Euro Vulnerable Against a Runaway US Dollar with Treasury Yields Jumping

[ad_1] Euro, EUR/USD, US Dollar, Fed, FOMC, Treasury Yields, China, Debt Default- Talking Points Euro bearishness appears intact for now as the US Dollar roars The trend in EUR/USD remains in play but a break above 1.1000 could change that If Treasury yields keep rising on official selling, will that sink EUR/USD? Trade Smarter –

[ad_1]

Euro, EUR/USD, US Dollar, Fed, FOMC, Treasury Yields, China, Debt Default- Talking Points

- Euro bearishness appears intact for now as the US Dollar roars

- The trend in EUR/USD remains in play but a break above 1.1000 could change that

- If Treasury yields keep rising on official selling, will that sink EUR/USD?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EUR/USD MACRO VIEW

The Euro capitulation could be mostly attributed to a roaring US Dollar strengthening across the board of late.

Overnight the Federal Open Market Committee (FOMC) meeting minutes showed a more hawkish board than the market had pencilled in.

The messaging from several Fed speakers over the past week has been a consistent mantra of keeping monetary policy tight for a long period. The minutes revealed that another hike might be in the offing if conditions warrant it.

The 1- and 2-year part of the interest rate market scaled back rate cut prospects by around 10 – 15 basis points this week.

Perhaps more importantly, further along the Treasury yield curve, there has been a parallel shift higher, underpinning the ‘big dollar’.

The benchmark 10-year bond is trading near 4.29%, a whisker away from the 4.33% seen in October last year, which was the highest return on that note since 2007.

The latest data on Treasury holdings for June revealed that China has been a consistent seller this year. The only month that they have been a buyer of US Government bonds was in March when the Yuan rallied significantly.

This week, the Yuan has been weakening and it’s possible that China has again been selling US debt in order to sell USD and buy Yuan..

The market perception of the situation in the world’s second-largest economy has deteriorated this week despite the People’s Bank of China (PBOC) cutting its 1-year medium-term lending facility rate to 2.50% from 2.65%.

Country Garden and Sino Ocean, two very large property developers, have defaulted on several offshore and onshore bonds this month.

The concept of contagion entered the markets’ lexicon after Zhongrong International Trust Co., a major player in China’s trust sector, missed several obligations to its clients over the past week.

If this scenario continues to play out, EUR/USD could see further downside. Click on this banner to learn more about how to trade EUR/USD.

Recommended by Daniel McCarthy

How to Trade EUR/USD

EUR/USD DAILY TECHNICAL ANALYSIS SNAPSHOT

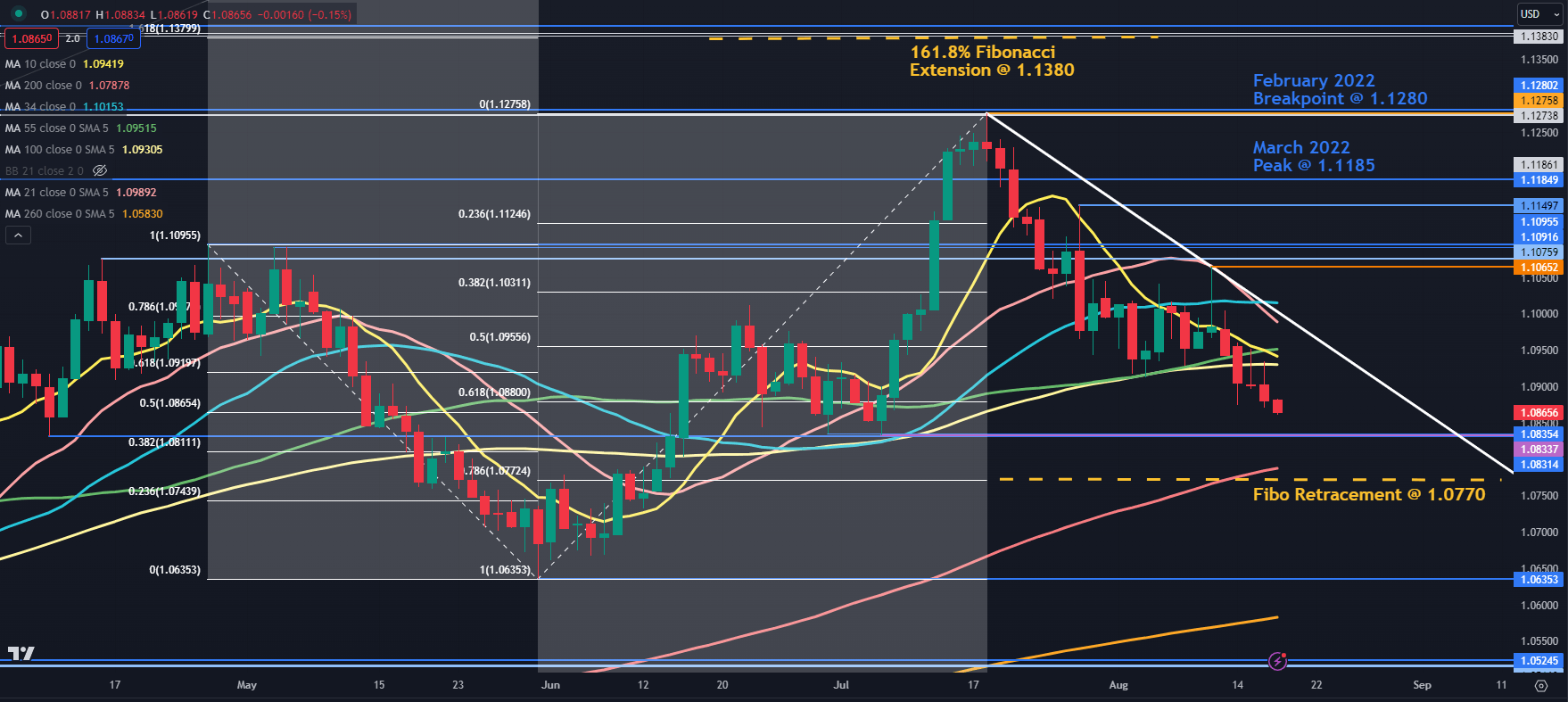

EUR/USD remains below a descending trend line as it appears set for its fifth straight day of declines.

If it was to rally and approach that trend line, there could be resistance at the 21- and 34-day simple moving averages (SMA).

Potential resistance might also be offered in the 1.1065 – 1.1095 area where several historical breakpoints reside along with a recent high and just ahead of the psychological level at 1.1100.

Further up, resistance could be at the breakpoint from the March 2022 high at 1.1185 or the recent peak at 1.1275, which coincides with two historical breakpoints.

Above those levels, resistance might be at the Fibonacci Extension of the move from 1.1095 to 1.0635 at 1.1380. Just above there are some more breakpoints in the 1.1385 – 95 area.

To learn more about Fibonacci technical analysis, click on the banner below.

Support could also be near the 78.6% Fibonacci Retracement levels at 1.0770 which is just below the 200-day SMA.

Ahead of that level, some prior lows and the breakpoint in the 10830- 1.0835 area may provide support.

Recommended by Daniel McCarthy

Traits of Successful Traders

Chart Created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0