Forexlive Americas FX news wrap 15 Sep: US dollar moves higher helped by higher rates.

The EUR is ending the day as the strongest of the major currencies. The USD is also mostly higher with gains vs all the major currencies with the exception of the EUR. The JPY and the NZD were the weakest of the majors. The strongest to the weakest of the majors. The gains in the

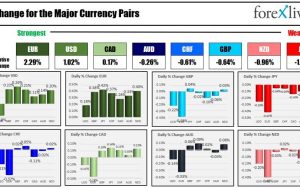

The EUR is ending the day as the strongest of the major currencies. The USD is also mostly higher with gains vs all the major currencies with the exception of the EUR. The JPY and the NZD were the weakest of the majors.

The strongest to the weakest of the majors.

The gains in the EUR come a day after the ECB raised rates by 25 basis points (10th consecutive hike in rates). Next week, the Fed will meet on Wednesday. The expectations are for no change in policy.

The SNB and BOE on Thursday, will also meet with each expecting to raise rates by 25 basis points. The BOJ will meet on Friday. Traders will be eyeing to see if they are ready to tighten conditions.

It will be a big week for central banks next week.

Today’s move higher in the US dollar was helped by higher rates. Data in the US was mixed today with the:

NY Fed Manufacturing stronger: The actual index is at 1.90, which is a significant improvement from the prior period’s -19.00, though it was expected to be -10.00.

Import and Export Prices MM higher: The monthly import prices increased by 0.5%, surpassing the forecasted 0.3% and the previous month’s 0.4%. Export prices for the month rose by 1.3%, which is higher than the expected 0.4% and the previous 0.7%.

Industrial Production MM stronger: Industrial production increased by 0.4% monthly, which is higher than the expected 0.1% and the prior 1.0%.

Capacity Utilization SA stronger: The capacity utilization rate is 79.7%, slightly above the forecasted 79.3% and matching the prior period’s rate.

U Mich Sentiment Prelim weaker: The preliminary sentiment index from the University of Michigan is 67.7, lower than the expected 69.1 and the prior 71.2.

U Mich Conditions Prelim weaker: The conditions index stands at 69.8, compared to the expected 75.3 and the prior 77.4.

U Mich Expectations Prelim modestly stronger: The expectations index is at 66.3, slightly above the forecasted 66.0 and below the prior 67.3.

UMich 1Yr Inf Prelim lower: The 1-year inflation expectation came in at 3.1%, down from the prior 3.3%. while the 5 Yr inflation came in lower too at 2.7% vs 2.9% last month

In the US debt market, the weaker was ignored with yields moving higher across the yield curve:

- 2 year 5.0347%, up 2.1 basis points

- 5 year 4.4615%, up 4.3 basis points

- 10 year 4.334%, up 4.4 basis points

- 30 year 4.419%, up 3.4 basis points

For the trading week, yields were also higher, helping to push the DXY index higher on the week (although it was mixed vs the major currencies),

- 2 year rose 4.2 basis points

- 5 year rose 5.8 basis points

- 10 year rose 6.8 basis points and closed at the highest level since November 2007

- 30 year up 8.4 basis points and closed at the highest since April 2011.

In the forex this week, the DXY is closing the week at 105.33, up by a modest 0.26%. Nevertheless, the rise took the price to the highest level since the November 21, 2022 trading week.

Looking at the major currency pairs, the currencies were mixed. The USD was higher vs the:

- EUR, +0.36%

- GBP, +0.66%

- JPY, +0.036%

- CHF, +0.53%

The greenback lost ground this week vs the commodity currencies with declines vs the:

- CAD, down -0.86%

- AUD, down -0.83%

- NZD, down -0.23%

US stocks closes sharply lower with the broader indices leading the way. The Nasdaq was the weakest with a decline of 1.56%, while the S&P fell -1.22%. The Dow industrial average fared relatively better with a decline of -0.83% but only 3 of the 30 Dow stocks advanced.

For the trading week, the declines today, shifted the fortunes of the Nasdaq and the S&P into the red. The Nasdaq fell -0.39% while the S&P fell -0.16%. The Dow eked out a small 0.12% gain on the week.

European indices closed the day and week higher:

- German Dax rose 0.56% today and 0.97% for the week

- France’s Cac rose 0.96% today and 1.91% for the week

- UK’s FTSE 100 rose 0.50% and surged 3.12% this week

- Spain’s Ibex rose 0.01% today and rose 1.98% this week.

IN other markets:

- Crude oil did turn into negative territory intraday but is trading up $0.61 or 0.68% at $90.77. For the week, crude oil closed higher for the 3rd consecutive week adding 3.73% today

- Gold moved higher by $13.93 today and was up 0.29% on the week

- Silver rose 1.8% today and rose 0.50% on the week.

IN the digital currency Bitcoin, the price is trading at $26482 currently after trading quietly between $26228 to $26683.

Hoping you all have a good weekend. Thank you for your support. Next week will be dominated by the Fed, BOE SNB and Bank of Japan from Wednesday to Friday.

| آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA + مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