Euro Risks Accumulate Ahead of NFP

[ad_1] EUR/USD news and Analysis Mixed EU Inflation and Cautious ECB Tone add to Downside Risks The euro sold off on Thursday after markets chose to pay close attention to the more encouraging core inflation print for the Euro area, as opposed to the slight move higher on headline readings. Core inflation printed at 5.3%,

[ad_1]

EUR/USD news and Analysis

Mixed EU Inflation and Cautious ECB Tone add to Downside Risks

The euro sold off on Thursday after markets chose to pay close attention to the more encouraging core inflation print for the Euro area, as opposed to the slight move higher on headline readings. Core inflation printed at 5.3%, in line with expectations but represents a move lower from last month’s 5.5% print.

In addition, recent communication from ECB rate setters suggests that a more cautious approach will be adopted by the governing council ahead of next month’s central bank meeting. In the moments before Christine Lagarde addressed delegates at Jackson Hole, unknown ECB ‘sources’ suggested that hawks within the committee have eased their previous stance which could see the group err on the side of caution should the decision to hike or hold be finely balanced. Earlier today, well-known hawk Isabel Schnabel

Elsewhere, US PCE data printed in line with market consensus for both the core and headline readings and both measures recorded a rise on the prior month’s year-on-year comparison. Markets now look to tomorrow’s NFP report which attracts even more anticipation than before, given the build up of lower impact jobs data in the lead up.

