Forexlive Americas FX news wrap 24 Nov: Canada retail sales send CAD higher. USD lower.

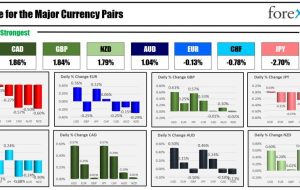

[ad_1] The CAD is ending the day as the strongest of the major currencies while the USD is the weakest. The USDCAD is the biggest mover in trading today Canada retail sales came in much stronger than expected with a gain of 0.6% for the month. That was much higher than the 0.0% gain expected.

[ad_1]

The CAD is ending the day as the strongest of the major currencies while the USD is the weakest.

The USDCAD is the biggest mover in trading today

Canada retail sales came in much stronger than expected with a gain of 0.6% for the month. That was much higher than the 0.0% gain expected. The ex-auto came in at 0.2% vs -0.2% est, while ex-auto and gas did show a -0.3% decline. The September advance “guesstimate” had growth at 0.0%. So the number was quite a surprise.

Contributing to the strong CAD was that the advance estimate for October came in at 0.8%.

The data helped to push the USDCAD lower (higher CAD) with the pair testing the 38.2% retracement of the move up from the July low at 1.35908. The price bounced off of that target and is trading at 1.3611 as the market winds down for the holiday-shortened week.

USDCAD falls to the 38.2% retracement target.

The fall in the USD came despite a rise in yields that saw the US 10-year yield move up 5.4 basis points at 4.470%. The divergence could be explained by the technical breaks. For the US 10 year yield, it moved away from support at 4.34%. For the USD, it had its own breaks in some of the major currency pairs today which propelled the greenback lower.

For a technical review of the dynamics, click on video below:

The bond market closed early today with the final numbers showing:

- 2 year yield 4.950%, +4.1 bps

- 5 year yield, 4.488%, +4.9 bps

- 10 year yield 4.470%, +5.4 bps

- 30 year yield 4.602%, +5.4 bps

In the US stock market, the price action was limited with the Dow closing higher, the S&P near unchanged and the Nasdaq down marginally:

- Dow industrial average rose 117.12 points or 0.33% at 35390.16

- S&P rose 2.70 points or 0.06% at 4559.33

- Nasdaq fell -15.01 points or -0.11% at 14250.84.

For the trading week, the major indices closed higher for the 4th consecutive week gain:

- Dow industrial average rose 1.27%. The 4 week gain has taken the price up 9.2%

- S&P rose 1.0% this week. The 4-week gain has taken the price up 10.73%

- Nasdaq rose 0.89% this week. The 4 week gain has taken the price up 12.29%

Next week, the RBNZ will announce their latest decision on rates with expectations for no change (8 PM ET on Tuesday) at 5.50%. The RBNZ has kept rates unchanged since May and plans to keep them steady for the foreseeable future. The central bank views the current rate as restrictive and believes it needs to remain at this level throughout the next year. The RBNZ sees interest rates as constraining economic activity and reducing inflationary pressure, with inflation expected to decline to target levels by the second half of 2024. Recent data, including softer-than-expected CPI and Labor Cost Index figures in Q3, supports the central bank’s current approach, and the decline in employment is likely seen as progress in its restrictive policy goals.

German preliminary CPI will be announced on Wednesday with the expectations for a decline of -0.1% vs 0.0% last month.

US PCE and Core PCE data will be released on Thursday. The headline PCE price index remained unchanged at 0.0% month-on-month (MoM) in October, compared to the previous month’s increase of 0.4%. Meanwhile, the Core PCE, which excludes volatile food and energy prices, is expected to rise by 0.2% MoM, slightly cooling from the 0.3% pace seen in September. This data is crucial in confirming the trend of easing inflation, as indicated by the October CPI report. Recall, the October CPI showed a decline from 3.7% to 3.2% in headline inflation and from 4.1% to 4.0% in core inflation, both falling below consensus expectations. These trends have led to diminished expectations for an interest rate hike by the Federal Open Market Committee (FOMC) in December. Markets believe that further declines in inflation may prompt discussions about potential interest rate cuts in 2024. Currently, the market fully priced in a rate cut for June.

ON Friday, US ISM PMI for November will be released (at 10 AM ET). The expectations are for an increase to 47.7, compared to the previous reading of 46.7. A reading below 50 is indicative of contracting manufacturing.

Also on tap next week is the OPEC+ meeting on November 30. The JMMC meeting for OPEC+ that was originally scheduled for November 26th was rescheduled to November 30th as members debated production cuts. The meeting is not expected to bring policy changes, but there are discussions about Saudi Arabia and Russia potentially extending or deepening their voluntary production cuts. Saudi Arabia has expressed dissatisfaction with the production levels of certain members, particularly Angola and Nigeria, and compliance among members is expected to be a point of emphasis. Possible scenarios for the meeting include an extension of current cuts, deeper production cuts, or maintaining the status quo. Currently, Saudi Arabia and Russia, along with other OPEC+ members, have collectively committed to reducing oil production by approximately 5.2 million barrels per day (BPD), with additional voluntary reductions from Saudi Arabia and Russia. These cuts account for around 5% of the world’s daily oil demand, and the commitment to these reductions has been extended into 2023.

Wishing you all a great and healthy weekend.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Americas ، CAD ، Canada ، Forexlive ، Higher ، News ، Nov ، retail ، sales ، Send ، Usd ، Wrap

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0