Fed Hikes Rates After Short Pause, Gold and US Dollar Forge Separate Paths

[ad_1] FOMC DECISION KEY POINTS The Federal Reverse voted to raise interest rates by 25 basis points to 5.25%-5.50%, the highest level in 22 years The decision to resume the tightening campaign was widely expected by market participants Gold and the U.S. dollar go separate ways following the central bank’s decision ahead of Powell’s press

[ad_1]

FOMC DECISION KEY POINTS

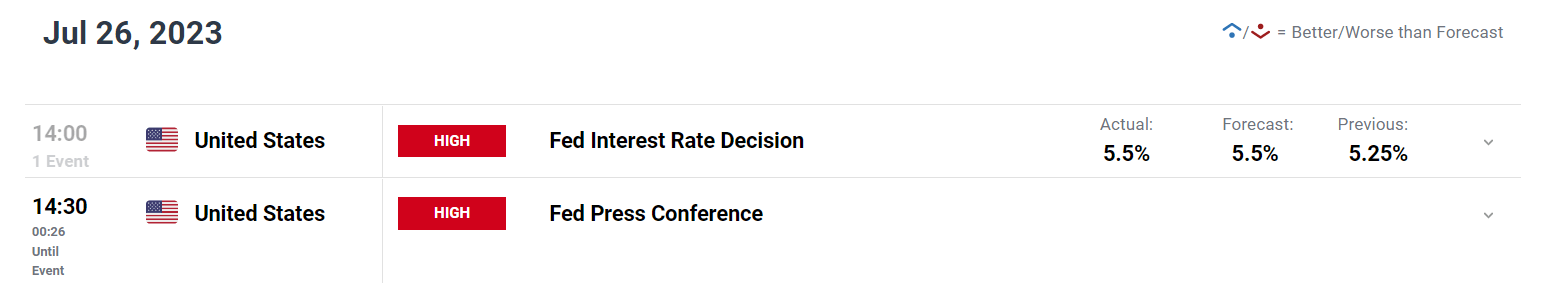

- The Federal Reverse voted to raise interest rates by 25 basis points to 5.25%-5.50%, the highest level in 22 years

- The decision to resume the tightening campaign was widely expected by market participants

- Gold and the U.S. dollar go separate ways following the central bank’s decision ahead of Powell’s press conference

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Could the Fed Trigger a Deeper Retreat in Bitcoin & Ethereum? BTC/USD & ETH/USD Price Action

The Federal Reserve today concluded its July monetary policy conclave and voted unanimously to increase its benchmark interest rate by a quarter percentage point to a range of 5.25% to 5.50%, the highest in 22 years. The move was widely expected by market participants given recent projections and comments from various officials, including chairman Powell during the inter-meeting period.

Today’s adjustment came after a brief hiatus last month. Policymakers had hit the pause button in June to buy time to study the impact of past actions on the economy, which can be unpredictable. For context, the FOMC has delivered 525 basis points of tightening since March 2022, undertaking one of its most aggressive hiking cycles in decades to defeat inflation

The fast and furious normalization campaign seems to be paying off. Headline CPI peaked at 9% last summer, but now stands at 3.0% year-on-year. While the directional improvement is welcome, it should not be mistaken for mission accomplished, especially with the core indicator sitting near 5.0% and showing extreme stickiness.

FED DECISION

Source: DailyFX Economic Calendar

Recommended by Diego Colman

Get Your Free Gold Forecast

In its communiqué, the Fed struck a positive tone on growth, noting that economic activity has been expanding at a moderate pace, a subtle upgrade from the previous “modest” characterization. The optimism was bolstered by comments on the labor market, which underscored that employment growth has been robust.

Focusing on consumer prices, the statement repeated that inflation remains elevated and that policymakers will be highly attentive to the risks it presents, a carbon copy assessment of last month’s observation.

Regarding guidance, the FOMC repeated that, in determining future steps, the committee will “take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

Maintaining the same guidance is likely part of a strategy to retain maximum optionality and adopt a highly data-dependent approach, while keeping a slight tightening bias in case additional policy firming is warranted later in the year. All this suggests decisions will be made on a meeting-by-meeting basis, but Powell may clarify the central bank’s position during this press conference.