Recommended by Richard Snow

How to Trade EUR/USD

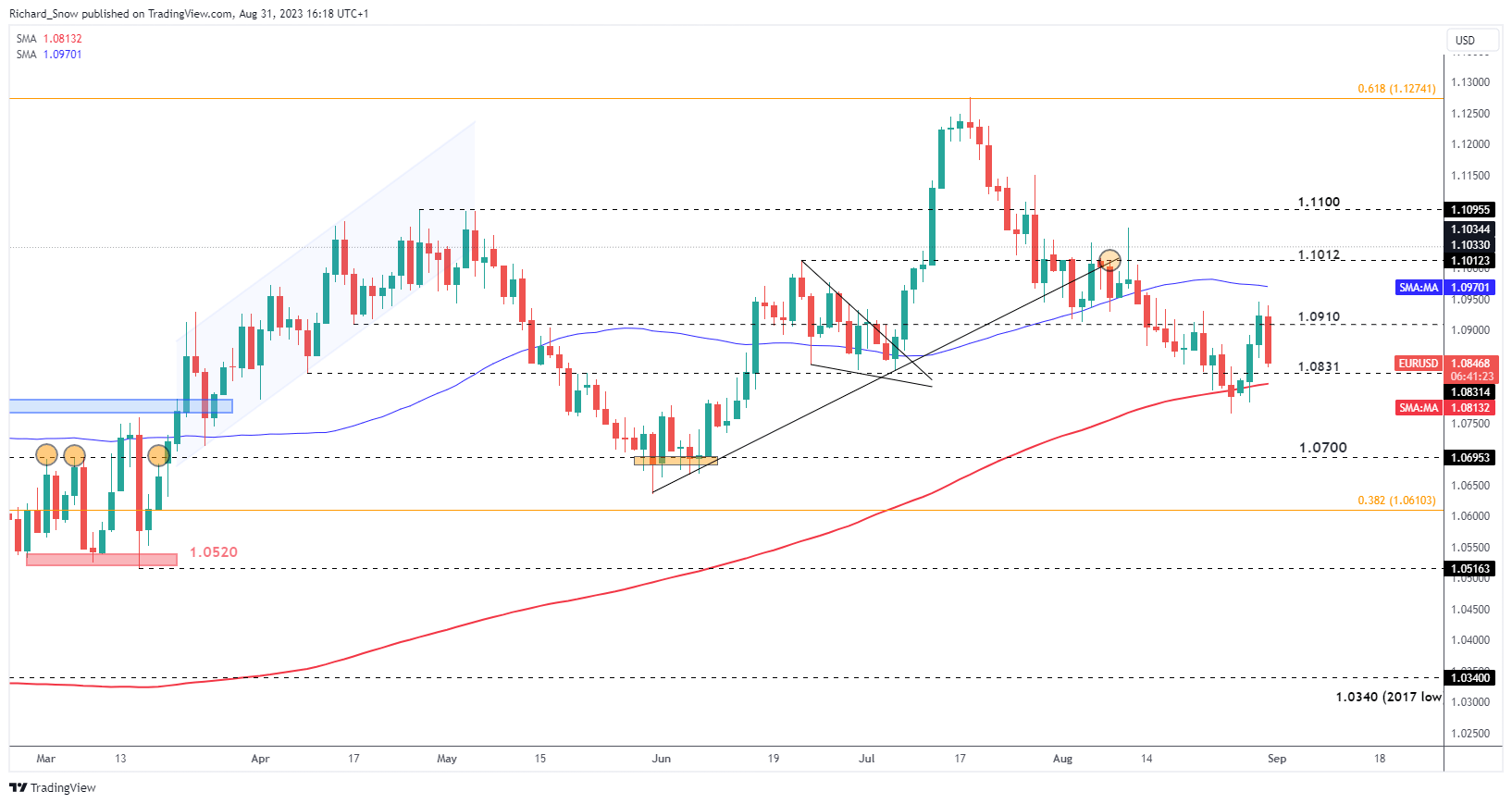

EUR/USD Appears Vulnerable – Will the 200 SMA Hold?

The EUR/USD pair declined on Thursday after European core inflation edged lower and US PCE remained elevated. The pair briefly traded above 1.0910 before surrendering all of yesterday’s gains. Immediate support now appears at 1.0831, followed closely by the 200 day simple moving average (SMA). Thereafter, 1.0700 comes into view, however, that remains a fair distance off for now. Of course it is worth noting year end flows can play a part in price discovery today so that always needs to be taken into account.

The difficulty with EUR/USD right now is you have vulnerability appearing across both currencies. The dollar has weakened amid slower GDP outperformance (outperformance nonetheless) and early signs of a softer jobs market – something the Fed has eyed as crucial to bringing inflation down to the 2% target. Downside risks have also accrued for the euro amid broadly declining inflation, and growth concerns that appear to be weighing on ECB members ahead of the rate decision next month. Resistance is back at 1.0910 followed by 1.1012 – the June 2023 high.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

