Fed Stays Put, Keeps Hiking Bias; Gold & US Dollar Display Limited Volatility

[ad_1] FOMC INTEREST RATE DECISION KEY POINTS The Federal Reserve stands pat on monetary policy, keeping interest rates unchanged at 5.25%-5.50% for the second straight meeting Forward guidance leaves the door open for further policy firming Gold and the U.S. dollar display limited volatility after the FOMC statement was released as traders await Powell’s press

[ad_1]

FOMC INTEREST RATE DECISION KEY POINTS

- The Federal Reserve stands pat on monetary policy, keeping interest rates unchanged at 5.25%-5.50% for the second straight meeting

- Forward guidance leaves the door open for further policy firming

- Gold and the U.S. dollar display limited volatility after the FOMC statement was released as traders await Powell’s press conference

Most Read: Bank of England Preview – Rates to Stay Put but QT due for Review?

The Federal Reverse today concluded its penultimate conclave of the year, voting unanimously to keep the target for its reference interest rate at a 22-year high within the current range of 5.25% to 5.50%. The move was largely in line with recent guidance offered by various central bank officials and Wall Street consensus expectations.

The decision to retain the status quo represents a commitment to a data-driven approach. This game plan may buy time to better evaluate the totality of incoming information and properly assess the impact of past actions on the broader economy, taking into account that monetary policy tends to operate with unpredictable and variable lags.

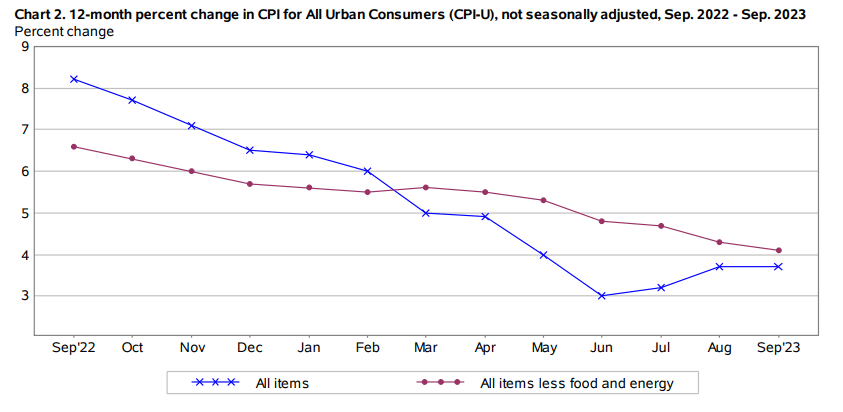

To offer some context, the FOMC has increased borrowing costs 11 times since 2022, delivering 525 basis points of cumulative tightening to slow down elevated price pressures that had diminished the purchasing power of most Americans. The strategy has yielded positive results, albeit at a gradual pace, with headline CPI running at 3.7% y-o-y in September after exceeding 9.0% last year.

At the last two meetings, however, policymakers have decided to stay put, reflecting their pledge to proceed carefully in the face of growing uncertainties. Several officials have also noted that the bond market has been doing the job for them by tightening financial conditions thorough higher yields, reducing the necessity for an excessively aggressive communication bias.

Enhance your trading prowess and seize a competitive edge. Secure your copy of the U.S. dollar’s outlook today for exclusive insights into the key risk factors to consider in the last quarter

Recommended by Diego Colman

Get Your Free USD Forecast

SEPTEMBER HEADLINE AND CORE US INFLATION CHART

Source: BLS

Wondering about gold’s future trajectory and the catalysts that will drive volatility? Find all the answers in our free Q4 trading guide. Download it now!

Recommended by Diego Colman

Get Your Free Gold Forecast

FOMC POLICY STATEMENT

In its communiqué, the Fed struck a constructive tone on growth, noting that economic activity has expanded at a strong pace in the third quarter, a subtle upgrade from the previous characterization of “moderate”.

The positive tone was bolstered by comments on the labor market, which underscored that job gains have moderated but remain strong, and that the unemployment rate has stayed low.

On consumer prices, the statement noted that inflation remains elevated and that policymakers will be “highly attentive” towards the associated risks, mirroring comments from last month.

Shifting the spotlight to forward guidance, the language remained largely unchanged, with the FOMC indicating that it would consider various factors “in determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time”. Keeping this message unaltered might be a strategic move to preserve maximum flexibility should additional actions become necessary in the future to contain inflation.