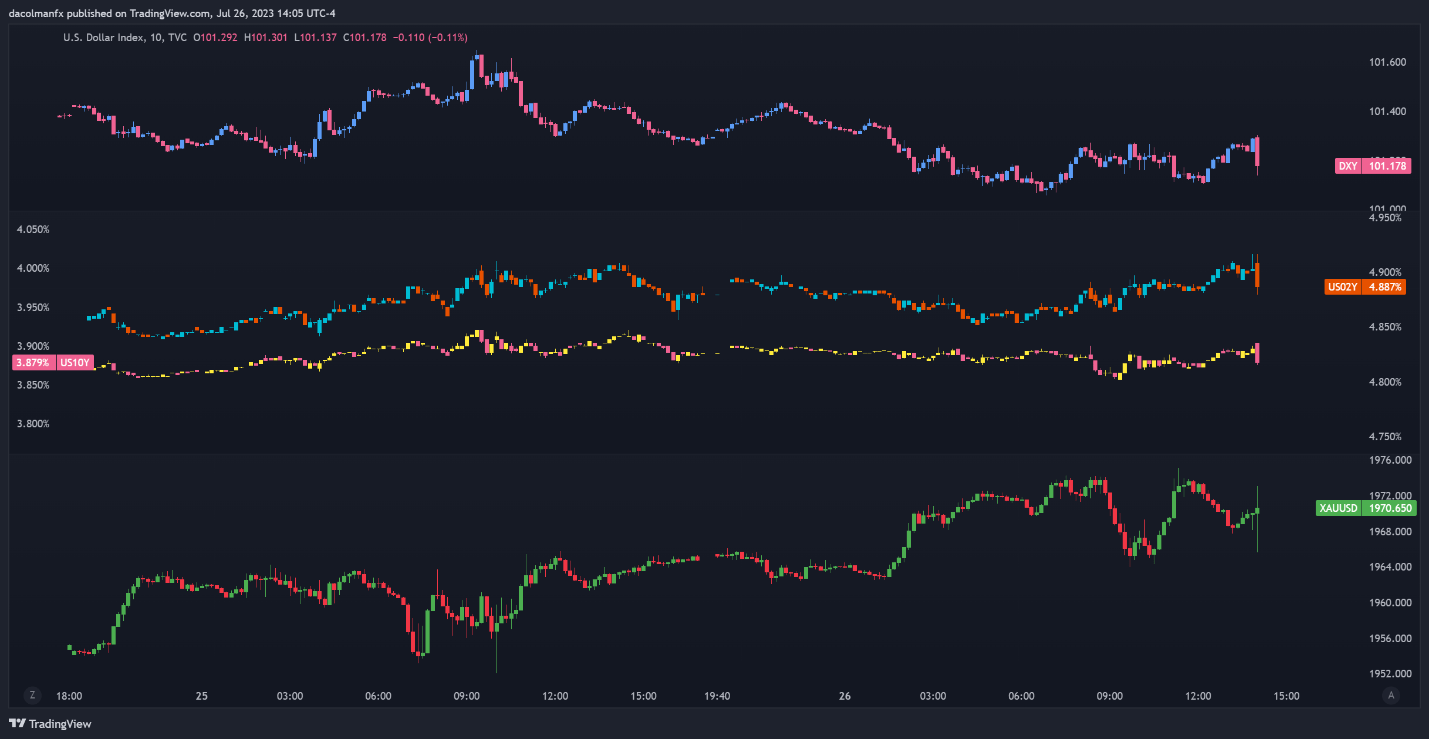

Immediately after the Fed decision was announced, the U.S. dollar retreated, extending the session’s losses, while bond yields trended lower. The move in Treasuries and the greenback boosted gold prices, with some traders possibly speculating that the lack of hawkish surprises could signify that July’s hike marked the end of the tightening cycle.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GOLD PRICES US DOLLAR AND YIELDS CHART

Source: TradingView

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0