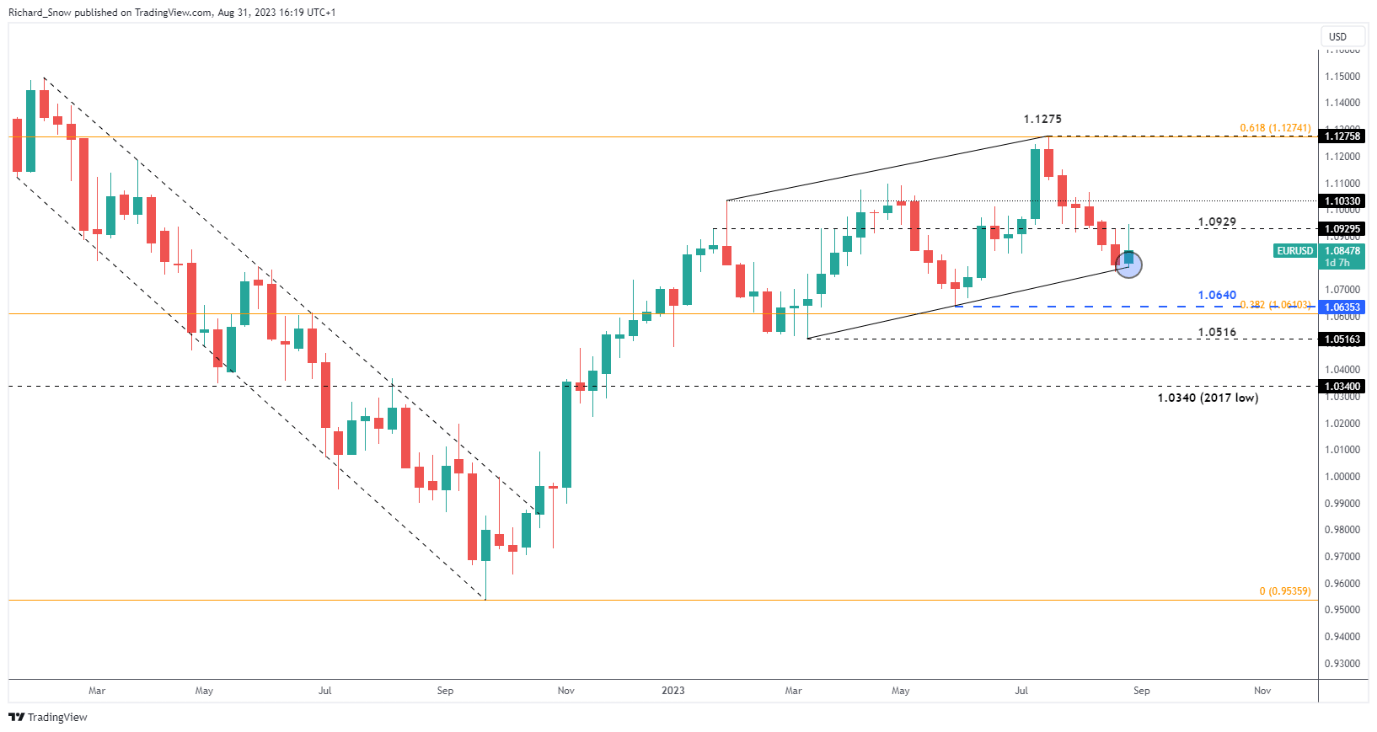

The weekly chart shows the relentlessness of the medium-term selloff which too place over six consecutive weeks. The pair has tagged channel support and has risen this week, although, gains are rapidly being clawed back ahead of NFP. This level of support remains a big test for EUR/USD bears – one to keep an eye on heading into the end of the week.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | 33% | -24% | 4% |

| Weekly | -1% | 3% | 1% |

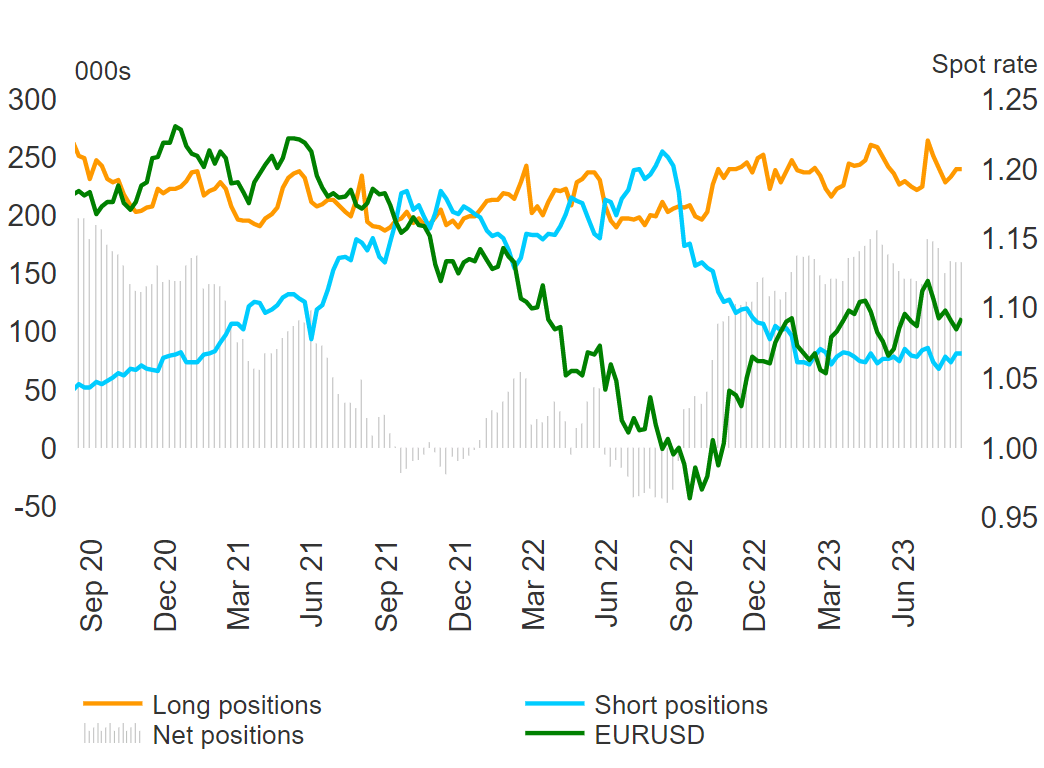

Institutional Positioning (Hedge Funds, Money Managers) from the CoT Report

Euro positioning remains strongly net-long, something that could soon change depending on incoming data and will certainly be tested in the lead up to the ECB’s September meeting. The CoT report gathers positioning data from reportable speculators like hedge funds and other large money managers.

Source: Refinitiv, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :Accumulate ، ahead ، Euro ، NFP ، Risks

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0