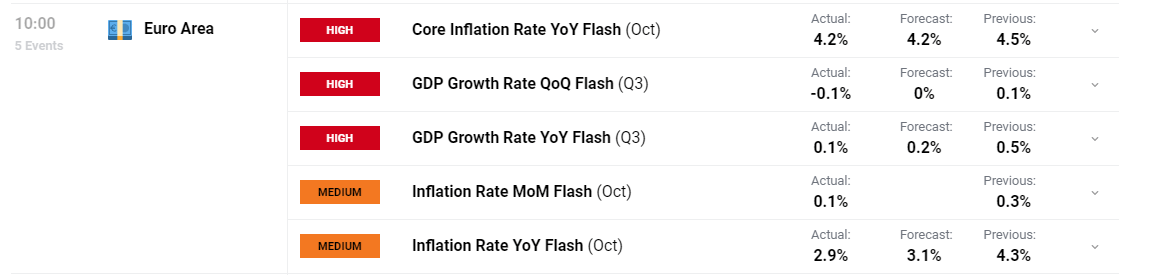

EU GDP, Inflation Breaking News

- EU economy contracts in Q3 (QoQ). Growth almost flat year on year

- German data yesterday revealed negative growth – Euro traded higher

EU Economy Contracts but Inflation Reveals Signs of Continued Progress

Economic growth in the euro zone contracted in Q3, following in the footsteps of Germany yesterday. The 0.1% contraction from the prior quarter confirms the challenging external environment as the global growth slowdown moves up a notch.

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Get Your Free EUR Forecast

However, the miss to the downside had not added to the euro’s woes and in fact the currency rose. Even yesterday, despite Germany’s economic contraction, the currency found some strength, although coming off a low base.

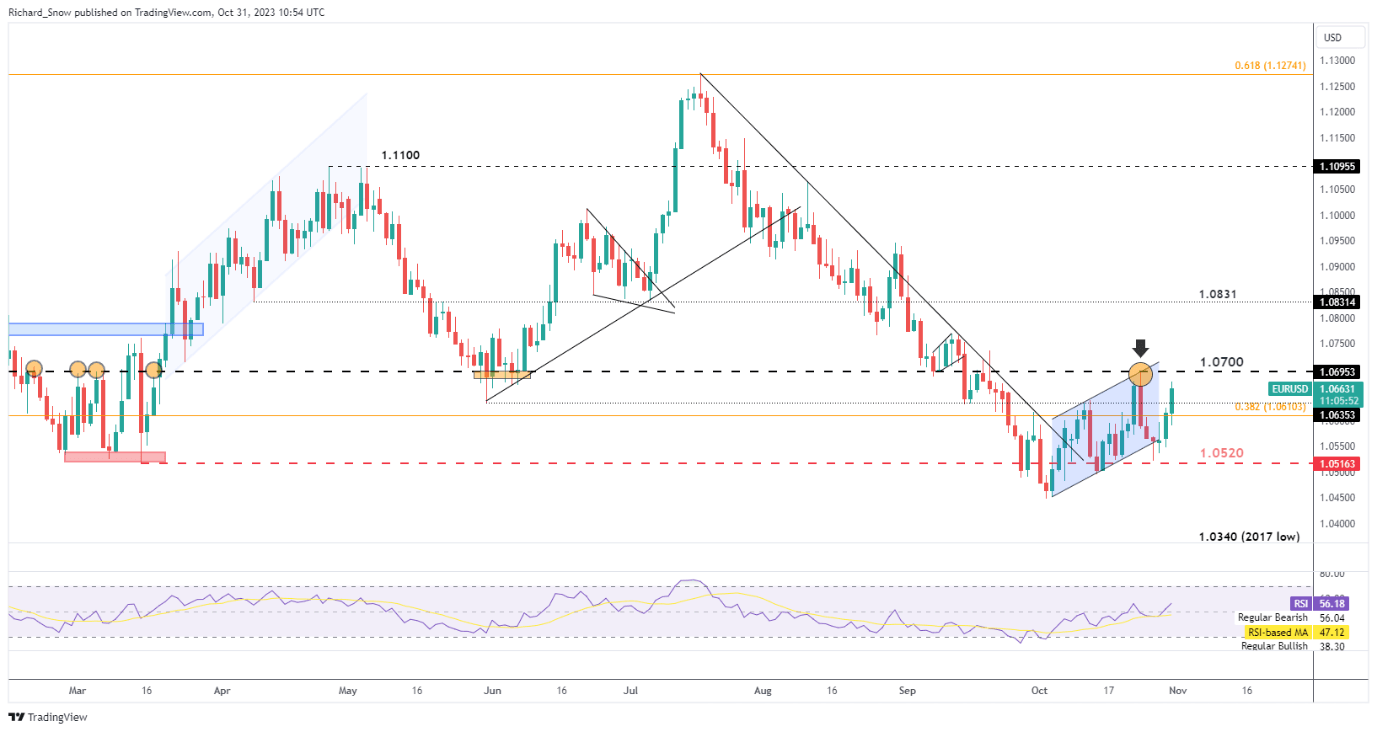

EUR/USD is now on track for two days of gains, heading towards 1.0700 once more. The ECB signaled it is content with interest rates where they are and inflation continues to show signs of improvement, keeping stagflation fears at bay for now. In addition, recent Chinese stimulus announced by Beijing officials has acted to stem declines in Chinese and China related assets in recent days. With China being a sizeable trading partner, the stimulus measures could help stem euro declines. Next up, FOMC, Non-farm payrolls and US services PMI data.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

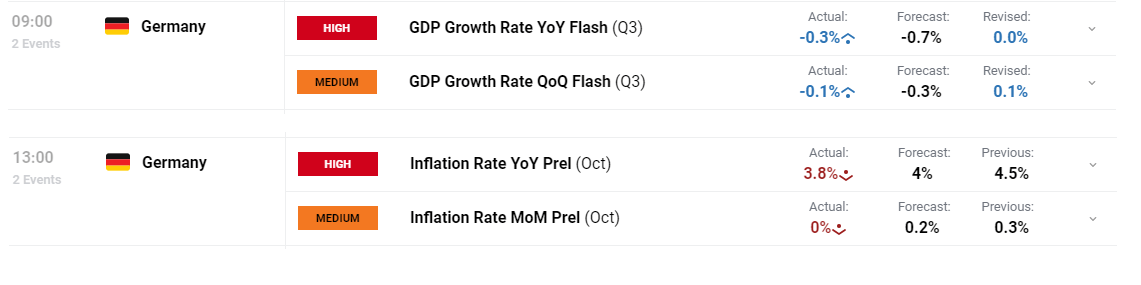

Europe’s largest economy Contracts but Data is Better than Initially Feared

Germany, Europe’s economic powerhouse, contracted quarter on quarter as well as year on year to post dismal figures although, the data was not as bad as initially feared.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0