold today fell $-2.30 or -0.12% at $1914.52. For the trading week, the price rose 1.36%.

- Silver rose $0.10 or 0.45% at $24.21. For the trading week silver rose 6.5%

- Bitcoin is trading at $26,029 and marginally lower than the price a week ago at $26,192.

Next week, is US jobs week with the US employment report being released on Friday. That data will be preempted by the ADP report report on Wednesday, and Challenger job cuts on Thursday. The jolts job data will be announced on Tuesday. US GDP will be announced on Wednesday and personal income and spending will be announced on Thursday.

| آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA + مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Americas ، Aug ، carefully ، Forexlive ، News ، PowellFed ، prepared ، Raise ، Rates ، Wrap

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