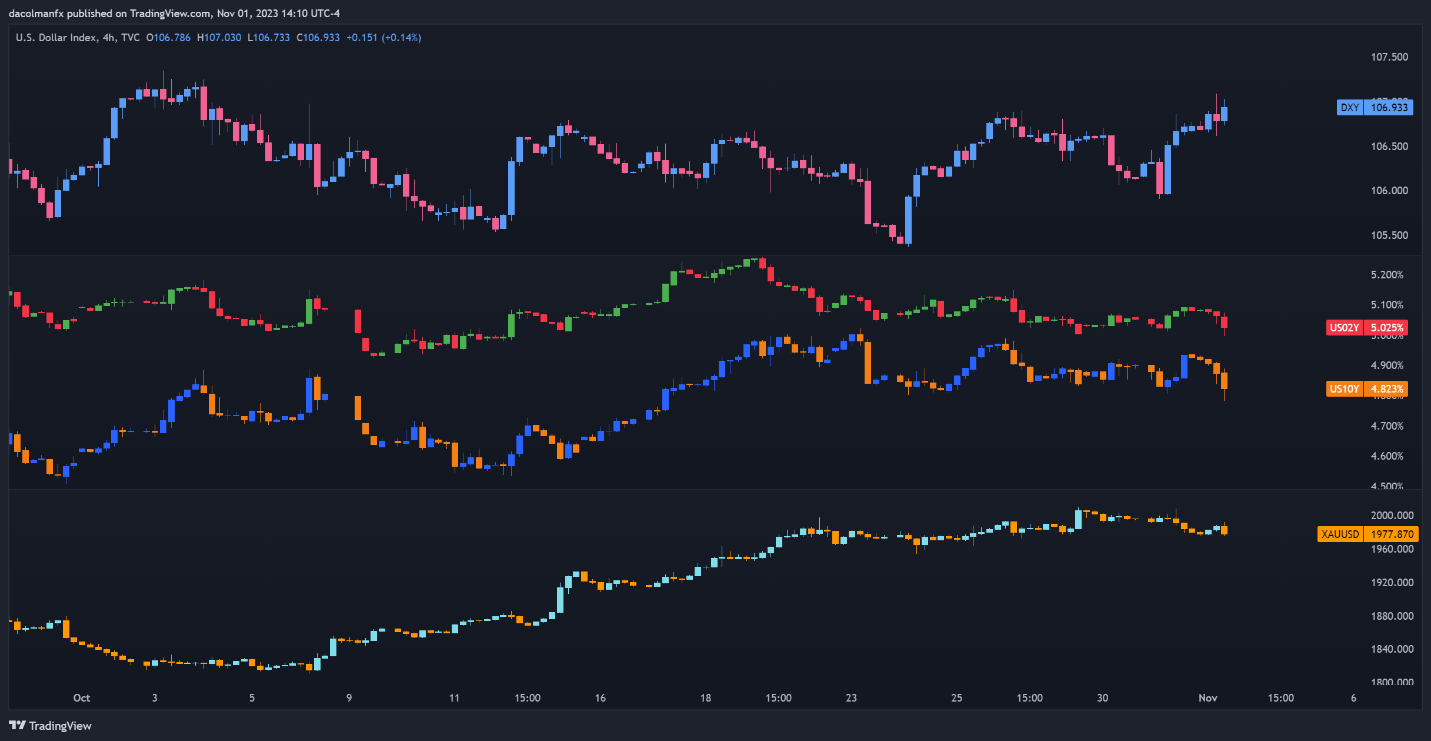

Immediately after the FOMC announcement crossed the wires, gold prices stayed in negative territory despite the pullback in yields. The U.S. dollar (DXY index), meanwhile, held onto daily gains, but market movements were subdued as traders awaited comments from Jay Powell, who may offer additional clues on the central bank’s next steps.

US DOLLAR, YIELDS AND GOLD PRICES CHART

Source: TradingView

Updated at 3:15 pm ET

These were some of Powell’s key comments during his press conference that moved markets:

– The full effects of past monetary tightening have yet to be felt

– The labor market remains tight

– Longer-term inflation expectations remain anchored

– Restrictive monetary policy is putting downward pressure on economic activity and inflation

– The FOMC is not confident enough the stance of monetary policy is sufficiently restrictive to return inflation to 2.0%

– The committee has not made a decision about the December meeting

– The Fed staff has not put back a recession into the forecast

– The committee is not thinking or talking about rate cuts

– The question the FOMC is asking is “should we hike more?”

– The Fed needs to see below-potential economic growth and softer labor markets to restore price stability

– The dot plot is a picture in time, its efficacy decays between meetings

– The Fed is close to the end of the cycle

– Policymakers are not considering changing pace of balance sheet runoff

– Reserves at $3.3 trillion are not even close to scarce at this point

– The banking system is quite resilient

– The neutral interest rate is unknowable, estimates must be taken with a grain of salt

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0